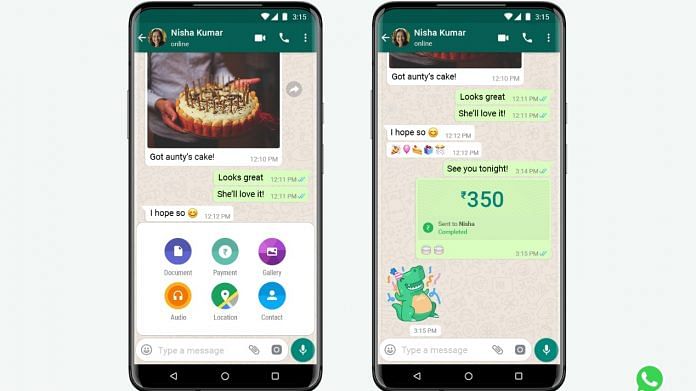

New Delhi: WhatsApp has finally received India’s approval to start operating its payments service in the country.

The Facebook-owned messaging platform can now go live with WhatsApp pay using the multi-bank Unified Payments Interface, the National Payments Corporation of India (NPCI) said in a statement Thursday.

While Facebook has been testing WhatsApp payments in India for some years, it was facing legal hurdles with allegations that it was not compliant with Indian regulations.

In a video statement, Facebook CEO Mark Zuckerberg said: “I am excited today that WhatsApp has been approved to launch payments across India. Now you can send money to your friends and family through WhatsApp as easily as sending a message. There’s no fee, and it’s supported by more than 140 banks. And because it’s WhatsApp, it’s secure and private too.”

The service is available in ten Indian regional language versions of WhatsApp.

“All you need is a debit card with a bank that supports UPI and you can set it up straight away. You can find it in the latest version of WhatsApp,” Zuckerberg added.

WhatsApp will be working with five leading banks in India — ICICI Bank, HDFC Bank, Axis Bank, the State Bank of India, and Jio Payments Bank.

Users can send money to anyone on WhatsApp using a UPI-supported app.

“Just like every feature in WhatsApp, payments is designed with a strong set of security and privacy principles, including entering a personal UPI PIN for each payment,” WhatsApp said in a statement.

The service is now available on the latest versions of iPhone and Android app.

Also read: WhatsApp introduces ‘disappearing messages’ that auto-delete after 7 days

What is multi-bank model

A multi-bank model means WhatsApp as a ‘Third party app provider’ (TPAP) must partner with more than one bank. TPAPs cannot directly participate in UPI but must do so through a bank that acts as the payment service provider (PSP).

WhatsApp’s PSP had been so far with the ICICI Bank. However, the NPCI mandates that TPAPs that would process more than 5 per cent of the total value per month on UPI must partner with more than one bank in case there are payment failures or one bank is facing outages.

“WhatsApp can expand its UPI user base in a graded manner starting with a maximum registered user base of twenty (20) million in UPI,” the NPCI, which owns UPI, said in its statement,

The NPCI issued another statement Thursday saying third party payment providers like WhatsApp cannot account for more than 30 per cent of the total transactions on UPI starting January 2021, and for existing payment apps two years from now.

The move is to address “risks and protect the UPI ecosystem” as UPI transactions grow, it added.

“The cap of 30% will be calculated basis the total volume of transactions processed in UPI during the preceding three months.”

Competition for PhonePe, Google Pay

WhatsApp is expected to be a large player in the payment industry given India has an estimated 400 million WhatsApp users. It is expected to pose competition to PhonePe and Google Pay.

At present, PhonePe is the most used UPI app in India. It has processed around 835 million transactions in October and has a nearly 40 per cent market share.

Google Pay with around 820 million transactions processed, occupies the second place.

WhatsApp’s payment service has been in pilot mode since February 2018, and available to only a million users.

The service had been stalled by multiple court cases and a complaint filed with the Competition Commission of India.

A petition filed by think-tank Centre for Accountability and Systemic Change in the Supreme Court said WhatsApp should not be allowed to operate payments service until a local grievance officer is appointed.

Another think-tank Good Governance Chambers had moved the Supreme Court saying WhatsApp is not in line with the UPI scheme since it does not have a separate app for payments. It also said WhatsApp was not fully complying with the RBI’s data localisation norms.

In August 2020, the Competition Commission dismissed a complaint against WhatsApp by an informant, Harshita Chowla, saying the concern that WhatsApp will have an established base of users as it enters the payment app market while other existing payment apps had to spend resources to establish themselves “does not really hold much merit”.

Also read: WhatsApp is counting on customer service tools, not ads, for revenue