New Delhi: Over the last few weeks, petrol prices have crossed Rs 100 per litre in several Indian cities.

As prices continue to soar, the Modi government is under increasing pressure to cut high taxes on fuel. However, the government has cited the instrument of oil bonds issued by the UPA regime under then Prime Minister Manmohan Singh to justify its inability to reduce the high incidence of taxes on petroleum products.

ThePrint explains what these oil bonds are and how they impact the budget calculation of the Modi government.

What are oil bonds

Oil bonds are special securities issued by the government to oil marketing companies in lieu of cash subsidy.

These bonds are typically of a long-term tenure like 15-20 years and oil companies are paid interest.

Before the complete deregulation of petrol and diesel prices, oil marketing companies were faced with a huge financial burden as the selling price of petrol and diesel in India was lower than the international market price.

This ‘under-recovery’ is typically compensated through fuel subsidies allocated in the Union budget. However, between 2005 and 2010, the UPA government issued oil bonds to the companies amounting to Rs 1.4 lakh crore to compensate them for these losses.

Why do governments issue such bonds?

Compensation to companies through issuance of such bonds is typically used when the government is trying to delay the fiscal burden of such a payout to future years.

Governments resort to such instruments when they are in danger of breaching the fiscal deficit target due to unforeseen circumstances that lead to a collapse in revenues or a surge in expenditure.

These types of bonds are considered to be ‘below the line’ expenditure in the Union budget and do not have a bearing on that year’s fiscal deficit, but they do increase the government’s overall debt.

However, interest payments and repayment of these bonds become a part of the fiscal deficit calculations in future years.

Also read: Growth, not inflation, has become RBI’s priority after second wave of Covid

Why are they in news?

As prices of petrol and diesel climb steeply, the Centre has been under pressure to cut the high taxes on fuel.

Taxes account for 58 per cent of the retail selling price of petrol and 52 per cent of the retail selling price of diesel.

However, the government has so far been reluctant to cut taxes as excise duties on petrol and diesel are a major source of revenue, especially at a time the pandemic has adversely impacted other taxes such as corporate tax. The government is estimated to have collected more than Rs 3 lakh crore from tax on petrol and diesel in the 2020-21 fiscal year.

The Modi government has blamed the UPA regime for its inability to cut taxes. It pointed out that the bonds issued by the Manmohan Singh government have weakened the financial position of the oil marketing companies and added to the government’s fiscal burden now.

It is an argument that has been often repeated since 2018.

The increased prices of petrol and diesel is a legacy of UPA’s mismanagement.

We are paying for the oil bonds that will come up for redemption starting FY2021 till 26, which were issued by UPA to oil companies for not increasing retail prices then!

Bad economics, bad politics. pic.twitter.com/I4hZR0i1K8

— Amit Malviya (@amitmalviya) June 20, 2021

If you can please ask your bosses in the high command as to how they hiked the price of petrol & diesel recently in ‘Karnataka’.

The country and our OMCs are also yet to recover from the shock of Oil Bonds worth Rs 1.4 Lakh Crores issued during the UPA regime.

— Dharmendra Pradhan (@dpradhanbjp) September 9, 2018

What budget documents show

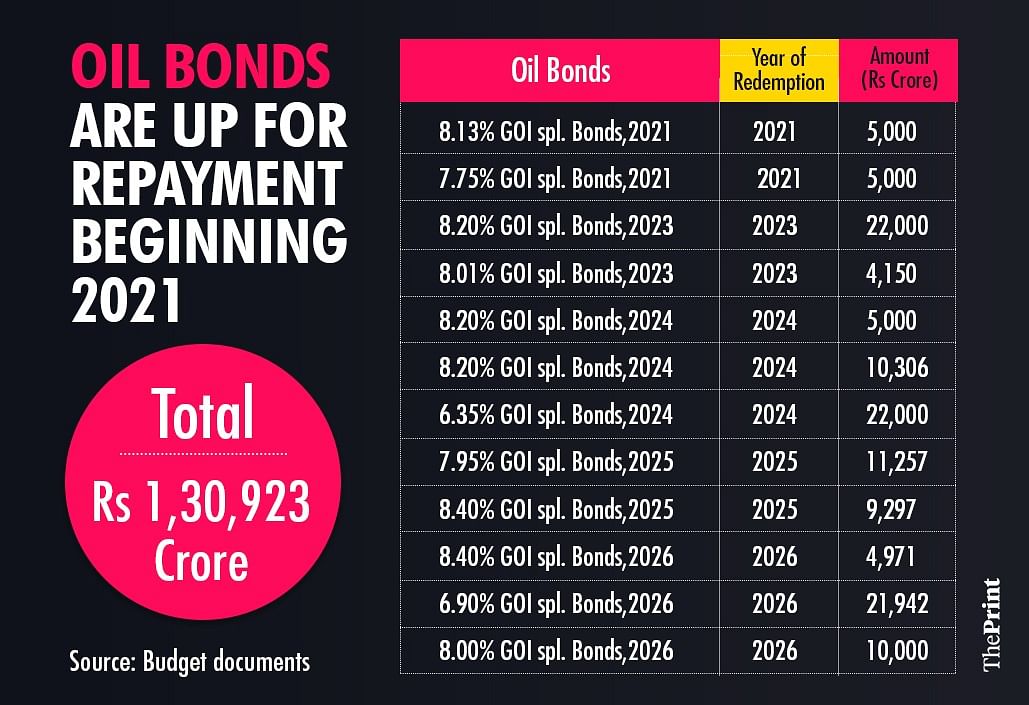

Budget documents show that such bonds will be up for redemption over the next few years — beginning with two to be redeemed in the current fiscal year — till 2026.

The government has to repay a principal amount of Rs 10,000 crore this year, according to these documents.

In addition, the government has paid around Rs 10,000 crore annually as interest over the last decade, according to a Rajya Sabha reply by Union petroleum minister Dharmendra Pradhan in December 2018.

The government is likely to pay a similar amount of interest for the current fiscal as well.

So, while the total outgo in the last few years has been Rs 10,000 crore annually, it will be around Rs 20,000 crore in the current fiscal.

Is issuance of such special securities restricted to UPA era?

Besides oil bonds, the UPA era also saw the issuance of fertiliser bonds from 2007 to compensate fertiliser companies for their losses due to the difference in the cost price and selling price.

However, the issuance of such special securities is not limited to the UPA regime.

Over the years, the Modi government has issued bank recapitalisation bonds to specific public sector banks (PSBs) as it looked to meet the large capital requirements of these PSBs without allocating money from the budget.

Since 2017-18, the government has infused more than Rs 2.5 lakh crore of recapitalisation bonds to banks and paid interest of more than Rs 20,000 crore over these three years.

The Modi government also used the National Small Savings Fund (NSSF) to finance its food subsidy bill outside of the budget. Beginning 2016-17 and till March 2021, the Food Corporation of India borrowed from NSSF to finance the food subsidy. However, the government repaid the entire amount last fiscal as it looked to move towards greater fiscal transparency.

(Edited by Neha Mahajan)

Also read: Cut petrol, diesel taxes to ease inflation, RBI’s monetary policy panel tells Modi govt, states