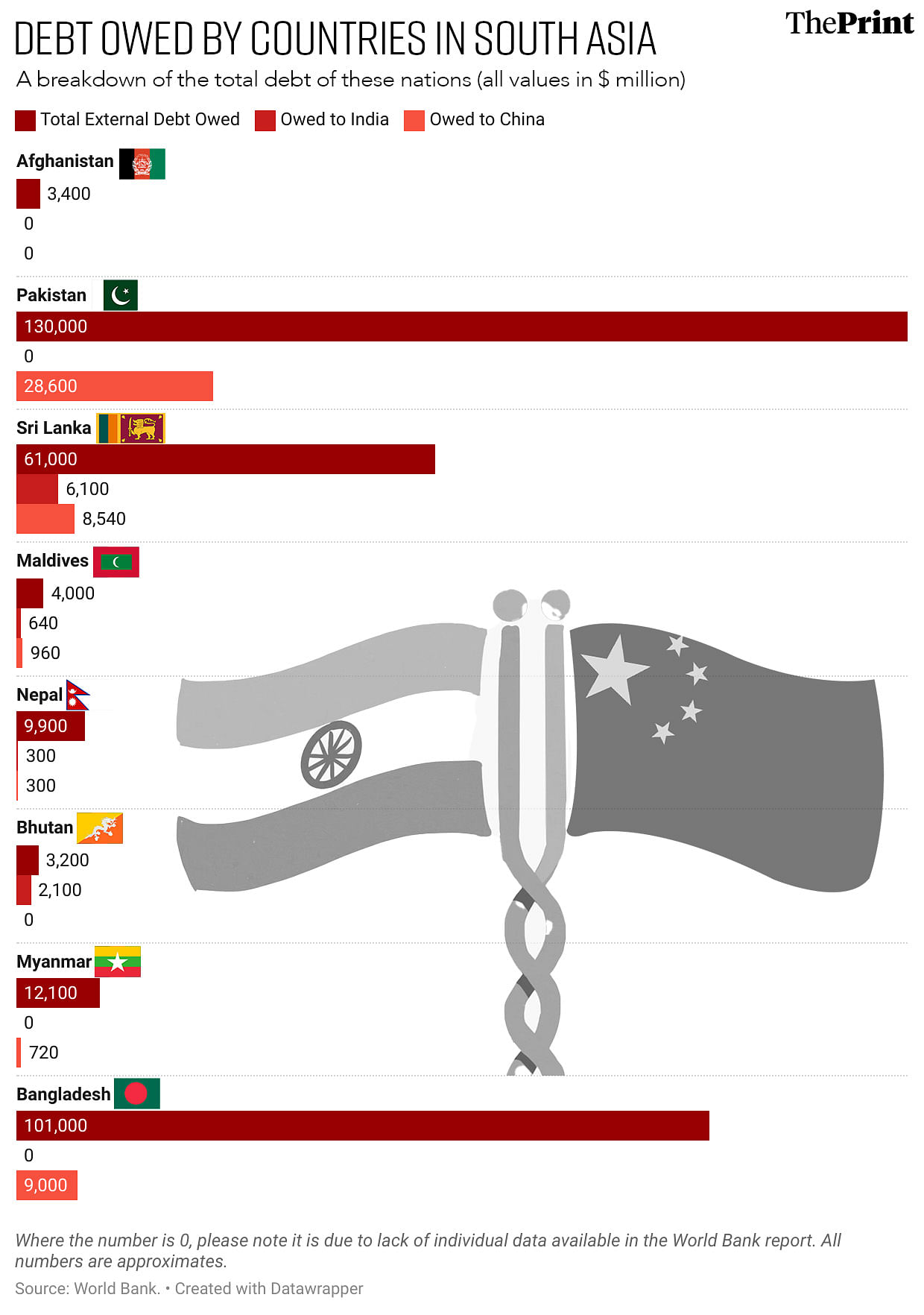

New Delhi: China has lent USD 48.1 billion to countries in India’s neighbourhood, more than five times the amount New Delhi has provided, a report by the World Bank published Tuesday has found. This accounts for 14.8 percent of the total $324 billion debt owed by these countries, including to the World Bank and other foreign institutions.

In comparison, India has lent $9 billion to the same nations, which accounts for 2.8 percent of the total debt owed by these countries.

The International Debt Report 2024 has found that South Asian countries—Afghanistan, Pakistan, Nepal, Bhutan, Bangladesh, Myanmar, Sri Lanka, and Maldives—cumulatively owe $324.6 billion to external lenders, which include both bilateral (other countries) and multilateral (the World Bank and the International Monetary Fund) institutions.

Of this, Pakistan (approximately $130 billion) and Bangladesh ($101.4 billion) alone account for around 71 percent of all debt in the region, the World Bank has found. In some of these countries, the financial amounts loaned by India are comparable to those from China.

ThePrint takes a look at each of the countries in the region and their largest creditors.

Also Read: Nearly 12,000 Indians hired in Israel for work since October 2023, MEA tells Rajya Sabha

Afghanistan

According to the World Bank, Afghanistan’s total external debt stock is roughly $3.4 billion, of which the largest creditor country is Russia. Kabul owes Russia roughly 36 percent of its total debt, which is approximately $1.2 billion. Saudi Arabia and Italy are the other large bilateral creditors for Afghanistan.

About 58 percent of its total external debt is from multilateral sources, including the Asian Development Bank (ADB), which accounts for roughly 23 percent, and the International Monetary Fund (IMF), which accounts for 21 percent. Individual figures for financial sums lent by India and China are not available in the report.

Bhutan

India is the largest creditor for the Himalayan nation, accounting for 66 percent of its total external debt stock. Bhutan’s total external debt stock, according to the World Bank, stands at $3.3 billion. India’s total lending in absolute terms to Thimphu stands at around $2.1 billion.

Around 70 percent of its total debt is to bilateral creditors, which include Japan (3 percent) and Austria (0.2 percent). Multilateral institutions, including the ADB (15 percent) and the World Bank (14 percent), are the two large creditors.

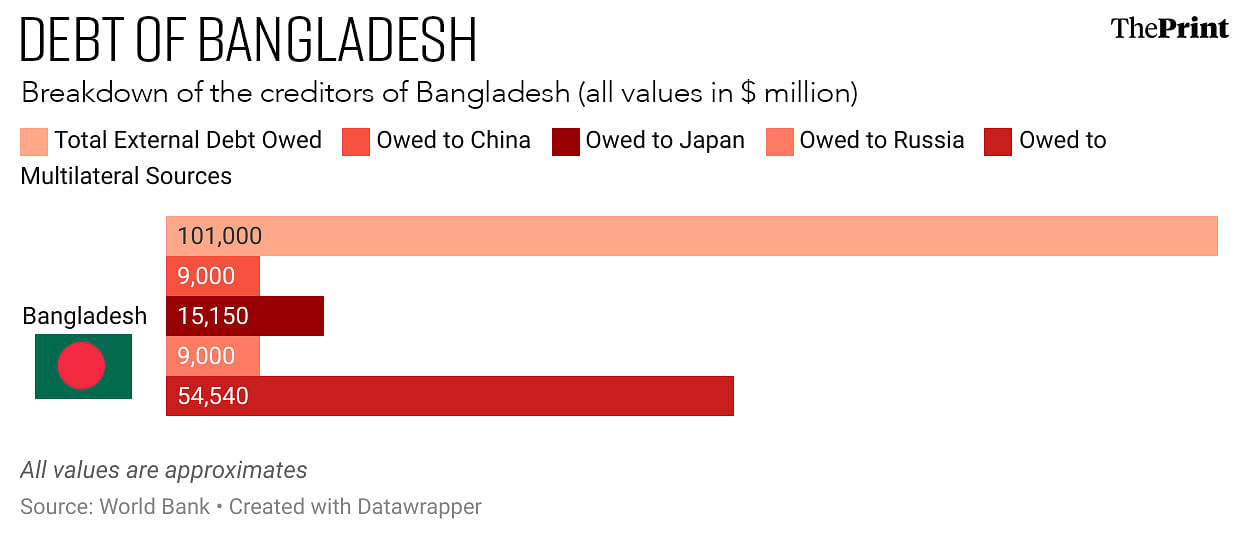

Bangladesh

Bangladesh’s total debt stock stands at $101.4 billion, according to the World Bank. While the individual figures of sums lent by India are not available, China accounts for 9 percent of the South Asian country’s total debt burden.

Bangladesh has borrowed approximately $9 billion from Beijing. However, China is not the country’s largest bilateral creditor; Japan is. Tokyo has lent $15.2 billion to Dhaka, while Russia is its third-largest creditor, lending approximately $9 billion to the South Asian country. The World Bank (26 percent) and the ADB (20 percent) are the two largest institutional lenders to Bangladesh.

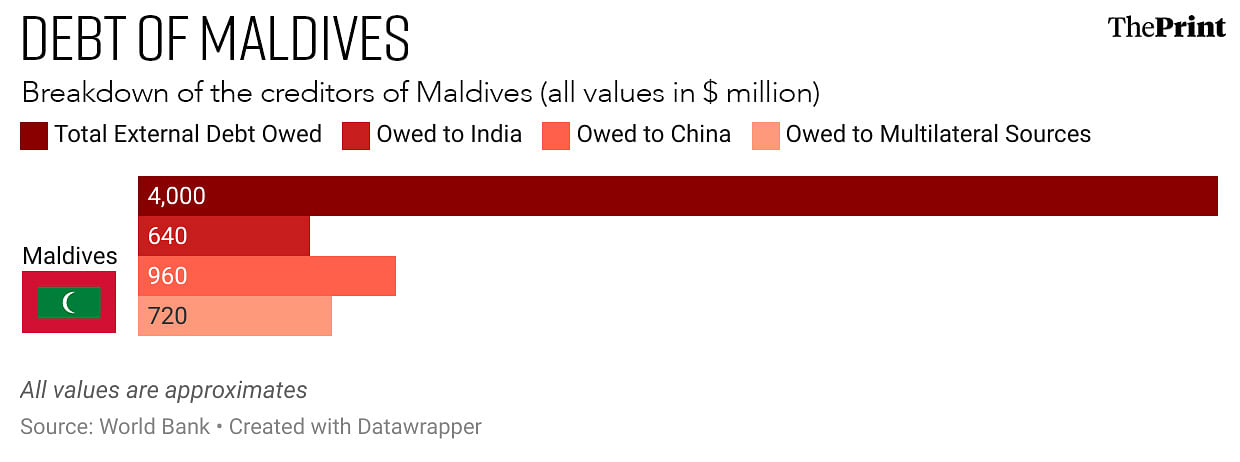

Maldives

The island archipelago nation of 521,000 owes roughly $4 billion to various creditors. The largest bilateral creditors are China and India, which account for roughly 40 percent of its total debt.

China, which is the largest bilateral creditor of the Maldives, is owed roughly $960 million, or 24 percent, of the total debt, while India is owed about $640 million, or 16 percent, of Malé’s total debt. Multilateral institutions make up only about 18 percent of the Maldives’ total debt, while private lenders, including bondholders and commercial debt, account for about 33 percent of the country’s total debt.

India, in recent years, has increased its financial footprint in the Maldives. In 2024, New Delhi rolled over two loans of $50 million each, while in October, India announced a currency swap facility of $400 million and Rs 3,000 crore with the Maldives.

China has long been investing in the country as part of its Belt and Road Initiative (BRI). Some of the Chinese-funded projects include the $200 million China-Maldives Friendship Bridge, which connects the island of Malé with Hulhulé, where the airport is located.

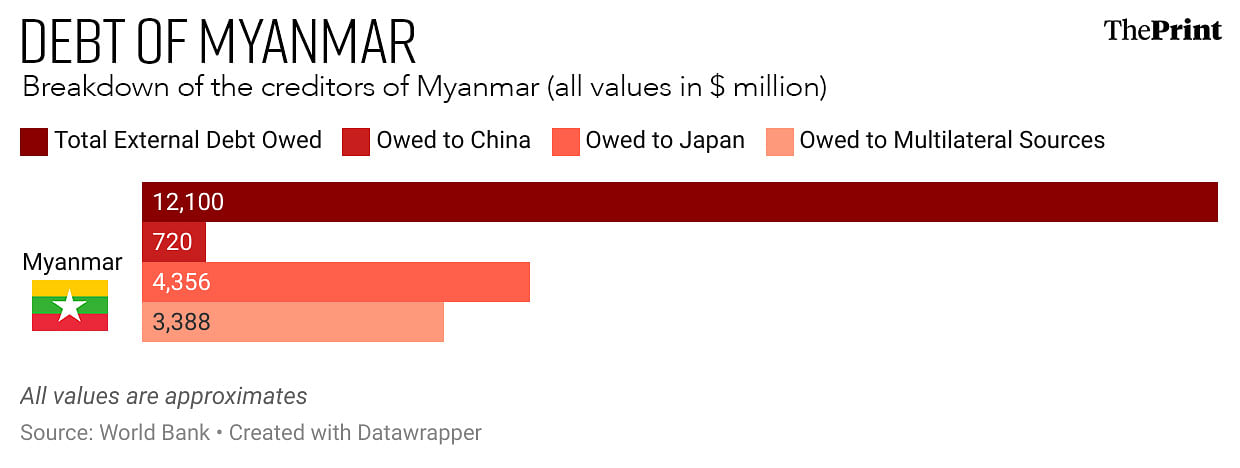

Myanmar

The country, which shares a border with both India and China, has been facing a civil war since the military junta took power in February 2021 from the civilian government, which had been re-elected just a year earlier in 2020.

The country’s total debt is approximately $12.1 billion, according to the World Bank, of which around 6 percent ($720 million) is owed to China. Individual figures for India are unavailable.

However, Japan is the single largest creditor to the country, lending roughly 36 percent of Myanmar’s total debt, which would be approximately $4.356 billion. Around 15 percent of its debt is owed to private lenders, while around 28 percent is owed to multilateral financial institutions, including the World Bank and the ADB.

Beijing’s recent investments in Myanmar include the LNG power plant in Mee Lin Gyaing, worth $2.6 billion, and infrastructure projects such as the New Yangon Project, reportedly around $1.5 billion.

For India, Myanmar is its key link to Southeast Asia, with several infrastructure projects delayed due to the political situation in the country. The India-Myanmar-Thailand Trilateral Highway (IMT Highway) is one such project, which would connect Moreh in Manipur to Mae Sot in Thailand via Myanmar. The bulk of the project runs through Myanmar.

Nepal

Around 88 percent of all the external debt owed by Nepal is to multilateral financial institutions like the World Bank and the ADB. Of its total debt stock of $9.9 billion, about 48 percent is from the World Bank, while 33 percent is from the ADB.

Among its bilateral creditors, both India and China have lent roughly 3 percent of Kathmandu’s total debt stock, which is about $300 million, according to the World Bank report. Nepal is a member of China’s Belt and Road Initiative (BRI), with the framework agreement for the implementation of these projects recently signed between the two countries last week.

Japan is the country’s largest bilateral creditor, lending around $500 million to the Himalayan country.

Chinese funding to Nepal includes the Pokhara airport, where a soft loan of roughly $216 million was extended by China’s Export-Import Bank for the construction of the airport.

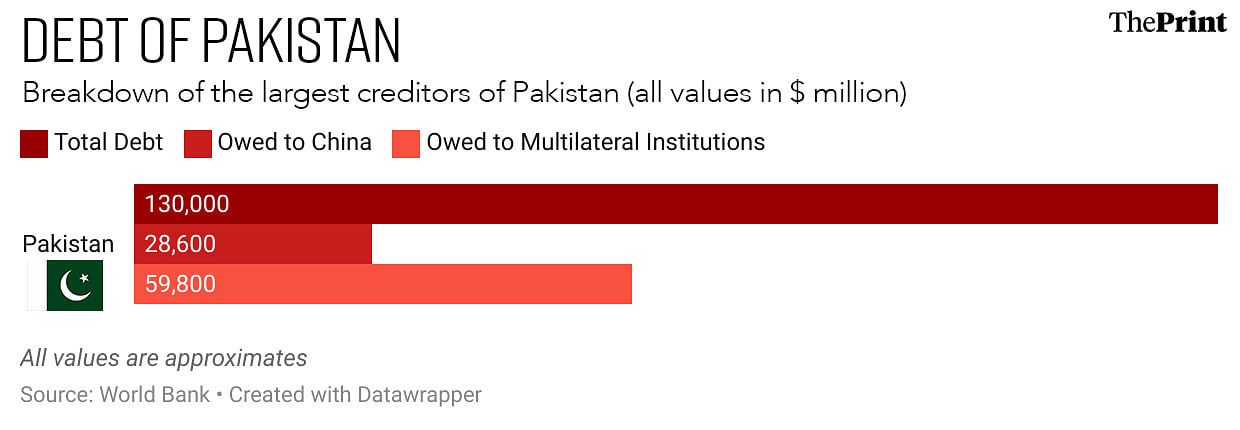

Pakistan

Islamabad is the largest recipient of Chinese loans in the region, receiving roughly $28.6 billion from Beijing, which accounts for 22 percent of its total debt. The country has a total debt of roughly $130 billion, according to the World Bank.

China is the single largest creditor for Pakistan, which has also borrowed from various multilateral institutions, including the World Bank, ADB, and IMF.

The country has consistently sought emergency funding from the IMF, given its precarious financial situation. However, for China, Pakistan is home to the China-Pakistan Economic Corridor (CPEC), a roughly 3,000-kilometre-long corridor connecting Beijing’s western provinces to the port of Gwadar in Balochistan.

CPEC has been one of the major investment planks of China’s BRI, which would see Beijing invest $62 billion over 15 years. Established in 2015, the project has increased Pakistan’s debt burden. According to the World Bank report, Islamabad’s interest payments amount to roughly 43 percent of its total export revenue, one of the highest in the world.

In September this year, Islamabad received another $7 billion loan from the IMF, given its economic conditions, which saw the country request multiple creditors to roll over loan repayments. China, Saudi Arabia, and the United Arab Emirates (UAE) have rolled over roughly $12 billion in loans owed by Pakistan this year.

Saudi Arabia accounts for roughly 7 percent of Pakistan’s total debt burden, while other bilateral lenders account for 8 percent.

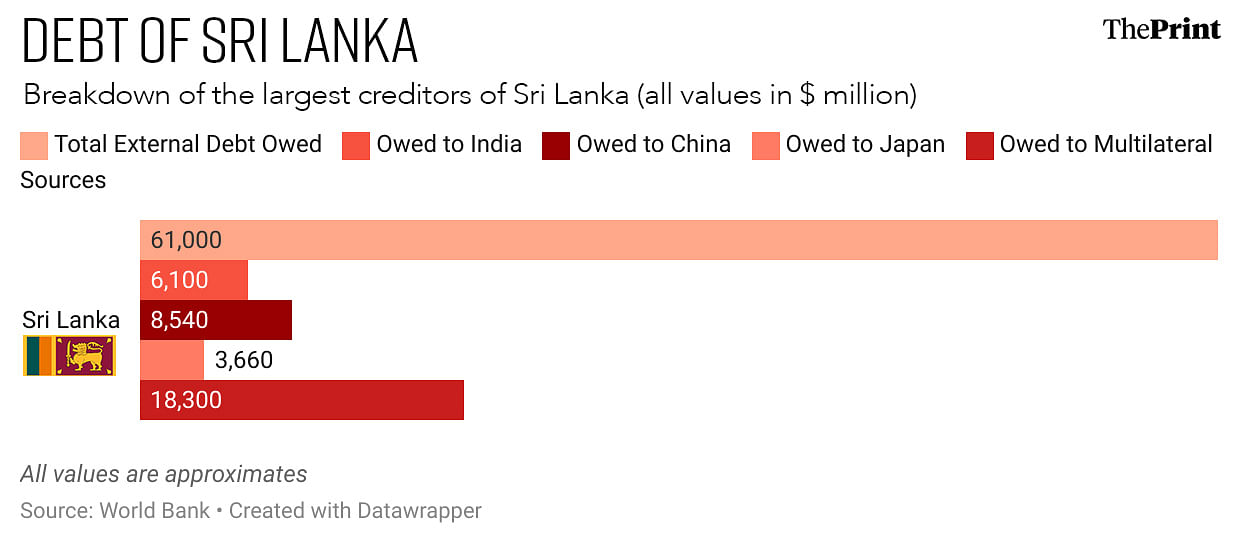

Sri Lanka

The island country is the recipient of India’s largest loan in the neighbourhood, worth roughly $6.1 billion or 10 percent of its total debt. China has lent Sri Lanka $8.54 billion over the years, according to the World Bank. Sri Lanka’s total debt is about $61.7 billion.

The bulk of India’s loans to Sri Lanka were extended after the 2022 economic crisis, during which New Delhi provided close to $4 billion in emergency financing to keep the country afloat following its declaration of bankruptcy.

One of the reasons for Sri Lanka’s high debt burden is a number of infrastructure projects considered to yield very little return, including the Mattala Rajapaksa airport, built for $209 million in 2013 and funded by China. The airport has a low volume of visitors.

Another project that has led the country to take on significant loans is the port of Hambantota, which is now managed by a Chinese company. The port was constructed with financing provided by Beijing.

Japan is the third-largest bilateral lender to the island nation, accounting for roughly 6 percent of its total debt.

(Edited by Radifah Kabir)

Also Read: Indians seeking asylum ‘denigrate’ system for personal gains, MEA says in Rajya Sabha

All indian neighbour are beggars.