Indian consumers have, in general, become more optimistic about the state of the economy. Both the Reserve Bank of India’s (RBI) consumer confidence index and Centre for Monitoring Indian Economy’s (CMIE) consumer sentiment index showed a marked improvement in the past two months.

The onset of the festive season has also given a boost to consumer confidence. Most of the high-frequency indicators have performed better in the first half of the current financial year. The data for the latest month show a continuation of the growth momentum, however areas of concern from the manufacturing and the rural sector remain.

Sharp jump in RBI’s Consumer Confidence Index

Consumer confidence rose to the highest in four years, according to RBI’s survey.

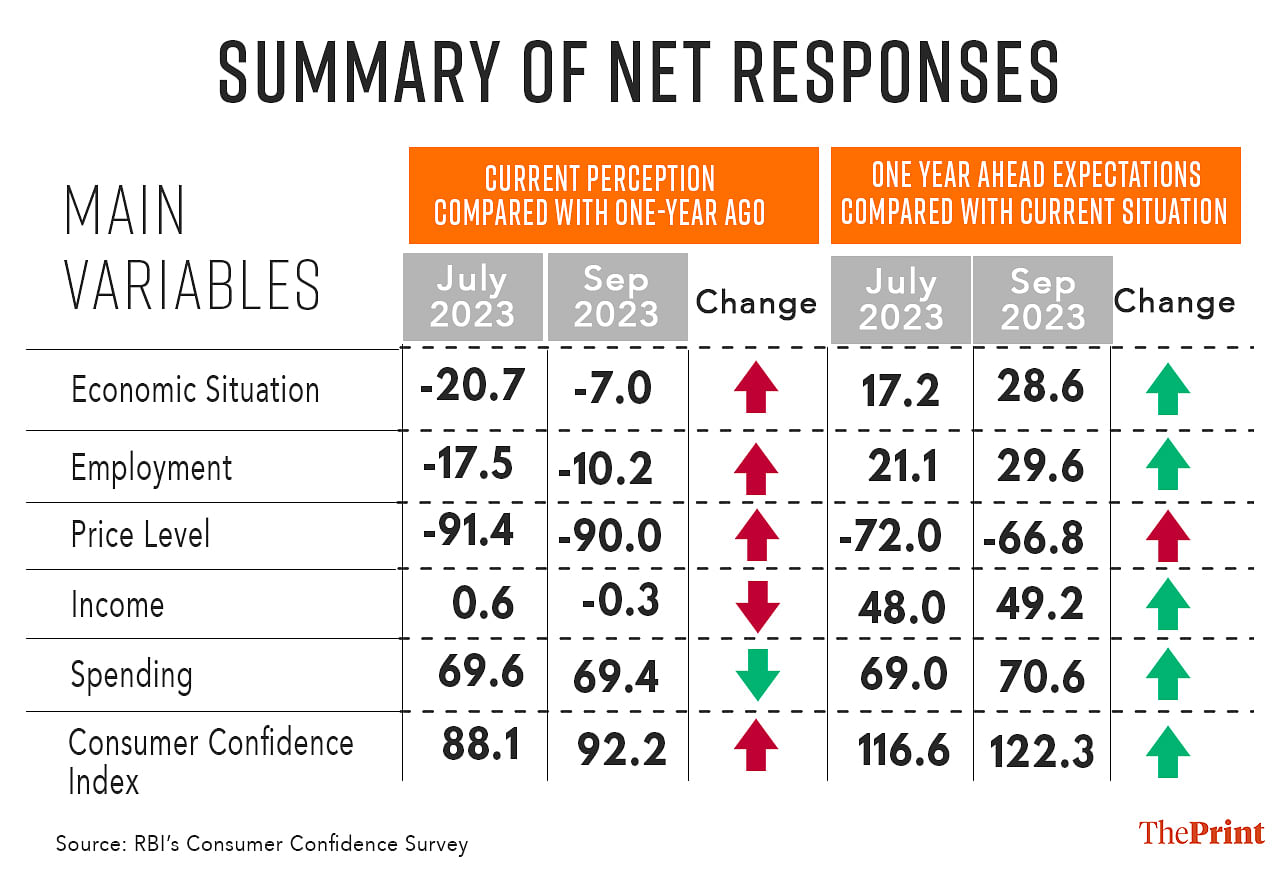

The RBI’s bi-monthly consumer confidence survey tracks households’ current perception and one-year ahead expectation of general economic situation, employment scenario, overall price situation and income and spending.

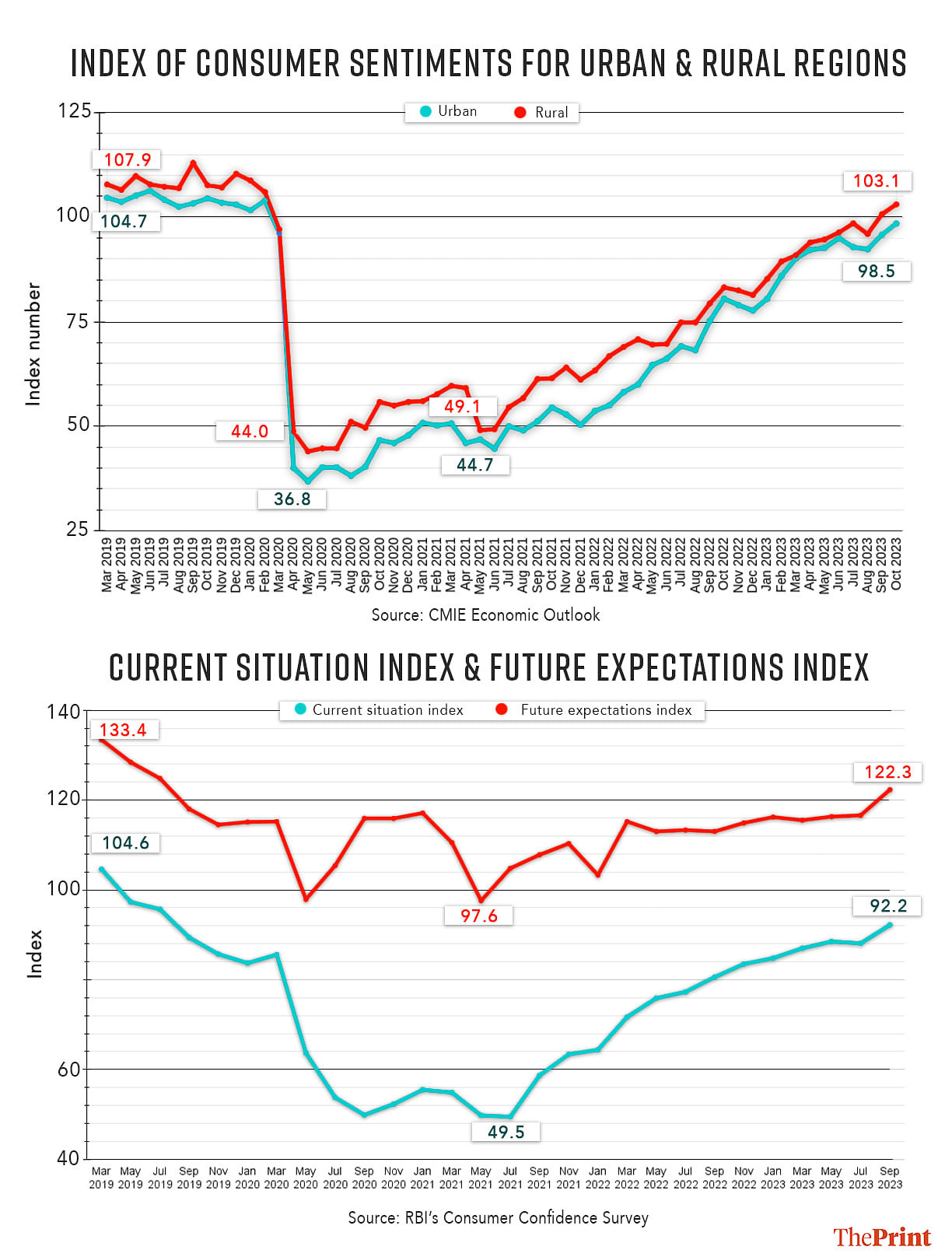

The current situation index, capturing the current situation, jumped from 88.10 in the July survey to 92.20 in the September survey. With this jump, the current situation index has reached the levels seen during the pre-Covid period. The pandemic had severely dented consumer confidence. During the first and second wave of Covid, the current situation index had sharply declined and had remained subdued in the range of 49 to 64. It was only in March 2022, that the index reported a significant improvement. It has been increasing since then. The latest September round is another instance of a sharp jump of more than 4 points in the current situation index.

The improvement in the current situation index is primarily driven by households’ optimism about the general economic situation and employment.

The percentage of households that expect an improvement in the general economic situation and employment have increased from July to September, while the percentage of households that expect a worsening of economic situation and employment has decreased. Not much change is seen in the households’ assessment on price level and spending.

On households income, the perception has deteriorated as compared to the previous round of the survey. The improvement in households’ optimism with regards to employment is also reflected in a noticeable decline in official unemployment rate in 2022-23, according to the report of the Periodic Labour Force Survey.

The index capturing the one-year ahead expectation has performed even better with a jump from 116.6 in the July round to 122.3 in the September round.

Households are optimistic about the one-year ahead economic situation compared with the current situation. They are also upbeat about the prospects for employment, income and spending. While the respondents continue to be concerned about price expectations for the year ahead, their negative sentiments, or pessimism, has moderated as compared to the July round.

Interestingly, urban consumers have been more optimistic about their future even during the Covid period when their immediate economic environment was challenging. In recent months, the shedding of the pessimism on the current situation has led to narrowing of the gap between the current assessment and future expectations.

Also read: India remains fastest-growing big economy in FY24 but Israel-Hamas war could hurt govt’s fiscal math

Optimism in consumer sentiments also reflected in CMIE Indices

While the RBI’s consumer confidence index presents an assessment of consumer confidence in cities, the CMIE’s Index of Consumer Sentiments covers both urban and rural consumers.

The CMIE Index of Consumer Sentiments for all India rose to 101.95 in October from 99.11 in September. Index values above 100 were seen prior to the onset of the pandemic.

The improvements in sentiments are broad-based as both urban and rural consumer sentiments registered an increase. Again, similar to the RBI’s index, the CMIE’s overall index has two constituents: index of current economic conditions and index of consumer expectations.

Urban and rural consumers differ in their assessment of current economic conditions and their expectations of one-year ahead income and economic and business environment.

Urban consumers are more optimistic about the current economic conditions as the index capturing the current economic conditions rose by almost 6 percent in October for urban consumers. Coming to expectations, it is the rural consumers who are more optimistic as compared to their urban counterparts.

High frequency indicators reflect improvement in consumer spending

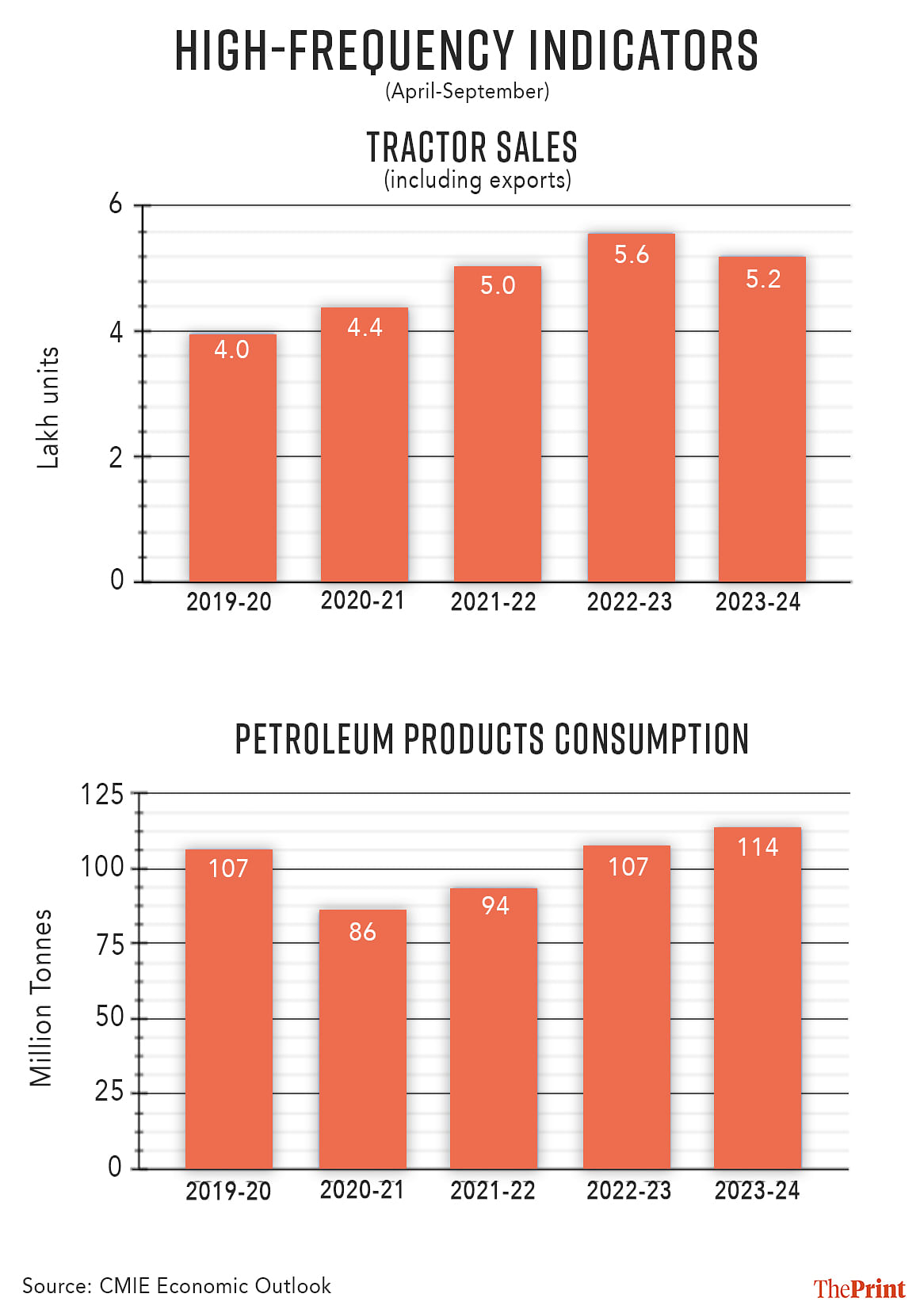

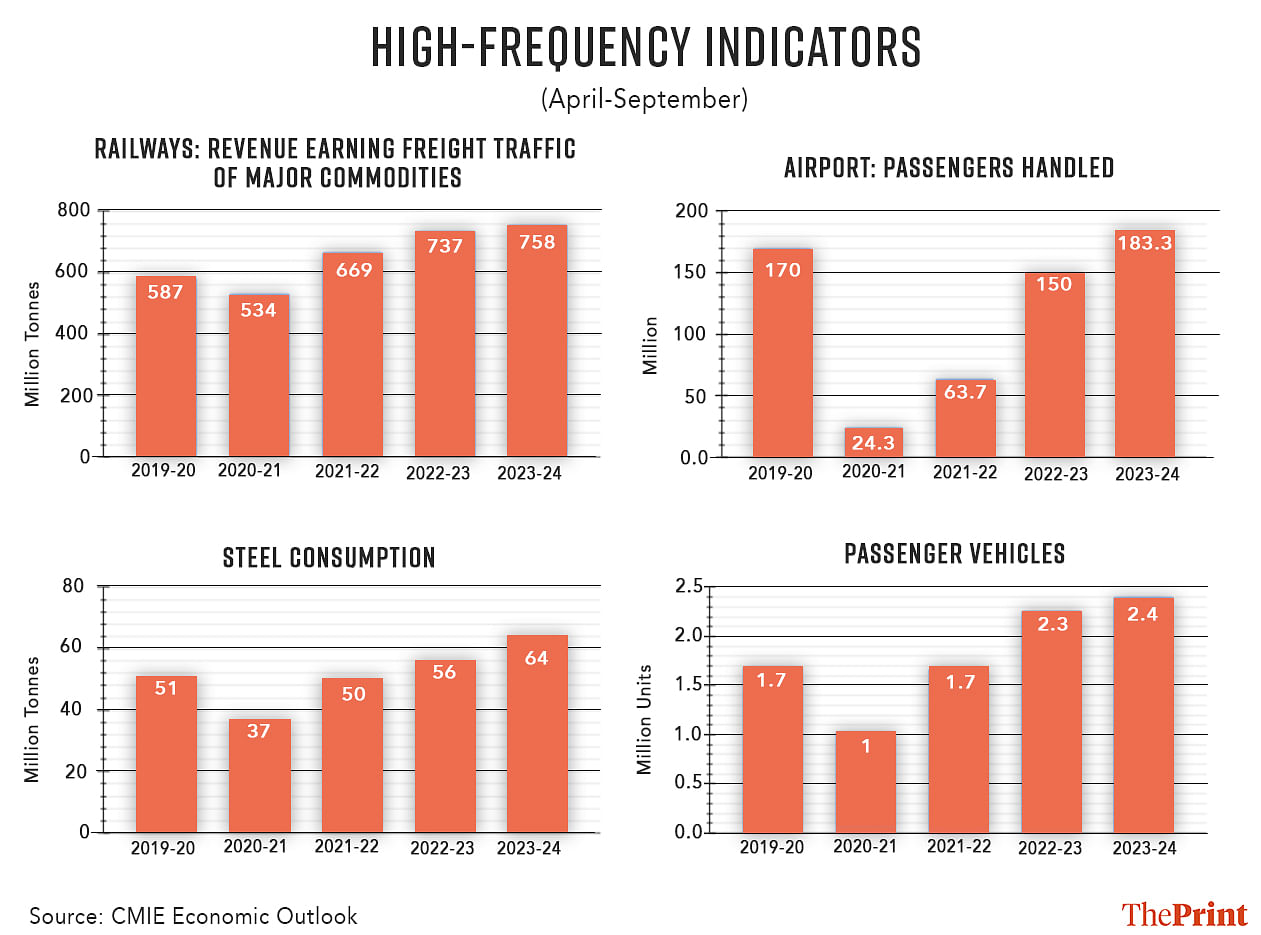

The high frequency indicators reflect an improvement in consumer spending. A useful way of assessing consumer spending is to compare the trajectory of key indicators in the first half of the current financial year with the corresponding period of the last four years. The year-on-year growth rate may be confounded by the base year, hence it is useful to look at the absolute levels of these indicators.

Sales of passenger vehicles, consumption of steel and petroleum products, passengers handled at airports, railway freight traffic have all shown a pick-up in the first half of the current financial year.

However, some of the indicators capturing rural demand such as tractor sales are yet to show a steady improvement in the current year.

The onset of the festive season has given a boost to consumer spending, which is reflected in the rising consumer confidence. Passenger vehicle sales reached a new peak in October. Goods and Services Tax (GST) collections and UPI transactions in October are also reflective of robust consumption.

Some areas of concern remain

A key gauge of India’s manufacturing activity, the Purchasing Managers’ Index (PMI), saw the slowest rate of expansion in October. The index was at an eight-month low of 55.5 as compared to 57.5 in the previous month. The slower growth was mainly on account of weaker demand for certain products.

In the rural sector, the sowing activity is a key determinant of consumer sentiment. If the sowing is delayed, yield of crops such as wheat would be impacted. This could cause an upward pressure on food inflation, leading to a dent in consumer confidence.

Overall, the trends in the high-frequency variables corroborate the findings of the consumer confidence surveys. However, the rural demand indicators need to see sustained growth for a continued improvement in consumer sentiments.

Radhika Pandey is an associate professor and Pramod Sinha is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal

Also read: Uncertainty over Israel-Hamas war, rising US bond yields to hit stock markets for foreseeable future