Mumbai: One of the most senior bankers in India has an antidote for the nation’s yearlong credit crisis that is showing no signs of abating: seek monies from overseas investors.

JPMorgan Chase & Co.’s chairman for south and south-east Asia, Kalpana Morparia, is advising policy makers to tweak bankruptcy rules to let foreign portfolio managers throw a lifeline to the troubled shadow banking sector. The overseas investors could also step in to fill the financing void left by the non-bank lenders, she said in a recent interview.

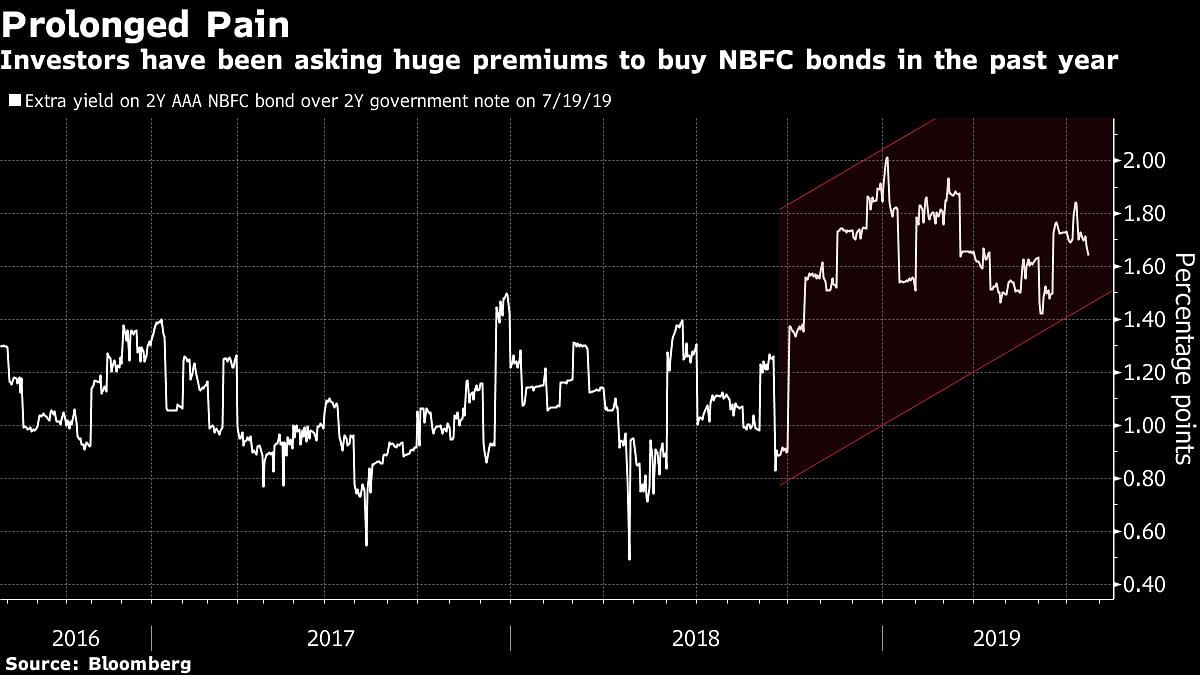

The cash squeeze in the financial system triggered by the default of infrastructure financier IL&FS Group last year has already taken a toll on the country’s economic growth and has policy makers looking for ways to avert contagion. Shadow lenders like Dewan Housing Finance Corp. and Reliance Capital Ltd. are resorting to fire sales of assets to survive the credit crunch.

“I expect foreign portfolio investors to take over some of the space vacated by non-bank financing companies as well as act as a source of liquidity for them,” said Morparia, who has been a banker for about 44 years. The government can look at the following steps to attract foreign portfolio investment into the country, she said:

- Issue guidelines on how insolvency and bankruptcy law apply to non-bank financiers. This would allow the lenders to raise funds from foreign players who are concerned about lack of clarity in the event of bankruptcy of shadow lenders.

- Develop a secondary loan market for direct sales and securitisations to allow foreign investors to buy wholesale loans in a securitised format.

The government has already taken several steps to ensure the availability of funds from overseas investors. This includes allowing them to buy investment trusts and company debt through the so-called voluntary retention route, Morparia, 70, added.

Earlier this month, the Reserve Bank of India eased liquidity ratio rules for banks to encourage refinancing for shadow lenders. The central bank is working closely with the lenders to prevent the collapse of another large systemically important NBFC, Governor Shaktikanta Das said this week. – Bloomberg

Also read: Shadow banking crisis, trade disputes & cut in govt spending could jeopardise profit margins

We seem to think of foreign investors only in times of stress. It is not their mission in life to help others ” tide over difficulties “. If anything, they will expect higher returns at such times.