New Delhi: The impact of Operation Sindoor extended far beyond the battlefield as aerial battles continued in the stock markets. After India carried out precision strikes on nine terror camps in Pakistan and Pakistan-occupied Kashmir in the early hours of 7 May, global defence markets reacted with notable fluctuations, reflecting investor sensitivity to regional tensions.

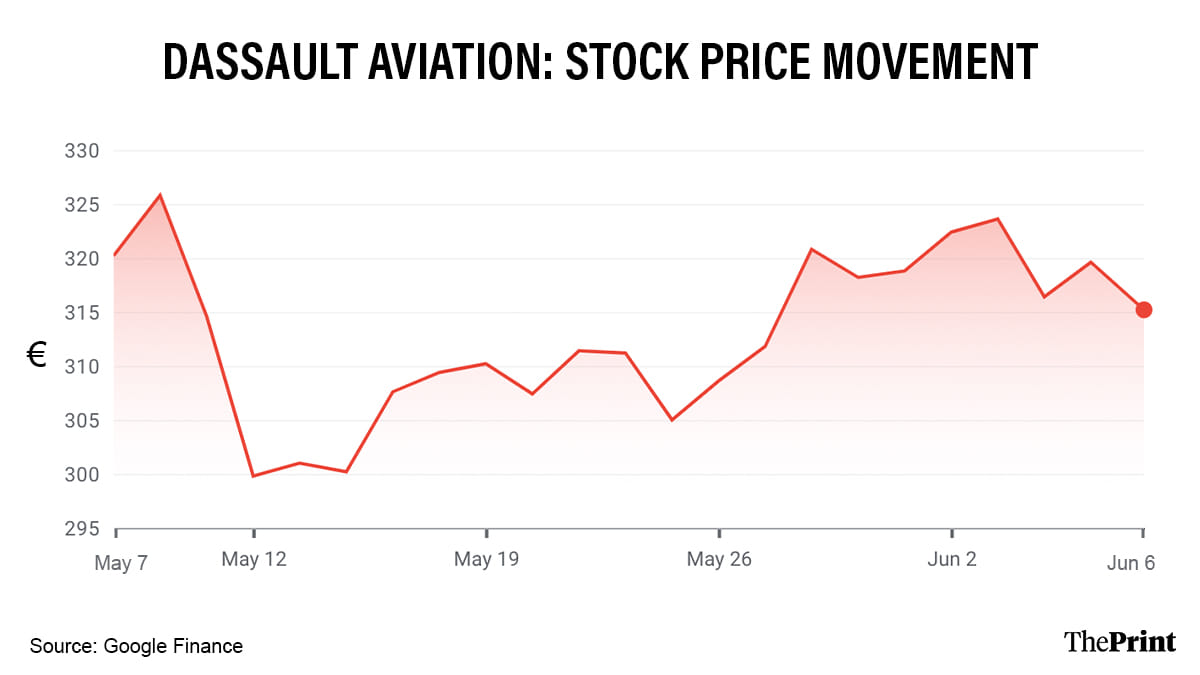

A rally in defence stocks, particularly among Chinese firms, may be attributed to the speculation or claims that Pakistan Air Force (PAF) fighters, mainly Chinese-origin JF-17s and J-10Cs, had downed multiple Indian Rafale jets. This was the first instance of Chinese fighter jets being tested in real combat, attracting attention from defence watchers globally. Equally, it was the first time any claim emerged of a Rafale being shot down, an event that weighed on market sentiment, including on Dassault Aviation’s stock.

But as the fog of war began to clear and these claims were found to be exaggerated, Dassault’s shares staged a recovery, reflecting a broader market correction.

ThePrint examines how the 88-hour India-Pakistan standoff sent ripples through global defence markets, impacting the stock prices of the Aviation Industry Corporation of China (AVIC) and its subsidiaries, as well as Lockheed Martin and Dassault Aviation.

Stock prices are compared from the day Operation Sindoor began through to the closing figures on Thursday, with all values converted to INR using the prevailing exchange rates at the time of reporting.

Also read: Defence stocks surge continues amid escalating India-Pakistan tensions since Pahalgam attack

Pakistan’s propaganda of multiple Rafale jets being shot fuelled Chinese defence stocks

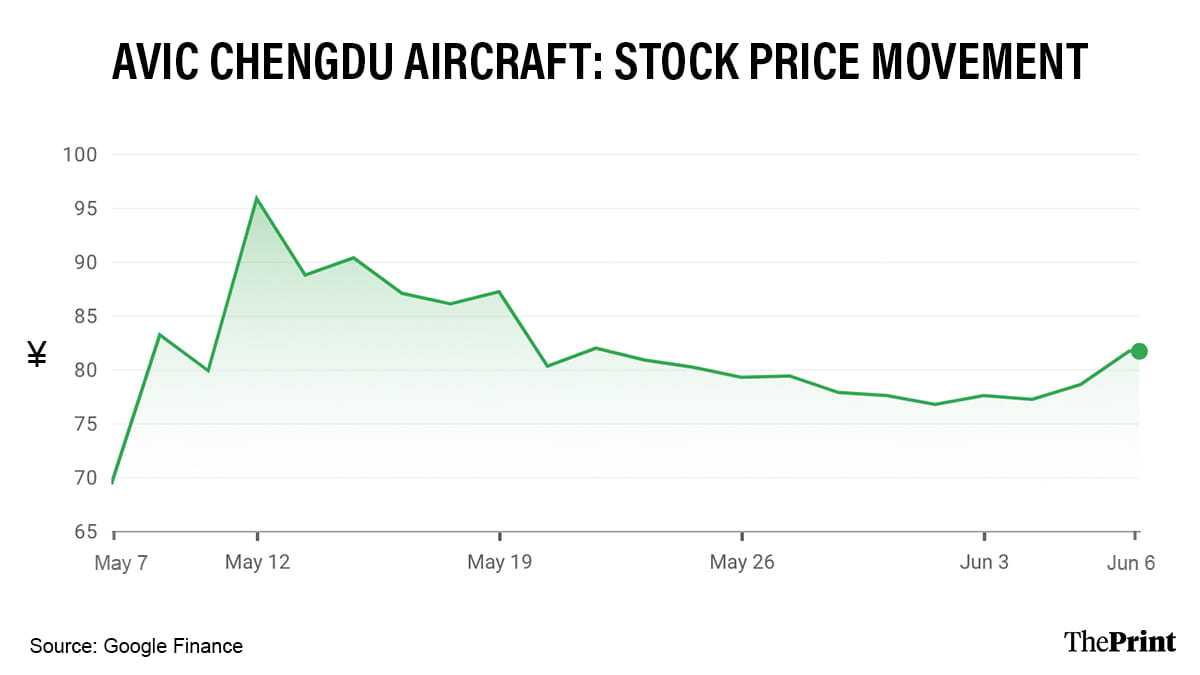

China’s state-owned Aviation Industry Corporation of China (AVIC), particularly its Chengdu Aircraft division, saw one of the sharpest stock moves.

AVIC Chengdu, which designs and manufactures the JF-17 and J-10C fighter jets used by the Pakistan Air Force, surged from Rs 828 on 7 May to Rs 1,145 by 12 May, witnessing a massive 38 percent jump in five days. Although the stock had cooled to Rs 939 by Thursday, it retained a net gain of 13 percent since the launch of Op Sindoor.

Furthermore, another subsidiary of the state-owned AVIC group—AVIC Airborne Systems—which supplies precision avionics and weapons for the J-series jets operated by Pakistan, also saw a modest rise.

Its stock climbed from Rs 136 to Rs 144 between 7 May and 12 May, marking a 5.9% increase that reflected growing investor confidence in China’s deepening role in Pakistan’s defence supply chain. By Thursday, however, the stock had eased slightly to Rs 138.

Other than the speculation of these Chinese origin fighters performing exceedingly well, these spikes are also driven by investor belief that Pakistan might accelerate fighter acquisitions to strengthen its aerial capabilities following Operation Sindoor.

Reports indicate that Pakistan could take delivery of the fifth generation FC-31 stealth fighter, the export version of China’s J-35A, later this year.

According to the latest Stockholm International Peace Research Institute (SIPRI) report, Chinese equipment accounted for 81 percent of Pakistan’s major arms imports over the past five years.

Subsequently, during last month’s hostilities, Pakistan fielded a range of Chinese-origin platforms, including JF-17 and J-10C fighter jets, HQ-9B long range air defence systems, HQ-16 medium range air defence systems, PL-15E beyond visual range air-to-air missiles (BVRAAM) and Chinese unmanned aerial vehicles (UAVs).

Beyond the loss of a couple of PAF aircrafts, several Chinese-supplied HQ-9B long-range and HQ-16 medium-range air defence systems were taken out by Harpy and Harop loitering munitions sourced from Israel.

Additionally, the recovery of debris of a PL-15E beyond-visual-range air-to-air missile (BVRAAM) was confirmed by DG Air Operations (DGAO) Air Marshal A.K. Bharti in a press briefing. It was learnt that the much-discussed Chinese PL-15E missile failed to register a single hit during the conflict.

Also read: Pakistan to go in for J-31 Chinese stealth fighters. What this could mean for balance of air power

Western defence giants and market sentiment

Western defence companies, from France’s Dassault Aviation to the U.S.-based Lockheed Martin, experienced divergent market responses, shaped as much by battlefield developments, speculative reports and domestic developments.

Dassault Aviation, the manufacturer of India’s Rafale jets, recorded a 6.4 percent decline between 7 and 12 May, with its stock falling from Rs 31,406 to a low of Rs 29,405. However, it had rebounded back to Rs 31,367 on Thursday, nearly regaining its pre-drop value.

Incidentally, while Dassault Aviation hit its lowest point on 12 May, China’s AVIC Chengdu registered its highest stock price during the same period, highlighting the contrasting market sentiments around the two defence suppliers amid the conflict.

The initial dip may have been driven by concerns over possible losses, as the Indian Air Force did suffer setbacks during the operation, first hinted at by Air Marshal A.K. Bharti during the tri-services briefing held on 11 May and later confirmed by Chief of Defence Staff General Anil Chauhan in a Saturday interview with Bloomberg TV.

Yet the Rafale jets, armed with SCALP cruise missiles and AASM Hammer glide bombs, carried out precision strikes on multiple targets across Pakistan and Pakistan-occupied Kashmir. The subsequent rebound in Dassault’s stock suggests renewed investor confidence in the aircraft’s combat effectiveness and strategic value.

Furthermore, on Thursday, it was announced that the Rafale fighter aircraft fuselage will now be manufactured domestically by Tata Advanced Systems, strengthening its position as a strong contender for the Multi-role Fighter Aircraft (MRFA) programme.

In contrast, Lockheed Martin, whose F-16 fighters once formed the backbone of the Pakistan Air Force, registered only a modest 1.34 percent gain during the same period, with its stock rising from Rs 40,449 on the day Operation Sindoor was launched to Rs 40,990 by Thursday.

The limited uptick can be attributed to heightened interest in the American aerospace giant’s F-21, an advanced 4.5-generation fighter pitched as a potential contender for India, especially after unverified reports of Rafale being downed during Operation Sindoor drew the attention of investors and defence analysts.

Lockheed Martin’s uptick movement in stocks may also be linked to U.S. President Donald Trump’s announcement on 15 May for the development of an upgraded ‘F-22 Super’ and a twin-engine variant of the F-35, provisionally dubbed the F-55.

How speculation, politics and perception shape market swings

Analysts also point out that stock movements observed since 7 May were driven not just by battlefield results but by narrative, politics and investor psychology.

“From a market perspective, defence procurement is a massive business. During events like Operation Sindoor, exaggerated speculation and misinformation are to be expected, especially when they serve the interests of those looking to profit,” Dr Vikas Gupta, CEO and smallcase manager at OmniScience Capital, told ThePrint.

Big-ticket defence exports such as fighter jets are typically sealed through government-to-government agreements that generate employment and strategic influence for the given party, he added. “At times, even governments may quietly encourage certain narratives if they align with their economic interests.”

Dr Gupta also pointed out how China’s market mechanics differ from the West. “In China’s case, there’s an added layer of complexity. Beijing can directly intervene in markets, banning short selling, for instance, to stabilise or boost the performance of AVIC subsidiaries. That kind of intervention isn’t feasible in countries like France, where the government usually avoids market interference.”

Ultimately, the swings observed in the wake of Operation Sindoor reinforce a perceived reality of defence stocks remaining highly reactive to geopolitical flashpoints, with prices shaped as much by perception, speculation, politics and investor psychology as by actual battlefield performance.

(Edited by Viny Mishra)

Also read: Operation Sindoor signals a real paradigm shift, says ex-IAF chief. ‘We hit where it hurts the most’