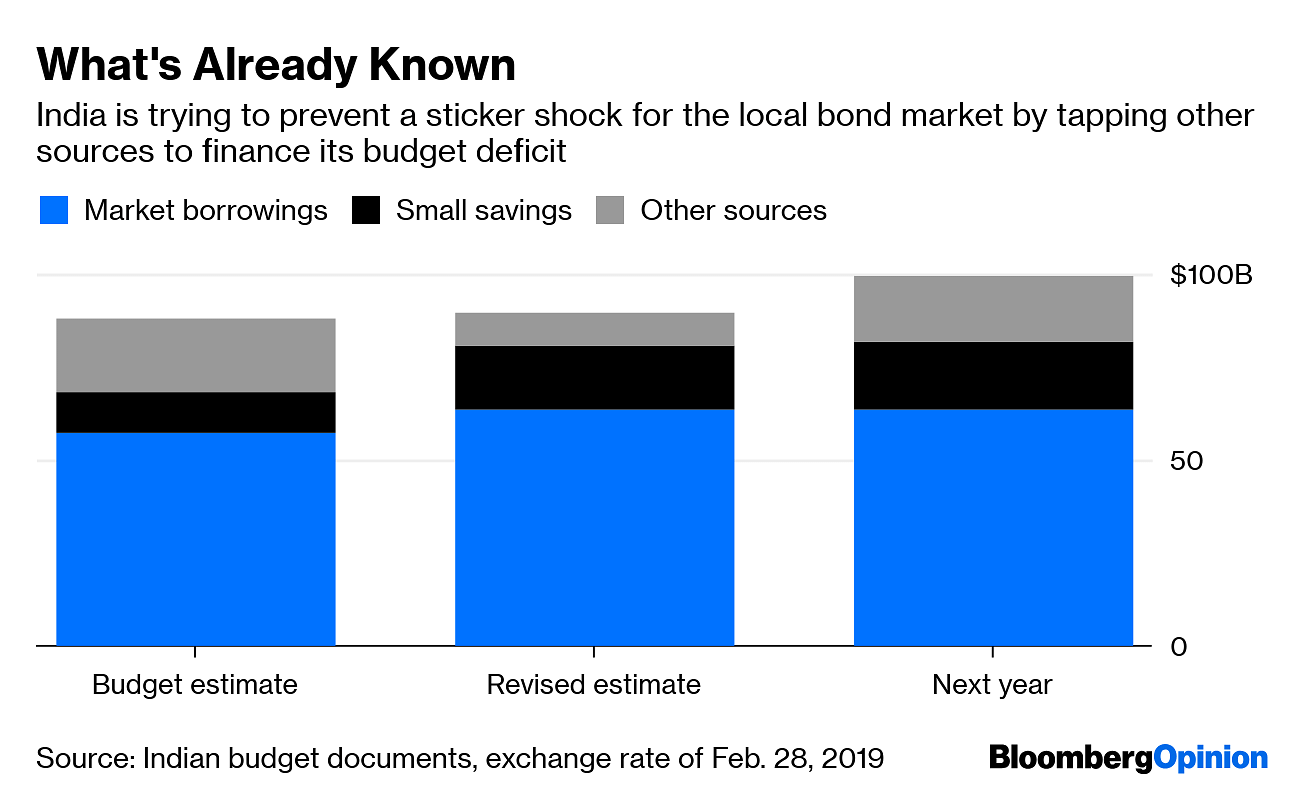

India’s economy is slowing, inflation is sputtering and the central bank is cutting interest rates. But the cost of long-term money is refusing to budge. The reason, in a single word: elections. Polls will be called any day now. Prime Minister Narendra Modi probably would have liked to make his reelection bid with less distress in the farm economy and a better jobs track record. If he hadn’t scored an own goal by banning 86 percent of the country’s cash overnight, he might even have succeeded. Officially, Modi will end the fiscal year on March 31 with a deficit of roughly $90 billion, a pre-poll bump that doesn’t appear to have helped in pump-priming the economy.

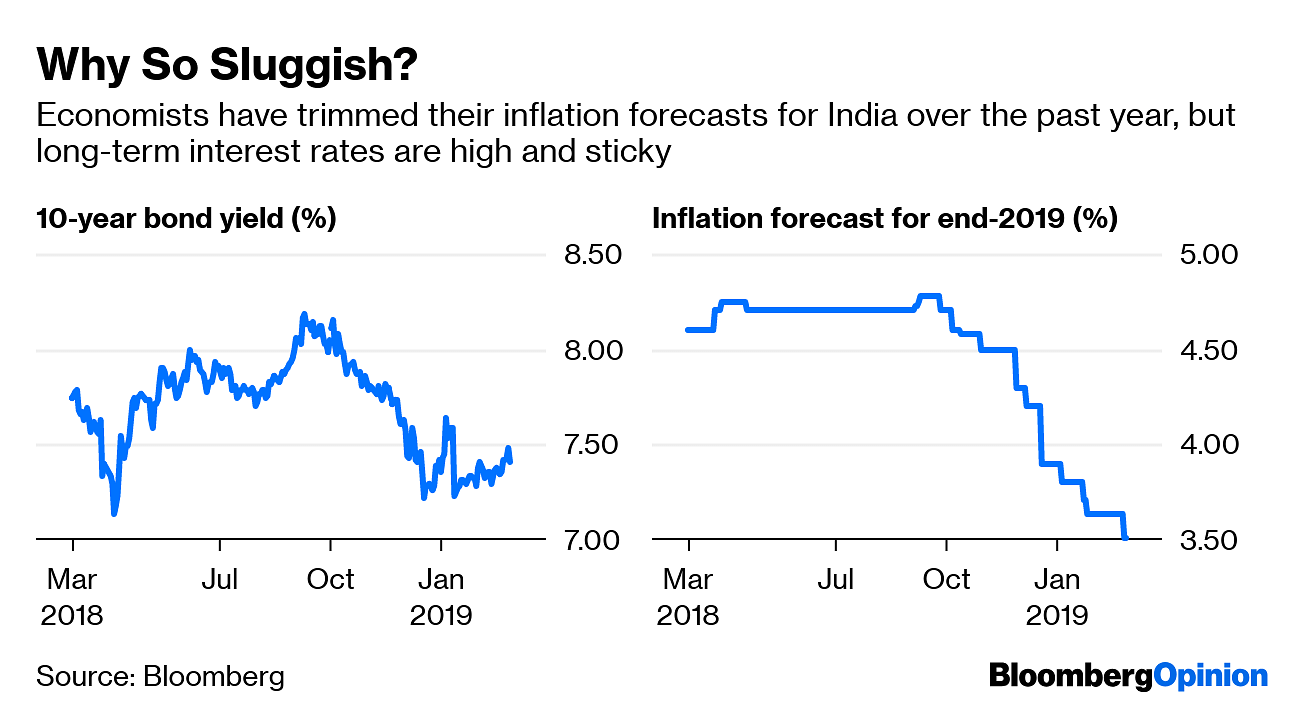

It comes as little surprise that the country recorded its slowest GDP growth rate in five quarters, with more weakness expected in the three months ended March. That can only mean more disinflation and deeper interest-rate cuts. Why, then, is the 10-year Indian government bond yield still tracking at 7.4 percent, more than double the expected inflation rate for the year?

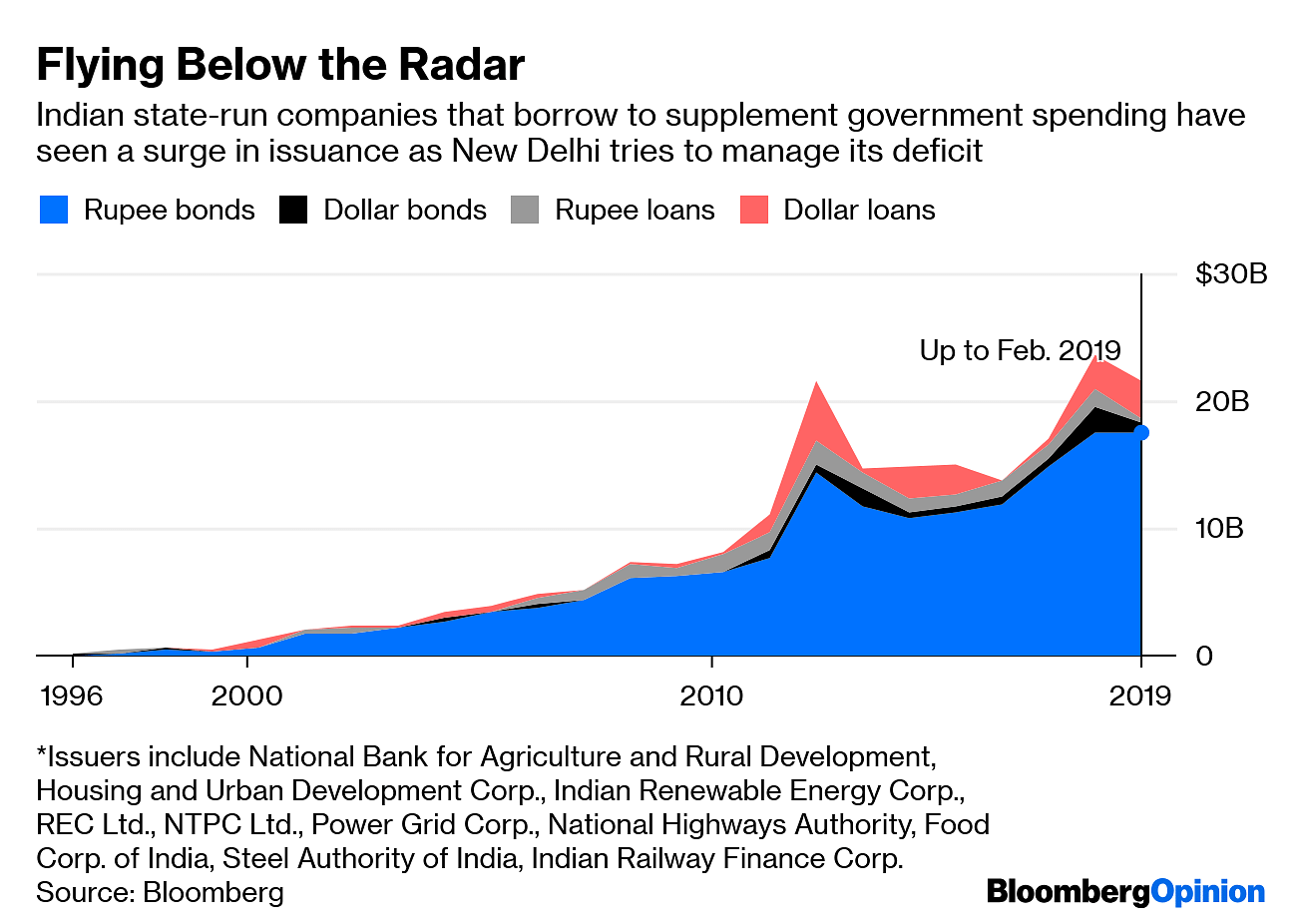

What’s troubling the market – beyond the known $100 billion deficit for the next fiscal year – is the additional, below-the-radar government funding it’s being asked to provide. India Ratings & Research Pvt., a unit of Fitch Ratings Inc., calls it “extra budgetary resource,” a euphemism for public spending via borrowings that are, for all practical purposes, sovereign liabilities (though not counted as such).

I considered the top 10 public enterprises that borrow either to create economic infrastructure, such as the National Highways Authority of India, or distribute state subsidies, such as the Food Corporation of India. While the liabilities sit on their balance sheets, their ability to repay comes from the government. A recent Food Corp. bond flopped after India introduced a clause diluting the agency’s sovereign backing, Cogencis reported.

What’s the quantum of such semi-hidden public financing? Some $22 billion, based on bond and loan-issuance data compiled by Bloomberg for the current fiscal year. With a month to go, this figure could surpass last year’s record of about $24 billion – and even that’s an understatement. The Food Corp. alone has borrowed $28 billion this year, according to an analysis by BloombergQuint, though more than four-fifths of that may have been from non-market sources such as the employees’ provident fund, postal savings and the Life Insurance Corp. of India.

Ultimately, though, it’s Indian households whose savings are being cornered by the government. For this to pay off, public spending has to make businesses and families more optimistic about investing and consuming. That could have happened a lot sooner were it not for the 2016 demonetization, or the spotty implementation of a badly designed goods and services tax.

But more worryingly, and to Team Modi’s frustration, animal spirits aren’t reviving quickly enough – despite simultaneous fiscal and monetary stimulus, as well as regulatory easing and $39 billion in central bank liquidity infusions since May.

The bond market is holding this campaign hostage.

If the 10-year yield stays elevated despite slowing growth and inflation, high real long-term interest rates will further depress private borrowers’ sentiment. And this when nonbank lenders’ moods are already sullen. The sudden bankruptcy of an infrastructure financier last September has raised their funding costs; a housing glut is adding to the nervousness around builders’ debt. With credit-risk premiums unlikely to narrow any time soon, it’s all the more important that India’s risk-free rate should fall.

Also read: India was the largest borrower from World Bank for 3 of last 4 years