The International Monetary Fund (IMF), in its latest version of the World Economic Outlook has raised India’s growth forecast for the current financial year from 6.1 percent to 6.3 percent projected in July.

The projection for the next year has been retained at 6.3 percent. The upward revision of 20 basis points is attributed to stronger than expected consumption in the April-June quarter. The estimates released by the ministry of statistics and programme implementation (MoSPI) showed a decent growth of 6 percent in private consumption, up from 2.8 percent in the March quarter.

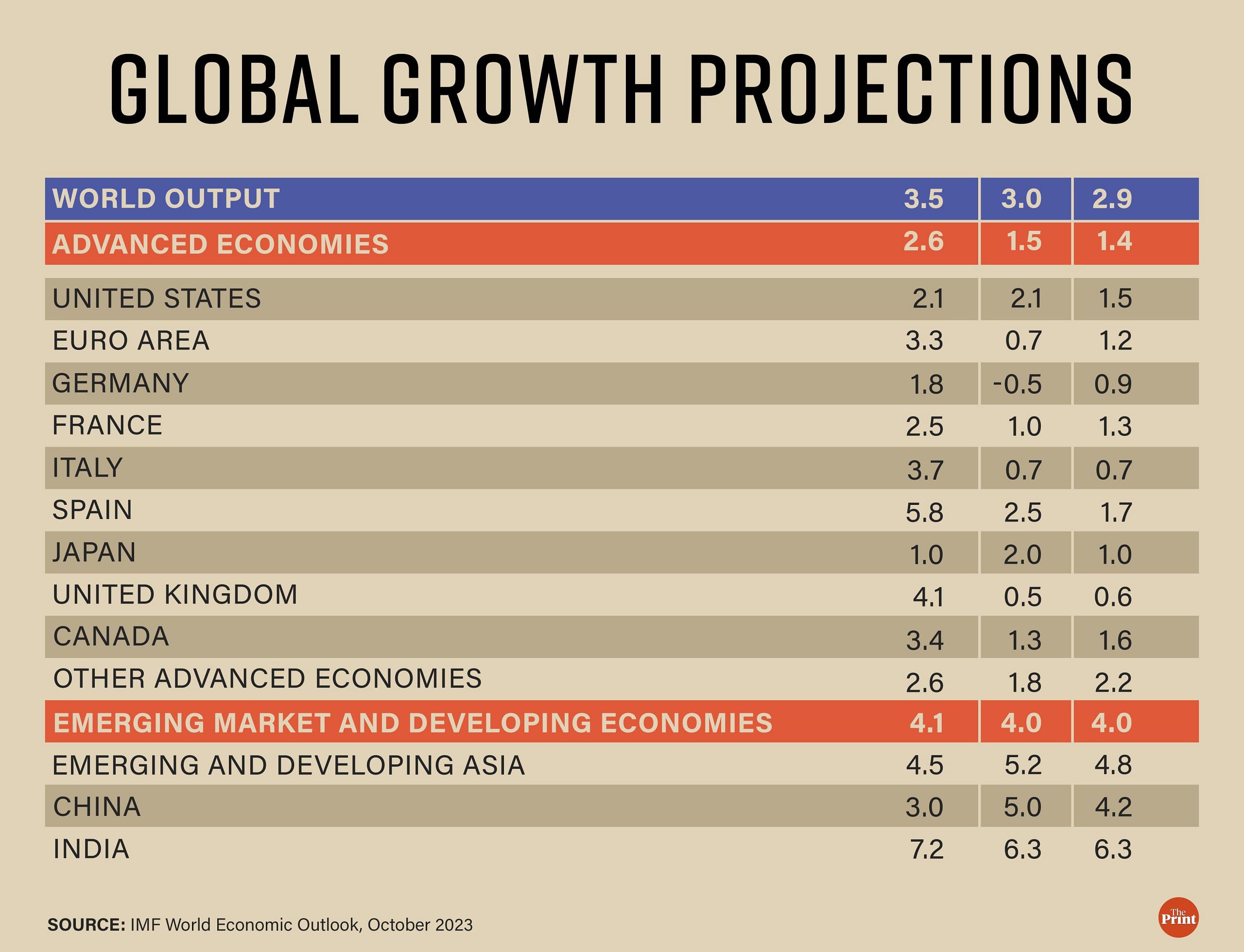

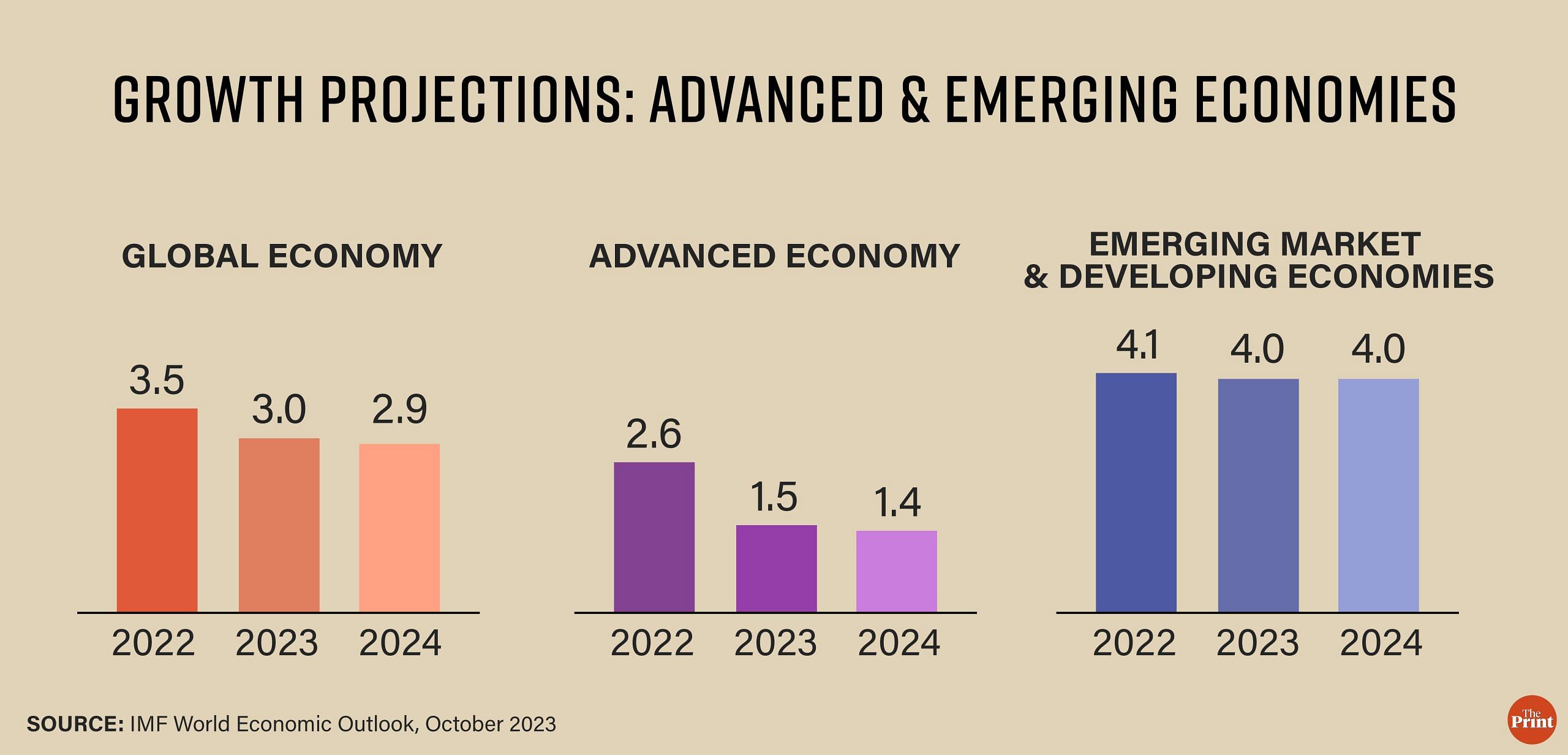

The IMF projects global growth to moderate from 3.5 percent in 2022 to 3 percent in 2023. While economies world over are grappling with the lingering effects of the pandemic and the Russia-Ukraine war, the fresh conflict in the Middle East could impart uncertainty to the growth projections by the multilateral agency.

For India, the escalation of the conflict could raise worries on inflation and put pressure on the rupee.

Also read: How inclusion of Indian bonds in global indices could unleash potential of India’s financial market

Divergence in global growth trajectory

The decline in global growth is led by advanced economies, with growth projected to slow from 2.6 percent in 2023 to 1.5 percent in 2024. There is a stark divergence in growth outlook within the set of advanced economies. Growth in the US is projected at 2.1 percent this year, an upward revision of 0.3 percentage points compared with the July update projections. Resilient consumption, tight labour market and strong business environment has led to an upward revision in growth forecast for 2023.

The US Federal Reserve, in its latest meeting, also sharply raised its projection for GDP growth. It now expects GDP to grow at 2.1 percent in 2023 as compared to 1 percent projected in June 2023. Unemployment rate is also projected to be lower at 3.8 percent in 2023 as compared to 4.1 percent in June 2023.

However, the IMF projects the US economy to slow to 1.5 percent in 2024 due to sustained monetary policy tightening and running out of the pandemic accumulated household savings which have helped in holding up consumption despite rise in interest rates.

In contrast, growth in the euro area is projected to fall from 3.3 percent in 2022 to 0.7 percent in 2023. As compared to the July update, growth in the euro area is revised downwards by 0.2 percentage points. Growth next year is projected to improve to 1.2 percent. Among European economies, Germany is likely to enter a recession this year or next.

Growth in the UK is also projected to weaken from 4.1 percent last year to 0.5 percent in 2023. Tight monetary policy and lingering impact of high energy prices have dented growth prospects in these economies.

Among emerging economies, China’s growth is seen to be losing momentum this year after the surge seen in the initial months of 2023. Growth is projected at 5 percent — a 0.2 percent downward revision from the July update due to a possible deepening of the real estate crisis and spillover impact on the financial sector and public finances.

Conflict in the Middle East could intensify inflationary pressures, disturb fiscal math

The IMF projects a moderation in global inflation from 9.2 percent in 2022 to 5.9 percent in 2023. Advanced economies are expected to see a sharper fall in inflation as compared to emerging economies.

For emerging and developing economies, while inflation is on a downward trajectory, it continues to remain elevated. This is because these economies are more vulnerable to commodity price shocks.

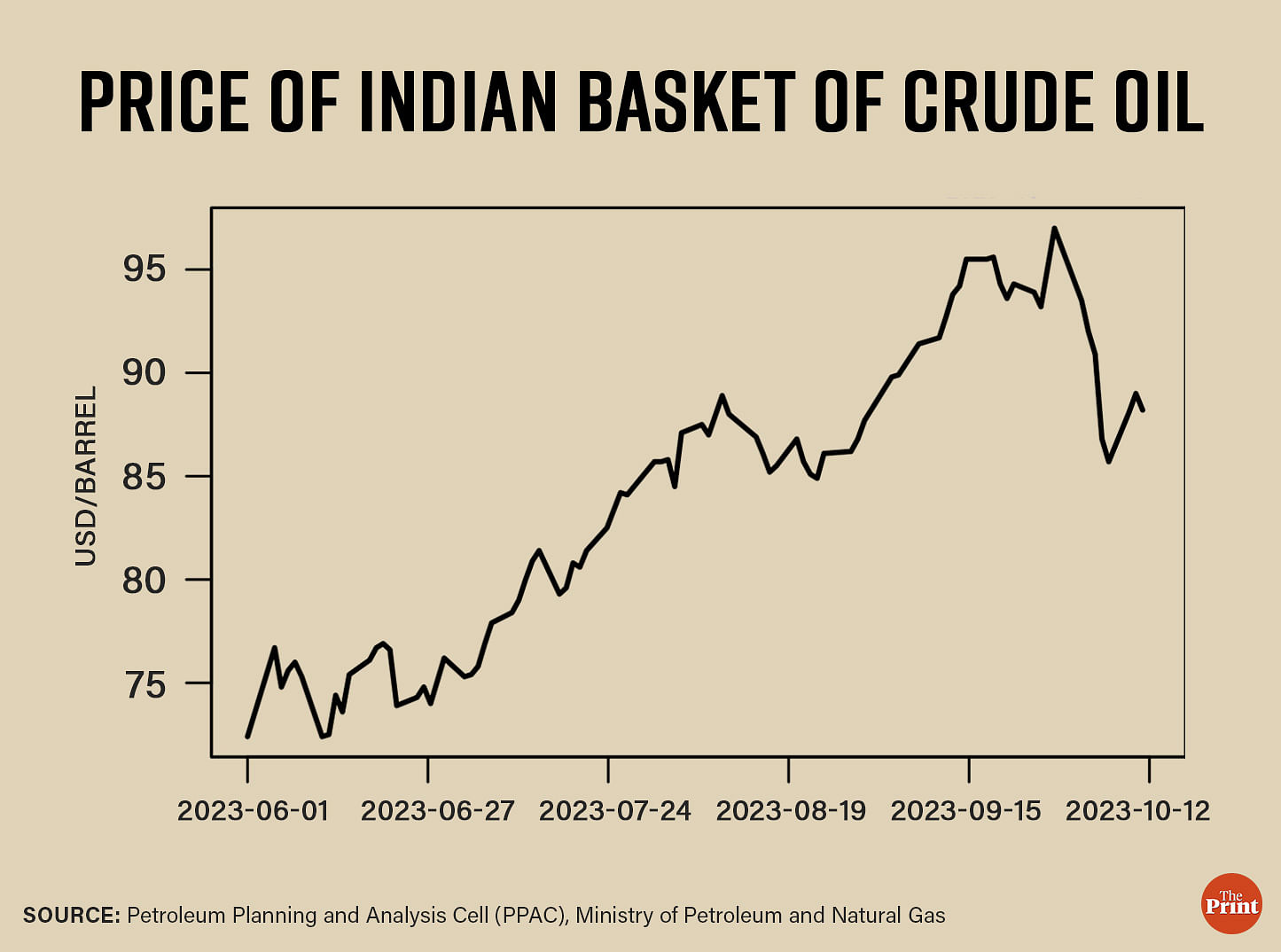

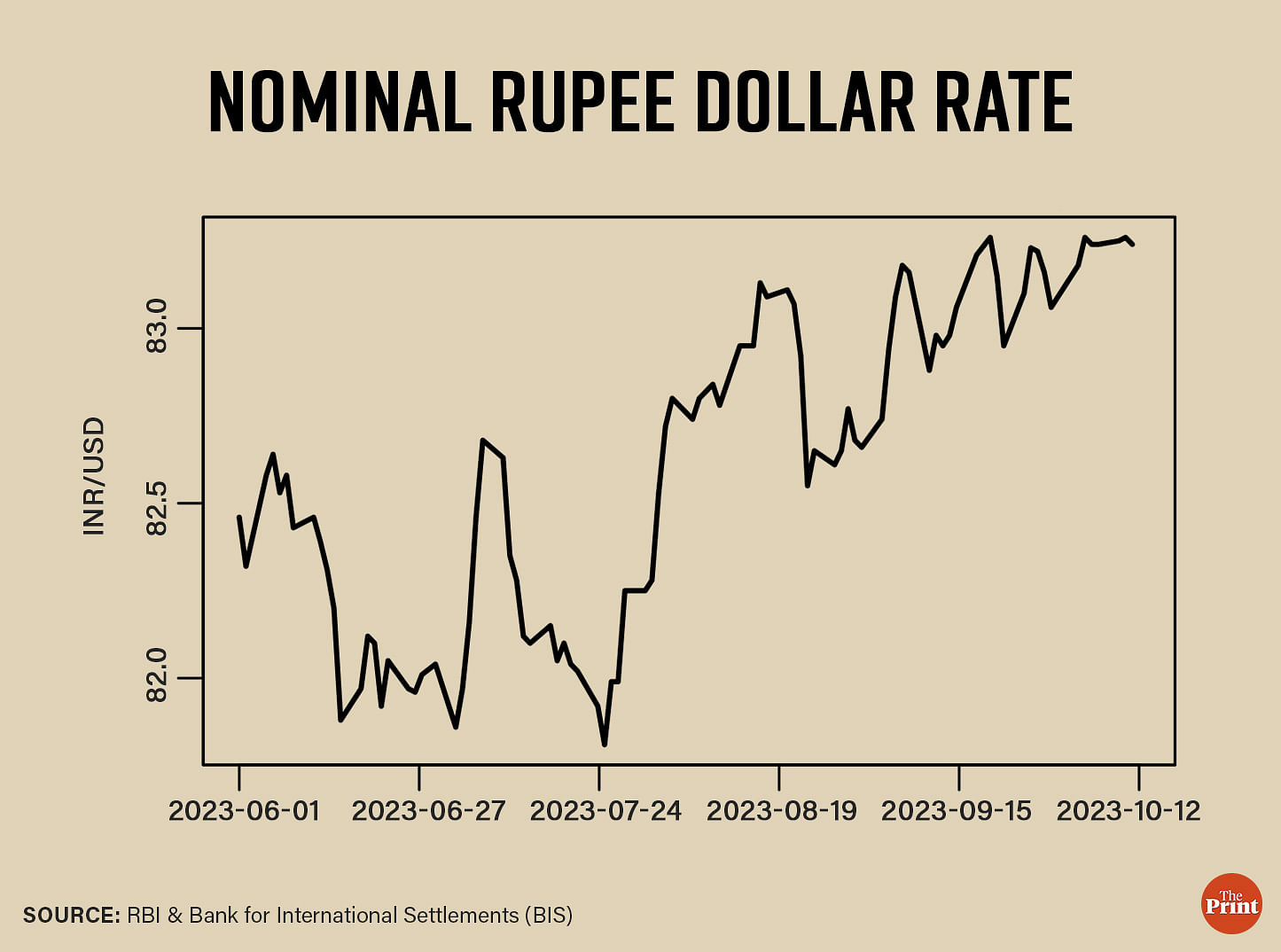

The inflation projection for India at 5.5 percent in 2023 is almost similar to the projection by the RBI (5.4 percent). One of the critical assumptions underlying these projections is relating to crude oil prices. RBI assumes crude oil price to remain around USD 85 per barrel and the exchange rate at Rs 82.5 against the dollar, in the second half of the current financial year.

The eruption of war between Israel and Hamas could upset these assumptions and forecasts. If the conflict escalates, it could disrupt the oil markets. If crude oil price surges above USD 90 per barrel, it could intensify inflationary pressures and complicate the task of monetary policy in taming inflation. According to the RBI, if the crude oil price goes 10 per cent above the assumption, domestic inflation could be higher by 30 bps.

If the government holds retail prices of fuel unchanged ahead of elections, its fiscal math may get disturbed. Higher prices of crude oil will raise our import bill, distort our current account deficit and put downward pressure on the rupee.

Currently, the exchange rate is stable but above the RBI’s assumption. The rising US bond yields as well as a stronger dollar are already putting pressure on the rupee as foreign portfolio investors are exiting Indian markets.

The current account deficit was 1.1 percent of GDP for the first quarter of the current year, significantly lower than the 2.1 per cent of GDP recorded in the same quarter the previous year. The deficit on the current account could rise in the second and third quarter, due to higher oil prices.

Globally, the likelihood of soft landing could become challenging

The downward revision in inflation projections renewed optimism of soft landing — of bringing inflation within the target range without hampering economic activity. This could become challenging in the event of a sustained rise in oil prices. Central banks would then have to keep rates higher for longer, which will adversely impact the ability of borrowers-individuals and businesses to service their debt.

Higher interest rates could amplify the fragilities of the households and corporate balance-sheet, leading to higher risk of default.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Households are saving less and borrowing more, but that’s not necessarily a bad thing