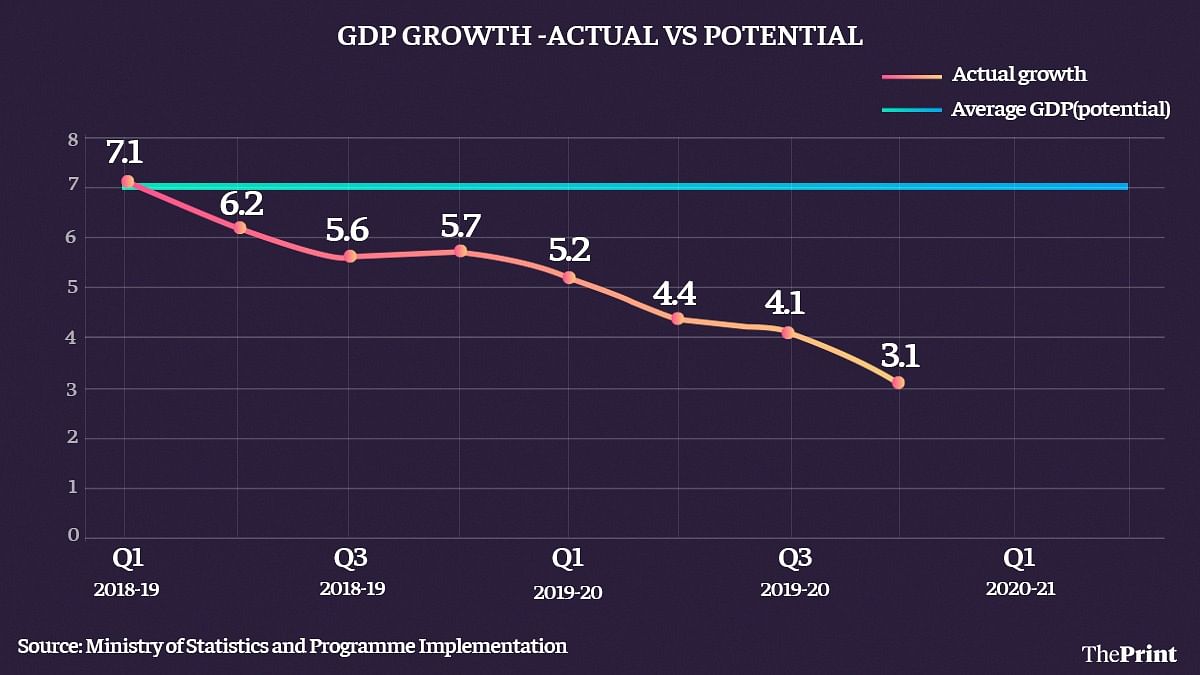

The recently released Q2FY21 GDP data showing a contraction of 7.5 per cent puts India in a technical recession for the first time since 1998. But, the less than anticipated de-growth at -7.5 per cent has cheered the financial markets, which think the worst is over. However, a thorough examination of GDP numbers hints at India’s lingering economic crisis. GDP growth averaged around 5.4 per cent over the last eight quarters from Q1 FY19 to Q4 FY20, compared to a healthy average growth of 7 per cent or so recorded over the last decade-and-half. If we include the Covid impact on Q1 and Q2FY21 for the analysis, then the average GDP growth will be a mere 1 per cent over the last 10 quarters. The economy is performing well below its potential over the last few years due to slowing demand, which was made worse by the pandemic.

But, blaming the pandemic entirely is kind of denying the inherent weaknesses in the Indian economy that persists for quite some time. A conservative back-of-the-envelope calculation reveals that India has lost over Rs 5.2 lakh core in the last 10 quarters (excluding Q1 and Q2FY21) and a whopping Rs 21.3 lakh crore, including Q1 and Q2FY21 when the economy fell by -23.9 per cent and -7.5 per cent respectively. The latter (Rs 21.3 lakh crore) is roughly equal to 15 per cent of the value of FY20 GDP, which stands at Rs145.7 lakh crore.

While the base effect is likely to pull back GDP growth into positive territory next fiscal, it will take a while for the Indian economy to make up for the lost output given the longstanding weaknesses in the macro-economic environment accentuated by sluggish exports and muted private investment. The negative output gap over the last two-and-half years shows that the economy was in contraction long before the coronavirus outbreak.

Also read: V-shaped recovery is evident, global uncertainty not mirrored in India, finance ministry says

Dip in key indicators

Consumer demand (private final consumption expenditure), the backbone of the Indian economy, which contributes roughly 55-60 per cent of the GDP grew at a tepid 2.7 per cent in Q4FY19. Capital formation or investment accounting for 30 per cent of the GDP has been in the negative territory since Q2FY20, decelerating at an average of 5 per cent every quarter. On the external front, merchandise exports have been hovering around $300 billion since FY12.

On the output side, the Index of Industrial Production, or the IIP data shows that both industrial production and manufacturing decelerated by -0.6 per cent and -1.2 per cent in FY20. The production of primary goods has been in the negative territory in 11 out of last 24 months, while that of capital goods in 22 out of 24 months, ending September 2020.

Only the country’s agriculture sector is providing support to an otherwise lacklustre economic performance.

Also read: Rupee strong from exports perspective, should depreciate a bit, says Raghuram Rajan

Things not moving

The government did act by providing a credit stimulus to the tune of ₹29,87,641 crore to revive demand but credit off-take did not respond positively — loan growth in micro and small industries (the country’s major employer after agriculture) has remained in the negative territory in the last five quarters. Add to this, private investment has remained muted over the last several quarters and public sector investments are unlikely to grow due to the stressed central government finances and states cutting down on investments primarily due to pending dues from the Centre.

A less than potential output growth over the last three years is bound to affect job creation, government revenues and consumer demand. Usually, inflation should be lower at a time when unemployment is high and the country’s economy is in technical recession. But in India, high unemployment and lingering output contraction are accompanied by high inflation, which is well above the RBI’s target levels. It is estimated that close to 12 million people enter the job market in India every year. With a slump in investment and consumption, the outlook on jobs doesn’t appear rosy, especially in the country’s informal sector. That is likely to worsen consumer demand slowdown, and in turn, will cap economic growth, going forward.

Steven Raj Padakandla @pstevenraj1 is a faculty at IMT, Hyderabad. Ritesh Singh @RiteshEconomist is the CEO of Indonomics Consulting Private Limited. Views are personal.

When we compare economy at the time of Manmohan and Modi we have to consider how much of the GDP growth during Manmohan era was ‘shadow economy’. If we discounted the percentage of shadow economy of UPA era, the current economy and previous economy was probably similar. During UPA era we can remember Mallya, Nirav Modi, Lalit Modi, Wadhawans, IL & FS, Yes bank….the list goes on….all these were heading towards NPA or failure. When Modi took over, with just a little regulation all these skeletons emerged out. So, with all these warts, how can we call Manmohan era was a roaring economy? No wonder it was, because, banks were handing them loans or cooperated in ways inexplicable despite not implementing simple checks and balances. No wonder Manmohan and Raghuram Rajan keep lamenting that under Modi, investors are in fear. Should the banks never ask for the dues then? How much should tax payers bear the burden? Under Modi hope we clean up the mess, start with clean slate and better regulation. That is true economy. Shadow economy is addictive, but if went that way we would end up in some major crisis some day. What economy we achieve with clean money is far far better than shadow economy on steroids. We can sleep well at the end of the day.

This malady of worsening consumer demand is because the consumer does not have a hope of the future. The consumer does no hope in the future because he does not trust the govt. He does not trust the govt. because right from the top nobody is sincere. They know that nobody is sincere because everyone lies. Do not go by the voting pattern. The people have just stopped caring who rules them. Its like the sh it picker in the olden days. Whether the ruler is a raja or a nawab he still has to pick the sh it. But they are ready to part with their monay.