India’s economic growth is expected to moderate in the July-September quarter, primarily due to sluggish consumption and capital spending amid heavy rains in some parts of the country. The Reserve Bank of India (RBI) has revised its growth projection for the September quarter from 7.2 percent to 7 percent.

Early quarterly financial performance of listed companies, particularly in the FMCG segment and consumer durables, suggests softness in urban demand. In the financial sector, while public sector banks’ performance was robust, slowdown in credit growth, alongside build-up of incipient stress in the unsecured retail portfolios of some private sector banks, could impact the growth momentum.

Global slowdown, bilateral tensions with Canada, conflict in West Asia and the continuing Russia-Ukraine war impacted exports in the September quarter.

Mixed performance in manufacturing sector

The quarterly sales revenue of listed manufacturing companies reported a weak growth of 1.79 percent for the quarter ending September.

Companies in the chemicals, metals and metal products reported a contraction in sales growth due to sluggish demand and decline in steel prices, respectively. Those in the consumer goods segment reported lower sales in the September quarter, as compared to June quarter. The softness in sales growth was particularly visible in personal and home care products and consumer electronics.

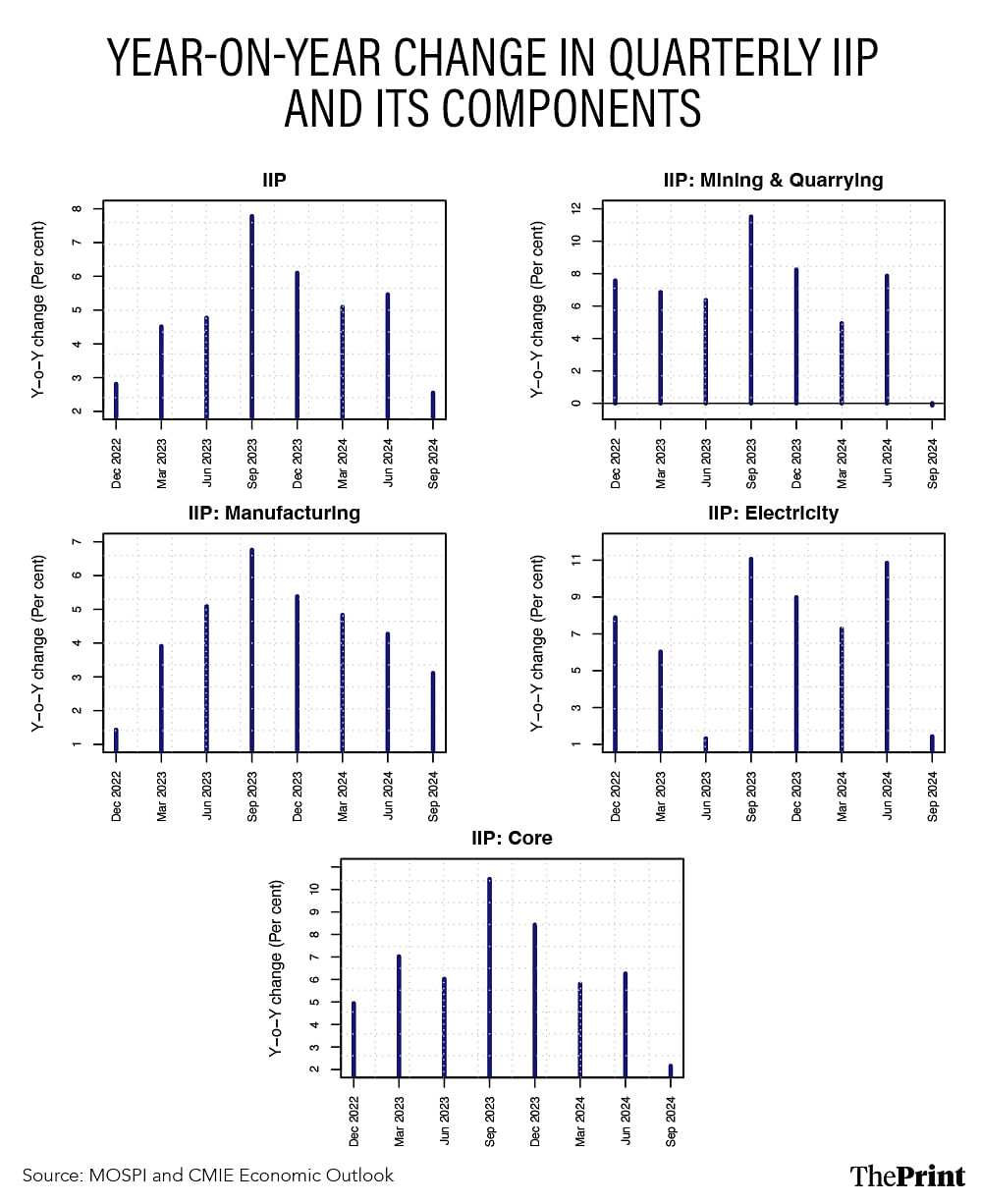

Another key indicator, growth in the Index of Industrial Production for the manufacturing sector slowed to 3.11 percent—the slowest since March 2023. Other segments of the industrial sector—IIP in Mining saw a contraction, while Electricity growth slowed considerably.

Slackness in capital expenditure

The central government’s capital expenditure contracted by 35 percent in the first quarter due to general elections. In the second quarter, while the pace of capital expenditure picked up to about 10 percent, for the first half of the year, it accounts for just 37 percent of budgeted estimate (BE), lower than the 49 percent of BE spent in the same period last year.

Capital expenditure needs to pick up substantially in the second half to achieve the budgeted estimate of Rs 11.11 lakh crore.

Some states have also been slow in ramping up their capital spending in the first half of the current year as revenue expenditure seems to be taking precedence.

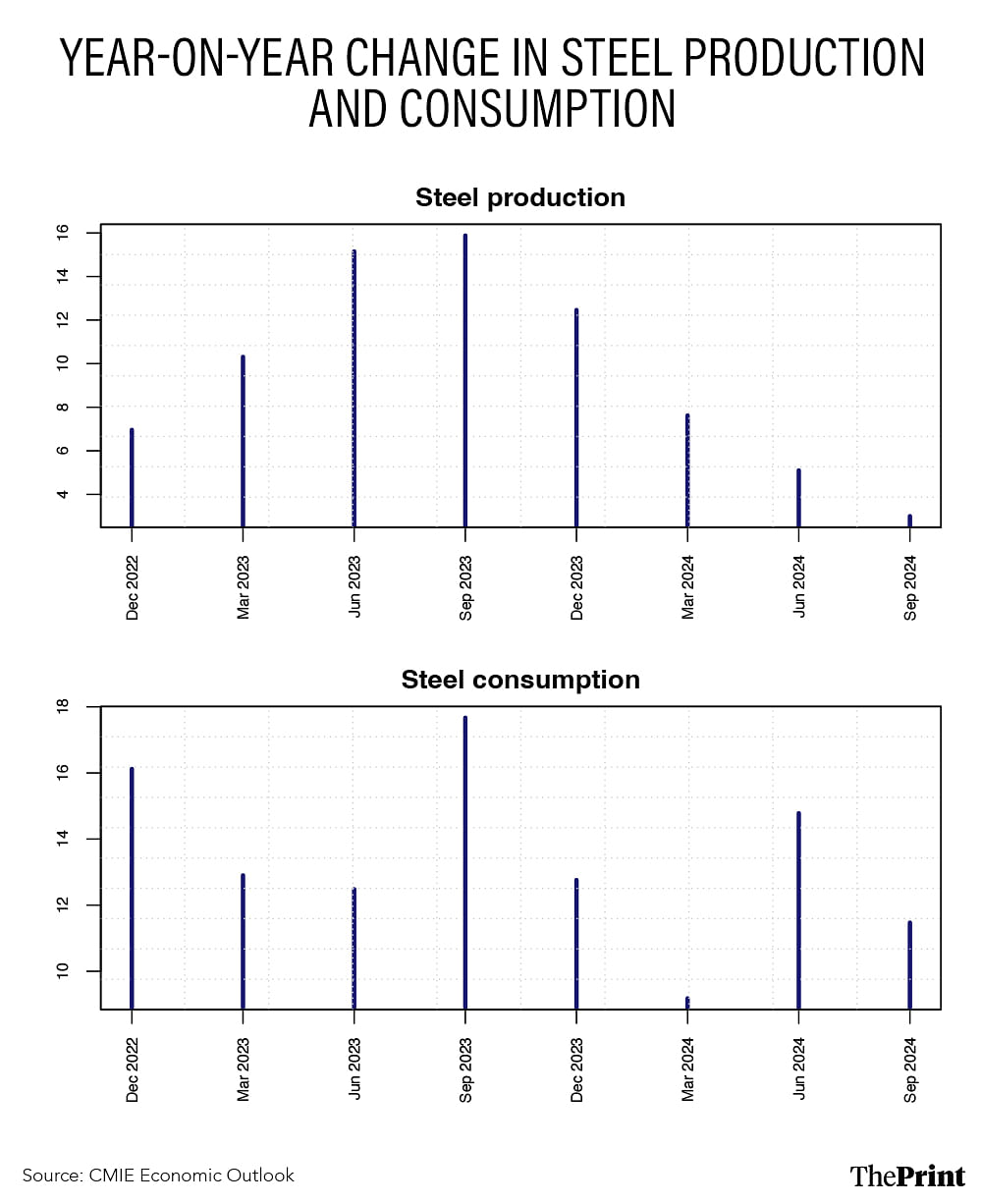

Weakness in central and state government capital expenditure, and slower growth in steel production and consumption, likely had a bearing on the performance of the construction sector.

Weakness in urban demand

Large companies in the FMCG and retail sectors reported weakness in urban demand, with a pick-up in rural demand reported by some companies.

As an example, Hindustan Unilever (HUL), in their conference call on the results of the September quarter, noted that urban growth has trended down in recent quarters. Growth in big cities is seen to be softening. However, in smaller cities and rural areas, demand continues to remain decent. Other companies in the FMCG segment also observed the outperformance of rural over urban demand.

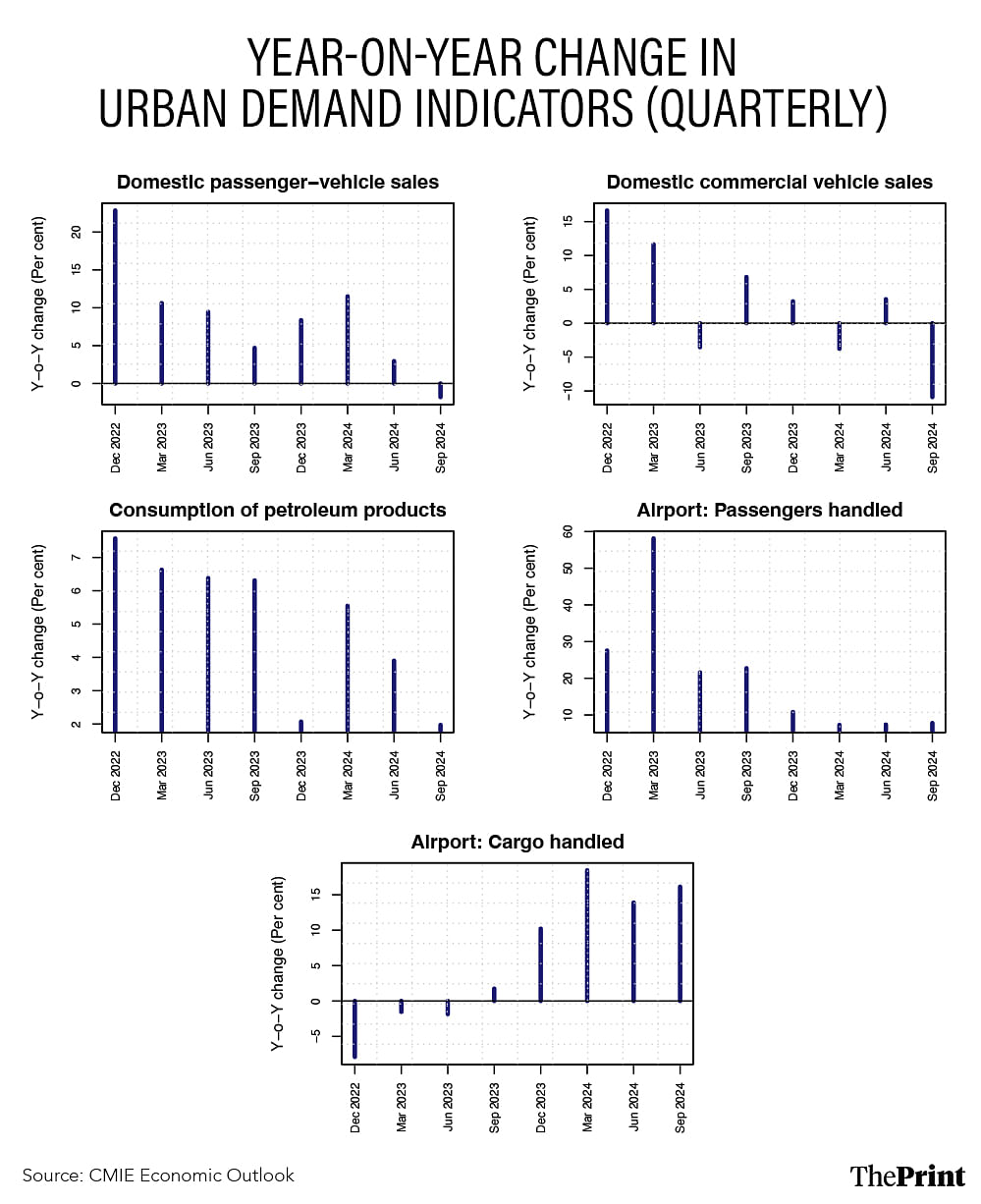

Other high frequency indicators of demand, such as passenger vehicle sales, reported a contraction in the September quarter. As of September end, passenger vehicle dealers faced an all time high inventory levels of 80-85 days, reflecting subdued demand.

To be sure, seasonal factors like Shraddh period and heavy rains also impacted sales during the September quarter. However, the onset of the festive season lifted sales in October.

Going forward, while the upcoming wedding season may provide a boost to demand for automobiles, inventory management would be a key monitorable.

The commercial vehicle segment also reported a contraction in sales due to low government spending on capex, extended monsoon and seasonal factors.

To be sure, some of the transport and communication-based indicators, such as passenger and freight traffic at airports, saw traction in the quarter ending September.

Rural demand indicators performed relatively better than their urban counterparts. Two-wheeler sales posted decent growth of 12.6 percent, albeit lower than the 20.4 percent seen in June quarter.

Encouragingly, the work demanded under MNREGA by households saw a visible decline in the July-September period, indicating the availability of better paying jobs. Good monsoon and increase in Minimum Support Price (MSP) for Kharif crops aided the lifting of rural demand.

Resilient performance by public sector banks

Public sector banks reported improvement in asset quality and profitability in the quarter ending September. The capital position of public sector banks is also comfortable. However, the net interest margin is seen to be declining.

The concerning feature is that overall non-food bank loan growth moderated in the September quarter, compared to a year ago. Including the impact of the HDFC bank merger, bank non-food credit growth moderated to 13 percent from 20 percent last year.

The two important constituents of bank credit, personal loans and services that drove bank credit growth to almost 20 percent last year, have visibly slowed in the July-September quarter.

Late last year, the RBI had imposed higher risk weights to curb exuberance in retail lending. Despite this, bank credit reported strong growth in the initial months of the current year.

However, some private sector banks have reported emergence of stress in the typically higher-yielding segments of unsecured retail loans, such as credit cards. This will likely lead to a cautious approach towards retail lending and may result in a slower credit growth.

Slow export growth

India’s merchandise exports contracted by 3.9 percent, mainly due to a steep 31 percent contraction in exports of petroleum products.

But even the non-petroleum exports saw a weak growth of 3.4 percent in the September quarter.

The widening of the trade balance in the September quarter, compared to the previous one, is likely to pose a drag on the external sector performance.

Radhika Pandey is associate professor at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Recession has been averted, inflation is down. But latest IMF reports sound alarm on global debt