New Delhi: In 1991, Benin, Trinidad and Tobago, Costa Rica and Pakistan were among the 64 countries that received more foreign direct investment (FDI) than India did.

By 2020, however, India emerged as the fifth-largest recipient of FDI in the world, data from the United Nations Conference on trade and development shows.

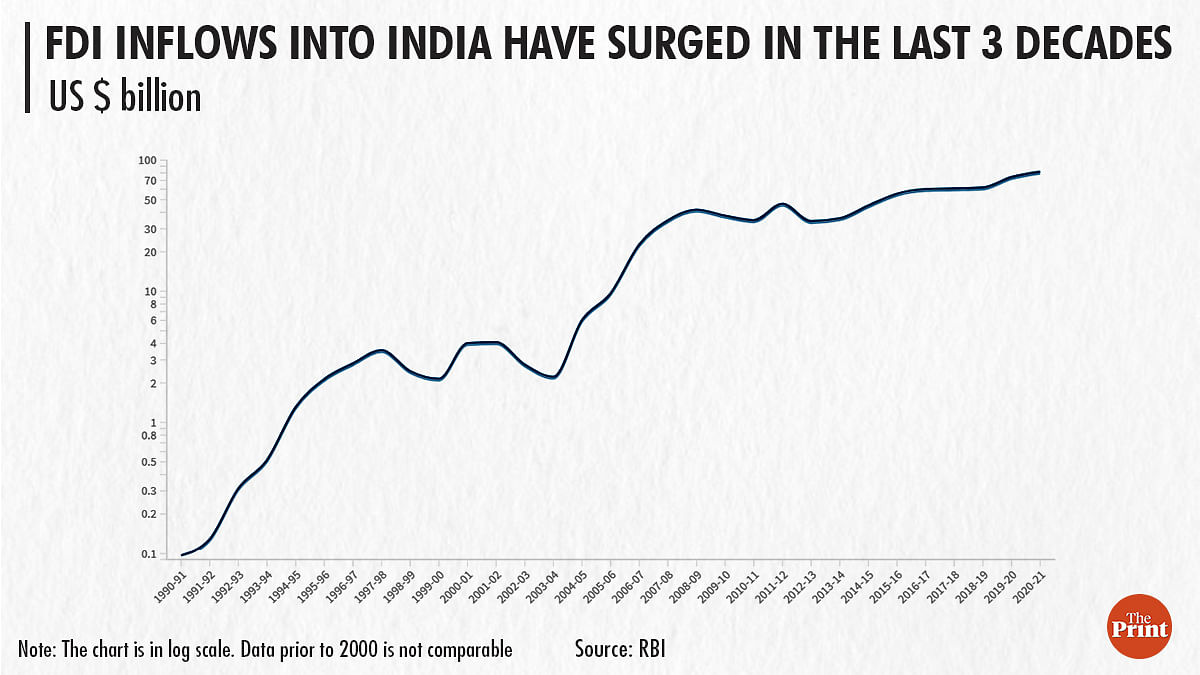

In absolute terms, FDI into India increased from $97 million in 1990-91 to more than $81,722 million in 2020-21, according to data with the Reserve Bank of India.

So what changed in the three decades that made India an attractive long-term foreign investment destination?

While opening different sectors to foreign direct investment has been a gradual process spanning many governments, the FDI reforms initiated as a part of the 1991 reforms played a major role in cementing the government’s intent in encouraging foreign investment.

While the first spurt of FDI was seen in the 1980s, only a handful of global firms set up their operations in India mainly on account of a highly restrictive policy that placed limits on the foreign equity shareholding in the Indian joint venture.

Foreign investors were allowed to hold only 40 per cent equity in the Indian joint ventures adversely impacting active technology transfers as foreign investors were wary of transferring technology where they didn’t have control over the joint ventures.

All this changed after 1991 as India tried to encourage foreign direct investment — considered to be a more stable form of capital.

Also read: Gold smuggling to cyber-aided financial crimes: How 1991 reforms changed crime in India

Not an easy journey

The 1991 industrial policy did away with the 40 per cent cap on foreign equity investment. It also empowered the Reserve Bank of India to grant ‘automatic approval’ to foreign equity investment of up to 51 per cent in more than 30 industries. This list was gradually expanded over the years.

Technology transfers to Indian joint ventures (JVs) from the foreign parent firm were also made easier by removing many mandatory approval requirements. Reduction of controls on technology and royalty payments were also announced to attract FDI.

All this meant Indians now had access to affordable television sets, new car models, consumer durable goods and the latest communication technology. The announcement saw companies like Sony and Mitsubishi start their manufacturing in India.

But it was not an easy journey.

The removal of FDI restrictions faced stiff resistance from the vocal Left parties and even from leaders of the ruling Congress. The government was blamed for yielding to the demands made by the International Monetary Fund.

Even top Indian industry officials were wary of the impact of FDI on their business. They submitted a memorandum to the then finance minister, Manmohan Singh, seeking a level playing field before FDI or imports are allowed into India.

There were other problems too.

As Montek Singh Ahluwalia, who was then a secretary in the commerce department and in the department of economic affairs, wrote in his book Backstage, foreign investors willing to invest in India faced many roadblocks — some that were not even envisaged by the Indian government.

For instance, while Japanese investors were willing to invest in India, restrictions on consumer goods imports presented a challenge for them to convince their Japanese staff to work in India as they weren’t allowed to import basic items like food ingredients needed for cooking.

FDI trends

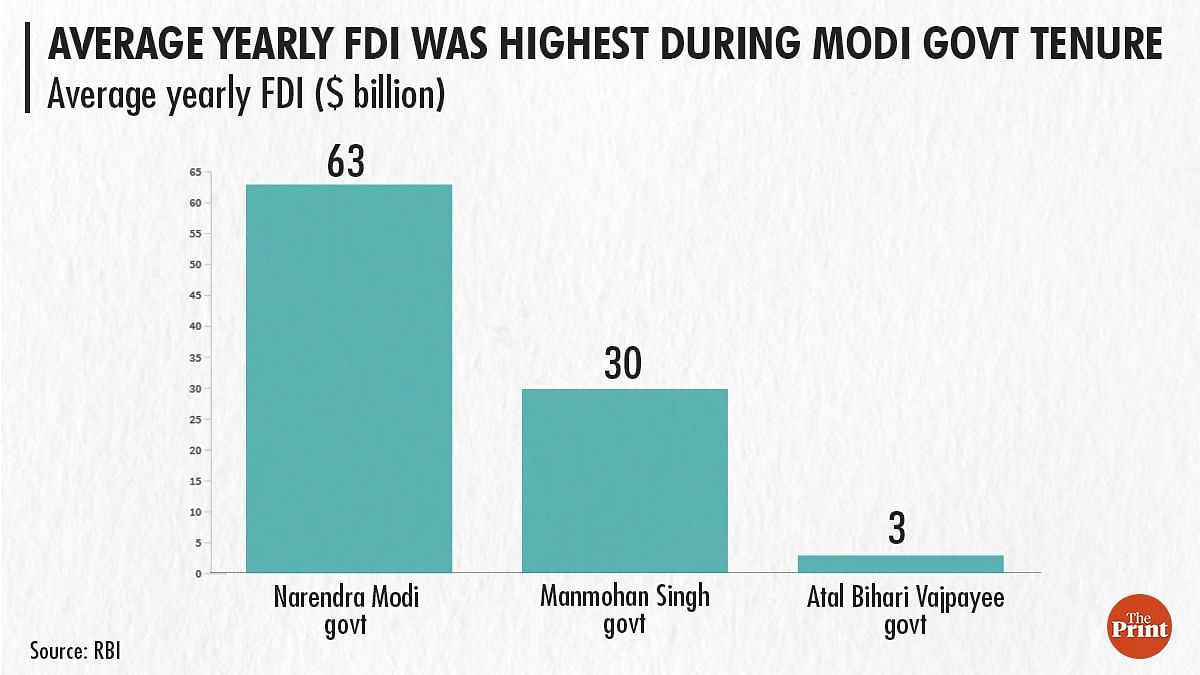

FDI in India has seen sharp growth over the years. FDI inflows have been the highest in the seven years of the Narendra Modi government.

Cumulative FDI inflows in this period were at $440 billion as against $305 billion in the 10 years of the UPA government under Manmohan Singh and $18 billion during the six years of the Atal Bihari Vajpayee government.

Average yearly FDI inflows have been at $63 billion during the tenure of the Modi government beginning 2014 as against an average annual inflow of $30 billion during the UPA government (2004-05 to 2013-14) and $3 billion during the Vajpayee tenure (1998-99 to 2003-04).

However, due to a change in the definition of FDI from 2000 making it more broad-based, the pre- and post-2000 data is not comparable.

“Manmohan Singh’s (1991) budget talked about attracting investment and making India competitive. But that vision was never really fully realised. FDI hardly came into manufacturing and went into services,” said Biswajit Dhar, Professor, Centre for Economic Studies and Planning, School of Social Sciences, Jawaharlal Nehru University.

“Even if you look at the FDI inflows now, while overall FDI inflows have gone up, there is an issue of composition,” he said. “The data indicates a lot of round-tripping may be going on as many tax havens are the major source of FDI inflows. In addition, there have been a lot of takeovers and stock sales. How much investment is actually going into greenfield investment and creating additional capacity and how much is going for taking over existing capacity?”

Dhar added: “The government is expecting FDI to come into manufacturing. That is not happening. Investment is coming to sectors that don’t really need it.”

FDI data shows that though India received record FDI inflows in 2020-21 despite it being a pandemic year, the majority of that FDI flowed into one company — Reliance Industries’ Jio Platforms.

(Edited by Arun Prashanth)

Also read: If we raise duties to make Indian industry competitive, we’ll end up close to 1991: Montek