New Delhi: Prime Minister Narendra Modi will woo the world’s 20 largest pension and sovereign wealth funds at a virtual roundtable Thursday as India looks to attract investments for its ambitious Rs 111 lakh crore infrastructure investment pipeline for the next five years.

The Modi government’s efforts to attract foreign investments into the infrastructure space comes at a time when around half of the proposed infrastructure investments by 2025 will have to come from private and foreign investors.

The government is banking on infrastructure to be the growth driver for the economy that is expected to contract by double digits in 2020-21.

To attract these funds to invest in India, it has already announced tax exemptions in this year’s budget to these long-term funds investing in infrastructure, making their income exempt from long-term capital gains, interest and dividend tax.

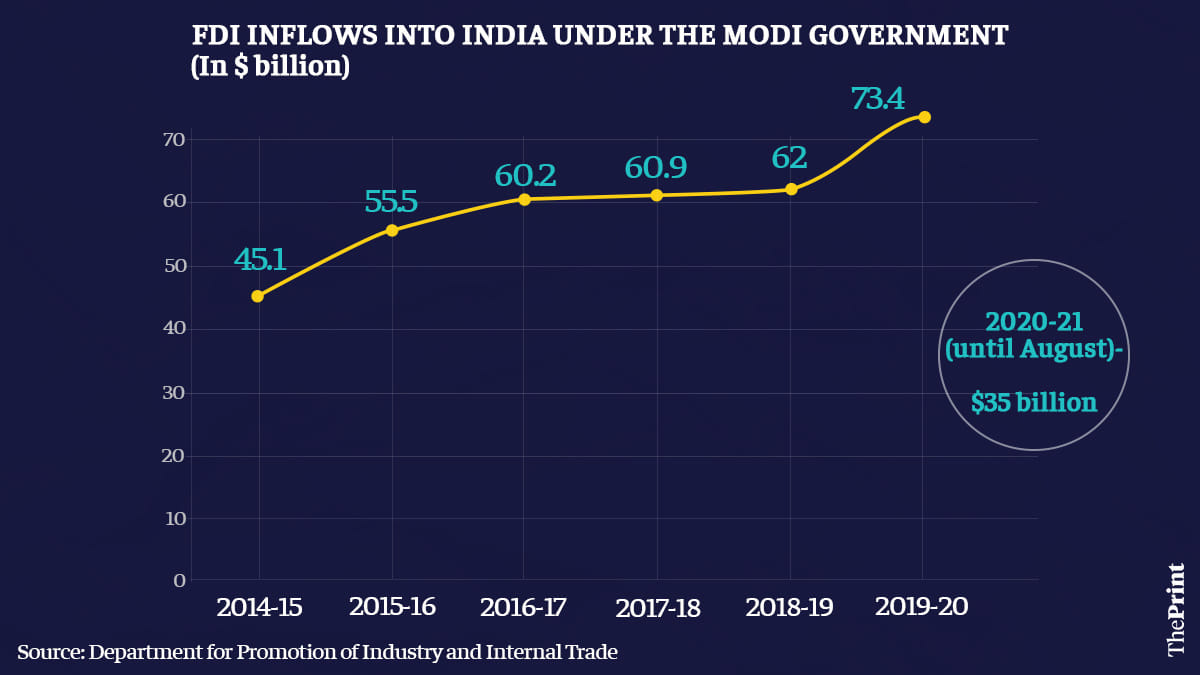

After stagnating for three years around the $60 billion level, FDI inflows into India rose sharply in 2019-20 to $73.4 billion. The inflows have been steady this fiscal as well, despite the Covid-19 pandemic. In the April-August period, India received $35.7 billion of inflows, according to data with the Department for Promotion of Industry and Industrial Trade.

Also read: Nirmala Sitharaman to unveil another stimulus package soon, says Economic Affairs Secretary

The call for investment

The virtual global investor roundtable, organised by the Ministry of Finance and the National Investment and Infrastructure Fund, will be attended by global investors who represent regions like the US, Europe, Canada, Korea, Japan, Middle East, Australia and Singapore, and have an asset under management of $6 trillion, the Prime Minister’s Office said in a statement.

These funds include Singapore-based GIC Pvt. Ltd and Temasek Holdings, Qatar Investment Authority, International Development Finance Corporation, PensionDanmark, Japan Post Bank and Korea Investment Corporation.

The roundtable will also be attended by Indian business leaders like Mukesh Ambani, Ratan Tata, Deepak Parekh, Nandan Nilekani and Uday Kotak, and Finance Minister Nirmala Sitharaman and Reserve Bank of India Governor Shaktikanta Das.

It will be followed by individual meetings of the investors with the PM over the next couple of weeks.

At the roundtable, Modi will talk about his vision for India to become a $5 trillion economy as well as the series of structural reforms undertaken by the government.

Despite the pandemic setback, the PM expressed hope last week that India can become a $5 trillion economy by 2024.

Repeated efforts

This is not the government’s first attempt to woo foreign investors.

Just ahead of PM Modi’s visit to the US last year, his government had announced a massive reduction in corporate tax rates to make India competitive vis-a-vis other Southeast Asian economies. The rates were brought down to as low as 15 per cent (effective tax rate of around 17 per cent) for new companies in the manufacturing sector.

Speaking at the India Global Week in July this year, Modi had urged investors to invest in India, pointing out that the country was reforming and remained one of the most open economies in the world. He had added that the government is rolling out a red carpet to investors.

Also read: ‘Landmark’ Rs 1 lakh cr monthly GST was first crossed in April 2018, but only 11 times since

Godi is dreaming of gaining $5T GDP in 4yrs, while facing a collapsing India economy and global pandemic crisis.

From $2.8T to $5T, it requires India GDP to grow $2.2T(78.5%) over 4yrs, or 15% p.a. growth rate. Even before COVID, India economy had already declined to 5% growth fueled artificially by 5.5% inflation and huge borrowing. Its debt-to-GDP has hit unsustainable 90%. So 25% of gov collectable revenues will go to pay interest alone, with nothing left for meaningful development. Its reckless confrontation with China will further bleed its little resources.

Out of 90 US companies that left China, only 3 setup in India. The rest went to SEAsia that have much better conditions than corrupted, bureaucratic red tape India with broken infrastructure and unskilled labours.

90% companies won’t give up China, the single largest and growing $6.8T market, with a most complete supply chain, largest mfg capacity, highly skilled labours, superb infrastructures, stable currency(RMB has infact strengthen from $1=8.2 to 6.8 within decade). This make China production cost lowest in the world while providing the largest purchasing power mkt.

To do business and invest in India is a great pain in as* even for local Indians, with extremely high risk of default(Spore gov $4.5Bils city project investment simply vanished once BJP lost its state election), non payment, scam, finance difficulty, long company registration waiting, tedious labour laws, lowly educated unskilled labours(ranked global bottom LAST in 2009 PISA), currency devaluation(rupees had dropped from $1=80 to 55 vs over decade), lowly educated PM & gov, unstable society plagued with riots, land acquiring difficulty, broken infrastructures…

Eg. Jp had won a 2016 tender to finance & build $Billions FSR for India, targeting to complete by 2021. After few years, only 2% land is acquired, with nothing build yet.

India may have same large population of China, but most are in poverty, 800Mils are depending on gov food handout. Few can afford expensive Western products. India import(exclude fuel)/export $300Bils is even smaller than tiny Spore $400B. Whereas China has 400Mils wealthy middle class, the largest growing $6.8T consumer market nobody want to miss. With China huge mfg capacity, there is no extra global demand to create another big player that India aspired. India has missed the 40yrs globalization cycle.