The study’s findings rekindle the debate on the Reserve Bank of India’s autonomy as losses could push it to seek financial aid from the government.

Mumbai: India’s central bank has insufficient capital, much less a surplus to hand over to the government, a new study shows.

Operating losses could push the RBI to seek financial assistance from the government, compromising its autonomy, wrote the authors, led by Amartya Lahiri, director at Mumbai-based think tank Centre for Advanced Financial Research and Learning and a professor at the University of British Columbia.

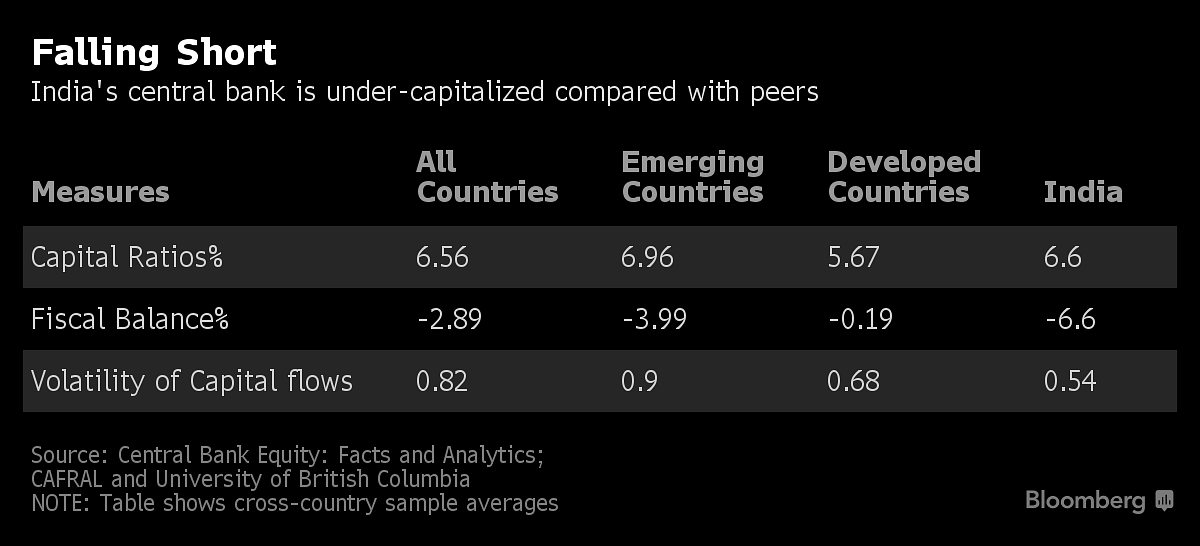

The study, which covered balance sheets of 45 central banks, found the global average capital to asset ratio – net of revaluation capital – was 6.56 per cent. The level for those in emerging economies was 6.96 per cent, with the RBI’s standing at 6.6 per cent.

The paper’s findings rekindle the debate on the Reserve Bank of India’s autonomy, just as a panel reviews how much funds the monetary authority should hold.

“The main takeaway from the above comparisons is that the RBI is not over-capitalized relative to overall international standards,” the authors wrote in their paper after discussions with RBI Deputy Governor Viral Acharya and former chief Raghuram Rajan, among others. “In fact, it is marginally undercapitalized.”

Separate research last year estimated that the RBI held at least 3.6 trillion rupees ($51 billion) more capital than it needed. The central bank has been under pressure to part with some of its reserves as the government seeks to plug a widening budget gap amid slowing tax revenues. That was seen as a key reason why Urjit Patel quit as governor last month.

The RBI-founded think tank’s study argues that for India — which runs a stubbornly high fiscal deficit — the central bank needs to have the insurance of higher capital to maintain operational autonomy.

“An argument for why central banks do not need a lot of capital on their balance sheets is that the government, which is their owner, can provide capital and resources in emergencies,” they wrote. “The weaker the state of public finances, the less credible this option is.”- Bloomberg

Also read: India’s ‘animal spirits’ wake up as cash crunch begins to ease

Even the LIC is being drained / bled of vitality. As are traditionally cash rich organisations like ONGC. Where else in the world would there be talk of a Basic Income Scheme in a country with a daily per capita income of $ 6.