New Delhi: A massive shortfall in tax collections could prompt the Narendra Modi government to start considering rate hikes under the goods and services tax regime.

In a letter dated 27 November, the GST Council — the federal decision-making body for the tax — has written to all states to suggest measures on “compliance and rates which would help in augmenting revenue”.

The Council has asked states for suggestions regarding review of items currently exempt from the GST levy, GST and compensation cess on various items, and rate calibration for addressing the inverted duty structure.

Since the rollout of the GST in July 2017, the GST Council has been consistently cutting tax rates applicable on various sectors as it has looked to lower the burden on consumers and help revive demand for many products. A rate increase will be a significant departure from the trend so far and indicates the pressure on government finances.

The next meeting of the GST Council is to be held later this month.

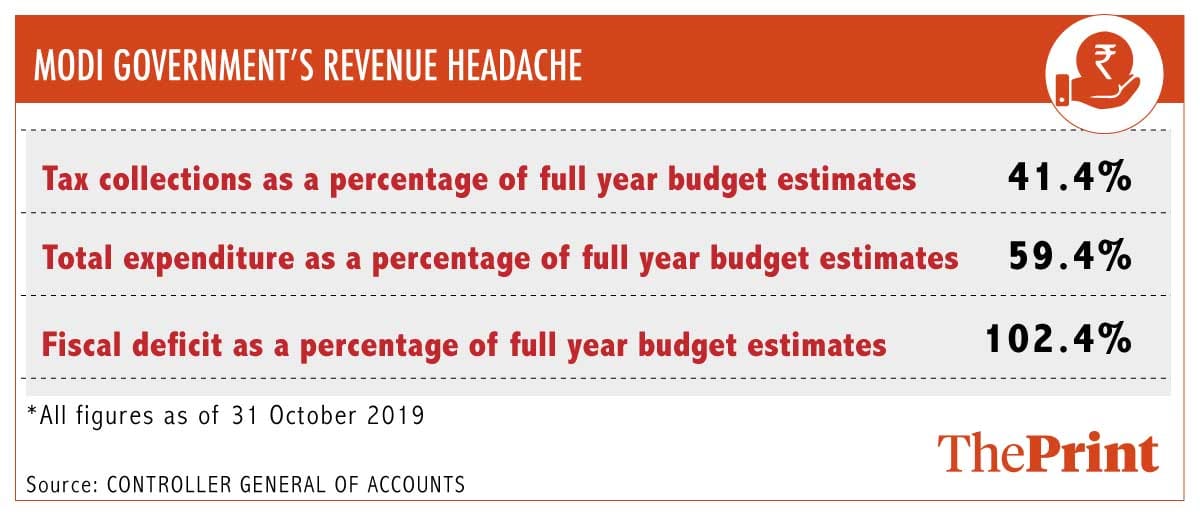

An increase in GST rates could add to inflationary pressures in the economy at a time when inflation has crossed the 4 per cent medium target of the monetary policy committee. At the same time, with GST revenues not picking up and corporate tax collection growth decelerating sharply, the government has been struggling to meet its fiscal deficit target of 3.3 per cent of GDP for 2019-20.

State of tax collections

In the letter, accessed by ThePrint, the Council noted that “lower GST and compensation cess collections” have been a matter of concern over the past few months. Compensation requirements have increased significantly and “are unlikely to be met from the compensation cess being collected”.

Constant rate cuts, tax evasion and lack of tax buoyancy have resulted in GST collections growing at a far slower pace than envisaged by the government.

Until November-end, the government had collected around Rs 3 lakh crore in central GST revenues, which was only 58 per cent of the budgeted full-year target of Rs 5.26 lakh crore. Compensation cess, collected by the union government and shared with the states, was at Rs 63,194 crore as of November-end, 58 per cent of the full-year target of Rs 1.09 lakh crore.

There is no reason to cheer on the direct tax front either, with growth in corporate tax collections decelerating. In the April-October period, the government had collected Rs 2.73 lakh crore in corporate taxes, only 36 per cent of the full-year target of Rs 7.66 lakh crore.

Also read: If GST is not simplified, it’s very purpose is defeated: Finance commission chief NK Singh

Promise ‘unfulfilled’

To bring all states on board for the implementation of GST, states were promised a compensation for any revenue losses arising on account of a transition to the GST for a period of five years. This amount was to be paid bi-monthly from the compensation cess pool.

Cess is levied on so-called demerit goods like luxury cars, cigarettes and aerated drinks over and above the highest 28 per cent tax rate applicable on these products.

However, the states have complained that the central government has not been releasing the compensation to the states for the last four months despite it being mandated by law.

GST Council must be convened at the earliest to discuss Compensation Payment dispute between Centre and States. Central government has defaulted the payment. Law says that Compensation must be paid in bi- monthly instalments. Today we enter the fourth month without payment.

— Thomas Isaac (@drthomasisaac) December 1, 2019

Shocking that the Centre is delaying the GST compensation amounting to ₹4100 crore as compensation & arrears to Punjab. Urge PM @narendramodi ji & FM @nsitharaman ji to intervene & solve the problem which has the potential to bring governance of the state to a grinding halt.

— Capt.Amarinder Singh (@capt_amarinder) November 24, 2019

Also read: GST revenue collection crossed Rs 1 lakh cr in November, after 2 months of negative growth

Soon extreme left wing Marxist Modi will bring back Indira Gandhi’s extortionate tax rates of more then 100 %.

More economic activity – which ideally does not mean more government spending – will yield more tax revenues. That is the only sustainable way forward.