At last, India’s in-court bankruptcies will show some urgency and common sense.

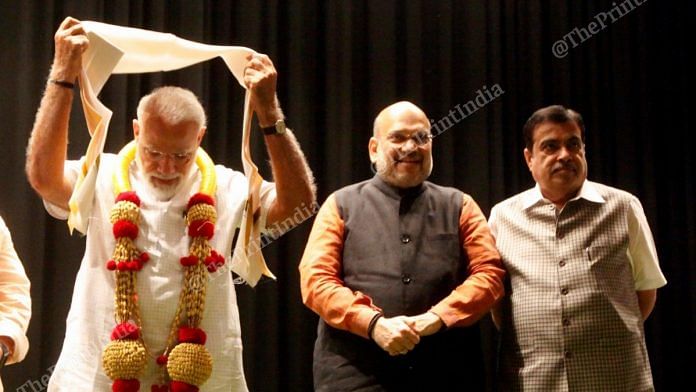

On Wednesday, the government said it would amend the 2016 insolvency law, a signature reform of Prime Minister Narendra Modi’s first term. Investors will cheer.

The legislation was getting mired in frustrating legal delays and bizarre judgments, threatening to scare off global investors from a $200-billion-plus bad-debt cleanup. The last straw was the recent order by the insolvency tribunal judges in the $6 billion sale of Essar Steel India Ltd. to ArcelorMittal. The judges ruled that secured creditors would have no seniority over unsecured creditors and suppliers.

As I have noted, the order would have reduced an assured 92% recovery rate for financial lenders to just 61%. While it has already been appealed by State Bank of India and other lenders in India’s Supreme Court, it’s helpful that the government has decided to get off the sidelines. If the top court had upheld the tribunal’s verdict – on the grounds that the law wasn’t clear about how sale proceeds would be divided – banks would have had to kiss goodbye to substantial recoveries, step up bad-loan provisions and push more salvageable debtors into liquidation, leading to unnecessary job losses. New Delhi had no option but to step in before the July 22 court hearing.

The tweak it proposes “to fill critical gaps in the corporate insolvency resolution process” will explicitly hand power over distribution of proceeds to creditors’ committees. That should return some common sense to a process that would have required financial creditors to share the money from any new buyer of a bankrupt business equally with sundry suppliers and other unsecured lenders.

As for urgency, delay tactics by large business families loath to lose their prized assets have pushed bad-debt resolutions such as Essar to more than 600 days; the intent was to wrap up cases in 270 days. Now the Modi government wants the clock to keep ticking even during appeals. Cases have to be admitted speedily and concluded in 330 days flat.

It’ll be interesting to see if India’s overburdened judiciary can actually dispose of legal challenges in 60 days. The good news is that any branch of the government, or any tax authority, won’t be able to hold up in-court bankruptcies to recover their dues. Mergers and de-mergers can also be considered alongside outright sales, allowing creditors to extract the most value from unworkable capital structures.

Homebuyers, who get equal recognition under the bankruptcy law as financial lenders, are now on creditors’ committees of builders that have gone belly up without delivering the homes they took payments for. Yet having a large and dispersed class of creditors weigh bids from buyers was leading to stalemates. The government is now proposing to streamline the decision-making: If half of the creditors present and voting say yes, plans will move forward. Those not in favor will receive what they would’ve gotten – according to seniority – in liquidation.

The changes are bold, practical and badly needed for India to turn the page on a brutal and long downward phase in its credit cycle. Three out of four of the economy’s engines – private investment, consumption and exports – have stalled, while government spending, the overworked last option, is sputtering. Amending the bankruptcy code won’t revive animal spirits overnight, but it would at least prevent a bad situation from getting indefinitely worse. –Bloomberg

Also read: Essar insolvency ruling is a big blow to Modi govt’s signature reform

I agree with the General’s view. At least some is thinking of reform.

If the fourth turbine had not been drinking so much ATF, more would have flowed to the first two. I am not an economist but my heart tells me the government is a very big part of the set of factors that have created this numbing economic downturn. So to plead for more public investment – expenditure, actually – is to give the patient the entirely wrong set of medication.