Amid the usual over-the-top and sycophantic praise for the Union Budget 2019, there was one stark exception: domestic market players and commentators, including declared partisans of the governing BJP party, decried increased taxation on the super-rich and prophesied disaster.

As if on cue, money began flowing out, especially foreign portfolio investment (FPI) in equities. Since the Budget, approximately Rs 10,000 crore of FPI in equities has flowed out of India, all this at a time when domestic stock markets appear in the grip of bearish sentiment.

While I can’t call myself a fan of the Budget, and have been critical of its failure to push the economic reform agenda in any serious way, this particular charge is unfair and unwarranted, and the ad hominem attacks on Finance Minister Nirmala Sitharaman, are unseemly and uncalled for.

Also read: 2 weeks after budget, stock markets in free-fall, Rs 2.8 lakh crore market cap wiped out

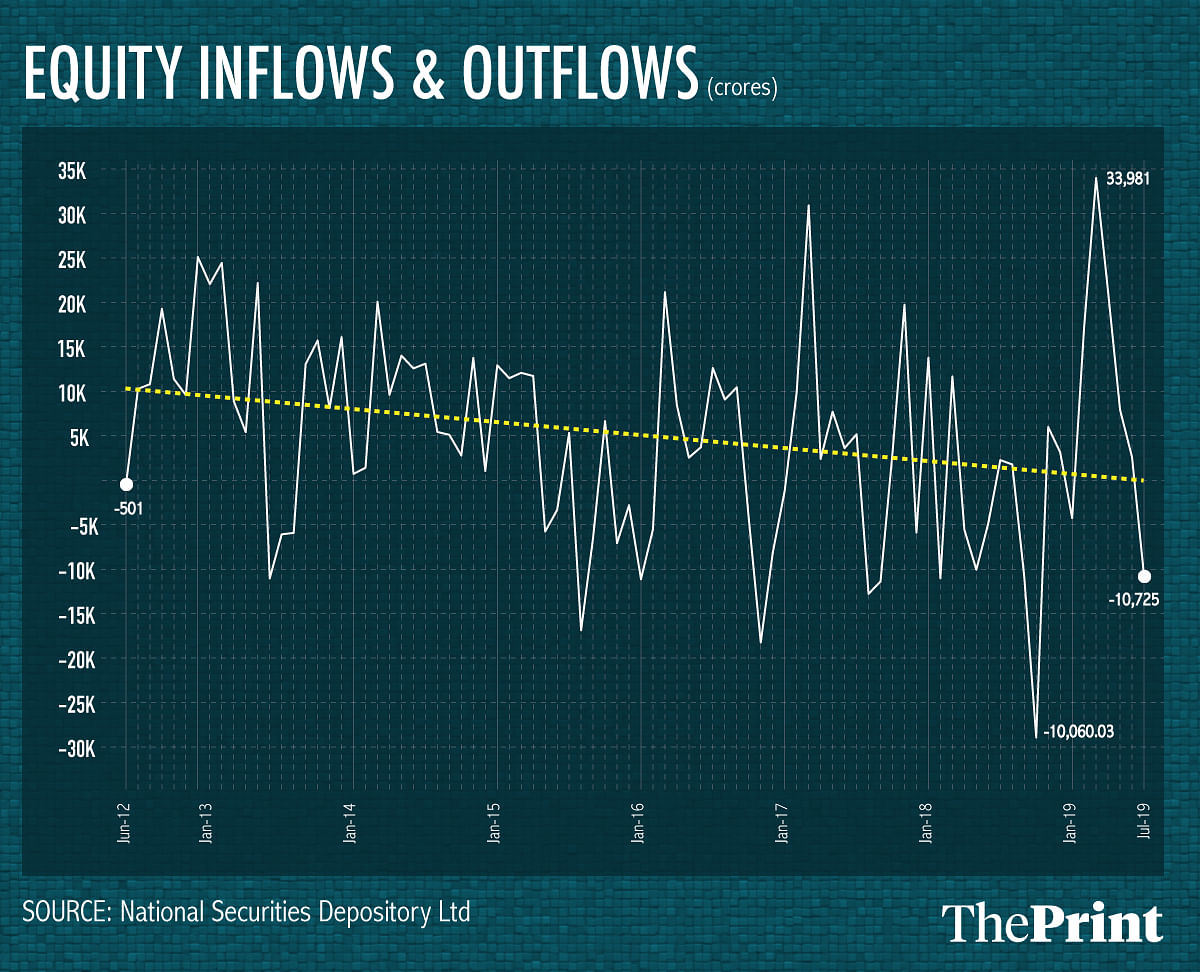

Consider one basic fact as captured in the chart, which shows net FPI flows of equities in crores of rupees. You’ll notice the recent sell-off is hardly remarkable, with much larger sell-offs evident most recently in October 2018, when almost Rs 30,000 crore flowed out. The fact is, other than what is usually called Keynesian ‘animal spirits’ for lack of a better term, there was no obvious change in India’s fundamentals last October that would have induced a sharp outflow. What is more, FPI flows are notoriously volatile, going up and down almost like a yo-yo, and they’re driven mainly by factors in the sending countries and the global economy, often having relatively little to do with macroeconomic conditions in the receiving country.

Seen in this light, this past month’s outflows are nothing to write home about, nor is it obvious that Sitharaman’s Budget proposals are the main driver. Recall that there is a heightened uncertainty in the global economy, with as yet unresolved trade tensions between the United States and China, and with Brexit imminent. In situations of global uncertainty, it’s well known that advanced economy investors return to the safe harbour of US treasury securities and, therefore, sell assets in volatile emerging markets such as India.

However, even if one could prove the current outflow has been driven by the new tax proposals, this is not a sound basis on which to criticise them. I’m not an advocate for higher taxes, but I appreciate the finance minister’s candour in saying she needs to spend more money on various government schemes and, therefore, needs to raise more revenue. One can debate the schemes, and I do not support the Leftward lurch of the current government, but one cannot argue the treasury’s need for resources, especially when the proceeds of goods and services tax and direct income tax receipts have fallen short of expectations.

Also read: Stocks crash after Modi govt stays super-rich tax on foreign fund trusts

More broadly, national economic priorities cannot be held hostage to footloose and fickle foreign investors, but rather must be guided by domestic public policy priorities. It’s perfectly fair to criticise the higher taxes as being harmful, as they impact negatively on domestic entrepreneurship and reduce the incentive to save and invest. Note that valid criticism relates to players in the Indian economy and not some anonymous trader pressing a button to sell Indian equities on a trading floor in New York or London.

There is a further oddity to the current spate of criticism, which is that many of the same critics were silent when large outflows took place earlier in the last decade, mostly under the Modi government. They have been conspicuously silent on the genuinely bad provisions in the Budget, for instance, the further lapse into protectionism, as well as the dangerous proposal that sovereign borrowing should occur now also in foreign currency, and the overzealous and economically unrealistic pursuit of electric vehicles.

Also read: Budget 2019 is fiscally responsible with a reforms thrust, but protectionist

There is a cynical and obvious explanation as to why today’s fierce critics were silent yesterday: many of them are directly hit by the new tax provisions. Criticism based on one’s personal financial situation should be rightly discounted. Likewise, criticism driven by the fear of flight of foreign investors must also be discounted. Rather, a serious critique will focus on those structural policies needed to boost productivity and real economic growth and will measure their success or failure based on the welfare of the average Indian, not the bottom line of a Dalalstreet broker or a Wall Street fund manager.

The author is an economist based in Mumbai. Views are personal.

Yes! The government is unwittingly following leftist ideas of socialism and scuttling the principles of free economy.

Who is to be blamed for foreign capital outflow since last two budgets ,

Unless capital market is strengthened, and public subscribe in Share market then how we get investment añd if no investment how do we get job creation

Last budget Govt introduced Long Term Capital Gains

Thus Budget Higher Taxes

Instead funds with low interest , lie tax regime would invite setting up more industries , more employment ,more consumption, more collection of taxes

One thing for sure, we cannot be dictated by foreign money as growth needs. Most of the FII gets in and get out at their periodicity and at time do profit booking. The retail investors are the real sufferers. Also keeping stock market index as only goal to set finance budget will not be a good long term approach. India needs patience, stock market is driven by short term operators.

Whilst it is right that foreign capital sloshing around, looking for higher returns is highly fickle and should not be a consideration for framing policies in the budget , but having said that , It is quite posssible that , the money might have justtified cause in moving out because of the ‘left’ slant of the govt which was expected to have capitalist ‘right’ slant.

Whether or not we like it, we have got addicted to foreign capital. Not only to finance productive projects – India could easily absorb about 3% of GDP on a continuing basis – but also to fund consumption, mainly by the government. Some have argued that if these inflows had not been there, India would have had to take hard decisions, which even the present Budget – at the confident start of a second term – shies away from. Inexplicable how blase we have become about zero export growth over the last five years. 2. The increase in top tax rates to about 42% is unfortunate. It upends conventional wisdom, which has been validated in India over the last twenty years, that lower tax rates lead to better compliance. Equally regressive is the now distinct trend towards protectionism. If people are disappointed with the Budget that is simply because it contains nothing that will boost the private investment our economy needs to grow to $ 5 trillion. 3. Consider something considered sacrosanct from inception : not raising sovereign debt in foreign currency. How shallow seems to have been the thinking behind the proposal to do so, how one mandarin could have this idea accepted without the deepest analysis and consideration. 4. I cannot judge whether the flight of the condors has been occasioned by some unwelcome provisions in the Budget. However, if the economy continues to sputter, they will move out in droves. And if the rupee comes undet pressure, Governor Das will raise rates by two hundred basis points overnight, mark a copy of his decision to the MPC.