In the past few weeks, Indian markets have been facing turbulence due to the resurgence of geo-political tensions in the Middle-East. In parallel, the sharp upsurge in the 10-year US treasury bond yield and the possibility of further rise has dampened the appetite for emerging market assets, including for Indian assets, resulting in massive sell-off by foreign investors.

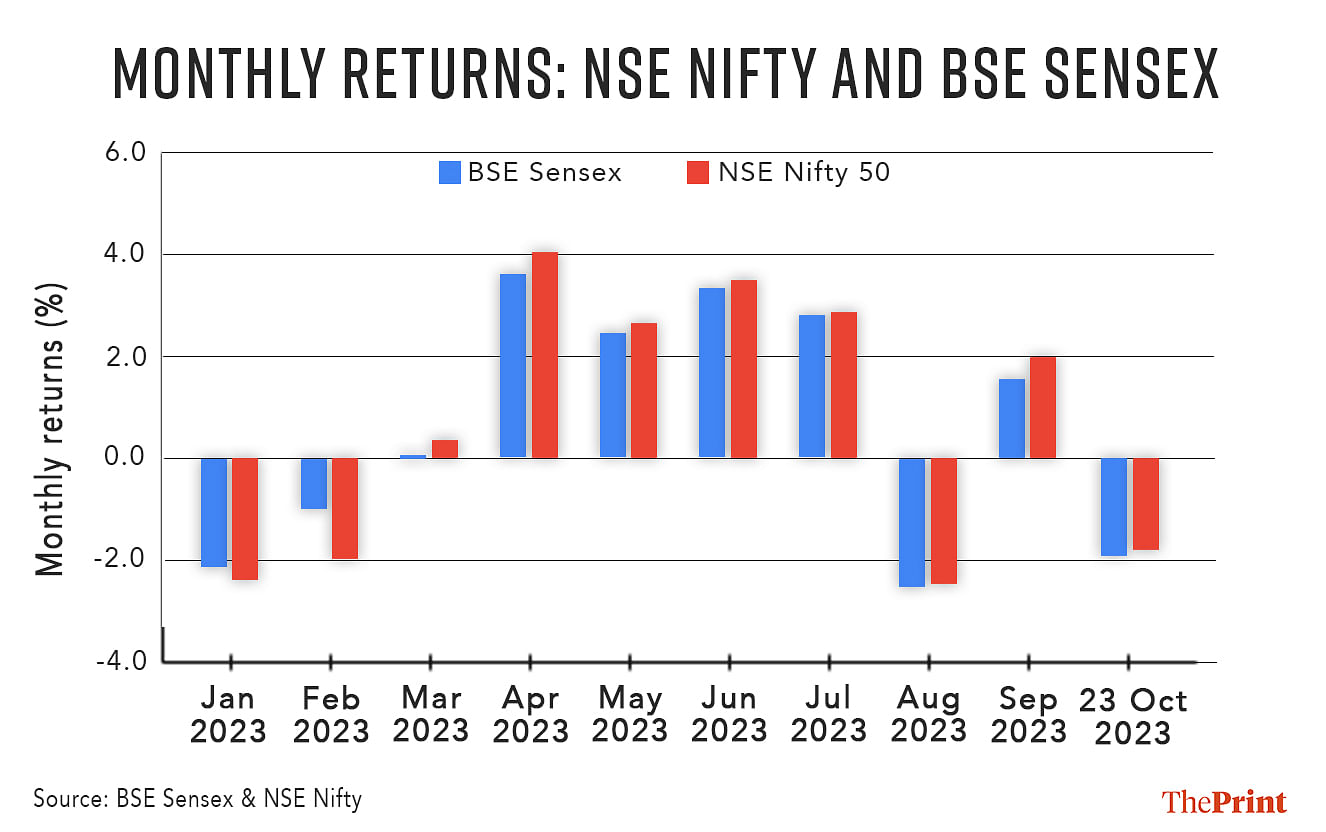

On 23 October, the BSE Sensex slid by 1.9 percent and the National Stock Exchange (NSE) fell by 1.8 percent over the previous month’s closing. In September, both the stock market indices, BSE and NSE, had posted a positive growth of 1.5 percent and 2 percent, respectively.

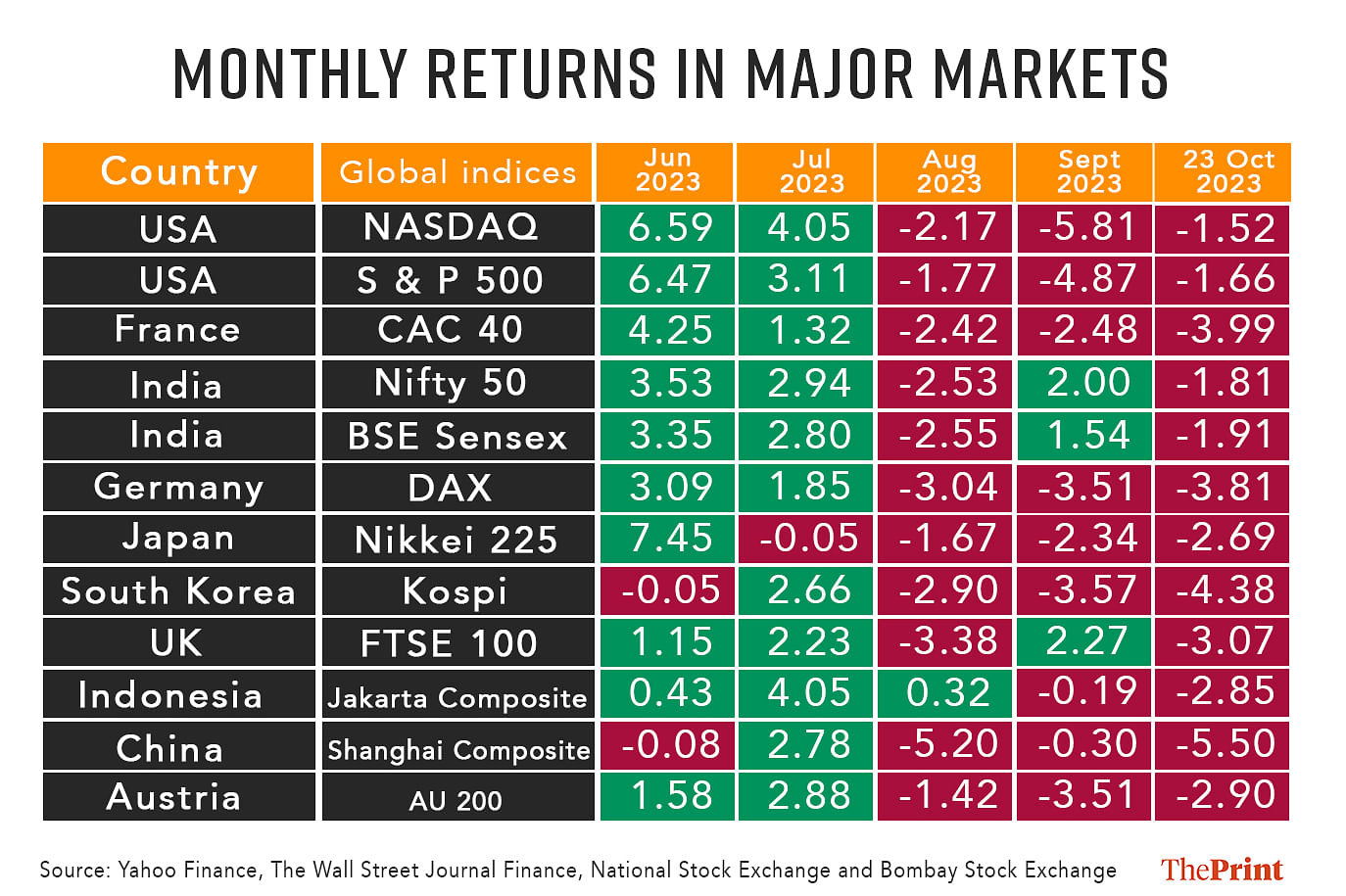

The slide in markets is not limited to India. Most of the major markets across the globe have been hit by the rising bond yields in the US and the uncertainty arising due to the Israel-Hamas conflict.

Also read: India remains fastest-growing big economy in FY24 but Israel-Hamas war could hurt govt’s fiscal math

Elevated bond yield in the US

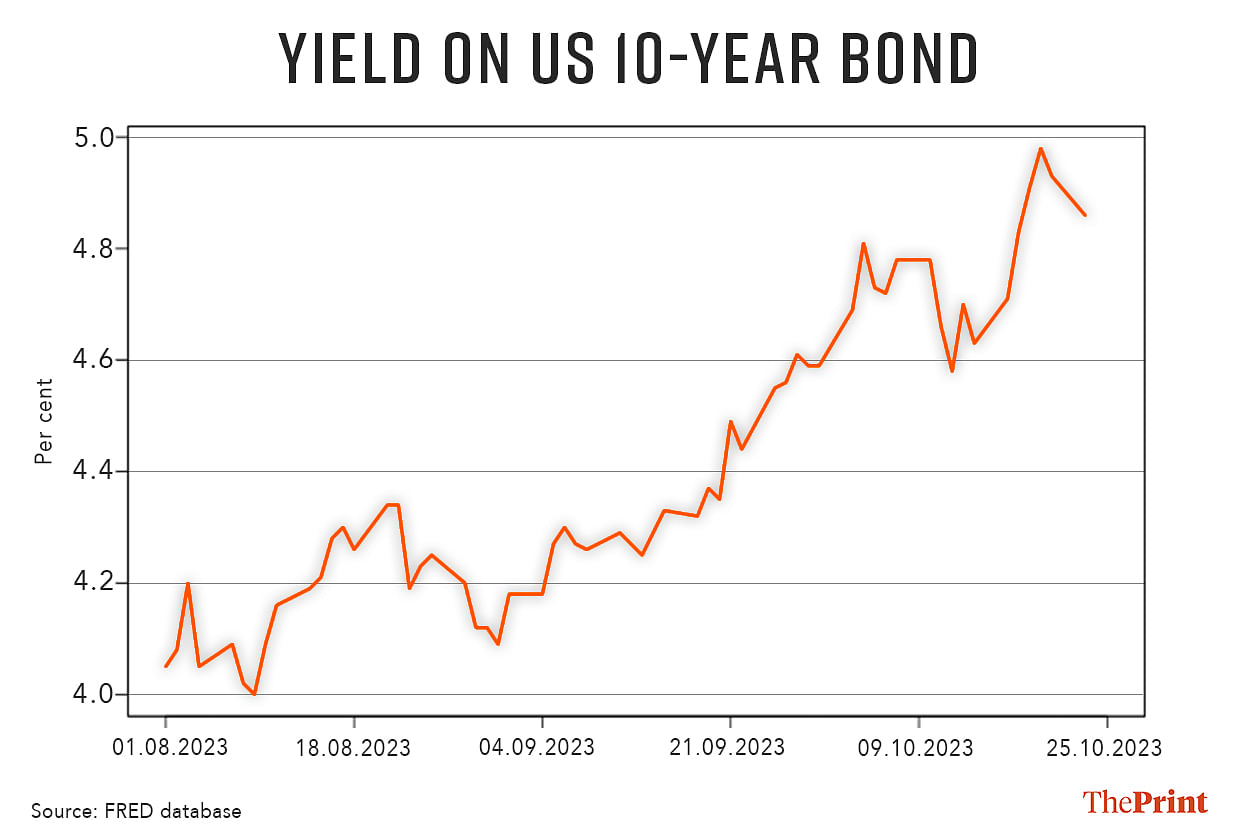

Typically, bond yields and equity markets have an inverse relation. Rise in bond yields make it an attractive asset class, as investors tend to sell equities and put more money into bonds. This is particularly true for the US bonds as it is considered a safe haven asset.

The 10-year US treasury bond yield, which was hovering in the range of 3.7-3.8 percent in June, is now closer to the 5 percent threshold. In fact, on 23 October, the 10-year bond yield surpassed the 5 percent mark for the first time since 2007 on hawkish stance by the US Federal Reserve. The Federal Reserve Chair reiterated that despite slowing inflation, the battle against inflation is not yet over and that interest rates could remain higher for longer to slow the economy.

Just when the markets were assuming that the Fed was closer to the end of its rate hike cycle, the hawkish tone by the Fed Chair renewed fears about lingering inflation and brought the US 10-year yields closer to the 5 percent range.

Latest macro data indicates a resilient economy and tightness in the labour market, something that could impose an upward pressure on inflation in the coming months and thus keep interest rate elevated.

Apart from the monetary policy challenges, the ongoing structural changes in the US economy have also imparted upward pressure on bond yields. The budget deficit clocked in at USD 1.7 trillion in fiscal year 2023, up from USD 1.38 trillion in 2022, driven by higher spending and more or less stable revenues. In terms of GDP, the deficit equaled 6.3 percent, a level last seen during the global financial crisis.

These factors have together led to an increase in the supply of bonds at a time when the US Federal Reserve is reversing its Quantitative Easing (purchase of bonds), adopted during the Covid period. Just two years ago, once an unlimited buyer of government bonds, the US Fed has turned into a seller of bonds, making the task of financing a near USD 2 trillion fiscal deficit all the more harder.

By 2033, the deficit is likely to surge to USD 2.9 trillion, adding to the already high debt levels. Persistent high deficits and debt will keep interest rates in the US elevated for longer. Markets in India and other emerging economies will have to brace for higher interest rates in the US and possibly in other advanced economies. This could mean more volatility for financial markets.

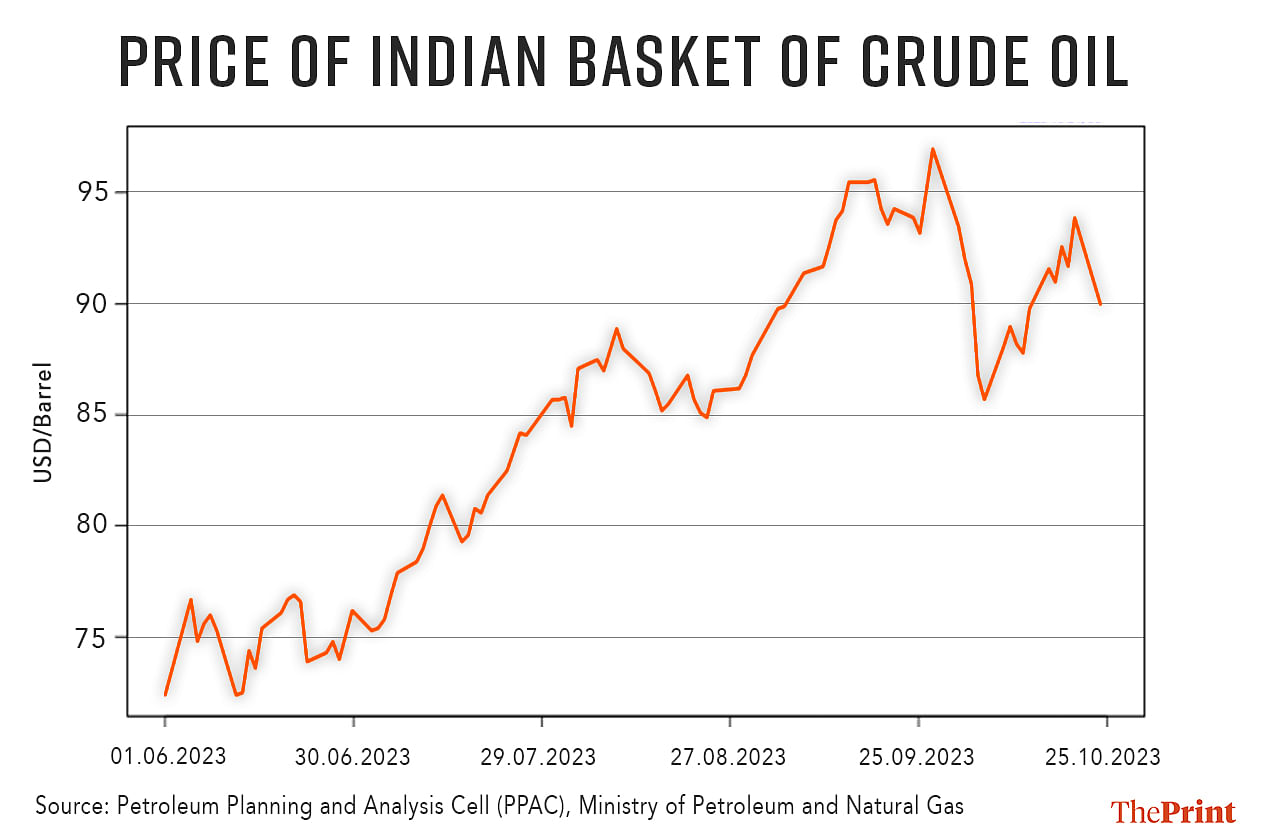

Swings in oil prices

Rising oil prices are yet another source of potential volatility for Indian markets. Oil prices have risen sharply after Saudi Arabia and Russia announced the extension of production cuts till the end of 2023. Oil prices rose further in the aftermath of the Israel-Hamas conflict. The Indian basket of crude oil has been above the USD 90 per barrel mark during the last week.

Volatility in oil prices have impacted investor sentiments, triggering a sell-off by foreign portfolio investors. Investors are likely to adopt a more cautious approach till some clarity emerges on the geo-political front. There are concerns that oil prices could rise further if Iran gets involved in the ongoing conflict.

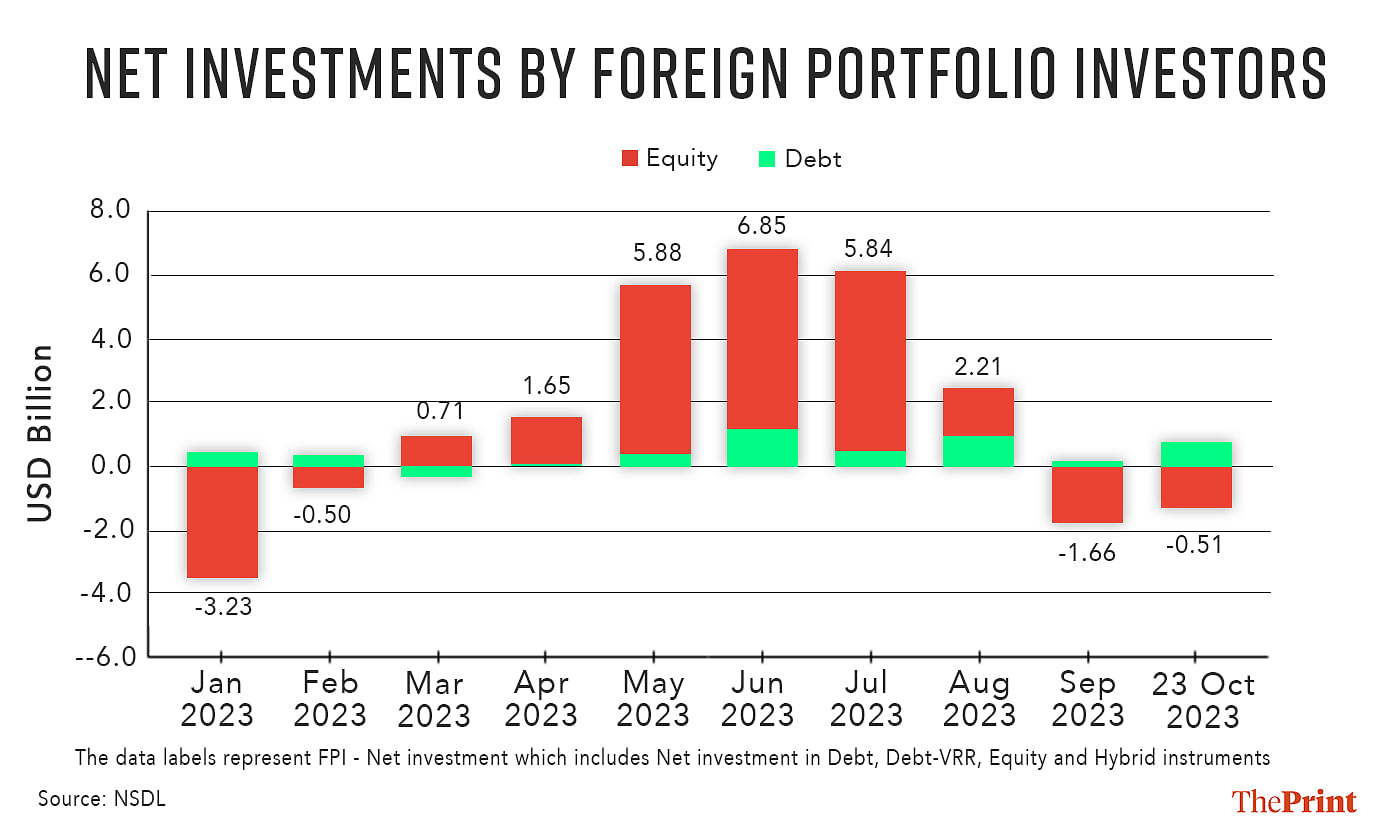

Outflows by foreign portfolio investors

After registering robust inflows, foreign portfolio investments have tapered off in the last two months. FPIs were net buyers of Indian assets from March to August. In September and October (till 23rd), FPIs have been net sellers in equity and net buyers in debt. FPIs are seen to be diversifying their investments into bonds due to higher returns.

Indian bond yields have edged higher in October after RBI’s announcement that it could consider open market operations (OMOs) through sale of bonds to manage liquidity. While there is no explicit plan for the conduct of OMOs, the announcement has pushed the bond yields upwards. The announcement of inclusion of government bonds in JP Morgan’s emerging market bond index has improved the attractiveness of Indian bonds.

In addition, markets have also been hit by the muted second quarter financial performance of key IT sector companies.

Market sentiment is likely to remain impacted by concerns over US bond yields and the ongoing conflict in the Middle-East.

Radhika Pandey is associate professor and Rachna Sharma is a Fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Lower manufacturing or data issues? Govt figures show some of India’s output below 2011-12 levels