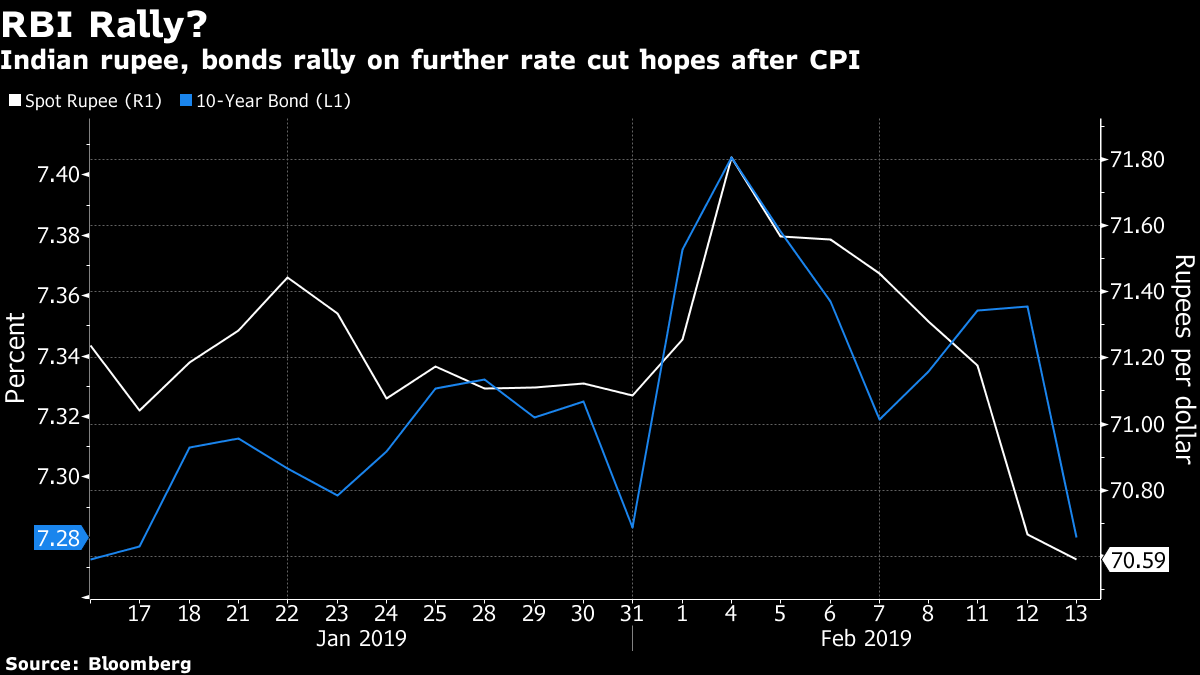

Mumbai: Asia’s worst-performing currency for the year offered the region’s best returns over the past week as slowing Indian inflation added to the cheer over the central bank’s surprise reduction in interest rates.

While a rate cut typically lowers a currency’s yield appeal, it bolsters foreign inflows into local shares, which helps strengthen the rupee. Global funds have bought $410 million of Indian shares this month, after being sellers in January. The inflow has fueled a seven-day rally in the currency, the longest streak in three months.

“The rupee is benefiting from foreign inflows as weaker-than-expected consumer inflation could give the RBI room to cut rates further,” said Khoon Goh, head of Asia research at Australia & New Zealand Banking Group Ltd.

Retail inflation data released Tuesday evening undershot forecasts and validated the cut announced by the Reserve Bank of India’s new governor Shaktikanta Das last week. The rupee gained as much as 0.4 percent to 70.39 per dollar on Wednesday, and the yield on the most traded 2028 bond fell nine basis points. The S&P BSE Sensex index of shares gained 0.2 percent.

“The bond market is treating the lower pace of inflation positively as it opens up the possibility of lower terminal rate expectations, possibly below 6 percent,” said Vivek Rajpal, a rates strategist at Nomura Holdings Inc. in Singapore.

Inflows are also being driven by the money from Axis Bank Ltd.’s share sale and Vodafone Plc’s investments in its India unit, supporting the rally in the rupee, traders said.- Bloomberg

Also read: Indian equity fund investors are unfazed by stock market turmoil