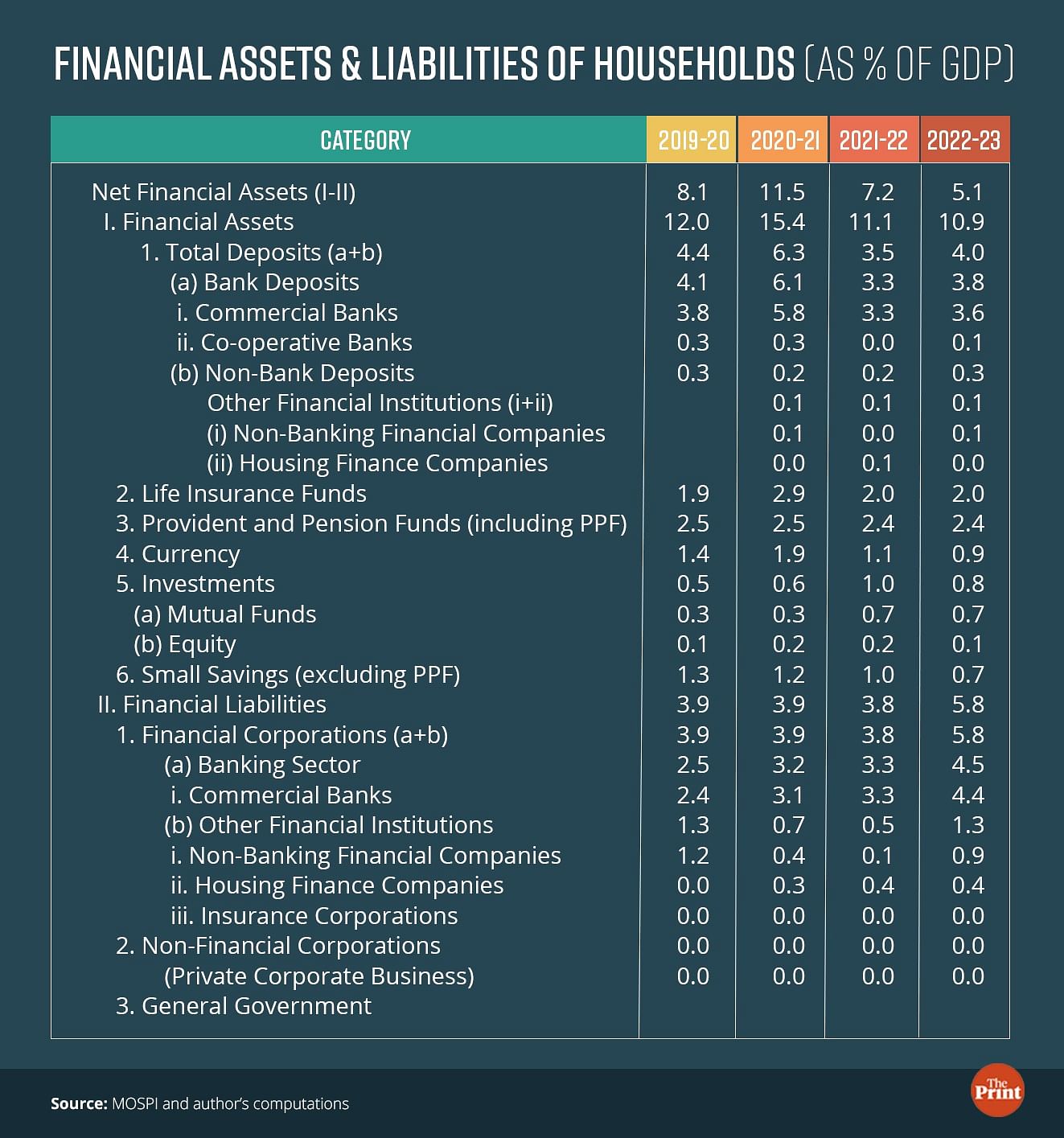

Households net savings in financial assets has seen a sharp decline to 5.1 percent of GDP in 2022-23 from 7.2 percent in the previous year. Leaving aside the Covid-induced jump in financial savings to 11.5 percent in 2020-21, the net financial savings of households had remained in the range of 7-8 percent over the past five years.

While on a gross basis, the household savings in financial assets has declined only marginally, the sharp fall in net financial savings is primarily attributed to the rise in financial liabilities of households.

Households’ financial assets include a wide range of instruments including bank deposits, insurance, provident funds, equity, mutual funds and currency.

Household liabilities jumped from 3.8 percent of GDP to 5.8 percent of GDP in 2022-23. The increase in household liabilities (in percent of GDP) in the last two years is almost equivalent to the fall in net financial savings during the period.

There are concerns that a dip in household financial savings could limit funds for government’s capital investments. Concerns have also been raised that rising household liabilities is a sign of distress. Government has dismissed the critical claims of household distress, saying that households are borrowing for asset creation.

A useful proxy indicator to assess the household borrowing pattern is the retail loan segment of the banking sector. The data shows that households’ reliance on borrowings has increased to finance their consumption and also for creation of physical assets. However, a clearer picture of household savings will emerge only when data for household savings is available from the National Statistics Office (NSO) including the savings in physical assets.

Also read: Share of Asian countries in India’s exports is falling, Europe’s is rising. Why this is worrying

Household financial assets rose in 2022-23, lower than in pre-Covid period

Household deposits across banks, NBFCs, housing finance companies and co-operative banks rose to 4 percent in 2022-23 from 3.5 percent in the previous year. However, this was lower than 4.3-4.4 percent of GDP seen in the two years prior to Covid. Financial assets held in small saving instruments and currency fell as a percent of GDP in 2022-23 as compared to the previous year.

Among the capital market instruments, while equity as percent of GDP fell in 2022-23, attractiveness towards mutual funds remained steady. The share of pensions and provident funds and life-insurance funds remained stable at nearly 2.4 percent and 2 percent of GDP, respectively.

Rise in households financial liabilities

Households’ financial liabilities, which primarily include households borrowing from banks and non-bank financial companies (NBFCs), saw a steep jump from Rs 9 lakh crore in 2021-22 to Rs 15.8 lakh crore in 2022-23. While borrowings from banks rose from Rs 7.8 lakh crore to Rs 12 lakh crore, borrowings from NBFCs also jumped from Rs 0.2 lakh crore to Rs 2.3 lakh crore.

With the rise in the retail loan portfolio of NBFCs, the proportion of unsecured loans by NBFCs has also seen a jump and is likely to rise further this year.

The consumer price inflation remaining above the upper threshold of 6 percent in 9 months of the previous financial year implies that poorer households had to rely on borrowings to maintain their consumption. On an outstanding basis, household financial liabilities rose from 36.9 percent of GDP to 37.6 percent of GDP.

Broad-based increase in the retail loan portfolio of banks in 2022-23

That the households’ reliance on borrowings has increased can be inferred from the steep jump in personal loans portfolio of banks. There can be many reasons for the jump in liabilities. One reason is the increase in credit card spending by households. While home loans constitute the biggest chunk of households borrowing from banks, credit card outstanding jumped from Rs 1.48 lakh crore at the end of 2021-22 to Rs 1.94 lakh crore in 2022-23.

On year-on-basis, credit card outstanding jumped from 12.6 percent to 30.9 percent during this period. In the pre-Covid period also, the credit card outstanding grew 30-35 percent annually, but the growth of 30.9 percent last year came on an already high base of Rs 1.48 lakh crore.

While the rising exposure to credit card spending indicates a perceptible shift in the payments landscape, it also exposes households to the risk of high-interest debt.

A part of the increase in household liabilities can also be explained by the increase in the pent-up demand in FY23, a normal year after two years of Covid-related disruptions.

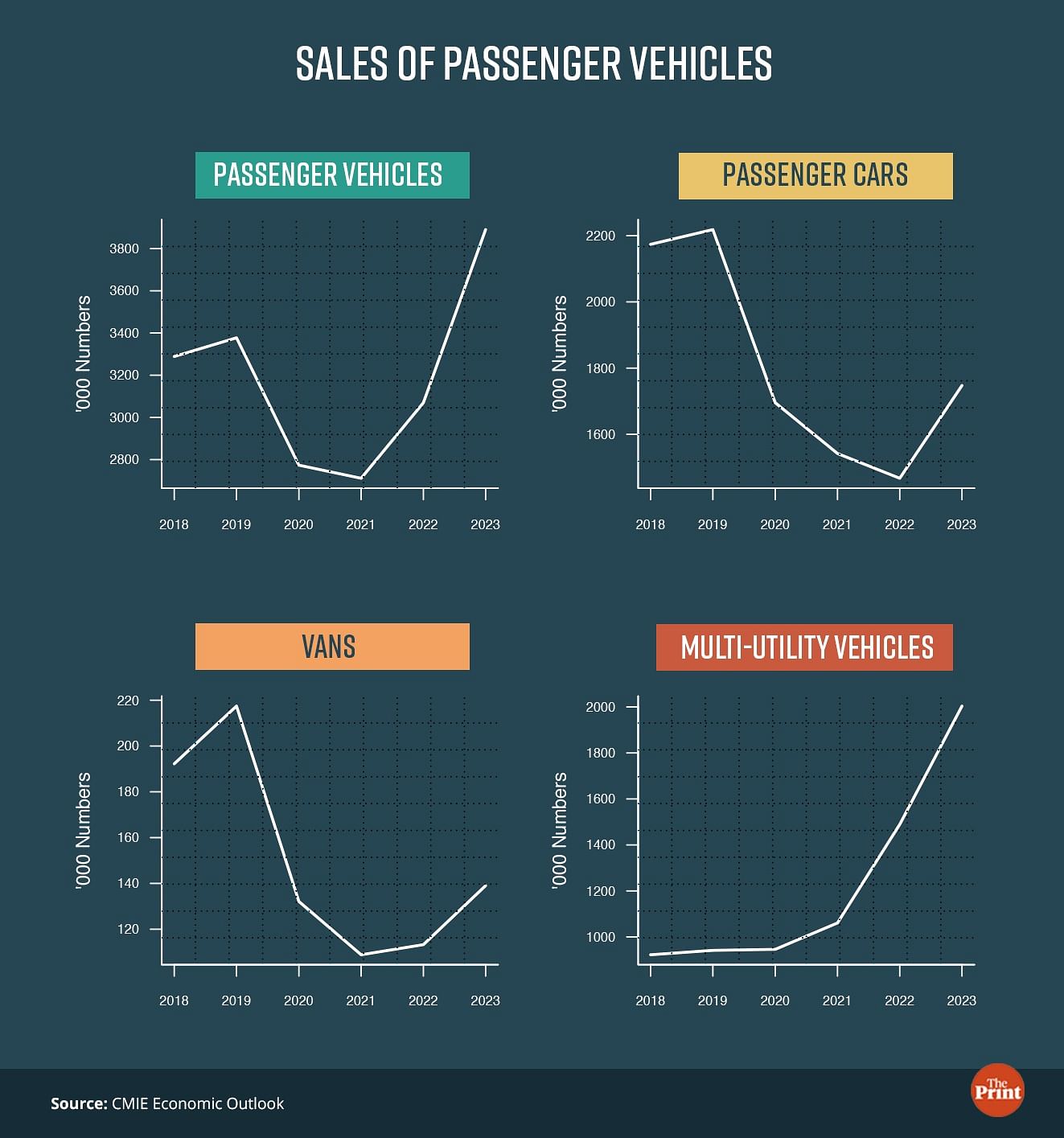

Borrowings for consumer durables which was in the range of Rs 160-170 billion from 2019-20 to 2021-22 jumped to Rs 200 billion in 2022-23. Households borrowing for purchase of vehicles also witnessed a rise in this year. This is corroborated by the stellar increase in the domestic sales of vehicles in 2022-23. Sales of vehicles increased by nearly 27 percent last year, driven by a 34.5 percent jump in the sales of multi-utility vehicles and a 19 percent increase in the sales of passenger cars.

Loans for housing constituted almost half of the personal loans in 2022-23. Robust demand for houses as witnessed in their record sales could have propelled the demand for housing loans.

According to Anarock, a real estate consultant, housing sales rose 48 percent across seven major cities in 2022-23. Coupled with new launches, the inventory overhang in the real estate has also declined substantially.

Stringent regulations enforced by the Real Estate (Regulation and Development) Act, 2016, have imparted confidence in the sector and boosted consumer demand.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Cheaper vegetables help ease food & retail inflation, but cereals & pulses continue to cause concern