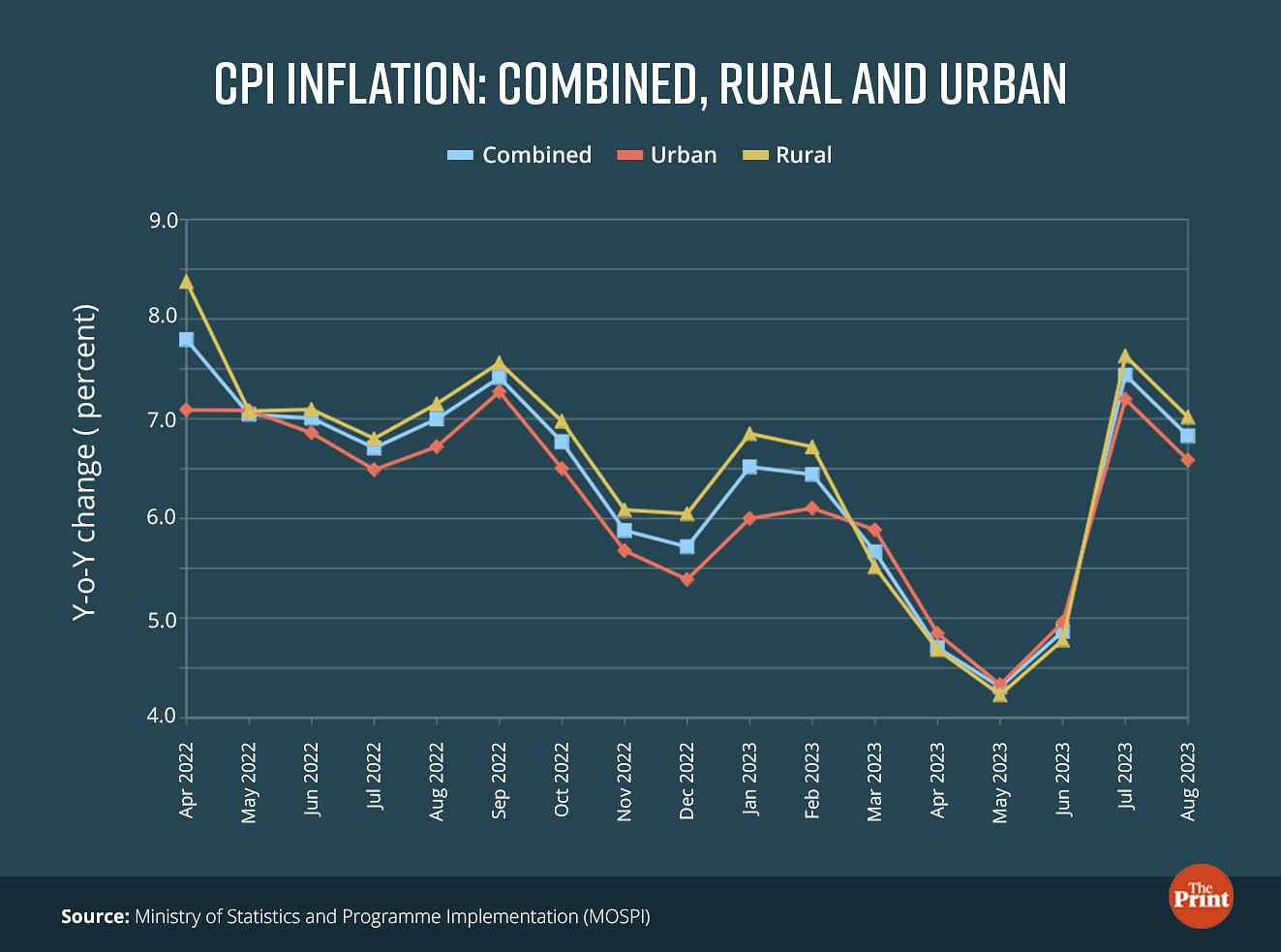

India’s retail inflation for August came in at 6.83 percent as compared to the same month last year, lower than 7.44 percent in July. The moderation from July is attributed to food inflation which stood at 9.9 percent as against 11.5 percent in July.

While vegetable price inflation came off its peak, declining from 37.4 percent year-on-year in July to 26 percent in August, the elevated inflation in cereals and pulses remains a concern for the inflation outlook. On the non-food inflation front, the recently announced LPG price cut will exert a downward pressure on prices. The extension of crude oil production cuts announced by Russia and Saudi Arabia, however, will pose an upside risk.

Also Read: Crypto regulation, debt resolution & more — possible key outcomes of India’s G20 presidency

Seasonal uptick in food inflation moderates

The upward pressure to food prices imparted by seasonal factors seems to be abating and is likely to wane further. On a sequential basis, vegetable prices have contracted by 5.8 percent from July to August, and are likely to fall further. Data on prices from the Department of Consumer Affairs, Ministry of Consumer Affairs, shows a sustained easing in tomato prices in the first two weeks of September as well.

However, prices of cereals and pulses continue to remain high. On a month-on-month basis (from July to August), cereals and pulses registered a growth of more than 1 percent. On cereals, while the government’s supply-side interventions could help limit the price rise, the almost 9 percent shortfall in the sowing of pulses — due to lower rainfall in Maharashtra and Karnataka in the months of May and June — is cause for concern.

Inflation in spices remained in double-digits for the 15th consecutive month, mainly driven by a steep surge in jeera and dry chilli prices.

Going forward, food prices could remain volatile if the impact of El Niño extends to Rabi sowing. The government would have to intervene with supply-side interventions, particularly to cool the prices of pulses.

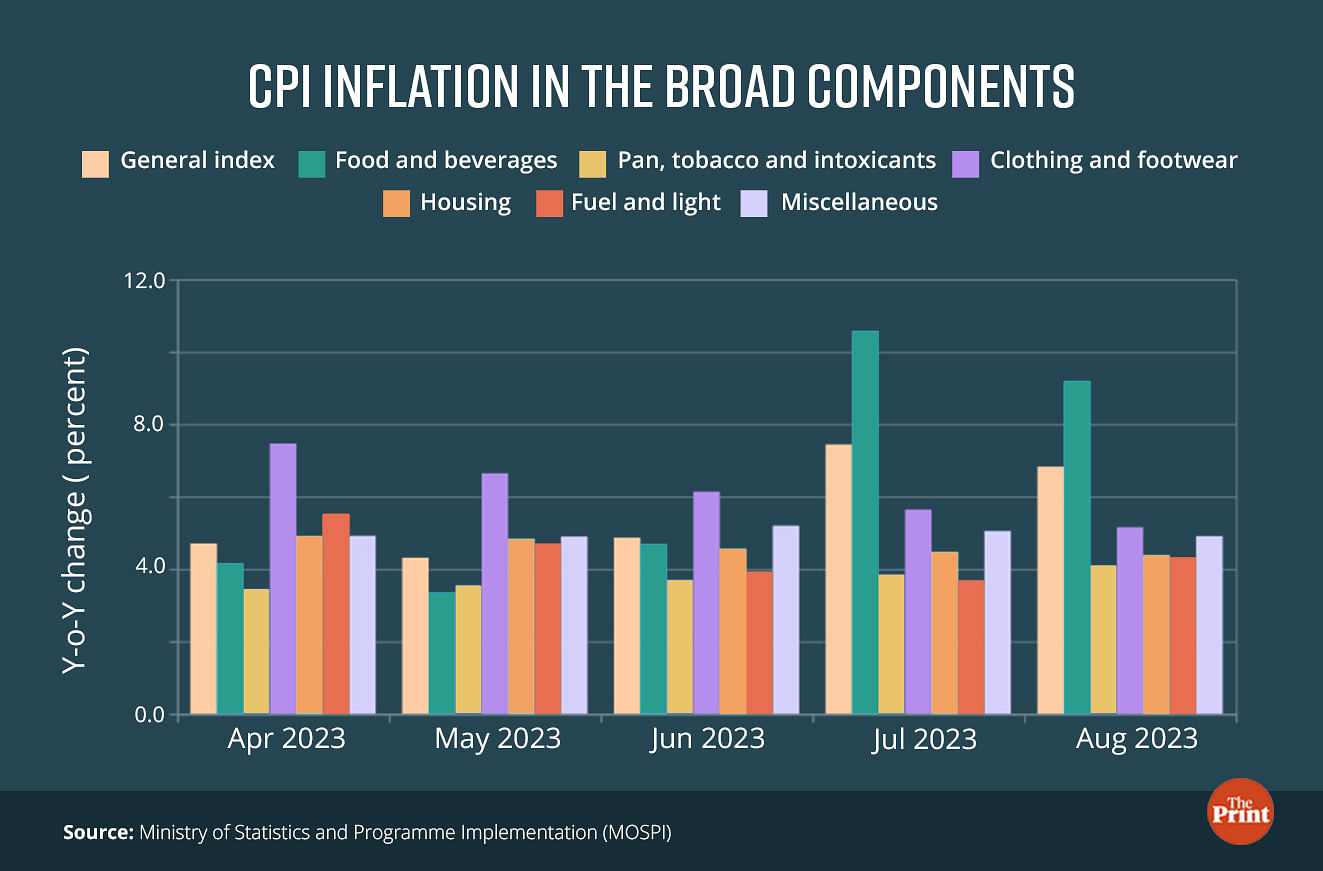

Comfort from non-food CPI categories

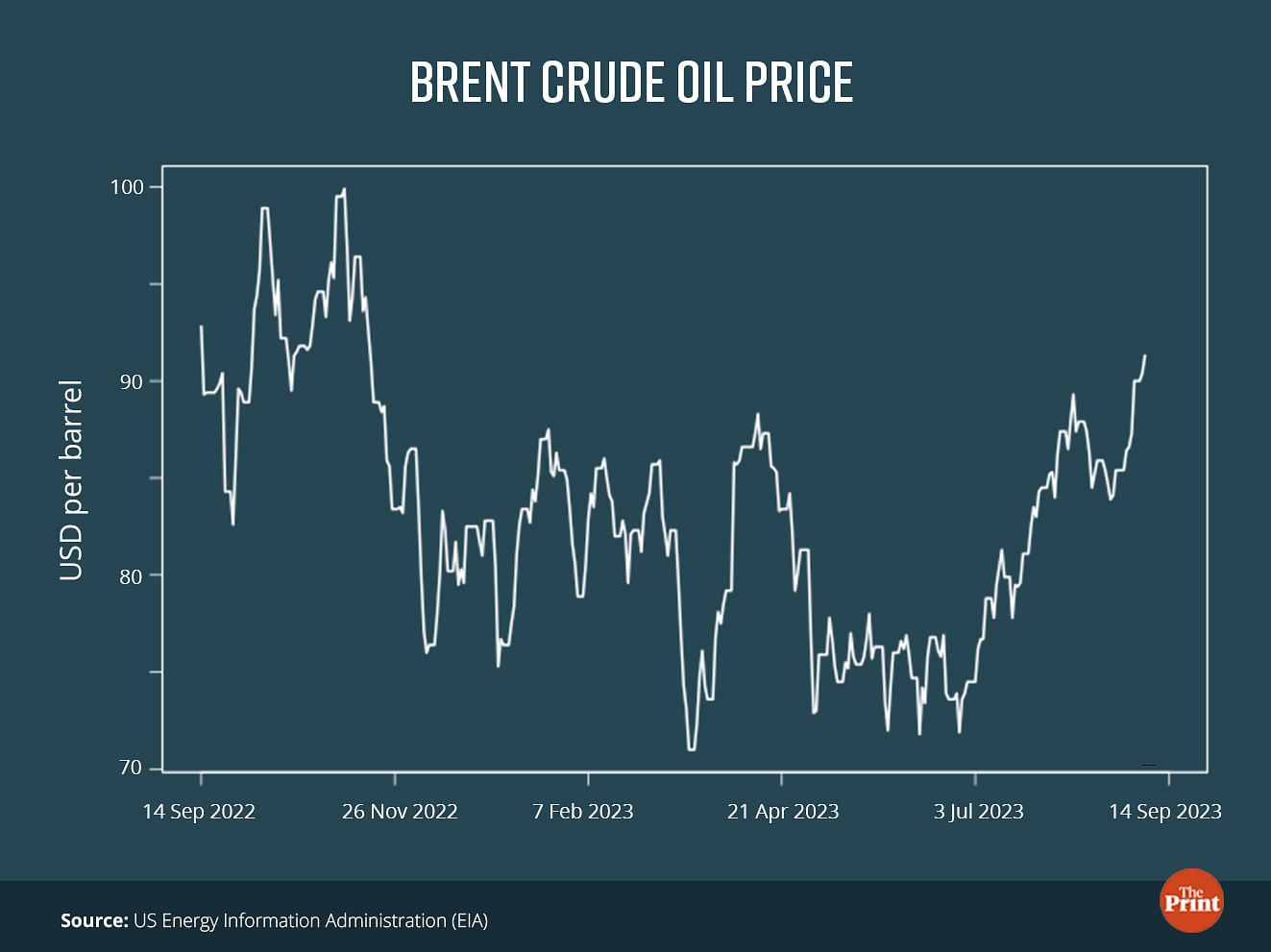

Among the non-food categories, fuel inflation hardened marginally to 4.3 percent in August from 3.7 percent in July. Fuel inflation could rise further if the recent spike in global crude oil prices is sustained. Russia and Saudi Arabia have announced the extension of their voluntary production cuts of 300,000 barrels per day and 1 million barrels per day, respectively, till the end of the year. Prices of crude oil have already surpassed the $90 per barrel-mark. This could translate into higher domestic fuel inflation in the coming months.

Inflation in other non-food components such as housing, clothing and footwear, and miscellaneous eased in August as compared to the previous month. Inflation in education and health remained broadly stable while in personal care and effects eased marginally. Overall, the core CPI inflation, after excluding the impact of food and beverages group and fuel and light group, continued to remain benign in August — less than 5 percent growth.

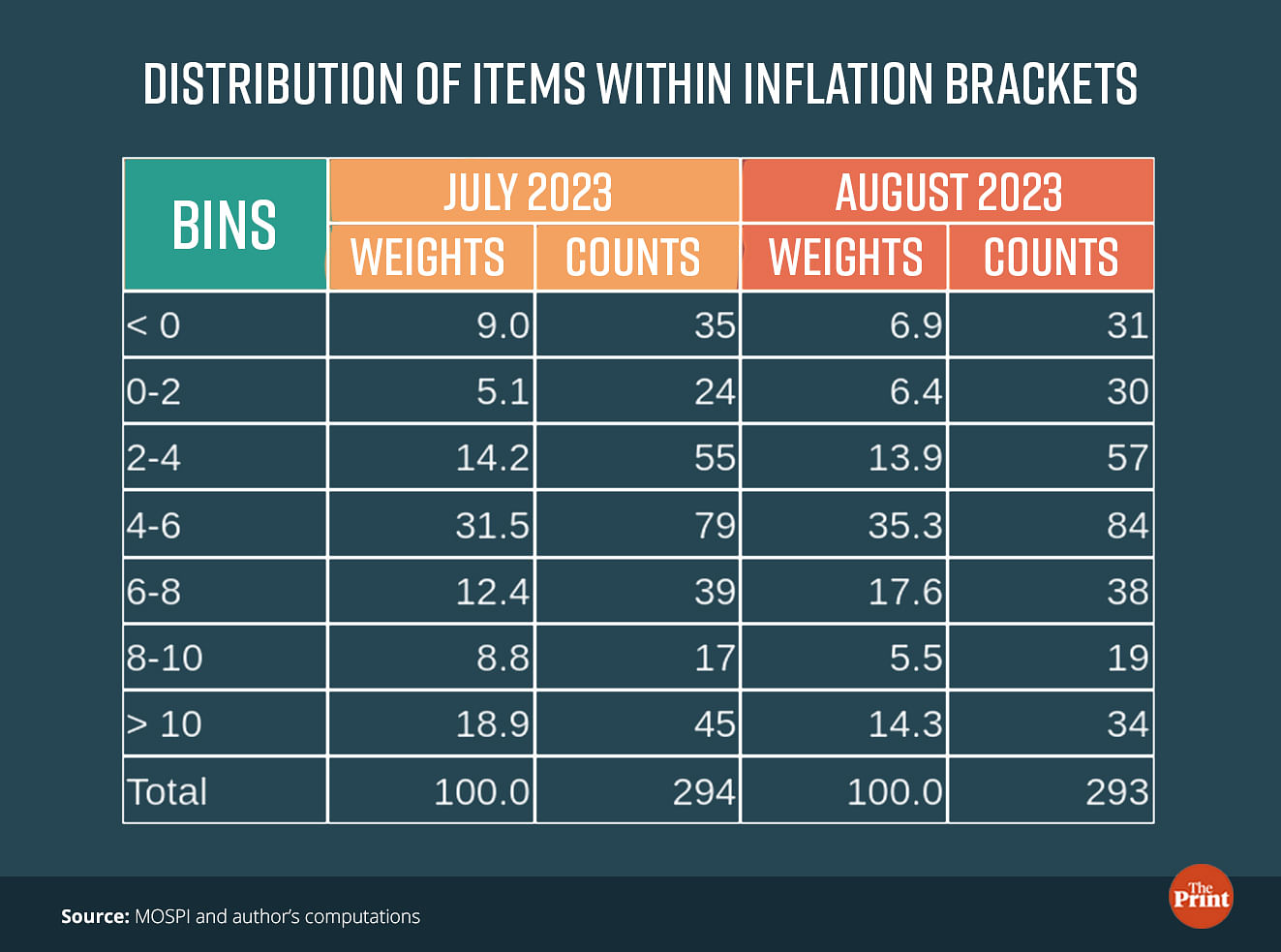

A useful way to assess how the nature of inflation transitioned from July to August is to look at the weights and count of commodities within the specific inflation categories. From July to August, the number of commodities registering more than 10 percent inflation fell from 45 to 34. In July, these commodities had a weightage of 18.9 percent in the CPI basket. In August, the weightage of such items fell to 14.3 percent.

Most of the commodities are seen to be in the inflation bracket of 4-6 percent or 6-8 percent. The number of commodities witnessing an inflation of 8 percent or more declined to 53 in August as compared to 62 in the previous month.

Uneven states inflation

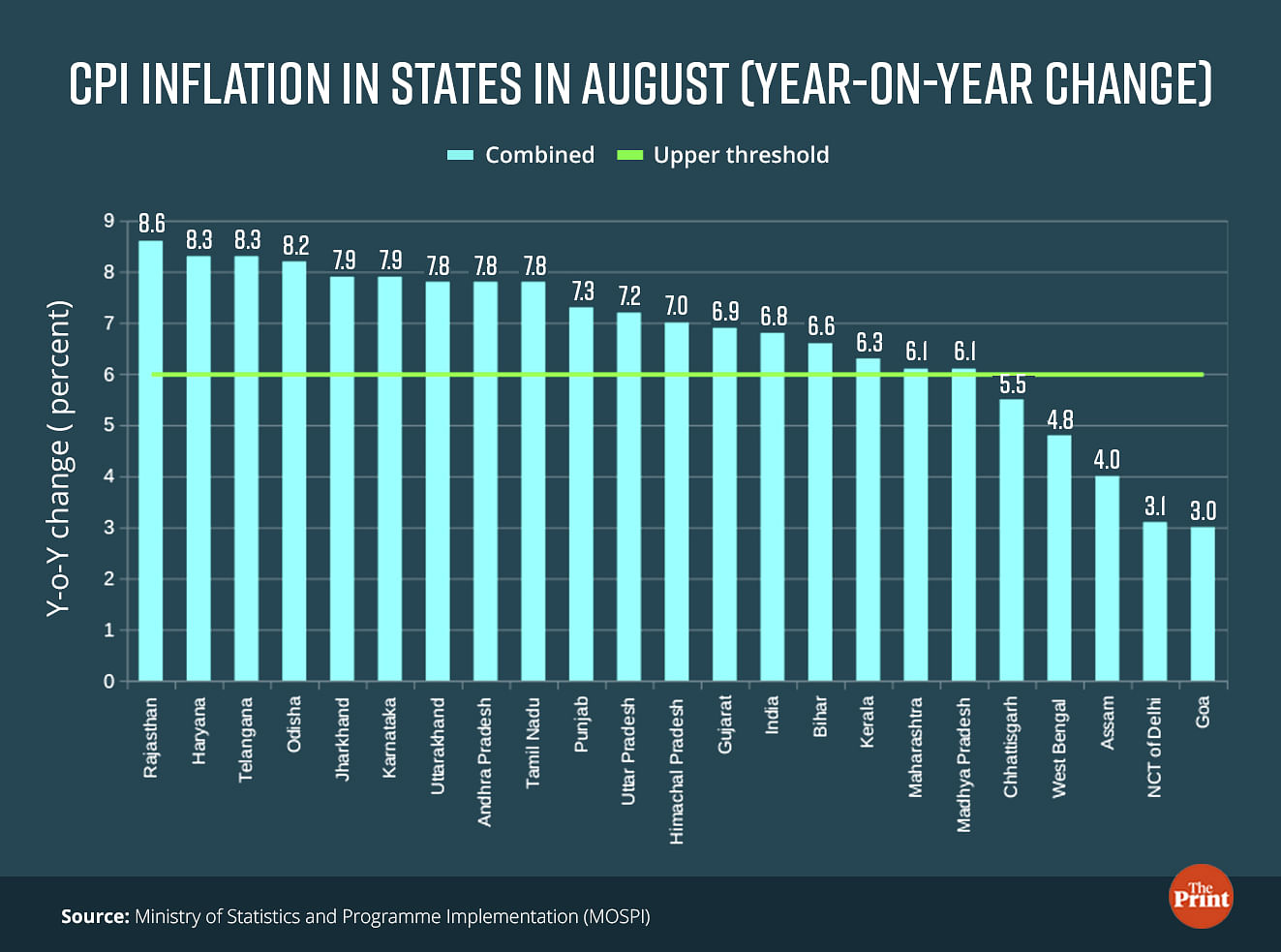

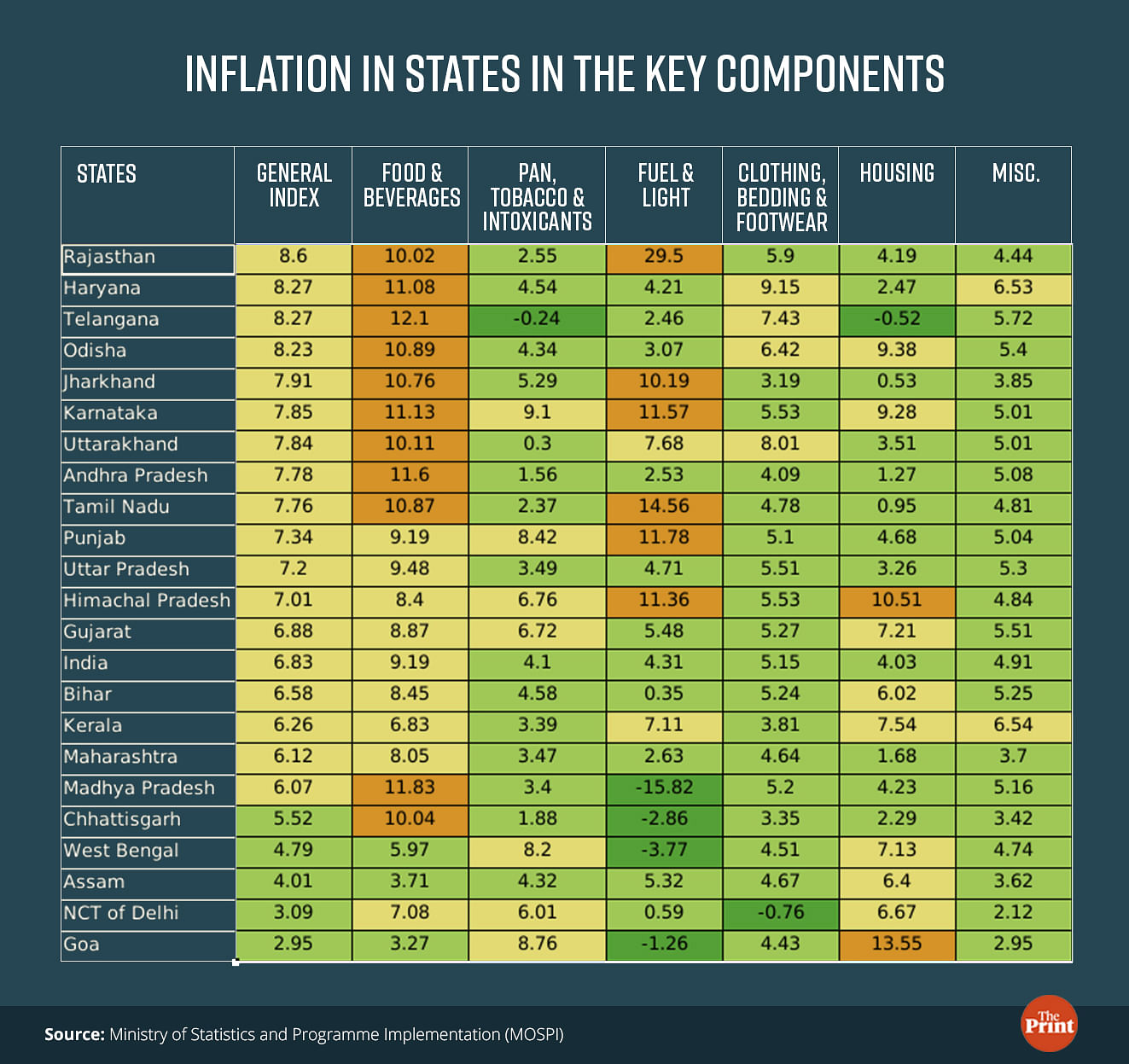

Among the states, Rajasthan clocked the highest inflation at 8.6 percent. Haryana, Telangana and Odisha recorded more than 8 percent inflation.

There is also a variation in rural and urban inflation amongst states. Strikingly, in Haryana, rural inflation at 9.7 percent exceeds urban inflation by more than 3 percent.

While food inflation is the key driver of high inflation in states, in Rajasthan, fuel and light inflation spiked to 29.5 percent. Rajasthan has one of the highest fuel rates in the country. Amongst the components of food, vegetables and spices have registered inflation in the range of 20-30 percent in the high inflation states.

The inflation rate in Goa was the lowest at 3.0 percent. Assam and West Bengal also witnessed moderate inflation at 4 percent and 4.79 percent, respectively.

US CPI inflation edged up due to rebound in gasoline prices

The US CPI inflation grew 3.7 percent on a year-on-year basis (as compared to August, 2022). What is noteworthy, however, is the jump in the month-on-month pace of inflation. The CPI had risen by 0.2 percent for two straight months but in August, it increased by 0.6 percent. The jump in the month-on-month inflation was driven by a sharp spike in gasoline prices.

The floods in Libya a week after Russia and Saudi Arabia announced extension of production cuts will lead to supply disruptions and further rise in gasoline prices.

While the overall inflation has been on a downward trajectory, the rise in global crude oil prices could complicate the task of the US Federal Reserve to lower inflation to the 2 percent-mark without hampering the demand conditions.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Robust services growth, revival in consumption demand & strong capex fuelled 7.8% Q1 GDP growth