Ending weeks of speculation, the government appointed Revenue Secretary Sanjay Malhotra as the new governor of the Reserve Bank of India for a period of three years. The new governor will have to walk the tightrope between controlling inflation and lifting growth amid a period of global uncertainty and heightened volatility.

While with the change in guard, the RBI could see a shift towards a more dovish monetary policy, the conventional policy response in the form of rate cuts will not be a given with mounting pressure on the rupee.

Growth slowdown & softening projection

The new governor takes over the reins of the central bank at a time when the growth engine is seen to be weakening. GDP (Gross Domestic Product) growth slumped to a seven-quarter low of 5.4 percent in the September quarter.

The manufacturing sector growth fell sharply to 2.2 percent from 7 percent in the previous quarter. Construction, which has been one of the prime engines of growth, also weakened to 7.7 percent from 10.5 percent in the June quarter.

On the expenditure front, investment growth weakened to 5.4 percent from 7.5 percent in the previous quarter. Consumption demand also dipped to 6 percent, mainly due to softening urban demand. The RBI, in its recently held monetary policy meeting, cut its growth forecast for the current year by 60 basis points to 6.6 percent.

Elevated inflation & upward revision to projection

While a growth slowdown would warrant an interest rate cut, an elevated inflation complicates the task for the central bank.

The Consumer Price Index-based inflation jumped to 6.2 percent in October from 5.49 percent in September, due to high food prices. While the seasonal dip in vegetable prices will likely ease inflation in the coming months, uptick in international vegetable oil prices and the adverse weather events are likely to pose an upside risk to the inflation outlook. In the latest monetary policy meeting, the RBI raised its inflation projection for the current year by 30 basis points to 4.8 percent.

Despite expectation of near-term easing of inflation, the latest round of Inflation Expectations Survey of Households shows that a larger share of households anticipate the one-year inflation to edge up due to higher food prices and cost of housing.

Managing the rupee

The third challenge relates to managing the rupee. The rupee has come under pressure with the dollar gaining strength in response to US President-elect Donald Trump’s statements and anticipation of his policies to spur growth and boost the dollar. Selling of Indian assets by Foreign Portfolio Investors (FPIs) has also added to the pressure.

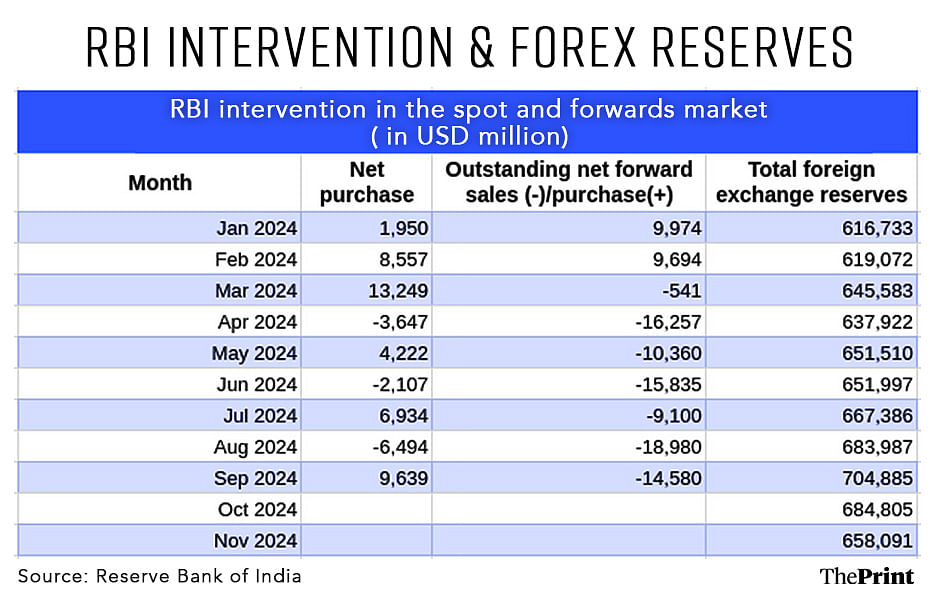

The RBI has been intervening to prevent the rupee slide, but sustained forex intervention has implications for rupee liquidity and the reserves position. When the RBI sells dollars, it absorbs an equivalent amount of rupee, thus reducing rupee liquidity. To be sure, outflows on account of tax payments also lower the system liquidity.

Amid anticipation of tight liquidity conditions, the RBI, in its recent monetary policy meeting, announced a 50-basis point cut in the Cash Reserve Ratio (CRR) to infuse liquidity. This was a departure from the Liquidity Adjustment Facility (LAF) framework, including Variable Rate Repo and Variable Rate Reverse Repo auctions that the RBI has been relying on to manage liquidity. The choice of the tool to manage liquidity in the coming months is something that will be keenly watched.

The management of the rupee has become challenging due to the emergence of the offshore non-deliverable forward (NDF) market. The volume of rupee trade has seen a significant increase in recent years. In addition to the spot market intervention, the RBI has been managing the rupee through taking positions in the non-deliverable forward market. This is in contrast to its earlier position, when it discouraged banks from building positions in the offshore market.

According to the RBI Bulletin, the outstanding net forward sales by the central bank stood at USD 18.98 billion in August and USD 14.58 billion in September. Despite a short position in the NDF market, India’s foreign exchange reserves surged to cross USD 700 billion by September-end.

The RBI’s short position in the NDF market has reportedly surged post September. In the NDF contract, there is no actual delivery of currencies. The management of rupee through the NDF does not impact foreign exchange reserves, but affects the RBI’s balance sheet through profit or loss when the contract matures.

The change of guard at the RBI could warrant a relook at the exchange rate management strategy—should the rupee be allowed to remain overvalued when seen through the prism of the real effective exchange rate (REER)?

Given that the dollar is likely to remain strong in the near term, the pace and extent of intervention in the spot and forwards market to manage the rupee may need to be reviewed.

Review of inflation target

The RBI Act requires the government, in consultation with the RBI, to determine the inflation target—but not the framework—once every five years. The current inflation target of 4 percent, plus or minus 2 percent, will be up for review in March 2025.

The government and the RBI with the new governor will have to agree on a desirable inflation target. Should the target be left unchanged at the current level, or should it be modified in light of growing protectionism and climate-related challenges, are all areas of healthy discussion.

Regulatory framework for addressing climate risks to financial system

A lot of work needs to be done, along with other financial sector regulators, to equip the financial system to the risks arising from climate change. A discussion paper on climate risk, a framework for green deposits and climate scenario analysis are some of the initiatives by the RBI in recent years to address climate-related financial risk.

The RBI has also released a draft disclosure framework for such risks. The final disclosure norms, in alignment with the emerging global standards on climate disclosure, comprise a key part of the agenda for the governor as the country moves to fulfill its climate related goals.

Radhika Pandey is associate professor at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.