After acting against Rana Kapoor, RBI will be forever held to a high standard and any compromises would damage its credibility.

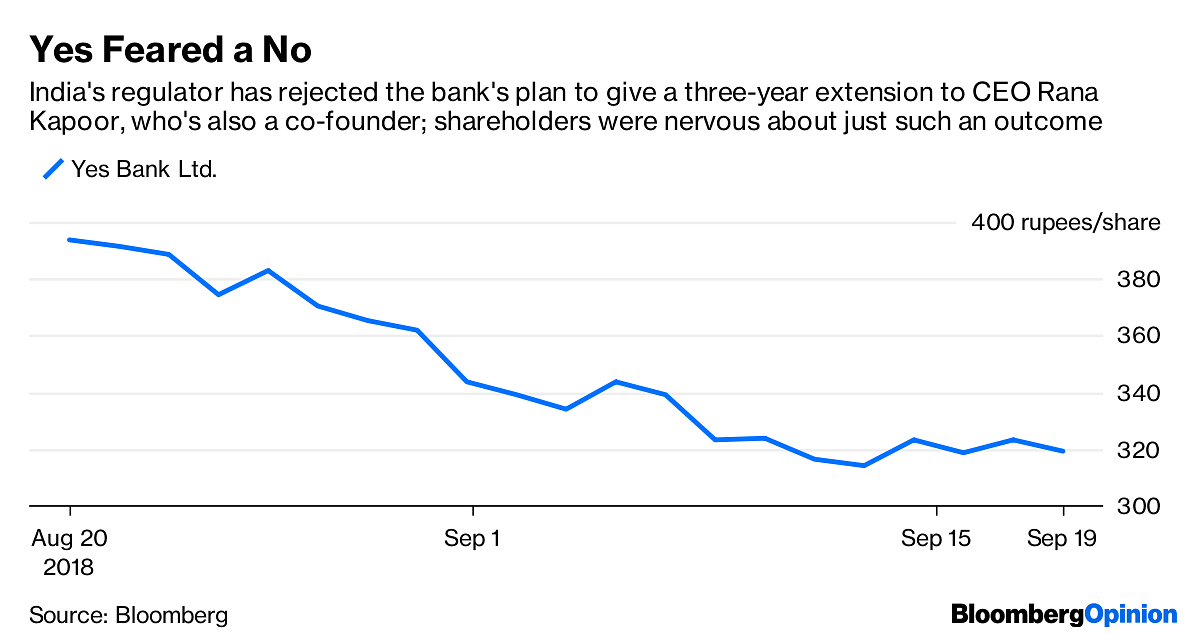

By denying a full three-year term to Yes Bank Ltd. Chief Executive Officer Rana Kapoor, India’s banking regulator has sent stern messages to not one or two, but five constituencies.

The first wake-up call is for the CEOs themselves: To preserve their equity interest in a bank, they’re free to chase higher price-to-book multiples, but not by pumping up what I’ve called the price-to-truth ratio.

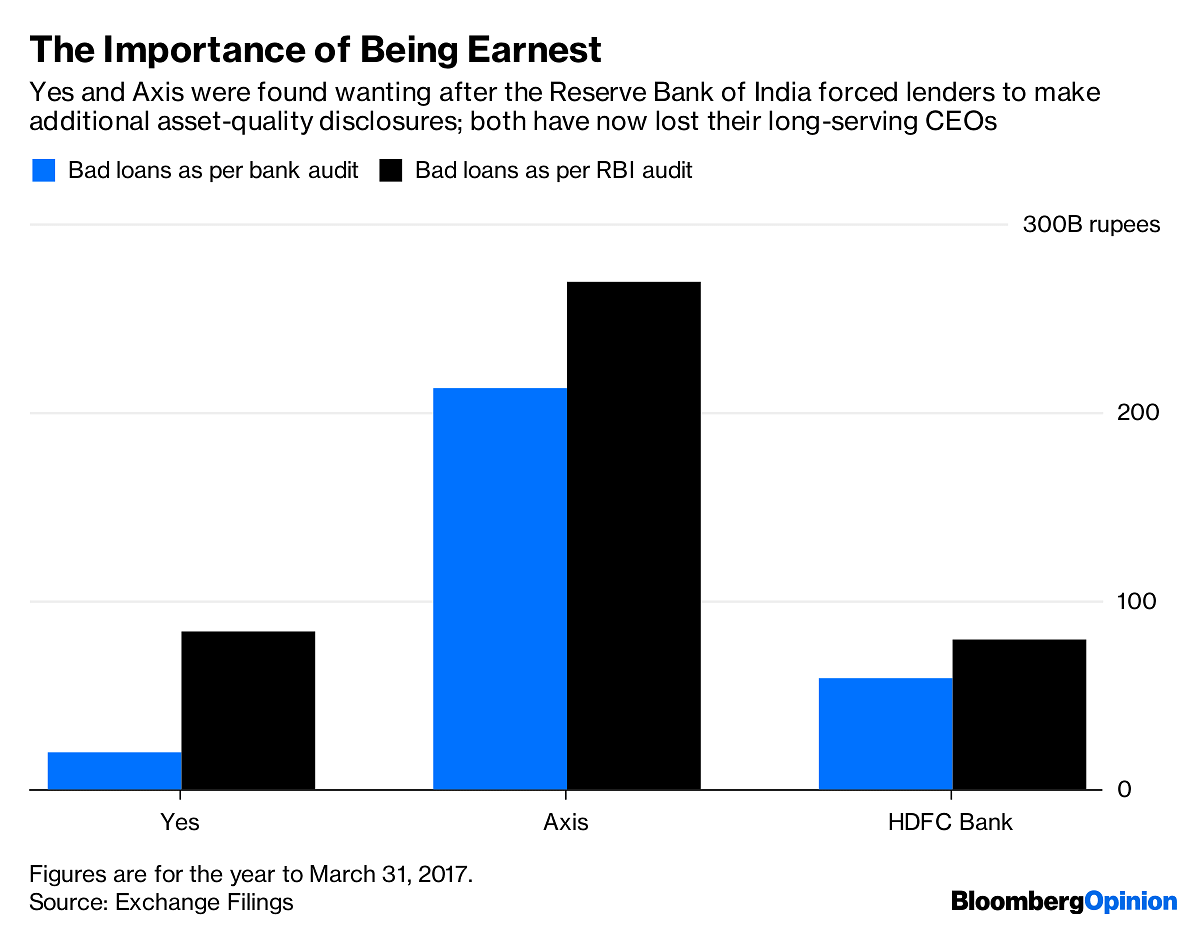

Kapoor earned the ire of the Reserve Bank of India by wrongly classifying loans he should have counted as nonperforming. Yes wasn’t the only bank to do this. RBI’s asset-quality reviews showed problems at Axis Bank Ltd. – and sure enough, the regulator refused to extend CEO Shikha Sharma’s reign, too. But while Sharma, who’ll leave at the end of the year, was a professional manager, Kapoor is a co-founder of Yes and a shareholder. The central bank wants him to step down after Jan. 31.

That’s the RBI’s second message: The regulator won’t accept skin in the game as a proxy for good behavior. Since banks are licensed to create money out of thin air, the advice Spider-Man received from his uncle – “with great power comes great responsibility” – is the yardstick from now on.

And so to the third message, directed at Yes Chairman Ashok Chawla and ICICI Bank Ltd. Chairman Girish Chandra Chaturvedi, both of whom are former civil servants. Their previous boss, the Indian government, may not have cared much about good governance; the RBI expects better from them and their boards. Chaturvedi’s predecessor had rushed to give ICICI CEO Chanda Kochhar a clean record when allegations of conflict of interest first arose against her. The board ordered an independent inquiry only later. Such CEO worship must now stop.

RBI Governor Urjit Patel’s fourth message is to the government. When New Delhi tried to deflect the blame for an unprecedented $2 billion fraud at Punjab National Bank toward the regulator, Patel objected, saying he didn’t have the same powers over state-run lenders such as PNB as he had over private institutions. Wielding that authority – with Axis, and now with Yes – is a reminder to the government to give Patel free rein with his tough-love doctrine. For instance, allowing state-run banks latitude to accept losses from dud loans to stranded power plants is a bad idea. The RBI is dead against it, even though that’s what the bankers want.

All of India’s finance industry ought now to feel the RBI’s regulatory heat, including Infrastructure Leasing & Financial Services Ltd. and its empire of 169 subsidiaries, associates and joint ventures. The IL&FS Group is systemically important, though it doesn’t take public deposits. Now that the infrastructure lender is defaulting on debt, it’s become painfully clear that the RBI hasn’t done enough to rein in that institution’s freewheeling ways.

So the fifth and final message from the RBI is to itself: After acting against Kapoor, the regulator will be forever held to that high standard. Any compromises now would damage the credibility the central bank is trying so hard to win. – Bloomberg

The rules and regulations and law abiding citizen and institution less said the better. We as Indian have developed a peculiar criteria to blame and to prosecute . If this is not the case then it is pure victimization and that is plenty in our country. No honesty has ever existed which has avoided such situation. This case could be such a case where justice will be served after the bank is taken over by interested stimuli.

Who knows after sometime this man may be discovered as friend of Modi, Shah, Jaitly.

I read similar article(100%copied) in economictimes.com. Is it OK to post someone else’s content ?

It is good to see RBI getting some spine after demonetization. The YES bank CEO has become caged parrot of current PM, and this reflected in his many external communication. By doing so, he put the bank at risk. Every head of premier institutions must not bend against any Govt. even though they may not get favors/extension. As highly intellectual they have many careers to choose.