What’s in store for India’s economy in 2025? The world’s fifth largest economy is likely to remain the fastest growing major economy, and is poised to surpass Japan to become the fourth largest one.

But this optimism is tempered by an uncertain and challenging global environment, and concerns around uneven domestic growth. Urban demand has been slowing down recently and private investment is yet to see a sustained pick-up.

On the positive front, rural demand is likely to sustain momentum. Inflation is less likely to be a major problem and current account deficit is likely to be within manageable limits.

Navigating stronger dollar, high US bond yields

The big source of uncertainty for India is what will happen on the trade front when Donald Trump assumes office as the US president next month. The US is India’s second largest trading partner, and hence, any adverse change in trade policy is likely to have profound implications for India.

Trump has described India as a “tariff king” and has reiterated his intentions of imposing reciprocal tariffs on India’s exports. A period of trade negotiations, discussions, retaliations, disputes and tensions is likely to prevail at least in early 2025.

But there could be a silver lining as well. Trump’s proposed tariffs on Mexico, Canada and China could redirect some of the trade flows to India, but this would require significant scaling up of manufacturing capabilities.

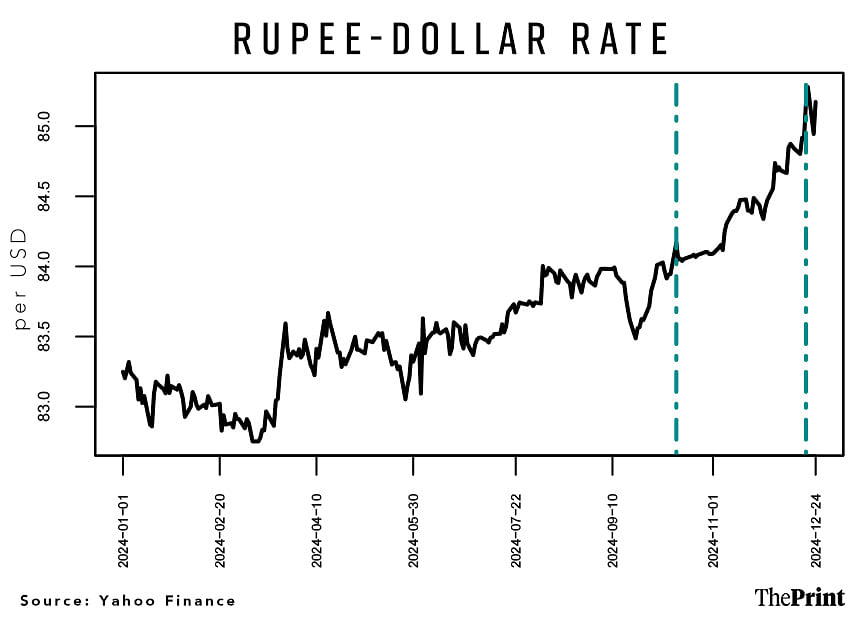

In any case, Trump’s pronouncements have given a strong impetus to the dollar, causing significant depreciation pressure on emerging market currencies, including India.

A stronger dollar, coupled with the possibility of fewer rate cuts as signalled in the recent monetary policy announcement by the US Federal Reserve, is likely to test the currency defence by the Reserve Bank of India. The last few days have seen a quicker pace of rupee depreciation. Emerging market currencies, including India, are likely to witness volatility in the coming year.

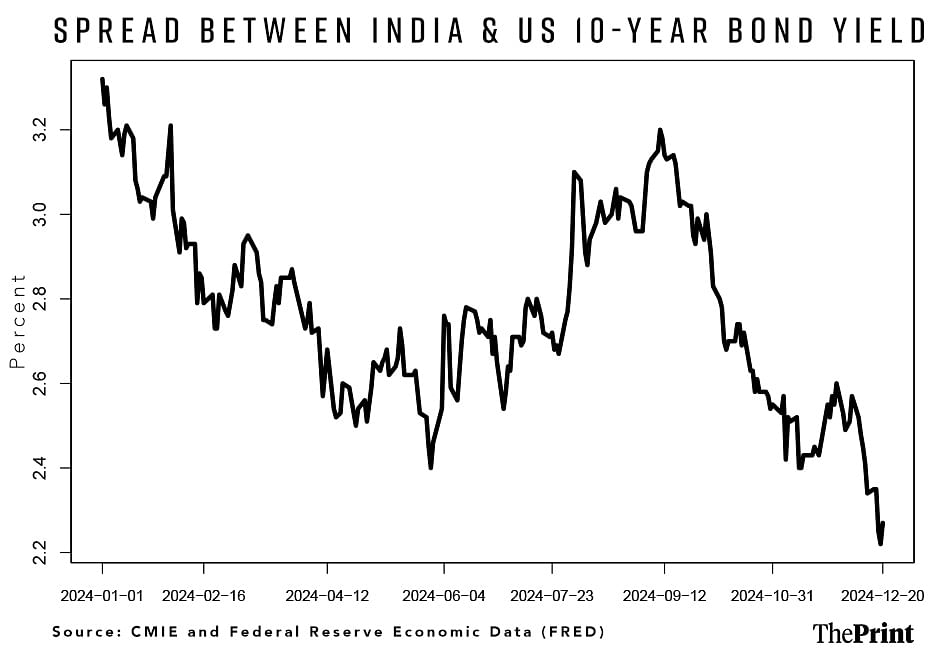

In addition to currency volatility, financial markets are also likely to witness swings, particularly in the initial months of 2025. The differential between the Indian and the US 10-year bond yield has significantly narrowed in recent months.

This narrowing of bond yield spread is unlikely to see a reversal amid a stronger dollar and a hawkish Fed. Narrowing of yield spread will impact foreign inflows in Indian assets as higher bond spread is needed to propel investors to invest in riskier assets. That said, there could be stabilisation in foreign portfolio flows as uncertainty around Trump’s policies abates in the second half of the year.

Also Read: Debt stock of low- & middle-income nations is troubling. Their debt servicing costs are soaring, too

Uneven private investment cycle

In the last three years, gross fixed capital formation has grown by 11 percent year-on-year. This growth has mainly come from government spending on infrastructure. But government capital spending to GDP may have likely peaked amid a focus on fiscal consolidation.

The next phase of the capex cycle needs to be driven by private capex expansion. Despite a healthy corporate balance sheet, credit to large industries has grown by an average of 6 percent in the last three quarters. The capacity utilisation in the manufacturing sector is yet to surpass the critical 75 percent threshold in a sustained manner. Uncertainty around consumption growth is possibly holding back fresh capacity additions.

Private sector investment outlook faces further risk from China’s over-capacity. Weak domestic demand and expanding industrial capacity has led to a surge of exports from China to emerging markets.

In response to tariffs from the US, China will likely redirect exports to emerging markets, including India. This will have several implications in the form of widening trade deficits, lower domestic production and limited incentives towards capacity expansion.

Rural demand expected to pick up further

Post pandemic, consumption demand has been uneven, swinging between rural and urban areas.

As the pandemic receded, urban demand picked up, while rural demand was weak due to high food inflation and weather-related disruptions to agricultural output. The unevenness in demand has continued in the current year as well. But this time, rural demand has picked up due to better monsoons.

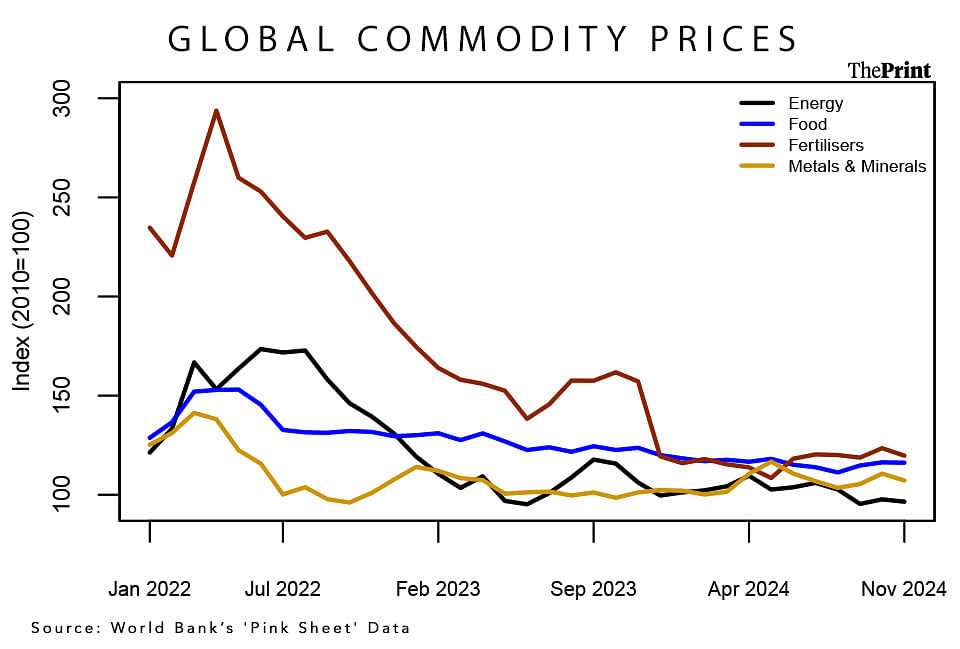

The rebound in rural demand is likely to sustain momentum in the coming year as well, thanks to the likelihood of better weather conditions and higher sowing. Easing of agricultural input costs, such as that of fertilisers, is also likely to lower food inflation and support farm income in 2025.

On the flip side, the rise in household indebtedness as reflected in the rise in household financial liabilities from 5.9 percent of GDP (Gross Domestic Product) in FY 23 to 6.4 percent of GDP in FY 24, and the recent moderation in personal loans growth, could hamper a sustained pick-up in consumption.

Commodity prices

Commodity prices (energy, agriculture, metals and minerals) are projected to decline by 5 percent in 2025, according to the World Bank.

The projected decline in commodity prices implies that inflation is less likely to be a pressing challenge for India in 2025, although currency depreciation and weather related disruptions would pose an upside risk to inflation.

Merchandise & services exports

Merchandise exports may continue to be impacted by sluggish growth in advanced economies.

However, strong services exports, driven by telecommunication and information services and other business services, coupled with healthy remittances, are likely to keep the current account deficit within manageable limits.

Radhika Pandey is an associate professor and Madhur Mehta is a research fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Balancing inflation & growth, managing rupee: New RBI governor’s docket will be full of challenges