New Delhi: The Narendra Modi government has filed a note in the Supreme Court in which it has pointed out that Kerala’s current fiscal woes have to do with its own “fiscal mismanagement” over the last 20 years rather than due to any of the Centre’s actions.

In the note, filed by the Attorney General of India on 25 January, and reviewed by ThePrint, the Centre pointed out that numerous bodies — including the 12th, 14th, and 15th Finance Commissions, the Reserve Bank of India, and the Indian Institute of Management, Kozhikode — have over the years repeatedly stressed the dire state of Kerala’s finances.

The note was in response to the Kerala government’s decision to move the Supreme Court against the Centre for limiting the borrowing capacity of the state, which it said could lead to a grave financial crisis in Kerala.

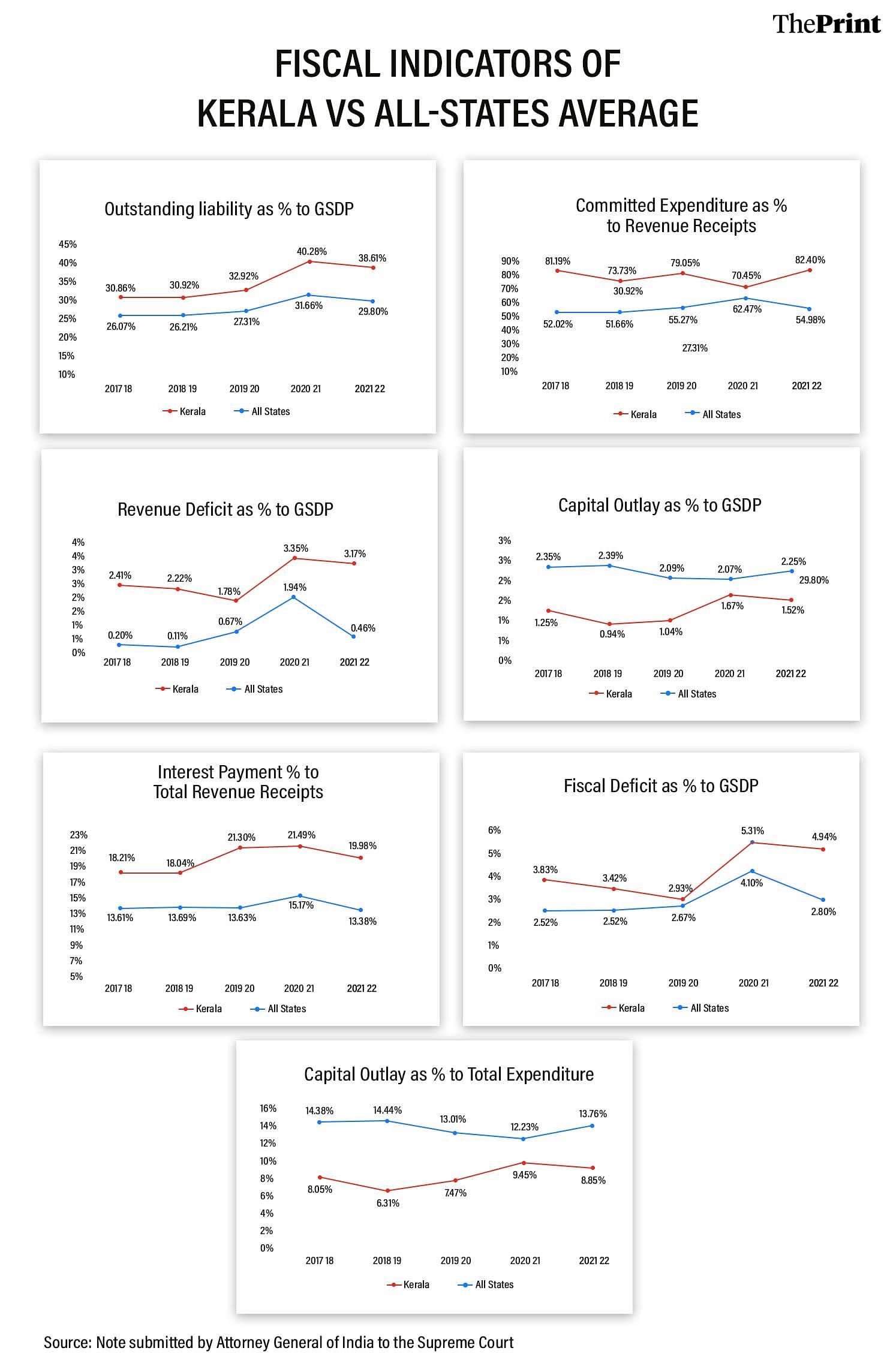

The poor performance of Kerala’s finances is evident not just through this commentary, but also through the data on numerous metrics such as the level of outstanding liabilities, high levels of committed expenditure, low capital expenditure, high revenue and fiscal deficits, high-interest payments, and elevated contingent liabilities, all of which are at worse levels than the all-India average.

In its note, the Centre said that the setting of borrowing limits was done on the recommendations of the Finance Commissions, and applied to all states equally.

“All the States in India are indebted to the Centre and hence require the permission of the Centre to borrow from any source,” the note said. “While giving this permission, the Centre keeps in mind the overall objectives of macroeconomic stability of the country as a whole and fixes a borrowing limit for the State seeking its permission.”

The borrowing limits of States are fixed in a non-discriminatory and transparent manner guided by the recommendations of the Finance Commission, the note said.

It further added that the Finance Commissions make their recommendations keeping in mind the spirit of the Fiscal Responsibility and Budget Management (FRBM) acts passed by the Centre and all of the states. One of the stated objectives of the acts is to achieve a fiscal deficit target not exceeding 3 percent of the Gross State Domestic Product (GSDP) of a state, the note said.

Enacted in 2003, the Fiscal Responsibility and Budget Management Act (FRBM Act) establishes financial discipline to reduce fiscal deficit. Each state has its own version of the law along the lines of the central legislation.

Kerala has not yet submitted any response to the central government’s note. But in his budget speech Monday, the state’s finance minister K.N. Balagopal squarely blamed the Centre for pushing Kerala towards the “worst financial crisis in its history”.

“Kerala cannot remain a mute spectator against the hostile approach of the central government which is pushing the state towards the worst financial crisis in its history,” Balagopal said in his speech.

He added: “Instead of waiting for justice from the central government, the state government will utilise all its resources to raise capital investments from private and public sectors, thereby ensuring speedy implementation of all its programmes”.

Poor state of Kerala’s finances

The numbers presented by the Centre in its note — sourced from the RBI, which annually brings out data on states’ finances — show that Kerala’s finances have deteriorated quite rapidly.

The data from the RBI shows that Kerala’s outstanding liabilities as a percentage of its GSDP rose from 31 percent in 2018-19 to reach 39 percent by 2021-22, the latest year for which RBI provides data. The average for all states was 29.8 percent in 2021-22.

“One of the major consequences of having a high outstanding liability ratio is enhanced outflow in terms of interest payments which in turn increases

the deficit of the State and may result in a debt trap,” the note said, adding that Kerala’s interest payments as a percentage of its revenue receipts have climbed to nearly 20 percent as against the 14th Finance Commission’s recommended level of 10 percent.

Kerala’s committed expenditure, which consists of its expenditure on interest payments, salaries and wages, and pensions, rose from 74 percent of revenue receipts in 2018-19 to 82.4 percent in 2021-22, the highest level for all states. The average of all States in 2021-22 was 55.29 percent.

“High levels of committed expenditure squeeze out the space for productive Government spending which negatively impacts the growth of the state in the long run,” the note highlighted.

According to the data in the note, Kerala’s revenue deficit and fiscal deficit — both of which are measures of how much expenditure exceeds revenue — have both worsened significantly and are far higher than the all-states average.

Kerala’s revenue deficit as a percentage of its GSDP rose from 2.4 percent in 2017-18 to 3.17 percent in 2021-22, whereas the average of all states was 0.46 percent. The state’s fiscal deficit stood at 4.94 percent in 2021-22, as compared to the all-state average of 2.8 percent.

“A high revenue deficit-fiscal deficit ratio implies that the state government is

borrowing not to invest in productive schemes but to meet its day-to-day

expenses such as salaries and pensions,” the note said. “Not surprisingly, the capital expenditure has suffered and is very low.”

Indeed, the data shows that Kerala’s capital expenditure as a percentage of GSDP stood at just 1.52 percent in 2021-22, compared with the all-state average of 2.25 percent. Similarly, the state’s capital expenditure as a share of its total expenditure stood at 8.85 percent in 2021, far lower than the all-state average of 13.76 percent.

Chronic issues for a while

“Kerala has been one of the most financially unhealthy States and its fiscal edifice has been diagnosed with several cracks,” the Centre’s note said.

It highlighted that the 12th Finance Commission, appointed in 2002, classified Kerala among the states that were seeing a deteriorating debt situation reflected both in terms of its debt-GSDP ratio and the ratio of interest payments to revenue receipts.

“The Commission also observed that Kerala had one of the lowest percent of capital expenditure at 1.1 percent,” the note said. “The 14th Finance Commission (constituted in 2013) also noted that there were only three States with high revenue deficits in 2007-08 namely, Kerala, Punjab and West Bengal.”

Further, the note added that the 15th Finance Commission (constituted in 2017) designated Kerala to be a “highly debt stressed” state and observed that it had “largely failed” to limit its fiscal deficit to 3 percent of GSDP for almost all of the past decade.

“The State has been breaching its FRBM targets with unhealthy levels of Revenue Deficit-Fiscal Deficit ratio (65 percent in 2018-19),” the note quoted the 15th Finance Commission report as saying. “This implicitly explains why the state has resorted to borrowing to finance its revenue deficit.”

The Reserve Bank of India, in a 2022 report, categorised Kerala among the five highly-stressed states — along with Bihar, Punjab, Rajasthan, and West Bengal — with high indebtedness requiring urgent corrective measures.

The report said Kerala, Rajasthan, and West Bengal are projected to exceed a debt-GSDP ratio of 35 percent by 2026-27.

“These States will need to undertake significant corrective steps to stabilise their debt levels,” the RBI said.

The note by the Centre went on to cite studies by the government of Kerala (2016) and by IIM-Kozhikode (2017) that pointed out the “acute fiscal crisis” being faced by the state.

(Edited by Uttara Ramaswamy)

Also Read: ‘Walked the path of fiscal prudence’ — what economists say about interim budget 2024’s fiscal maths