A rout in emerging-market currencies, high oil prices and fears of fiscal slippage before 2019 general election have made weakened the rupee.

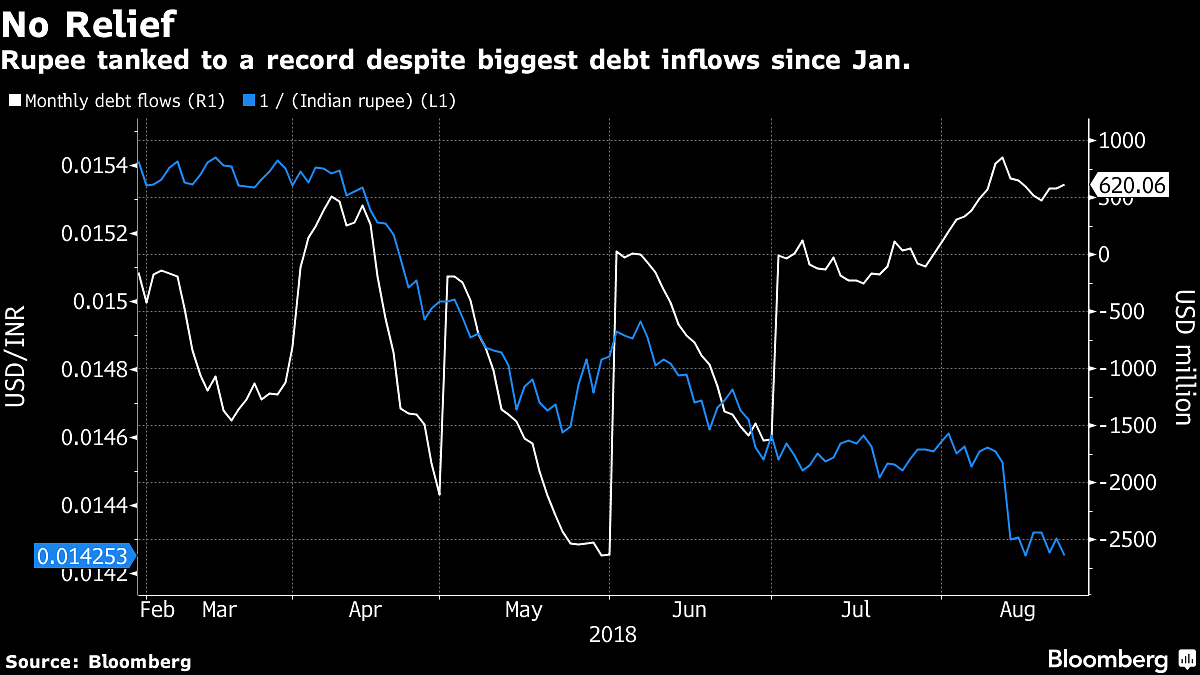

Global investors in August bought the most Indian bonds in seven months, showing signs of returning to a market they’d abandoned for the better part of 2018. The inflow brought no joy for currency traders as the rupee hit multiple new lows in the past two weeks.

Funds plowed $403 million into rupee-denominated bonds after $105 million in July, amid optimism the worst of the yearlong rout that sent the local benchmark yield to its highest since 2014 is over. The streak needs to extend to chip away at this year’s outflow of $5.6 billion that has contributed to the currency weakness.

A rout in emerging-market currencies, elevated oil prices and fears of fiscal slippage before a general election next year have combined to make the rupee Asia’s worst performer in 2018. The currency capped its biggest monthly retreat in three years in August, falling past an unprecedented 71 per dollar on Friday.

Local traders polled by Bloomberg last month expect the headwinds, most notably from the price of oil, to persist.

“Yields are attractive but the overall negative sentiment around emerging markets will put pressure on Indian bonds,” said Manu George, Singapore-based director of fixed income at Schroder Investment Management Ltd., which oversees $582 billion in assets. “We’re less bullish on bonds now” after recently increasing exposure to India, he said.- Bloomberg