New Delhi: The Indian economy was ravaged by the pandemic in 2020-21, but foreign direct investment (FDI) flows were at record highs — mainly driven by one company.

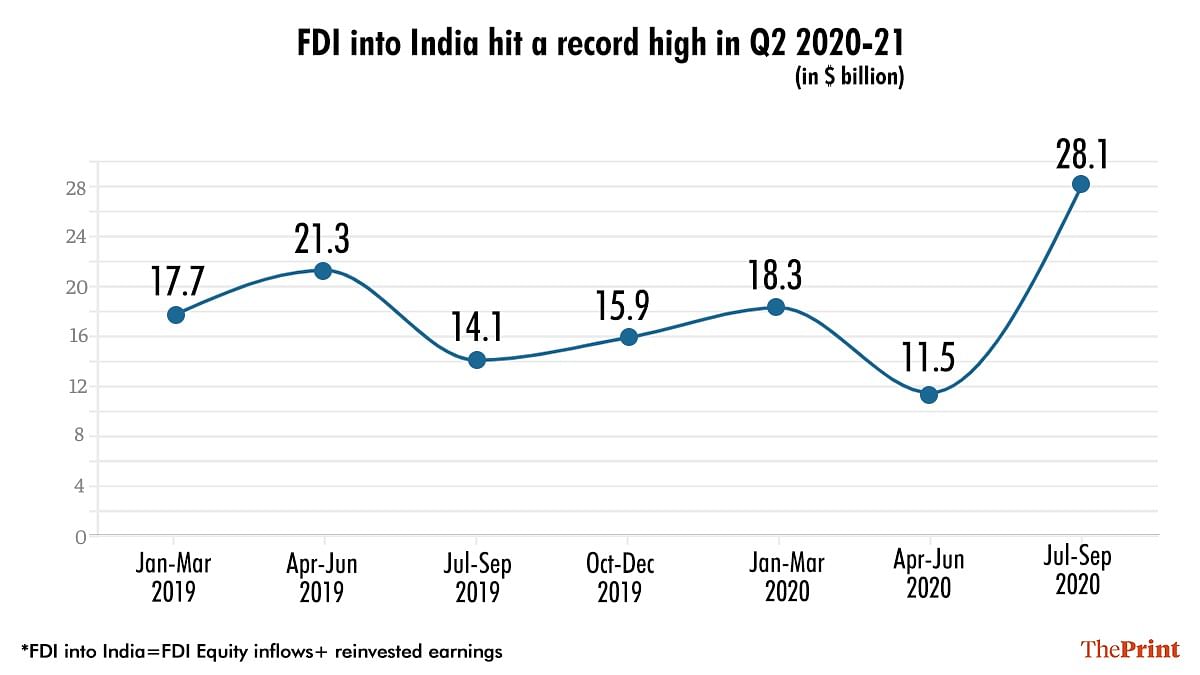

India received a total FDI of $28.1 billion in the July to September quarter, and $11.5 billion in the previous April to June quarter, adding to a total FDI inflow of $39.6 billion in the first half of the fiscal.

Over $30 billion of this were in the nature of equity FDI inflows, or basically investments made by foreign companies for equity stakes in Indian firms, with the remaining money as reinvested earnings or profits ploughed back into the business.

Data with the Department for Promotion of Industry and Internal Trade (DPIIT) shows that the majority of these equity FDI inflows in the first half of 2020-21 were into the computer software segment and driven by investments into Jio Platforms, a subsidiary of Reliance Industries Ltd.

The sharp rise in FDI along with a contraction in GDP in the current fiscal could also see FDI as a percentage of GDP cross its previous years’ levels — this level has remained stagnant over the last five years.

Also read: Modi govt still hopes global giants will join race to buy Bharat Petroleum

Dominant sectors

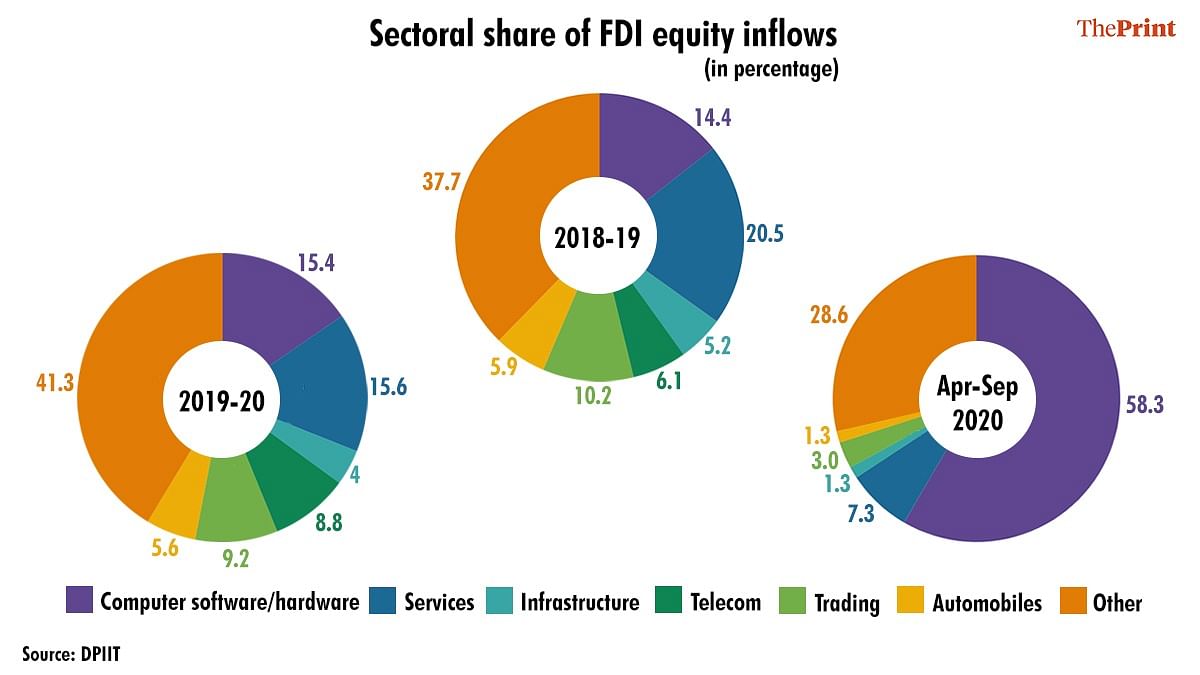

The category of computer software received 58 per cent of all the equity FDI in the country at $17.5 billion, followed by the services space which received nearly 8 per cent of the FDI during the period at over $2.2 billion.

Historical FDI data shows that traditionally these two have been the main sectors attracting FDI into the country, with services attracting the highest investor interest followed by computer software.

Other sectors like trading, automobiles, infrastructure, hotel and tourism and telecom are yet to see a significant foreign investment unlike the previous years when they attracted large amounts of FDI. To be sure, some of these sectors were also the worst hit due to the pandemic and the subsequent lockdowns and restrictions placed on sectors that required physical contact.

Investments into technology companies peaked in the September quarter following substantial investments into Jio Platforms. Firms like Facebook, Silver Lake, Vista Equity partners and others announced investments into Jio exceeding $15 billion or 50 per cent of the total FDI equity flows into the country during this period.

Data shows that the state of Gujarat received the largest amount of FDI during the period followed by Maharashtra, driven mainly by investments into Jio Platforms.

Mahendra Swarup, Managing Partner, Avocado Ventures, said only the big opportunities are attracting investments into the country. “The investments are coming into creating digital assets rather than real assets. They are not coming into manufacturing. They are not coming into sectors where the government would want it to come,” he said.

Also read: Prospects of a strong rupee face headwinds from RBI desire to hoard dollars

Defence could attract huge investments ahead, says govt

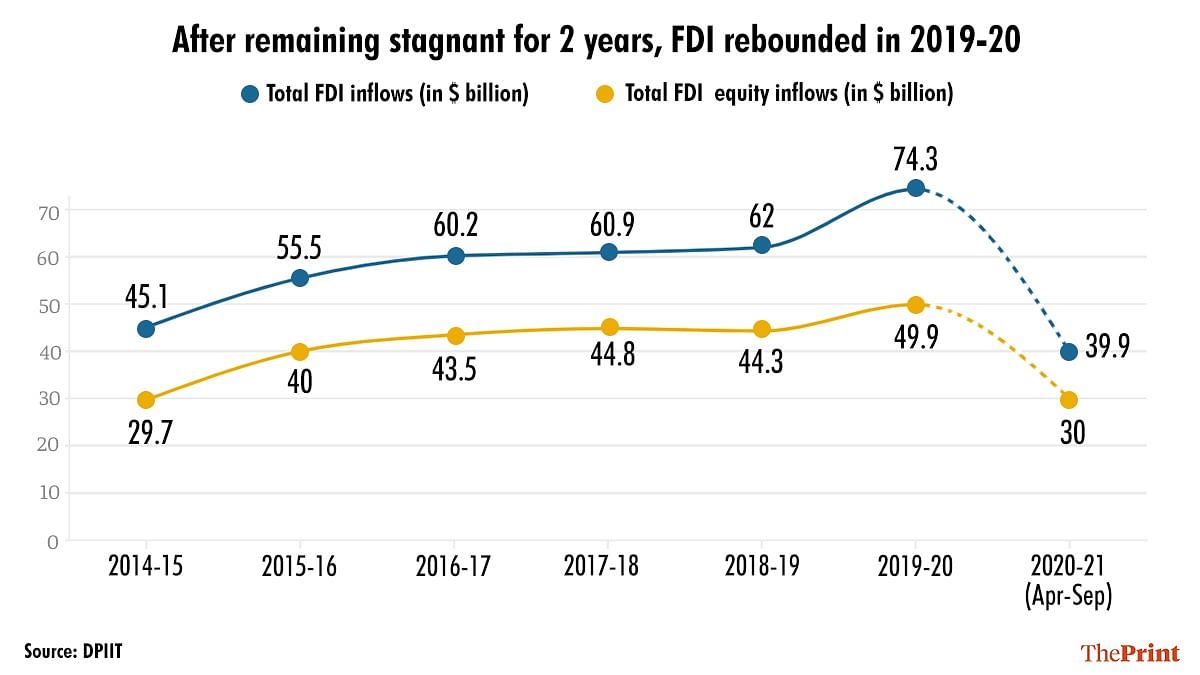

After registering relatively flat growth in 2017-18 and 2018-19, FDI investments into India rose sharply to $74 billion in 2019-20 from $62 billion in 2018-19 and $60.9 billion in 2017-18.

“The growth of FDI into India has been steady and impressive over the last few years even if one leaves out the one-time investments into one firm as seen this year,” DPIIT Secretary Guruprasad Mohapatra told ThePrint.

“Post-Covid, FDI and FPI flows are growing steadily. Investor sentiment is quite positive about India,” he said, pointing out that this will translate into larger flows ahead.

“Fintech and healthcare are some of the other sectors that are seeing investor interest. Going ahead, with the opening up of the defence sector, there could be substantial foreign investments into the sector in the next few years. Many joint ventures between big Indian firms and foreign companies have already been announced,” he said.

Mohapatra added that traditionally, brownfield projects attract larger inflows as compared to greenfield projects.

India is banking on its attractive corporate income tax rates, the removal of FDI caps in different sectors as well as the government’s push for manufacturing through the production-linked incentive (PLI) scheme to attract substantial foreign investment into the country.

“The PLI scheme is designed in a way to encourage incremental sales domestically and to make India an important part of the global supply chain. It will see a lot of greenfield projects as well as expansion of brownfield projects. It will attract both domestic and foreign investment into manufacturing,” Mohapatra said.

Swarup, however, was less optimistic. “The PLI scheme may help but only to a limited extent. Any FDI investor looking to invest looks at the long term prospects rather than short term subsidy. So their focus is on the larger regulatory environment.”

He added, “In India, bringing in money has been easy but taking it out is not easy. The Indian business houses may benefit more from the PLI as it will help them generate cash immediately.”

FDI as a % of GDP stagnant for last 5 years

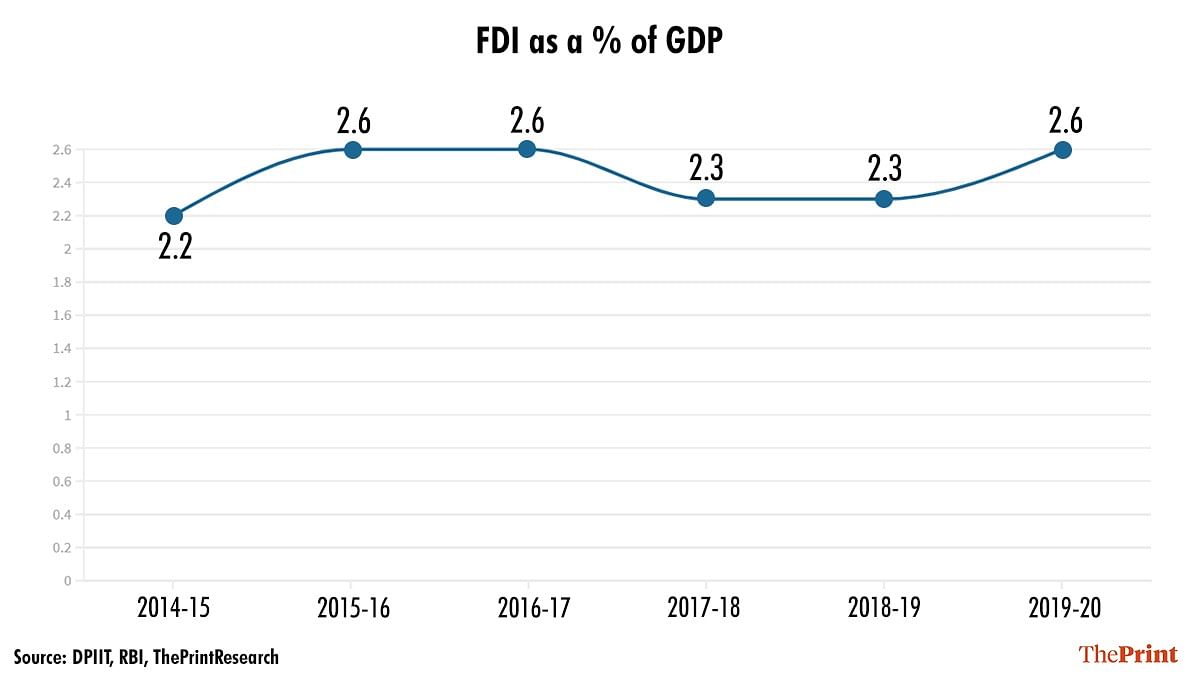

Data shows that FDI coming into India, when calculated as a percentage of the gross domestic product, has been stagnant around 2.3-2.6 per cent for the last five years ending 2019-20.

However, this could change this year as a fall in nominal GDP due to the Covid-19 pandemic as well as a sharp rise in FDI inflows thanks to investments in Jio could see FDI as a percentage of GDP cross 3 per cent.

In the April-September period, FDI inflows as a percentage of the half-year GDP was 3.5 per cent. To be sure, this number may fall as the economy expands in the second half of the fiscal year.

Rajesh Chakrabarti, professor and dean at Jindal Global Business School, said FDI is an indicator of the level of globalisation of the country.

“The fact that FDI as a percentage of GDP has remained stagnant, means that the country has not globalised much in the last few years. But one must remember that the last five years has also been the time when countries have looked inward across the world and the anti-globalisation sentiment has come to the fore,” he said.

“There is also no dramatic change in perception about India as an investment destination,” he added.

Also read: Why bankrupt DHFL’s ordinary FD holders will lose more money than banks that supported it