New Delhi: For a government that has been unsuccessful in its attempts to resolve large tax disputes like the ones involving Vodafone and Cairn Energy, it has quietly managed to make substantial headway in reducing its relatively smaller-sized disputes.

The Narendra Modi government’s ‘Vivad Se Vishwas’ scheme — aimed at resolving direct tax disputes and bringing down overall litigation — has managed to resolve around 30 per cent of the direct tax disputes that were pending as of January 2020, data available with the Ministry of Finance shows.

Of the nearly 5 lakh plus disputed cases recorded until 31 January 2020 (before Finance Minister Nirmala Sitharaman announced this scheme in her 1 February 2020 budget), more than 1.4 lakh cases are set to be resolved under this scheme of the government.

However, companies involved in large tax disputes with the income tax department have steered clear of the scheme, said finance ministry sources.

Data available with the I-T department shows that the scheme has managed to significantly bring down the number of disputed taxes cases. However, in terms of the amount of the disputed tax, the collections are less than 10 per cent of the disputed amounts involved because of the large firms staying out.

Of the total Rs 19.55 lakh crore of tax demand involved in the disputed cases as of January 2020, the amount of disputed tax that could be resolved is slightly over Rs 1 lakh crore.

This is because most of the big disputed tax cases faced by the tax department continue in various domestic courts and international arbitration courts. For instance, India lost to Vodafone Plc and Cairn Energy in international arbitration in cases related to retrospective taxation but has decided to continue with the litigation by filing appeals against the decisions over the last few months.

Under the Vivad Se Vishwas scheme, taxpayers were offered a complete waiver of interest and penalty and prosecution. The taxpayers were required to only pay the disputed tax to settle the case. In case the dispute was around the levy of interest or penalty, the taxpayers had the option of resolving it by payment of around one-fourth of these dues.

The scheme was also extended by a year from its initial deadline both due to the pandemic and to give ample time to taxpayers to decide if they wish to opt for the scheme.

Also read: Citibank to exit consumer business in India and 12 other markets across Asia, Europe

Only central PSUs using scheme to resolve high value disputes

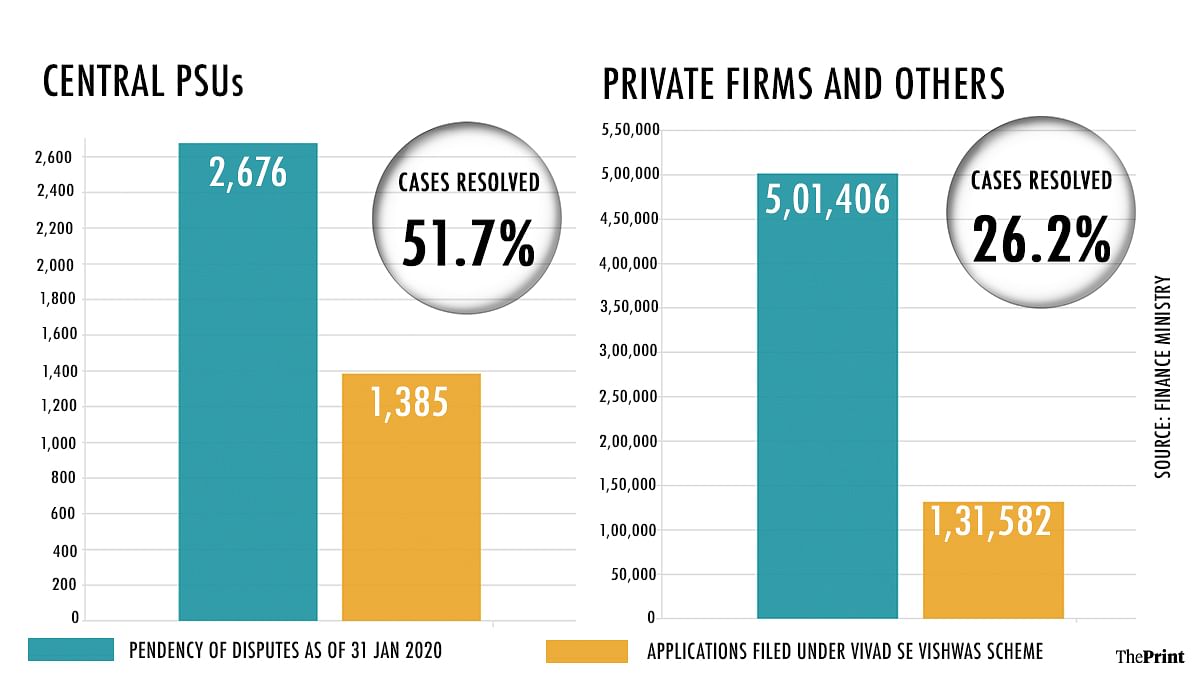

The data also shows that only central public sector undertakings (PSUs) have used this scheme to settle their relatively larger tax disputes.

The disputed tax amount involved in the 1,385 declarations filed by central PSUs was Rs 35,109 crore — an average of Rs 25 crore of disputed tax involved in each case. In contrast, the total disputed tax amount involved in the over 1.3 lakh declarations made by private companies and others was Rs 63,713 crore — an average of Rs 50 lakh of tax dispute involved per case.

Further, while 51 per cent of the appeals involving PSUs are set to be resolved under the scheme, only 26 per cent of the appeals involving the private sector and others will be resolved.

S. Vasudevan, executive partner, at Lakshmikumaran & Sridharan Attorneys, said the I-T department’s assessment of the success of the scheme may be true statistically, but one needs to look beyond the numbers and understand how the scheme could have been more successful.

“Even the numbers indicate that more than half of the disputed tax collections have come from public sector undertakings. It is an open secret that many of the public-sector undertakings were nudged by the central government to settle pending tax disputes under the scheme, even though considerably high and unsustainable demands were raised by the tax department,” he said.

“Even though settlement of long pending disputes by paying only the tax amount, without having to pay any interest and penalty, was a very attractive proposition, many of the private taxpayers were not willing to settle to opt for the scheme as issue-wise settlement was not allowed. Similarly, exclusion of cases involving prosecution, foreign undisclosed assets, etc. also kept many potential taxpayers away from the scheme,” he added.

Also read: Amazon’s future CEO firm on India expansion amid protests by local vendors

Modi govt’s efforts to bring down litigation

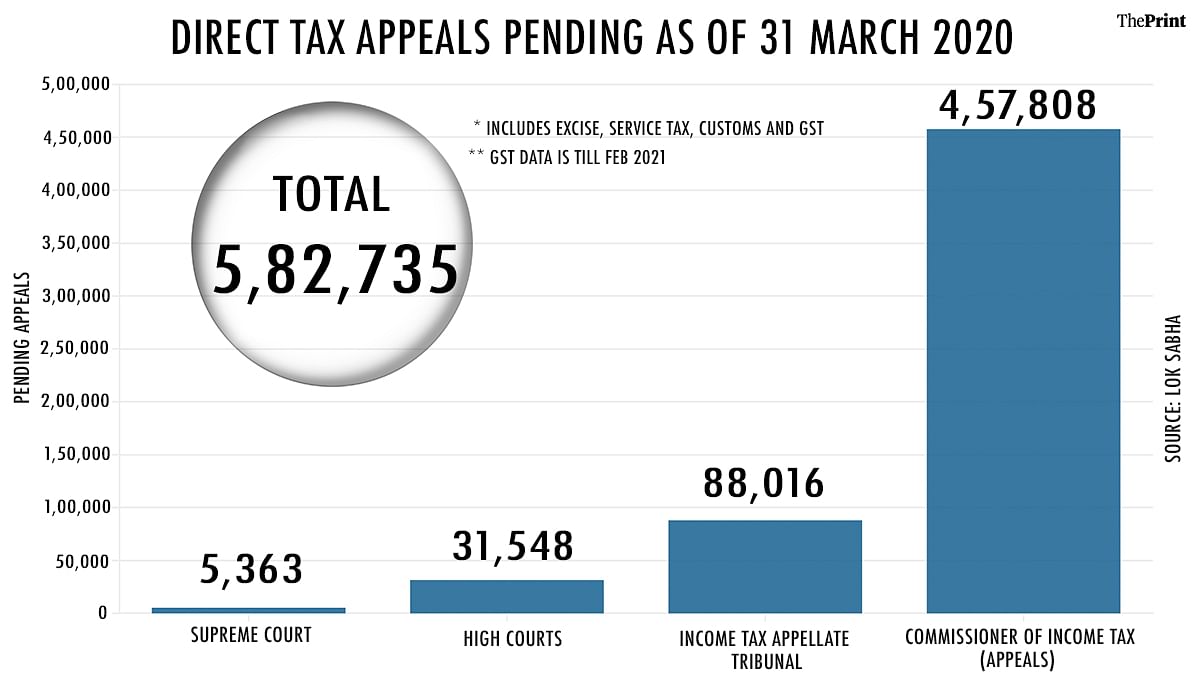

There were 5.82 lakh direct tax-related pending appeals across judicial and quasi-judicial bodies like the Supreme Court, high court, income tax appellate tribunal and Commissioner of Income Tax (Appeals) as of 31 March 2020, according to finance ministry data presented in a reply to a member query in the Lok Sabha.

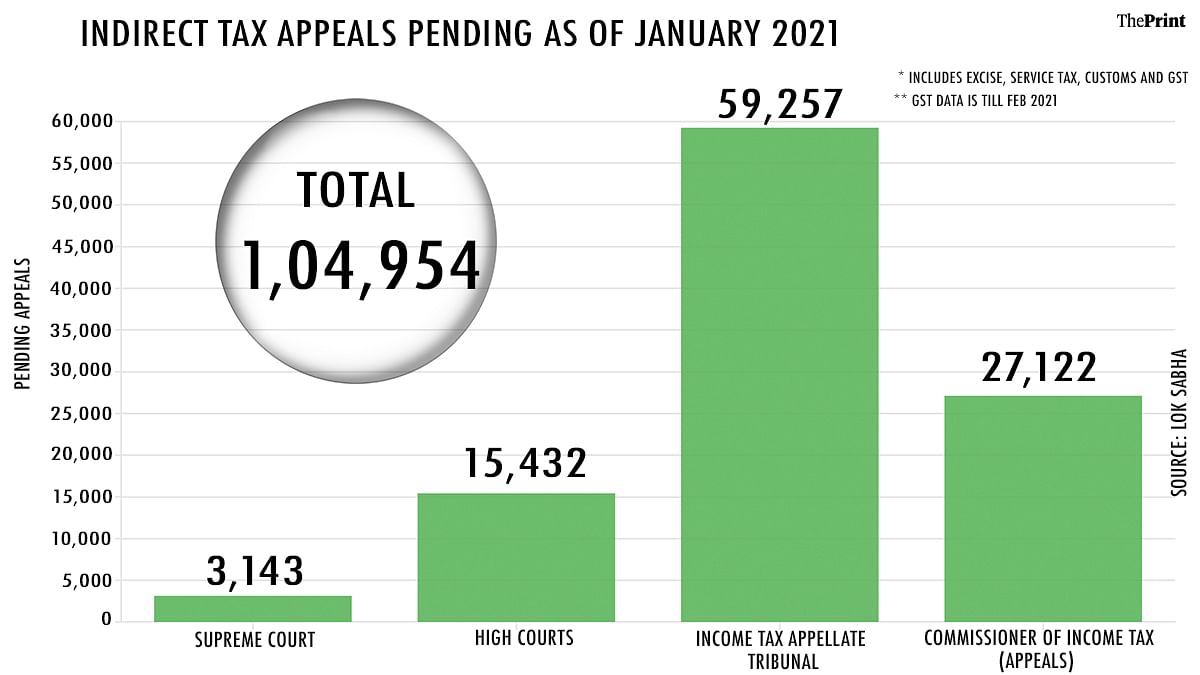

Pending appeals for indirect tax cases including those involving excise, customs, service tax and the goods and services tax were over 1 lakh as of the end of January 2021.

Since coming to power in 2014, the Modi government has taken many steps to reduce disputes. These include raising the threshold of the amount of tax involved for filing appeals in both the lower courts and in the higher judiciary in 2019.

For instance, for the I-T department to file an appeal in the income tax appellate tribunal against a taxpayer, the amount of tax involved has to be at least Rs 50 lakh as against the previous limit of Rs 20 lakh. In addition, the amount of tax involved for appeals to the high courts and Supreme Court were doubled to Rs 1 crore and Rs 2 crore, respectively.

To resolve indirect tax disputes, the government also introduced the ‘Sabka Vishwas’ scheme in 2019 collecting nearly Rs 40,000 crore from it.

The ‘Vivad Se Vishwas’ scheme has garnered over Rs 54,000 crore for the government in 2020-21 and is likely to further add to the direct tax collections kitty further this year as well as firms make the remaining payments by the end of April.

Also read: India’s growth prospects are being rolled back as Covid cases hit new records everyday

Both in direct and indirect taxes, demands are raised and confirmed for frivolous reasons. In the appeal before the appellate tribunals, 80% of the cases are decided in favour of the assessees. The tax payers know which side of the bread is buttered! Most of the huge demnds anounced soon after some search and seizure operation eventually flops, many years later. They never make headlines when such cases fail.