All kinds of patchwork solutions are in the works for reviving comatose state-run lenders that account for 70 per cent of India’s banking sector.

Each new day brings a fresh band-aid in India’s efforts to patch up its banks. Last week’s highlight was an egregious plan to dump moth-eaten IDBI Bank Ltd. into the lap of a state-run life insurer. This week began with a proposal for a national asset management company, or bad bank, as if 21 state-run lenders weren’t enough bad banks.

Missing from discussions around these quick fixes is a crucial question: How will bond vigilantes react to the sound of cans being kicked down the road?

For the first time in almost seven years, the benchmark Indian government bond has rounded off four straight quarters of losses. The jump in the 5-year yield has been almost 2 percentage points since December 2016, the biggest surge among 14 Asian local-currency benchmarks. Foreigners have already pulled out more than $6 billion from Indian bond markets this year.

Think about what this vigilante attack is doing to the banks. State Bank of India, the biggest by assets, reported $1.4 billion in unrealized (or mark-to-market) investment losses in the fiscal year ended in March, sacrificing two-thirds of the gains it made by selling securities. Considering this was the year when the lender had to provide for $10.6 billion in loan losses, the blow from rising yields hit SBI — and other state-run banks — hard. If yields continue to climb, finding the money to fix the banking system’s $210 billion problem of stressed assets will become that much tougher.

It’s hard to see how yields can be contained below 8 percent for much longer. Global oil prices and the cost of capital are both rising. New Delhi’s fiscal calculations are going awry just as the banking system sinks deeper into a morass. That’s because even before the chaos of Prime Minister Narendra Modi’s November 2016 currency ban could fade away, India replaced a plethora of local taxes with a goods and services levy. The GST is still a work in progress, struggling to reach its collection target.

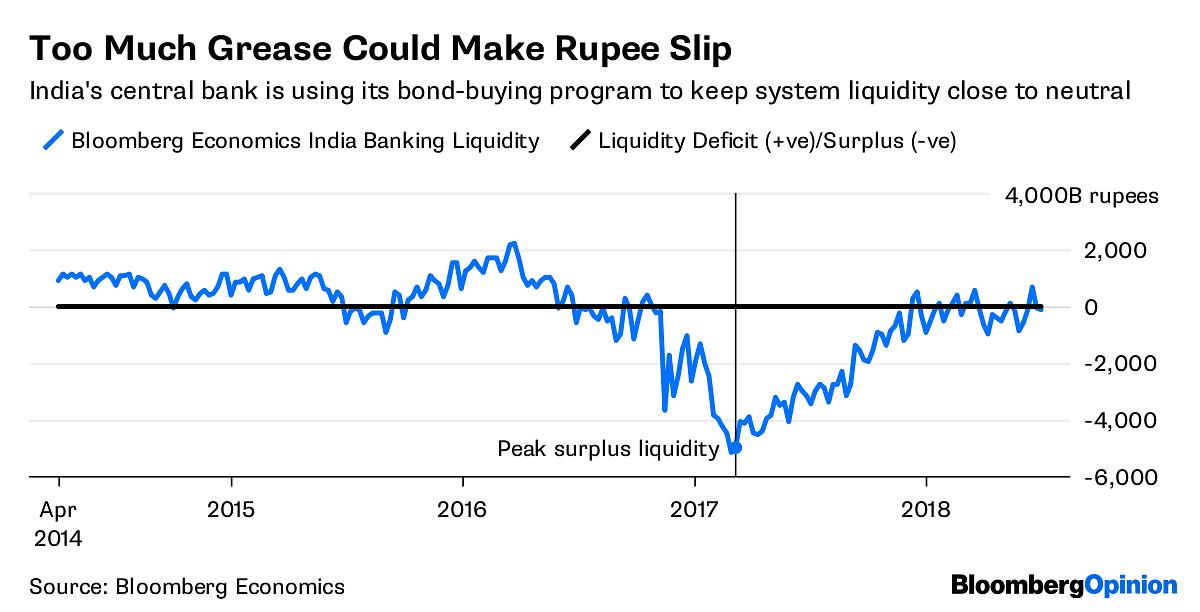

Now, it’s technically easy for the central bank to cap rising yields by running its own quantitative easing program: All it needs to do is buy government bonds from banks to lift their prices (and lower their yields).

While the RBI did indeed take recourse to bond purchases to tackle an incipient liquidity shortage, there’s a limit to how far it can go.

Printing additional rupees at this juncture would mean watching the currency, already the most beaten-down in Asia this year, slump further against a resurgent dollar. With the rupee near an all-time low, that isn’t a politically palatable option for Modi’s team ahead of next year’s election.

One way to break the cycle may be to take a leaf from the Indonesian monetary authority’s super-hawkish stance. Bank Indonesia has raised interest rates by a full percentage point since May, including a harsher-than-expected half-percentage-point boost on Friday. If the RBI can convincingly choke off rising inflation, bond yields have a chance of settling below 8 percent.

Even this is politically unfeasible, however. A sharp increase in prices at which the government buys farmers’ crops — including what the local media is speculating will be the single-biggest bump in any year for rice — may be announced soon. The Modi administration wants to deal with criticism that its policies haven’t given a fair shake to farmers, but to try to remedy the imbalance all at once could harden households’ inflation expectations.

For the RBI, which has so far raised interest rates by only a quarter-point in the current cycle, a preemptive strike against price pressures would mean sacrificing a good chunk of growth. The latest Nikkei India purchasing managers’ index for manufacturers showed a sharp uptick in June. Whacking growth on the head just as it’s coming out of a multiyear funk would make things worse for banks.

All kinds of patchwork solutions are in the works for reviving the comatose state-run lenders that account for 70 percent of assets. The objective is to make the banks whole with the least capital.

This isn’t the time for cleverness, however. Markets would be more impressed by simple things like fixing the GST, appointing a chief statistician, and publishing the long-delayed back series for GDP. Without regaining bond investors’ trust, whatever little capital India throws at its banking problem will sink without trace. – Bloomberg