The All-India Debt and Investment Survey (AIDIS) is conducted by the National Sample Survey Organisation (NSS) in both rural and urban India at periodic intervals. The latest survey was conducted between January and December 2019 and its report was released recently. According to the NSS, AIDIS 2019 sampled 5,940 villages covering 69,455 households in rural India, and 3,995 blocks covering 47,006 households in urban India. Before AIDIS 2019, the NSS had carried out the AIDIS in its 70th round (January-December 2013) which provided information on assets and liabilities of households as on 30 June 2012.

AIDIS provides us four indicators that give us a glimpse into the debt and investment situation in rural and urban India. These are:

- Average value of assets (AVA): AIDIS 2019 provides us with the average value of all physical and financial assets owned per household as on 30 June 2018.

- Incidence of Indebtedness (IOI): The latest survey tells us the percentage of households with any outstanding debt as on 30 June 2018.

- Average amount of debt (AOD): It tells us the average amount of cash dues per household as on 30 June 2018.

- Debt-asset ratio (DAR): It tells us the AOD outstanding on a given date for a group of households, as a percentage of the AVA owned by them on that date.

In this data narrative, we will look at the findings of AIDIS 2019.

Average value of assets (AVA)

According to AIDIS 2019, cultivator households constitute 57 per cent of all rural households in India. In urban India, households are classified into two occupational categories — self-employed, and others. The latter includes households with a regular wage or salary earnings, casual labour, and others. According to AIDIS 2019, self-employed constitute 26 per cent of all households in urban India.

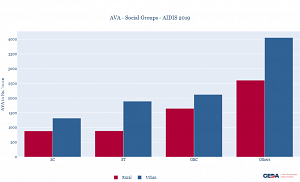

In rural India, SC households had an AVA of Rs 879,000 which was only 34 percent of the AVA for Others (Rs 26,03,000). Rural OBC households’ AVA was Rs 16,45,000, which was 63 percent of the AVA for Others. This gap is wider in urban India. Other households had an AVA of Rs 40,45,000 in urban India, but this value was only Rs 13,15,000 for SC households (32 percent of Others) and Rs 21,20,000 for OBC households (52 percent of Others).

Average Amount of Debt (AOD)

In rural India, we observe a sharp rise of 37 percent in AOD for non-cultivator households in AIDIS 2019 over AIDIS 2013. Overall, for rural India, AOD has increased by 60 percent in AIDIS 2019 over AIDIS 2013. The picture is not different in urban India as self-employed households show a sharp rise (44 percent) in AOD in AIDIS 2019 over AIDIS 2013. Overall, urban Indian households AOD increased by 24 percent in AIDIS 2019 over AIDIS 2013.

Also read: Not just farmer suicides, let’s talk about rural debt due to government policies

Indebtedness

AIDIS also provides us information on households’ indebtedness. In AIDIS 2019, a household was considered indebted if it had any cash loan outstanding on 30 June 2018. AIDIS provides us three kinds of information related to indebtedness.

- Incidence of indebtedness (IOI): IOI is the percentage of indebted households, i.e., the percentage of households that has a cash loan outstanding.

- Average amount of debt (AOD): AOD is the average amount of cash dues on 30 June 2018 per household.

- Average amount of debt per indebted household (AODL): As the term suggests, AODL is the average amount of debt per indebted household.

We find that incidence of indebtedness for both cultivator and non-cultivator households has gone down in 2019 in comparison to 2013. In urban India too, the IOI has decreased for both self-employed and other households.

Also read: 9.1 crore Indians don’t have basic water supply. But India isn’t paying attention

Indebtedness across social groups

How is incidence of indebtedness spread across various social groups in Indian society? ST households have the lowest IOI in rural India while SC, OBC, and Other households show a similar level of IOI in rural India. ST households IOI also shows highest increase (46 percent) in AIDIS 2019 over AIDIS 2013 across all social groups.

In urban India too, ST households show the least incidence of indebtedness among all four groups reported in AIDIS 2013 and AIDIS 2019. OBC households report the highest IOI in urban India in AIDIS 2019 (25.3 percent) with SC households only slightly behind at 23.4 percent. However, when we compare the data from AIDIS 2013 and 2019, we find that urban OBC households IOI has declined by 3 percent in AIDIS 2019 over AIDIS 2013.

Also read: Economic recovery has finally begun, but India needs to watch out for global headwinds

Change in Households’ Net Worth

While AIDIS 2019 informs us of a broad decline in households’ average assets (AVA) and increase in their average debt (AOD) since AIDIS 2013, it becomes more apparent when we compare households’ net worth in AIDIS 2013 with that in AIDIS 2019. Net worth of a type of household has been calculated by subtracting its AOD from AVA. We find that every type of household saw its net worth decline in this period. While cultivator households’ net worth declined by 33.8 percent, non-cultivator households’ also saw their net worth decline by 0.1 percent. In urban India, self-employed households saw their net worth decline by 30.5 percent, while other households saw a decline of 3.7 percent in their net worth. All comparisons have been made using real value for AIDIS 2013.

The broad trend we observe in AIDIS 2019 is a decline in AVA for cultivator households in rural India and self-employed households in urban India vis-à-vis AIDIS 2013. We also see a decline in IOI for cultivator and non-cultivator households in rural India and self-employed and other households in urban India. AIDIS 2019 also reports a decline in IOI for non-institutional credit for nearly all decile classes over AIDIS 2013. The most striking finding in AIDIS 2019 is the sharp decline in households’ net worth across rural and urban India.

The article is an excerpt of the report titled AIDIS 2019: Lower assets and higher indebtedness for Indian households. It has been published with permission. Read the full report here.

Ankur Bhardwaj is Editor, Centre for Economic Data and Analysis. Views are personal.