Against warnings of long-term economic risks, Finance Minister Nirmala Sitharaman reaffirmed the government’s 2019 Budget plan to issue overseas sovereign bonds. She also said higher surcharge on super-rich wasn’t intended to hurt the foreign portfolio investors but ruled out any rethink for now. The government’s draft e-commerce policy too proposes norms that will be costly to foreign firms like Amazon and Flipkart.

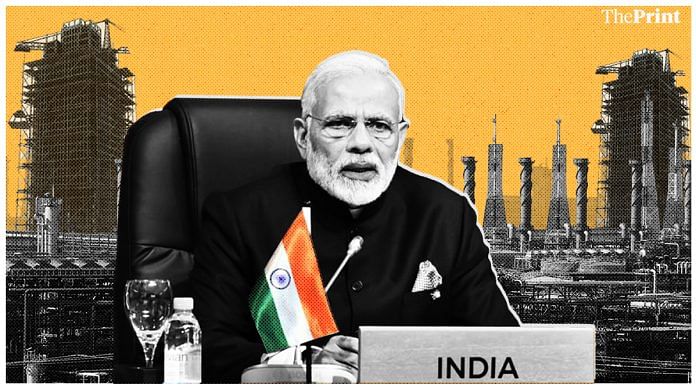

ThePrint asks: What can Modi do to reassure foreign investors that India is still an attractive destination?

Govt should reconsider and withdraw this tax for foreigners, which might have been unintended

Ila Patnaik

Ila Patnaik

Economist/Professor, NIPFP

The additional tax proposed in the 2019 Budget on the super-rich has hit the foreign investors’ confidence in India. More than Rs 3,000 crore has exited Indian stock markets in the last one month. Trusts like pension funds and sovereign wealth funds, about 40 per cent of foreign portfolio investors in India, have to consider changing their structure if they wish to escape the additional tax. This may not be optimal as becoming corporations has other costs. These institutional investors invest globally, and it is likely that instead of changing their legal and organisational structure to optimise for India, they might exit the Indian market altogether.

Finance Minister Nirmala Sitharaman has indicated that she is willing to discuss the issue and the tax was not intended to be anti-foreigner. In many jurisdictions, taxes are ‘residence based’ rather than source based. In other words, residents of a country pay taxes and when they earn income and pay taxes where they are not residents, the two countries may have a treaty to avoid double taxation on them and they get refunds.

Since the entity paying the tax in India is the fund, it is difficult for the tax to be attributed to each investor. The budget proposal puts additional tax burden on foreigners, including small pensioners who have traditionally been welcome in Indian markets, and who are not super rich. This was perhaps unintended. The government should reconsider its proposal and withdraw this tax.

Views are personal.

Also read: Don’t blame Finance Minister Nirmala Sitharaman for the flight of foreign capital

Reassurances and concessions don’t attract foreign investors, a strong economy like India does

Ashwani Mahajan

Ashwani Mahajan

National Co-Convener of Swadeshi Jagran Manch

If you ask any activist of the Swadeshi Jagran Manch, they would say that India needs to stop obsessing about foreign investment. There are so many countries in the world that keep reassuring foreign investors but still they get no investment. It is important to understand that reassurances and concessions do not attract foreign investors; what does attract them is a strong economy.

Foreign investors know there aren’t too many countries at present that are viable for investment. But they are interested in India because of our strong and robust economy. The IMF’s decision to reduce GDP estimates isn’t India-specific. Recession is cyclical and will soon be over. If our targets are not met this year, they will be next year. Therefore, the Modi government does not need to give concessions to investors because India is and always will be an attractive destination for foreign investment.

The reassurance we can give is by strengthening our economy and this means opening new sectors, safeguarding the interests of MSME workers, and investing in data localisation. We have an ever-expanding middle class, which is a great attraction for foreign investment. Therefore, there is no need to cow down to them. If we strengthen our economy, generate employment, and increase production, foreign investors will automatically come.

Also read: Foreign investors can help India tide over credit crisis, says JPMorgan’s Kalpana Morparia

A stable, predictable policy regime is critical to make India a preferred investment destination

Radhika Pandey

Radhika Pandey

Fellow, NIPFP

The underlying theme of this year’s budget is to make India a $5 trillion economy by 2024-25. Investment – both domestic and foreign – is critical for achieving the aspirations of a $5 trillion economy. A number of proposals have been mooted in the budget, like development of corporate bond market, push to infrastructure investment and measures to revive the NBFC sector.

The proposal to levy higher surcharge on the super-rich doesn’t sit well with the intent of making India a favourable investment destination. Super-rich individuals as well as non-corporate foreign portfolio investors (FPIs) such as trusts will bear the brunt of this additional taxation. A solution has been offered by asking non-corporate FPIs to opt for ‘corporate’ structure.

While it appears to be a simple alternative, this does not help because FPIs are registered in their home jurisdictions as trusts or partnerships and cannot simply convert into corporate structures without entailing huge costs. As an outcome, we have seen a net FPI outflow of Rs 3,700 crore in July.

On the one hand, a number of initiatives have been proposed in the budget to promote FPI investments, such as easing KYC norms, alignment of FPI investments to sectoral limits, merger of FPI and NRI route of investment. The positive impact of all these measures looks doubtful unless the proposal to tax the super-rich is reviewed. While the finance minister has indicated that she is willing to hear out the investors, a stable, predictable policy regime is critical to make India a preferred investment destination.

Views are personal.

India must walk the talk on ‘Ease of Doing Business’

Deven Choksey

Deven Choksey

Managing Director, KR Choksey Investment Managers

To reassure foreign investors that India is still an attractive destination, it is important the Narendra Modi government understands that sudden policy changes like surcharge on taxation or changing the tax rates will automatically detract investors.

No country in the world would appreciate these ad-hoc changes, which take place overnight. Narendra Modi-led India says that it is working towards ‘Ease of Doing Business’. But it is important that India walks the talk.

The government has increased the surcharge from 15 per cent to 25 per cent for those with taxable income of Rs 2-5 crore, and from 15 per cent to 37 per cent for those with income above Rs 5 crore. Changes like these must be well-planned because such steep hike in taxation will automatically result in investors moving away from India. Eventually, the talent pool will be forced to leave the country.

The government needs to understand that it has a certain responsibility towards the investors and sudden policy measures will tarnish its reputation.

The Modi government needs to adopt practices that are accommodative and not restrictive. And, it needs to start with scrapping the surcharge levied on foreign portfolio investors. When 99 out of 100 people are saying that this is a wrong step, the government must listen to them and review its decision.

Govt should have a 30-day notice & comment period for new regulations to provide stability

Aman Thakker

Aman Thakker

Former Research Associate, Wadhwani Chair in US-India Policy Studies, CSIS

Prime Minister Narendra Modi’s NDA government has been extremely pro-investment since it first took office in 2014. But recent steps like the higher surcharge on trusts and super-rich have created anxieties for foreign polio investors (FPIs). These anxieties call for some broader structural reforms, which have been covered in the CSIS India’s economic reform scorecard.

The changes in tax levies, in particular, should signal to the government that it should institute a 30-day notice and comment period for new regulations, which can provide regulatory stability and allow for inputs from affected parties before they are implemented. Furthermore, while the government has created a committee under the Central Board of Direct Taxes to block retrospective taxation of cross-border investments, it has not yet amended the income tax code to repeal the provision entirely. This creates an opportunity for future governments to re-institute cross-border taxation. This Modi government should amend the code to dispel the concerns of FPIs.

Finally, the long-standing 10 per cent limit on single institutional investors should be increased, maybe even by 20 per cent. These reforms, if undertaken, would not just make India a more attractive destination for foreign investment but would also help achieve some goals the government has outlined for itself on long-term economic growth and job creation in India.

As investors turn away from China, India has a unique opportunity to position itself as ‘market of choice’

Richard M. Rossow

Richard M. Rossow

Senior Adviser and Wadhwani Chair in US-India Policy Studies, CSIS

Foreign investors were concerned by the Narendra Modi government’s policymaking priorities in the final years of its previous term in office. The government made over forty positive changes to India’s foreign investment regime. However, only three came in the last two years of its term. And in the final year, new rules on data localisation and changes in existing foreign investment rules for retail trade dented the Modi government’s “pro-investor” image.

India’s foreign investment numbers remain solid. Foreign portfolio investment (FPI) is rebounding; after a down year in 2018, India has seen five consecutive months of net inflows. And foreign direct investment (FDI) remains solid with around $44.2 billion in new equity inflows over the last 12 months; down slightly year-on-year, but well ahead of India’s 10-year average.

However, as investors turn away from China, India has a unique opportunity to position itself as the “market of choice,” and start pulling in record levels of foreign investment. It will take a range of domestic reforms, as well as a fresh commitment to removing foreign investment limitations. Finance Minister Nirmala Sitharaman prioritised a few sectoral FDI reforms in her maiden Budget speech earlier this month. Fast action on these, and the addition of others, will be warmly welcomed by investors.

By Revathi Krishnan and Fiza Jha

Feeling awful to read about Shri Siddharth, founder of Cafe Coffee Day. I think this question needs to be rephrased : What can be done to Make India an attractive place to do business, for both domestic and foreign investors. His letter – more in the nature of a suicide note – mentions the difficulties he faced with the tax authorities. Perhaps it is not fair to blame them, for when tax buoyancy melts, they come under tremendous pressure to collect taxes. There seems to be an unbridgeable gap between government and business. Does not portend well for the economic recovery. If the underlying problems are not redressed, the sag and the listlessness will continue.

The rich tax is not a good idea. It should be rescinded. Not just for foreigners, but Indians as well. Our ATF has the same calorific value as Wall Street’s. 2. Clean the accounts. Let Indian data be once again taken at face value by the world. 3. Announce some serious reforms, starting with privatisation. The Budget has sunk without a trace. Without creating a sense of panic, convey confidence that the contours of the crisis are well appreciated and being dealt with. 4. The messaging needs to be simple, honest, direct.

Swadeshi jagran Manch murdabad, RSS Murdabad. Capitalism zindabad.