New Delhi: India implemented the goods and services tax (GST) in July 2017. In less than a year, GST collections crossed Rs 1 lakh crore in April 2018, with then finance minister Arun Jaitley terming it a “landmark achievement”.

GST collections in April exceeding Rs. 1 lakh crore is a landmark achievement and a confirmation of increased economic activity as brought out by other reports

— Arun Jaitley (@arunjaitley) May 1, 2018

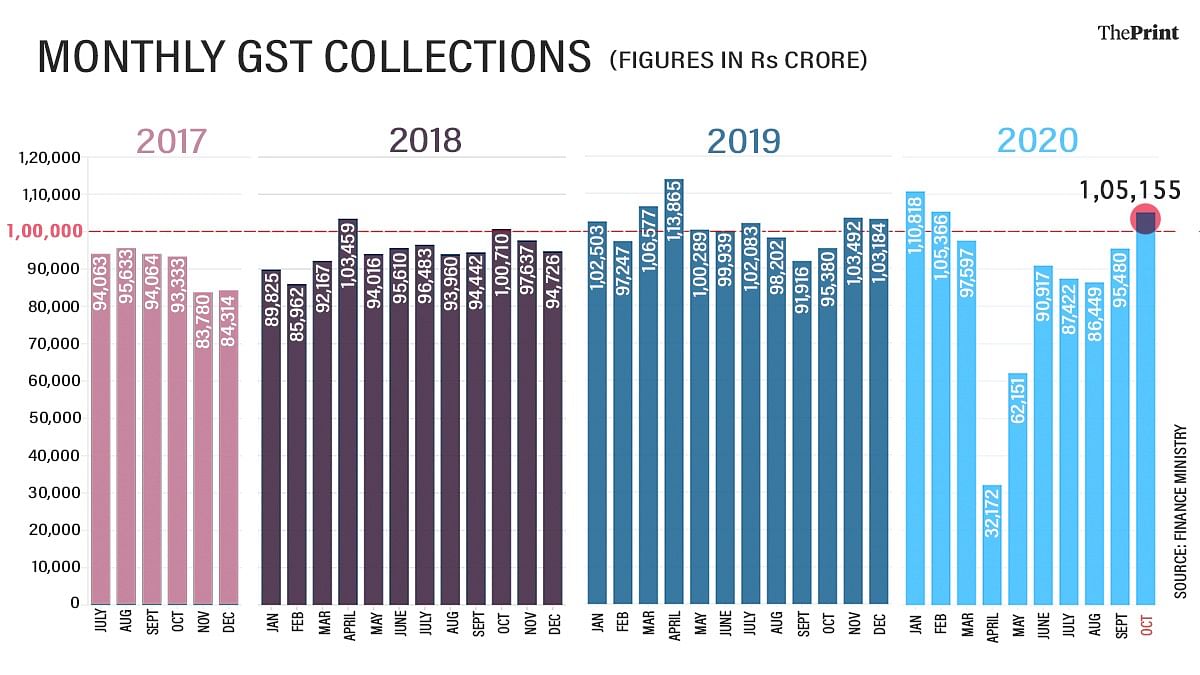

Yet in the 40 months since the indirect tax regime’s launch, monthly GST collections have crossed Rs 1 lakh crore only 12 times, the latest being the Rs 1.05 lakh crore clocked in October 2020.

And in the 30 months since the Rs 1 lakh crore benchmark was first crossed, tax collections exceeded this figure 11 times.

The highest collections so far under the GST was in April 2019 at nearly Rs 1.14 lakh crore, followed by Rs 1.1 lakh crore in January this year.

Additionally, monthly data does not show a consistent increase in the tax collections. At best, collections have increased for two-three months at any stretch before falling again.

But to be sure, at least for seven months beginning March this year, Covid has played a major role in slowing down the tax collections.

Also read: India’s manufacturing PMI surges to a decade high in October

GST collections not buoyant?

Frequent changes in tax laws leading to increasing uncertainties for businesses, lowering of rates without a corresponding increase in tax buoyancy, lax implementation leading to evasion and economic slowdown are some of the reasons attributed by experts for the lack of a buoyant GST.

Considered to be India’s most ambitious tax reform, GST subsumed a host of indirect taxes levied by the central and state government including excise duty, service tax, value added tax, entertainment tax and purchase tax.

However, its implementation has been replete with frequent changes, making it difficult for the regime to stabilise.

Sumit Dutt Majumder, former chairperson of Central Board of Excise and Customs (now Central Board of Indirect Taxes), said GST is a tax on supply of goods and services and for it to increase consistently, the economy needs to be growing. He also attributed the stagnant collections to leakage caused by tax evasion due to a lax enforcement mechanism.

“In the first year, there was hardly any enforcement action. At that time, the main priority was to implement GST and not terrorize taxpayers,” he said.

Majumder also stressed the need for the council to discuss annual targets. “It can’t be the same target for the last three years. The situation has changed from July 2017. One must have a proper evaluation and set annual increase in targets,” he said.

M.S. Mani, partner, Deloitte India, pointed out that the GST rates have come down over the past three years on many products and, to that extent, the collections at present also reflect the rising consumption levels achieved during this period.

“The present rates on most products are lower than the rates that existed when GST was introduced and significantly lower than the pre-GST rates. However, with more information becoming available to the tax authorities through the GST annual returns and with the advent of e-invoicing, the ensuing controls and anti-evasion measures, would help in significant improvements on the collections front,” he said.

Over the years, the tax rates of many items have also come down sharply. The GST on items like toothpastes, shampoos and soaps was lowered to 18 per cent from 28 per cent. The rates on consumer durables like refrigerators, washing machines and television sets has also been lowered to 18 per cent from 28 per cent, the only exception being air conditioners.

Moreover, the deadline for filing the annual returns for the year 2017-18 were extended multiple times until it was finalised in March 2020. The deadline for filing the annual return for 2018-19 has also been extended to December 2020. This meant that tax authorities had no comprehensive data to detect tax evasion by any firm till March 2020.

However, the mandatory implementation of e-invoicing for business with a turnover of Rs 500 crore from October this year is expected to check tax evasion.

Also read: India’s economic recovery will be hit if banks aren’t recapitalised, former RBI chiefs warn

Collections encouraging but real picture to emerge in December

GST collections have surged in October due to robust festive demand and are likely to continue in November as well with Diwali falling on 14 November, tax officials said.

After falling to Rs 32,172 crore in April, tax collections have been improving, touching Rs 95,480 crore in September and Rs 1,05,155 crore in October.

“Even before Covid, collections had been static as the economy slowed down,” Majumder said, pointing out that the surge in collections in October this year was on account on festive demand which may continue to November as well.

“The real picture will emerge in December when the festive buying ends,” he said.

Also read: Economic reforms now a sideshow, Modi govt focused on other priorities, says ex-FinSec Garg

this piece is an example for seeing negative in every positive….