New Delhi: Petrol prices breached the Rs 100-per-litre mark in Delhi Wednesday and the national capital has now joined the list of many Indian cities where petrol now costs in three figures.

With this steep rise becoming a political issue again, here’s a look at how the fuel price has charted the course over the last 17 years under the current and the previous regimes.

Measure of rise

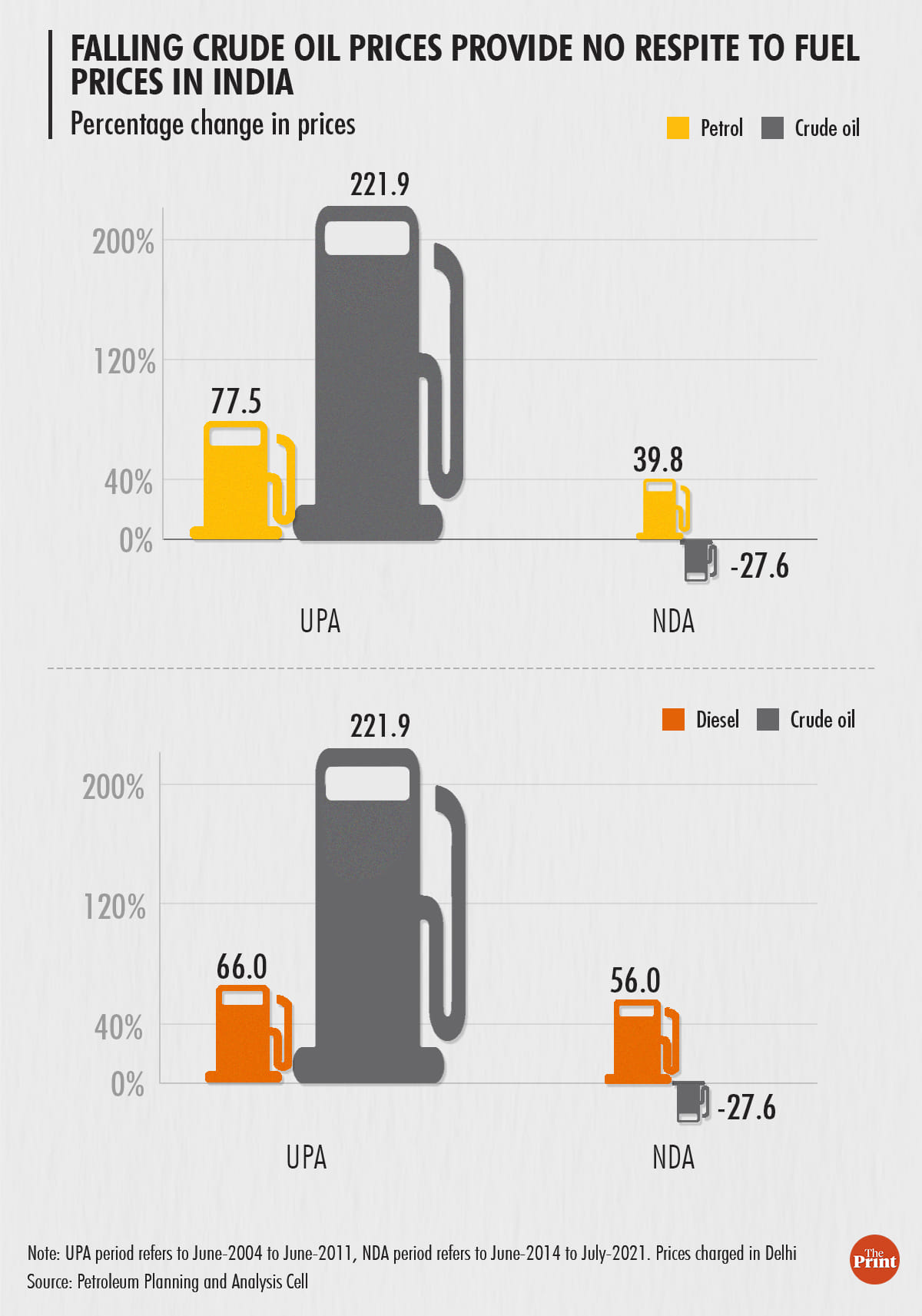

In the seven years since it came to power, the Narendra Modi government has raised petrol and diesel prices by 40 and 56 per cent, respectively — from Rs 71.41 and Rs 57.28, to Rs 100.21 and Rs 89.53.

Under the first seven years of the previous United Progressive Alliance (UPA) government, petrol and diesel prices were raised 77 and 66 per cent, respectively — from Rs 36 and Rs 23, to Rs 63 and Rs 38.

Also read: Why India’s bankruptcy framework needs urgent reform, once again

Why prices went up under respective regimes

During the UPA tenure between 2004 and 2014, crude oil prices had seen a 222 per cent rise — from $34.16 per barrel to $110 per barrel. This was the primary reason for the increase in petroleum products.

Since 2014, the crude oil prices have fallen by 28 per cent — from $109 per barrel to $78.85 (average June 2021 values by Petroleum Planning & Analysis Cell).

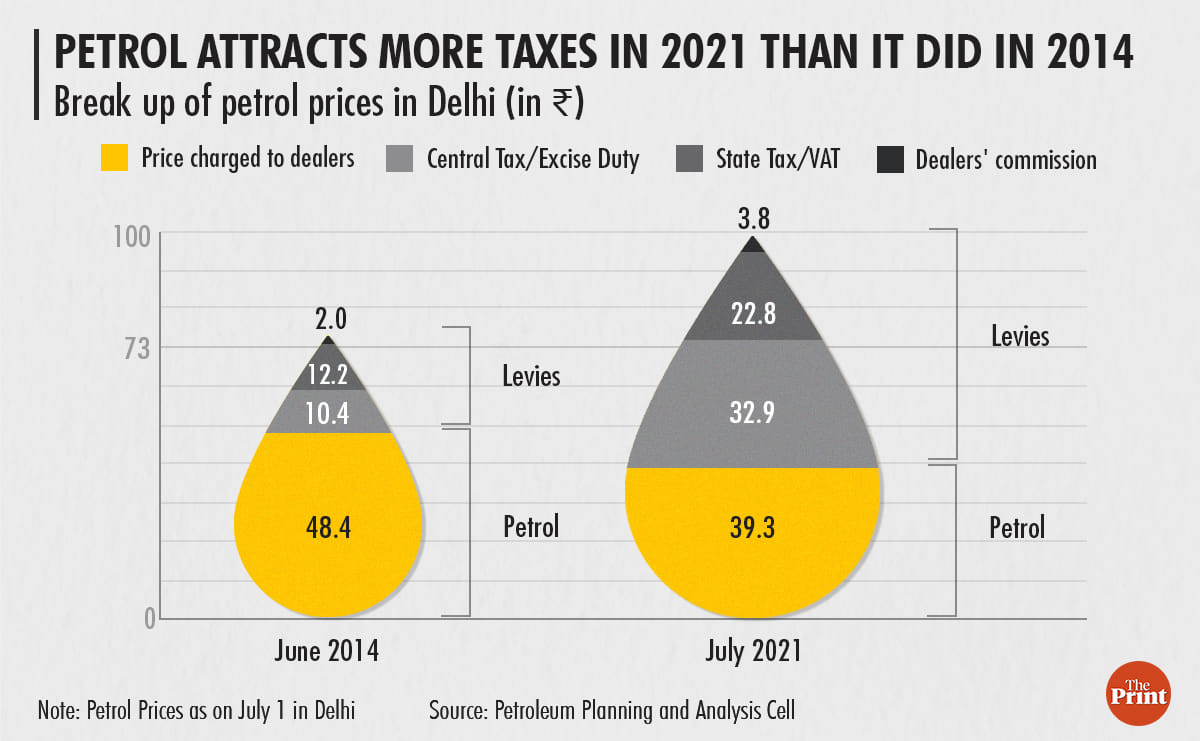

The increase in petroleum product prices under the Modi government despite a fall in crude costs has come due to higher taxes.

In June 2014, a month after the new regime came to power, the petroleum price charged from dealers, i.e. without any levies, formed nearly two-third of the retail price. In July 2021, nearly 60 per cent of the retail selling price accounts for taxes and levies.

According to a finance ministry reply in Parliament in April-January of the 2020-21 fiscal, the excise duty collected from selling fuel formed roughly 12 per cent of the government’s gross tax receipts. This is a threefold rise from the respective share in FY14.

Reasons presented by governments

The UPA government had justified the price hike in order to prevent public sector oil marketing companies (OMCs) from making huge losses.

The then oil minister, Murli Deora had said, “What we did was bare necessity. We were compelled to do so because oil PSUs were faced with Rs 74,300 crore under recoveries (revenue loss on fuel sales this fiscal). The opposition is being a hypocrite in its criticism.”

On its part, the ruling Bharatiya Janata Party (BJP) has cited various reasons for the rising prices.

Petroleum Minister Dharmendra Pradhan said last month that the high taxes on fuel were actually supporting the various welfare programmes the government has to run.

A week later, the BJP IT cell head Amit Malviya claimed that the previous UPA government had issued oil bonds worth 1.3 lakh crore to keep retail prices in check, which the present government is servicing.

The increased prices of petrol and diesel is a legacy of UPA’s mismanagement.

We are paying for the oil bonds that will come up for redemption starting FY2021 till 26, which were issued by UPA to oil companies for not increasing retail prices then!

Bad economics, bad politics. pic.twitter.com/I4hZR0i1K8

— Amit Malviya (@amitmalviya) June 20, 2021

The UPA government used these bonds to prevent OMCs from making losses and keep fiscal deficit within limits.

The Modi government’s liability for the current fiscal for servicing oil bonds is roughly Rs 20,000 crore.

In Parliament, Minister of State for Finance Anurag Thakur had shared that in the first 10 months of FY21, the government had collected close to Rs 3 lakh crore from central excise duties levied on petrol and diesel.

Between FY14 and FY21 (April-January), the excise duty collected from petrol and diesel increased nearly six times even as the government’s gross tax receipts only doubled, the reply revealed.

Also read: Why Modi govt’s prized food scheme went from ‘dal of choice’ to no dal at all

What the Congress is saying now and BJP said then

The Congress is now alleging that the Modi government is charging too much tax on fuel when the international crude oil prices haven’t risen. The party’s chief spokesperson Randeep Surjewala had called the taxation under Modi regime “excessive public loot” last month.

Senior party leader Rahul Gandhi has also taken numerous potshots on fuel price hikes on microblogging site Twitter. While sharing a news clip about how the government had earned more from levying taxes on petrol diesel compared to what it earns on income and corporate tax, Gandhi said the government had attained “PhD in extorting taxes”.

टैक्स वसूली में PhD. pic.twitter.com/RfRxmF8o7J

— Rahul Gandhi (@RahulGandhi) June 20, 2021

Before coming to power, the BJP in opposition had led several protests over fuel price hikes.

Former finance minister, the late Arun Jaitley, had even asked the government to rationalise the taxes in 2012, to provide relief to the common man.

When in opposition, Arun Jaitley & Sushma Swaraj minced no words in criticising the UPA government for rising oil prices. Watch: pic.twitter.com/lC8DgYsK9P

— ThePrintIndia (@ThePrintIndia) September 27, 2017

Impact of fuel price rise

Rising fuel prices can build inflationary pressures on the economy.

Petrol and diesel have a combined weightage of 4.7 per cent in the wholesale price index (WPI), which measures the inflation rate of products before they reach market shelves. The WPI reached an all-time high of 10.49 per cent in May this year, majorly led by fuel and power indices, which jumped by 20.94 per cent on a year-on-year basis.

In February this year, Reserve Bank of India (RBI) Governor Shaktikanta Das had urged the government to cut indirect taxes on petrol and diesel in order to keep inflation under control.

“Proactive supply side measures, particularly in enabling a calibrated unwinding of high indirect taxes on petrol and diesel – in a coordinated manner by centre and states – are critical to contain further build-up of cost-pressures in the economy,” he was quoted in the minutes of the meeting.

In May, retail inflation breached the 6-per cent limit set by the RBI.

(Edited by Amit Upadhyaya)

Also read: Kabuli chana price set to rise, could cost Rs 130/kg ahead of festive season as states unlock