In a recent meeting of the governing council of the NITI Aayog, some state governments sought a five-year extension for the compensation paid to states for revenue shortfall due to the implementation of the Goods and Services Tax (GST). The fiscal health of states deteriorated sharply owing to the collapse of revenue and a sharp increase in expenditures due to the pandemic.

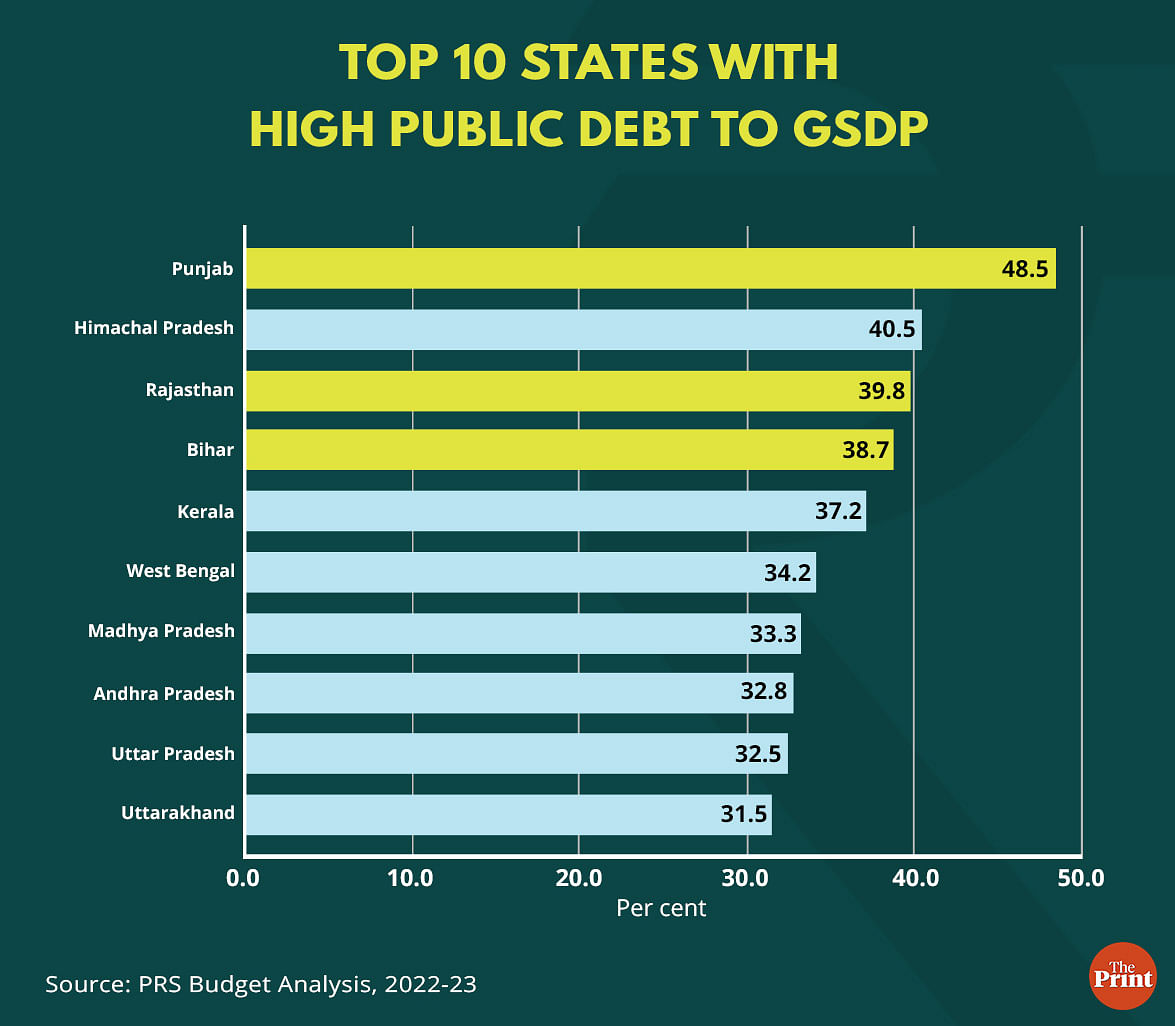

While revenues have turned robust in recent months, the fiscal position of states continues to remain weak. However, there are substantial inter-state variations. The Reserve Bank of India in its recent analysis has identified Bihar, Kerala, Punjab, Rajasthan and West Bengal as highly fiscally stressed states.

The first quarter data suggests that Bihar’s finances continue to be a cause of concern. The finances of states like Rajasthan and Punjab also need attention as they have high debts and higher proportion of committed expenditures, which squeezes the fiscal space for incurring developmental expenditure.

Also Read: Why Modi govt is on strong ground on fiscal deficit but some states are struggling

Bihar: Decline in own tax revenues & deterioration in expenditure quality

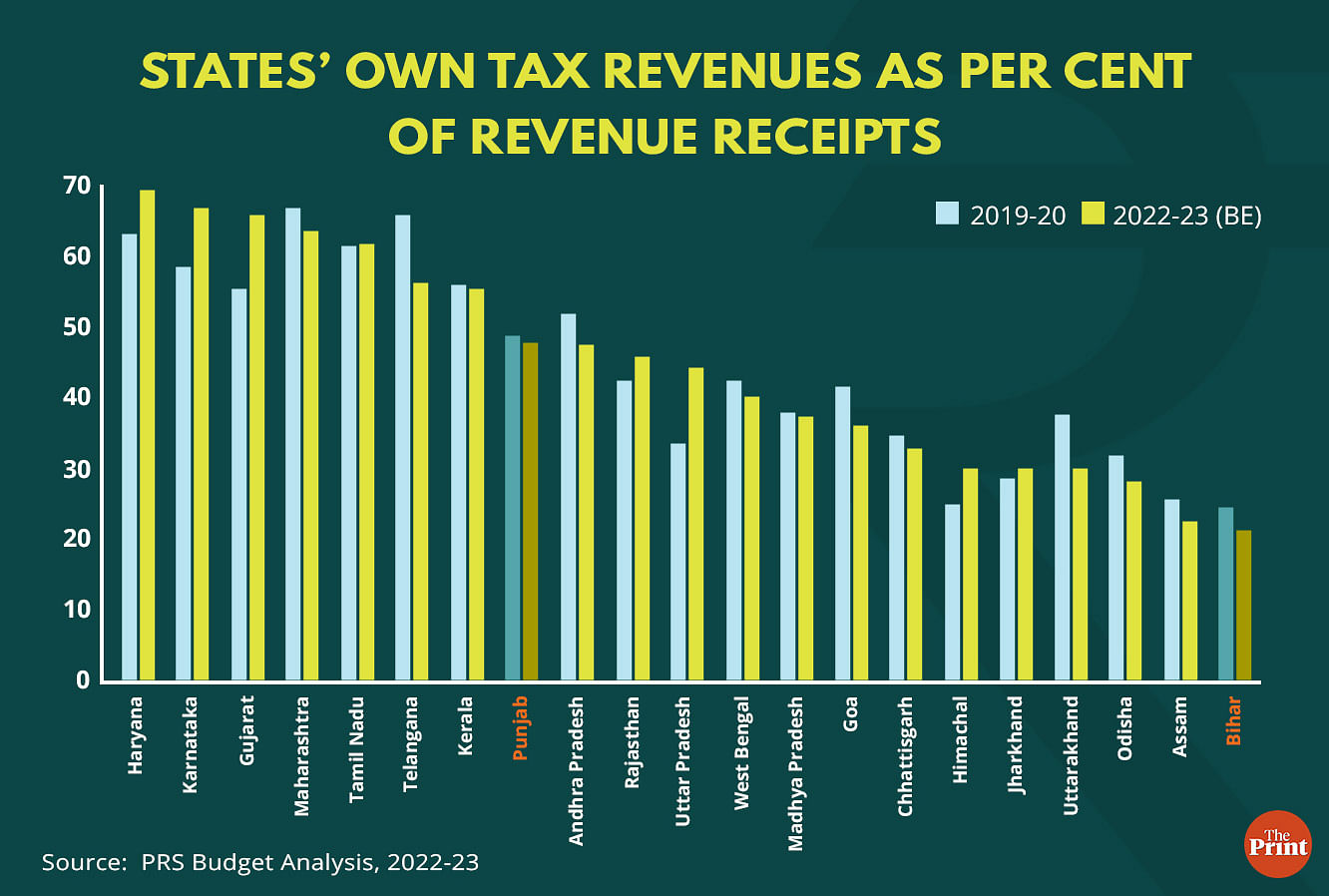

Tax revenues of states include states’ share in central taxes and states’ own tax revenues. The Finance Commission in its five-year award period determines the share of each state in central taxes based on certain criteria. Bihar has the lowest own tax revenue as a share of revenue receipts amongst all major states. From 23.7 per cent in 2020-21, the share of own tax revenues in the total revenue collections declined to 20.7 per cent in 2021-22. In contrast, states like Maharashtra, Gujarat, Tamil Nadu, Telangana, Karnataka and Haryana generate more than 50 per cent of their revenues through their own taxes.

Interestingly, Uttar Pradesh has seen a turnaround in its own tax revenues with more than 10 per cent jump in the share in the last two years. Karnataka has also seen an uptick in its share of own tax revenues. The decline in own tax revenues affects the state’s expenditure planning and increases dependence on market borrowings. Bihar needs to significantly improve its revenue base.

The tepid growth in own tax revenues is also reflected in higher fiscal deficit of the state. For 2021-22, the state’s budgeted fiscal deficit was 2.97 per cent of Gross State Domestic Product (GSDP). However, the revised fiscal deficit surged to more than 11 per cent of GSDP. For this year, the Bihar government has projected a fiscal deficit of 3.47 per cent, which is sought to be achieved by a massive 23 per cent reduction in capital outlay.

According to the audit report on Bihar’s finances by the Comptroller and Auditor General of India (CAG), capital expenditure has been showing a slide since 2016-17. The share of capital outlay to GSDP declined from more than 6 per cent in 2016-17 to 2.94 per cent in 2020-21.

Punjab: Higher share of committed expenditure, low capex and highest debt

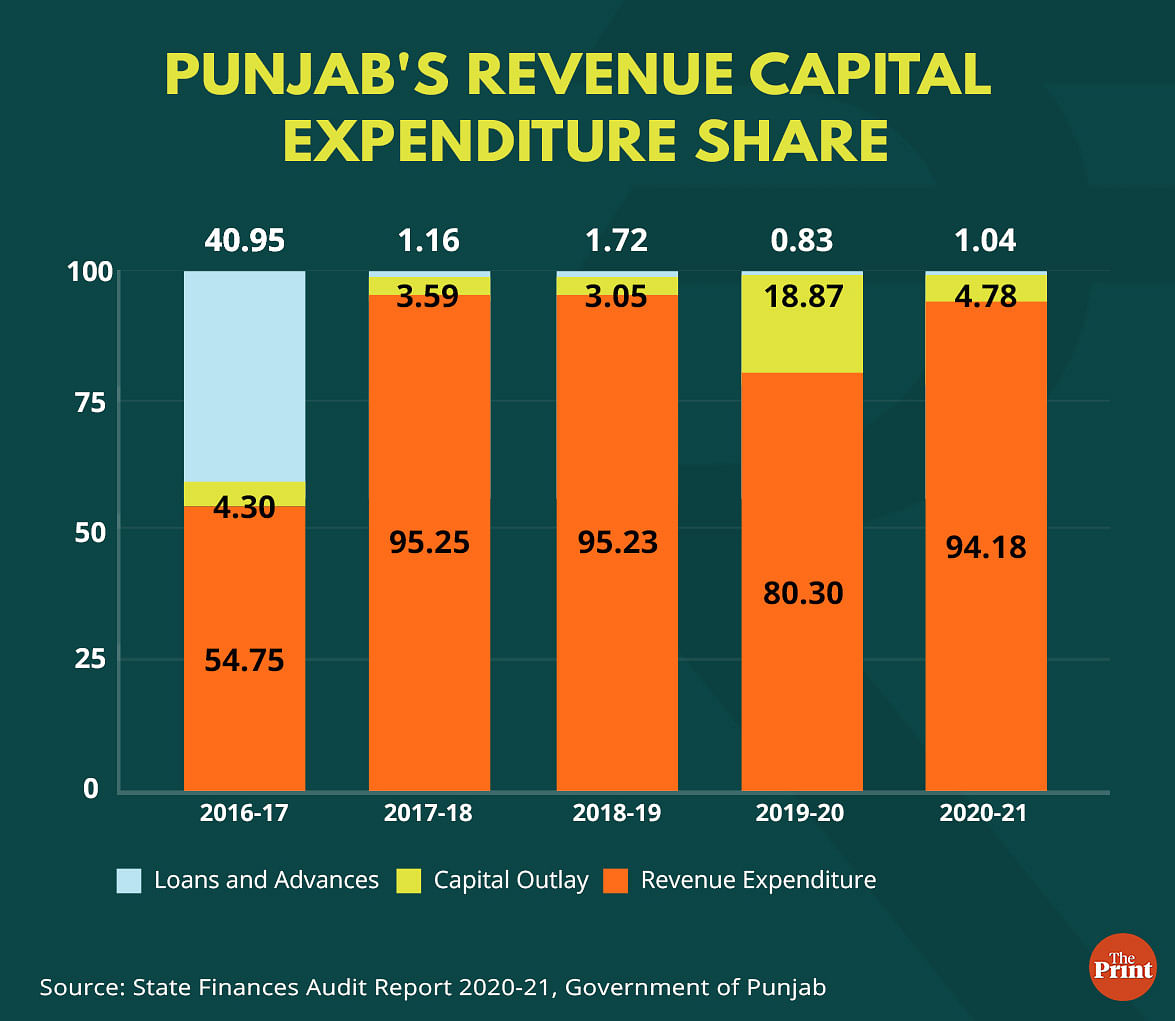

The audit report on state finances highlighted that during 2017-2021, revenue expenditure constituted the dominant proportion of the total expenditure (between 80-95 per cent). The state government has attributed low capital expenditure to high committed expenditures of the state such as salaries, wages, pension and interest servicing. In 2022-23, Punjab is estimated to spend 70 per cent of its revenue receipts in committed expenditure.

Another big component of revenue expenditure has been on subsidies, particularly on power. In this year’s budget, Punjab has allocated Rs 6,947 crore towards providing free power to farmers. According to a note by PRS Legislative Research, the states’ expenditure on education, health, roads and bridges has been lower than the average expenditure by states.

A recently released white paper on state finances by the government of Punjab highlighted that the share of central transfers in the total revenues of the state has doubled from 23 per cent in 2011-12 to 46 per cent in 2021-22. During the same period, the state’s own tax revenues as a share of total revenues has decreased from 72 per cent to 48 per cent. The decline in the state’s own tax revenue indicates little emphasis on revenue mobilisation measures by the state.

The decline in own tax revenues has resulted in higher borrowings. Punjab is one of the highly indebted states with its outstanding liability as percentage to GSDP estimated to be 48.5 per cent at end March 2023. Punjab is expected to remain in the worst position as its debt is likely to exceed 45 per cent in 2026-27.

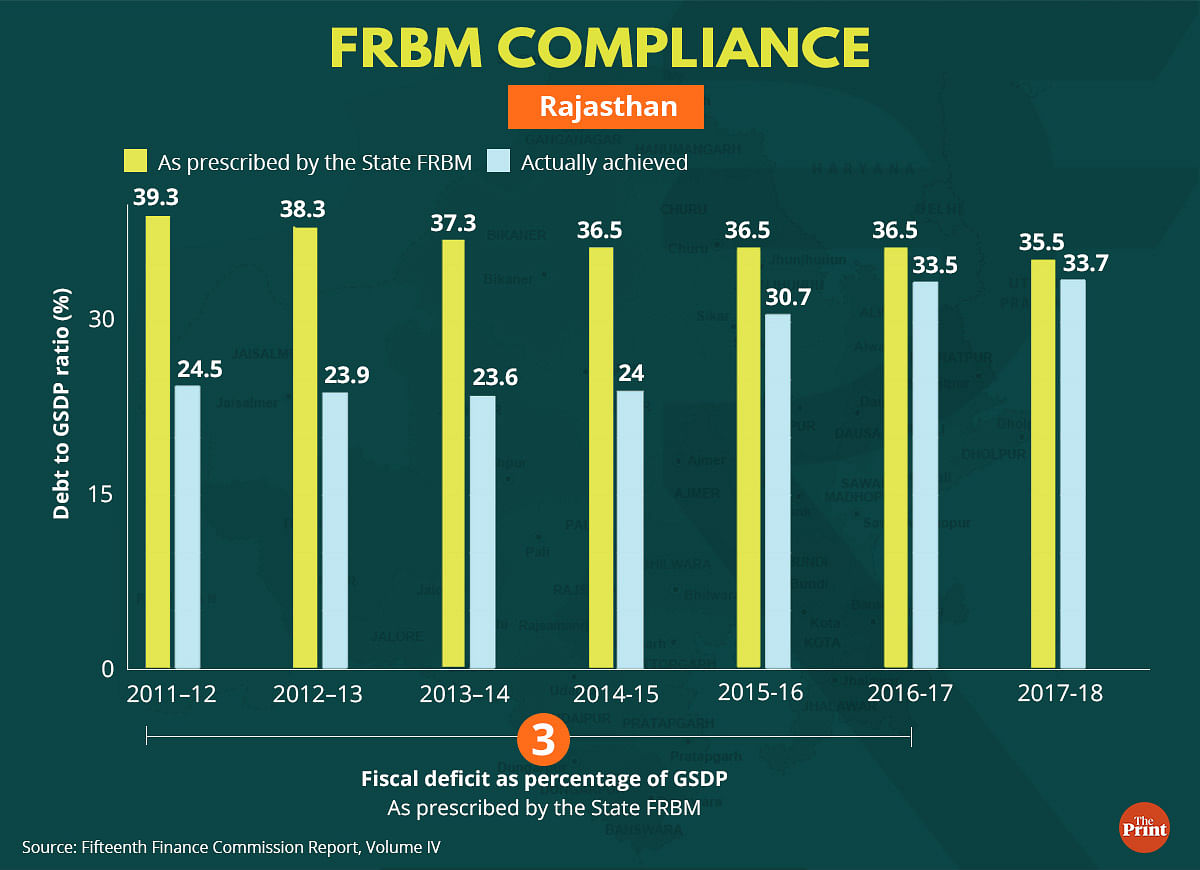

Rajasthan: Deviation from fiscal deficit targets

Rajasthan’s fiscal position is also characterised by high debt levels, low share of capital expenditure in the total expenditure and a substantial share of committed expenditure in total revenue collections. The audit report on state finances has shown a slide in the share of capex in total expenditure from 3.2 per cent in 2015-16 to 1.4 per cent in 2019-20. Like Punjab, committed expenditure accounts for a substantial proportion of revenue receipts. In 2022-23, Rajasthan is estimated to spend 56 per cent of its revenues on committed expenditure.

The 15th Finance Commission’s report shows that while the state has adhered to its debt ratio as mandated by the Fiscal Responsibility and Budget Management (FRBM) Act, it has deviated from its fiscal deficit target in recent years. In 2021-22, against a fiscal deficit target of 3.93 per cent of GSDP, the revised estimate showed a deficit of 5.14 per cent. Clearly, the state needs a careful calibration of expenditure for generating income.

The fiscally vulnerable states need to walk a tightrope between looking after their vote banks and enhancing fiscal prudence.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Views are personal.

Also Read: Freebies, bailouts, revival of pension scheme — why many states are at risk of fiscal stress