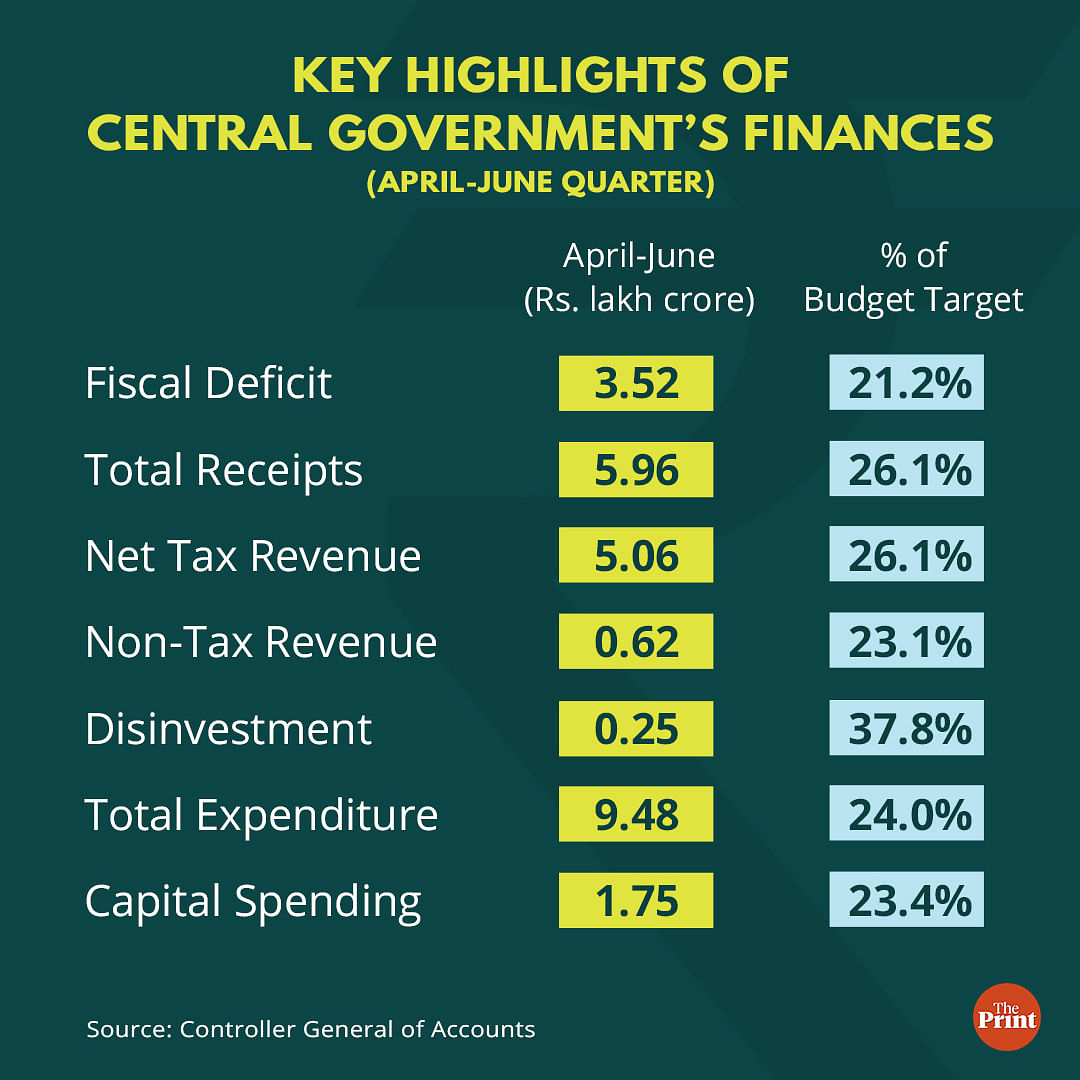

New Delhi: As per the recent data released by the Controller General of Accounts (CGA) at the end of June 2022, the fiscal deficit of the central government in the April-June quarter touched 21 per cent of the full-year target, owing to robust capital expenditure and relatively weak revenue receipts. While the lowering of the RBI’s surplus transfer led to a weak rise in revenues, going forward, buoyant tax collections could help the government absorb higher than the budgeted subsidy expenditure and the revenue loss due to excise duty cuts. Further, the moderation of crude oil and commodity prices, if sustained, should control the government’s expenditure on mitigating inflation risks.

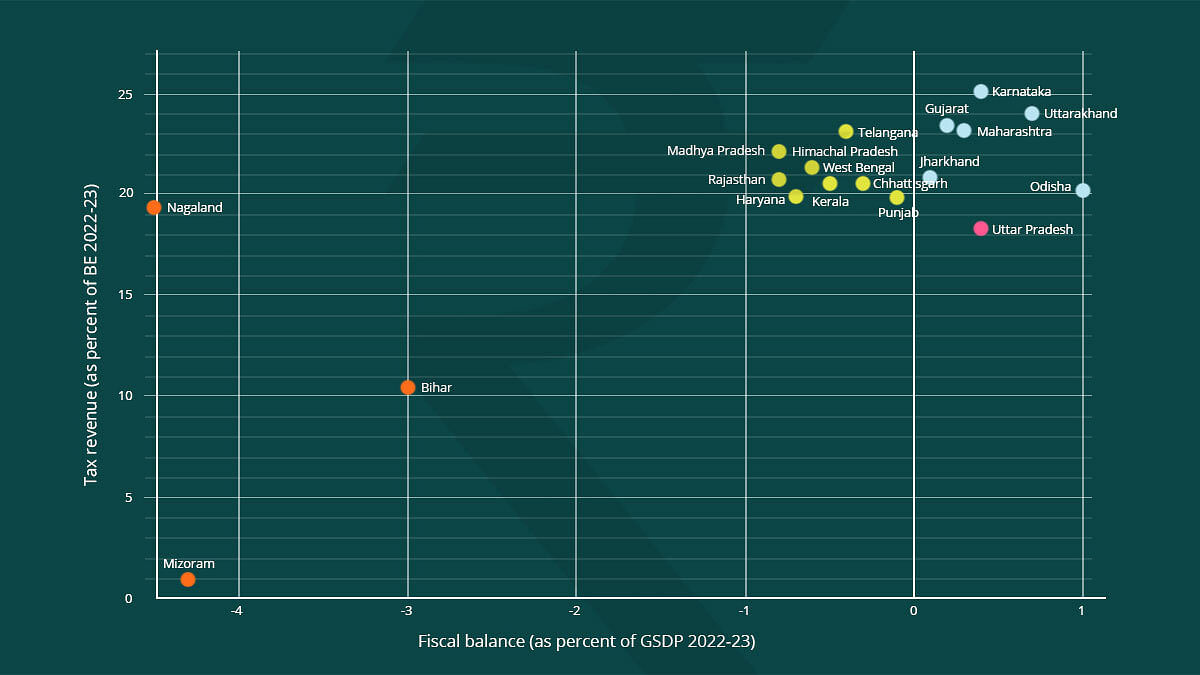

The first quarter numbers suggest that, on an aggregate basis, states’ fiscal position looks better than the corresponding period of the last few years. However, finances of some states are a cause of concern. Bihar, for instance, has witnessed a contraction in tax revenues as well as capital expenditure in the first quarter. Bihar is also the state with the highest fiscal deficit as a percentage of the Gross State Domestic Product (GSDP).

Revenue and expenditure profile of govt in the first quarter

The central government’s revenues registered a weak growth of 5 per cent in the first quarter due to a contraction in non-tax revenues. A key component of the non-tax revenues is the dividend payment from the Reserve Bank of India (RBI) to the government. The RBI approved a sharply lower transfer of Rs 30,307 crore to the government for the fiscal year ending March 2022. Last year, the RBI transferred more than Rs 99,000 crore as dividends. However, the tax revenues present an encouraging picture as they posted a growth of 22 per cent over the same quarter of last year. These account for 26 per cent of the full year’s budgetary target. Within tax revenues, while income tax, corporation tax, and Goods and Services Tax (GST) registered a growth over the same period last year, receipts from customs and excise duties were down as compared to the corresponding quarter of last year. The decline could be attributed to the cut in excise duty on petrol and diesel, and also to the cut in customs duty on commodities such as palm oil and cotton.

Capital receipts, excluding borrowings, have also fared better than last year owing to the disinvestment of the Life Insurance Corporation (LIC) of India that fetched the government Rs 21,000 crore. The disinvestment target for this year is Rs 65,000 crore, out of which the government has managed to garner almost Rs 25,000 crore in the April-June quarter.

A notable feature of the fiscal position of the government has been the sharp jump in capital expenditure. Amid an environment of weak private investment, the government has budgeted to spend Rs 7.5 trillion on capex this year. Out of the full year’s target, the government has spent Rs 1.75 lakh crore in the first quarter. This accounts for 23 percent of the full year’s target and is a whopping 57 per cent jump over the same period last year. As a share of total expenditure, the capex was 18.5 per cent — the highest in the past few years. Infrastructure sectors such as roads and railways saw the bulk of capital spending in the first quarter.

To incentivise states to spend on capex, the government proposed a 50-year, interest-free loan of Rs 1 lakh crore on capital investments. It has set out rules for disbursing these crore loans to states. While Rs 80,000 crore will be sanctioned in accordance with the state’s share in central taxes and duties, the remaining Rs 20,000 crore will be for specific schemes such as the PM Gati Shakti and PM Gram Sadak Yojana. While the government has sanctioned Rs 20,000 crore as capex loans, the transfers could pick up pace in the coming quarters now that the rules for disbursement are in place.

Also Read: Rupee’s fall to 80/dollar will impact twin deficits. But here’s why you shouldn’t panic

How do states fare?

An analysis of 21 states, whose data has been released by the Comptroller and Auditor General of India (CAG), shows that tax revenues in the April-June quarter have broadly performed better as compared to the corresponding quarters of previous years. The aggregate tax revenues of states stood at Rs 4.4 lakh crore as compared to Rs 3.2 lakh crore last year with state excise duties and states Goods and Services Tax posting a healthy growth. While the capital expenditure of the central government posted a growth of 57 per cent, the capital expenditure of states posted a modest decline, as compared to the same quarter of the last year. However, with rules on disbursing loans to states for capex in place, capital expenditure by states should see a pick up in the coming quarters.

Data shows that Bihar’s tax receipts were a meagre 10.4 percent of the full year’s target. In contrast, states like Gujarat, Karnataka, Maharashtra, Uttarakhand, Telangana and Sikkim have been able to achieve more than 23 percent of their full year’s taxes in the first quarter. Out of these, Gujarat, Karnataka, Maharashtra, and Uttarakhand have seen fiscal surplus (revenues exceeding expenditure) in the first quarter. Jharkhand, Odisha, and Uttar Pradesh are the other states that saw a fiscal surplus in the first quarter.

While tax revenues of states have improved, the capital expenditure of some major states has seen a sharp decline in the first quarter. Telangana, Punjab, Haryana, Uttar Pradesh, and Uttarakhand are some of the big states that saw a sharp decline in capex.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Pramod Sinha is currently working as a consultant at National Institute of Public Finance and Policy (NIPFP).

(Edited by Siddarth Muralidharan)

Also Read: Global slowdown could hurt India but don’t worry too much about recession in 2023