The upcoming G20 Leaders’ Summit under India’s Presidency presents an opportunity to help seek consensus on areas of global concern, particularly those that affect the Global South. Faster resolution of debt of countries reeling under debt distress; reform of the multilateral development banks (MDBs) to augment financing for emerging challenges such as climate change; and a coordinated approach towards crypto-currency regulation are likely to be some of the focus areas on which consensus would be sought.

Timely resolution of debt distress

Debt vulnerabilities in low- and middle-income economies have risen manifold. India has been pushing for greater traction on debt restructuring under the G20 Common Framework.

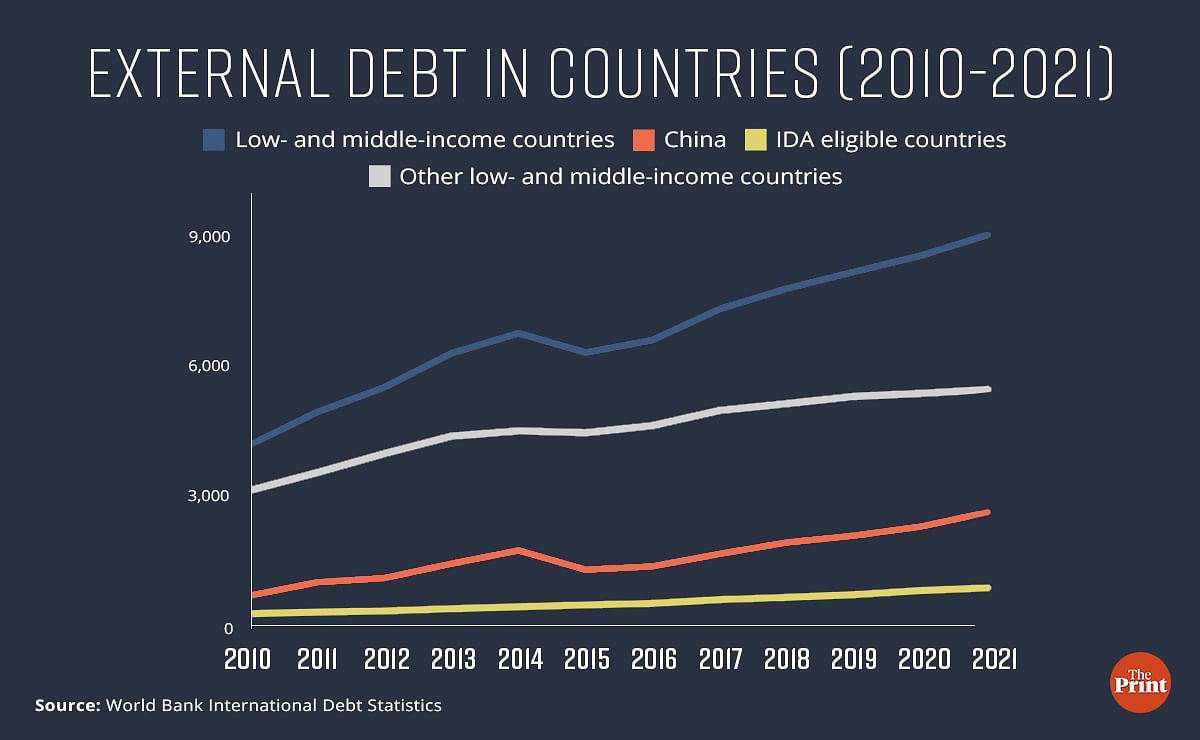

The total external debt of low- and middle-income countries increased to USD 9 trillion in 2021 — more than double from a decade ago. With rising interest rates and slowing growth, about 60 per cent of the poorest countries are at high risk of debt distress or are already in distress.

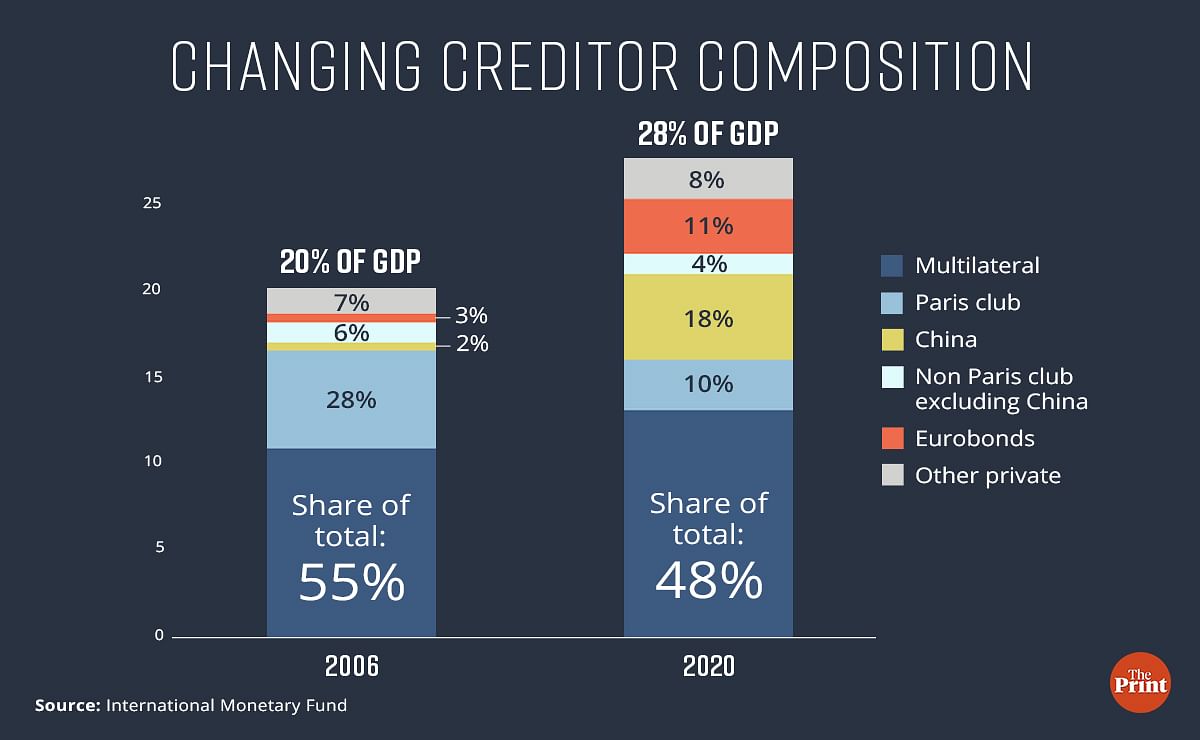

G20 nations launched the “Common Framework” when Covid disrupted countries’ finances. The Common Framework considers debt treatment on a case-by-case basis, based on requests by debtor countries. Creditor committee is convened to discuss the specifics of debt restructuring. Since China has emerged as the dominant lender in recent years, bringing it on board alongside the Western-led Paris Club creditor nations, G20 official creditors and private creditors has proved to be a challenging task.

Specifically, China has pushed for the inclusion of MDBs in sovereign debt restructuring under the Common Framework. This position has been resisted by the international community as it would subject the MDBs to take haircuts, undermining their preferred creditor status.

Currently, only Zambia, Ghana, Chad and Ethiopia have requested for debt relief under the Common Framework. However, debt resolution for all four countries has been subject to delays due to the impasse in negotiations.

Under its G20 Presidency, India has been successful in facilitating the formation of creditor committees for Ghana and Sri Lanka (beyond the CF), and has called for a prompt debt treatment agreement for Ethiopia.

Zambia’s debt treatment agreement was finally reached in June 2023, with India as one of the creditors. Additionally, the Indian G20 Presidency has collaborated with the International Monetary Fund (IMF) and World Bank to set up the Global Sovereign Debt Roundtable (GSDR) to strengthen communication among stakeholders within and outside the Common Framework.

With the institutional setting in place, India would try to achieve consensus on the need for time-bound debt resolution of countries suffering from debt distress.

Also read: Healthy loan growth, comfortable capital position — what’s behind banking sector’s ongoing dream run

Reforming the MDBs

There is a growing recognition that MDBs must enhance their financing for the lower-income countries (LICs). The lower-income economies face multiple challenges emerging from the pandemic, geo-political conflicts, higher inflation, exchange rate fluctuations and unsustainable debt. These economies are the most vulnerable to climate change and need additional funding towards making their countries climate resilient.

MDBs are uniquely positioned to address these challenges as they provide low cost, long maturity financing, policy advice and knowledge sharing. While private creditors have emerged as the dominant source of lending, the gross disbursements by MDBs have not kept pace with the growing challenges faced by low- and middle-income countries. This requires fundamental reforms in the way MDBs operate.

Under the aegis of India’s G20 Presidency, an independent expert group on strengthening multilateral development banks was set up. A key objective of the expert group, among others, was to suggest a roadmap for enhancing the financial capacity so that MDBs are better equipped to finance a wide range of challenges, from climate change to health.

Another objective of the expert group was to present a range of estimates of the financing needs required by MDBs and from MDBs. The expert group has recommended that the MDBs should have a triple mandate of eliminating extreme poverty, boosting shared prosperity, and contributing to global public goods. Here global public goods broadly include climate change, preservation of biodiversity, global water cycle and pandemic preparedness and response.

The expert group recommended that the MDBs need to substantially enhance their lending to meet their triple mandate. The group estimated that an additional spending of USD 3 trillion would be required annually for developing countries. Of which USD 1.8 trillion would be required for climate action and USD 1.2 trillion would be required towards meeting sustainable development goals.

To enhance their lending capacity, the MDBs need to review their capital adequacy frameworks, and work towards innovative methods of raising finance including access to central bank liquidity and greater involvement of the private sector. These measures will help unlock additional funds by MDBs for disbursements to developing economies.

As of now, the recommendations of the expert group have not been accepted by the G20 finance ministers. They were only taken “note of”. If the G20 leaders can agree on the roadmap to reform the MDBs, that will be a notable contribution of India’s G20 Presidency in the sphere of reforming the global financial architecture.

Internationally agreed standards of crypto regulation

While many countries have put in place frameworks to regulate cryptocurrencies, India has been pushing for a comprehensive and coordinated approach to crypto-regulation. In this context, India has published its Presidency Note which emphasises on the need to incorporate risks specific to emerging markets, in the ongoing work of international organisations. The IMF and the Financial Stability Board have come out with policy documents outlining their approach towards the regulation, supervision, and oversight of both crypto-assets and markets.

India requested for a synthesis paper on crypto regulation. The synthesis paper that has been circulated to the G20 members brings together the risks identified by each institution and how they interact. The paper highlights the amplified macro-financial risks from crypto-assets that emerging and developing economies may face, which would require additional policy responses. The paper also includes a roadmap for future work. The roadmap is expected to form a central part of the discussions in the upcoming G20 Leaders’ Summit. If the roadmap is endorsed by the G20, then the resultant formulation of a comprehensive global regulatory framework on crypto assets would mark as one of the key contributions of India’s G20 Presidency.

Radhika Pandey is an associate professor and Anandita Gupta is a research fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Robust services growth, revival in consumption demand & strong capex fuelled 7.8% Q1 GDP growth