Failure to address the debt ceiling and possibility of an unprecedented default on debt could have adverse implications for US’s economy. A prolonged breach of debt limit could cut thousands of jobs across the US, raise borrowing costs for households and businesses, undermine consumer confidence, weaken banks’ balance-sheets and trigger recession in the US and the global economy.

Recession or even a steep slowdown in the US would impact emerging economies through lower trade flows. A higher probability of a debt default could make financial markets more volatile and impact capital flows. The event could severely tarnish the image of the US dollar as the safe haven currency.

US debt ceiling

The US has a legislative limit on the amount of money the federal government can borrow. The US Congress periodically votes to raise or suspend the ceiling so that it can borrow more.

The limit currently stands at USD 31.4 trillion. That limit was breached in mid-January and since then the US treasury has taken extraordinary measures to limit spending and provide more cash to the government.

The challenge in lifting the debt ceiling is the disagreement between the Democrats and the Republicans on whether the increase in debt ceiling should be accompanied by spending cuts.

While the Republicans want the increase in the borrowing limit to be accompanied by spending cuts, the American President is opposed to the idea of linking spending cuts to the debt ceiling and wants an increase in debt ceiling without any conditions.

This standoff is prolonging the lifting of the debt ceiling. With the extraordinary measures, the treasury will be able to meet federal obligations only till 1 June. A continued stalemate on debt will have adverse consequences such as frozen federal benefits, job cuts with recession, higher borrowing costs for households and businesses, and financial market volatility.

Credit tightening, crash in consumer confidence, and signs of economic weakness

The US economy is still grappling with the aftershocks of the banking crisis. According to the Federal Reserve’s quarterly Senior Loan Officer Opinion Survey (SLOOS), respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to large and middle-market firms as well as small firms.

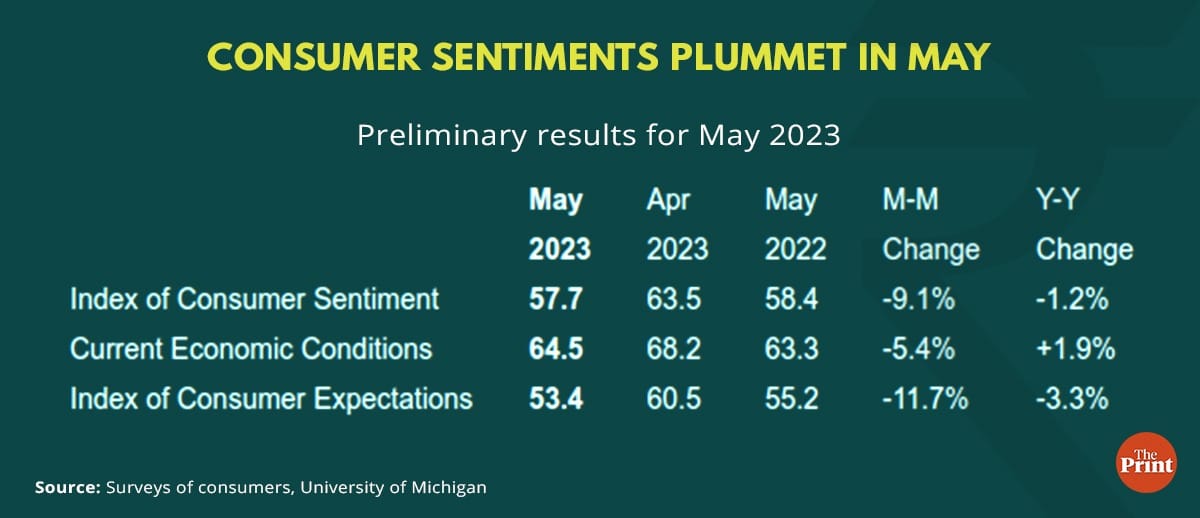

Consumers’ worries about the economy, including the debt crisis stand-off, led to tumbling consumer sentiments. The May preliminary report for the Michigan Consumer Sentiment Index came in at 57.7, down 5.8 (9.1 percent) from the April final figure.

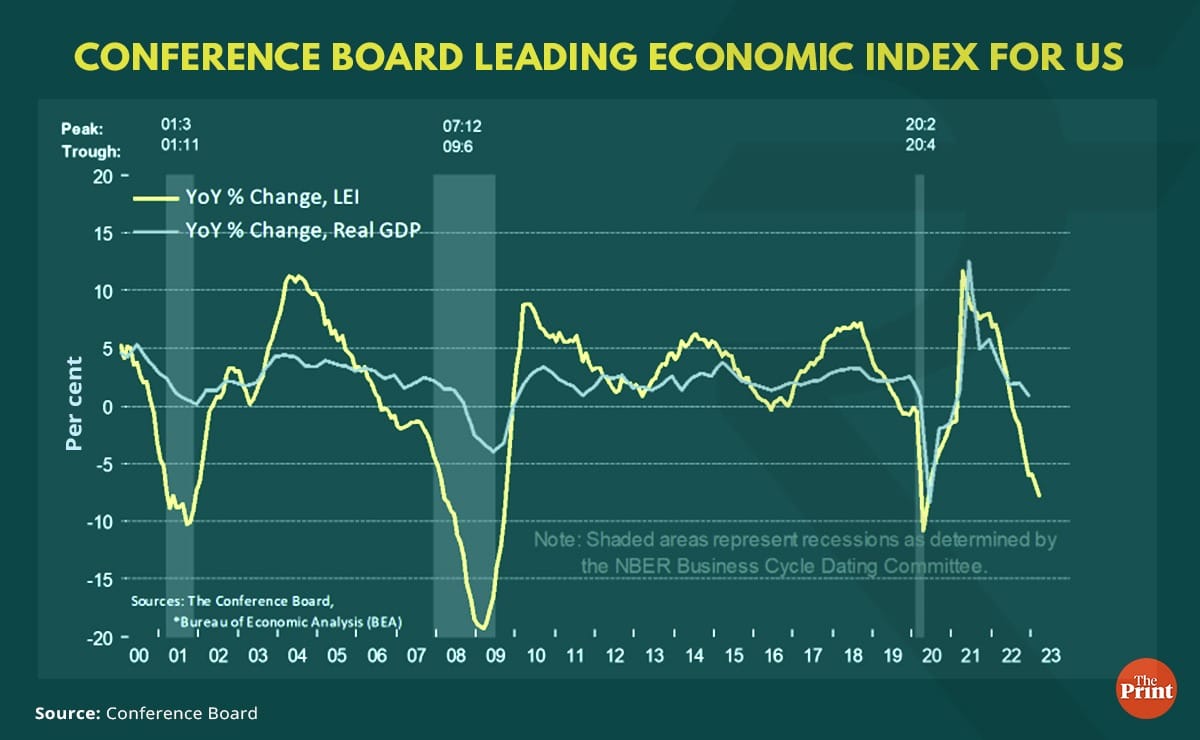

Flashing signs of recession in the economy, the US Leading Economic Index fell to its lowest level since November 2020. Overall, the Leading Economic Index is down 4.5 per cent over the six-month period between September 2022 and March 2023, a steeper rate of decline than its contraction over the previous six months.

Possible intervention by the US Fed

In the event of a default, the value of US treasury securities would plunge and yields would rise.

The Federal Reserve would have to purchase treasury securities to help the US government finance its debt. The Fed would have to provide emergency funding support to banks whose balance-sheets might be impacted due to exposure to US treasury securities.

The recent bank crisis was also prompted by a drop in the value of treasury securities owing to sharp rise in interest rates. These measures would imply a reversal of the tight monetary policy that the Fed has been pursuing to tackle the record high inflation.

Export contraction and hit to earnings of companies

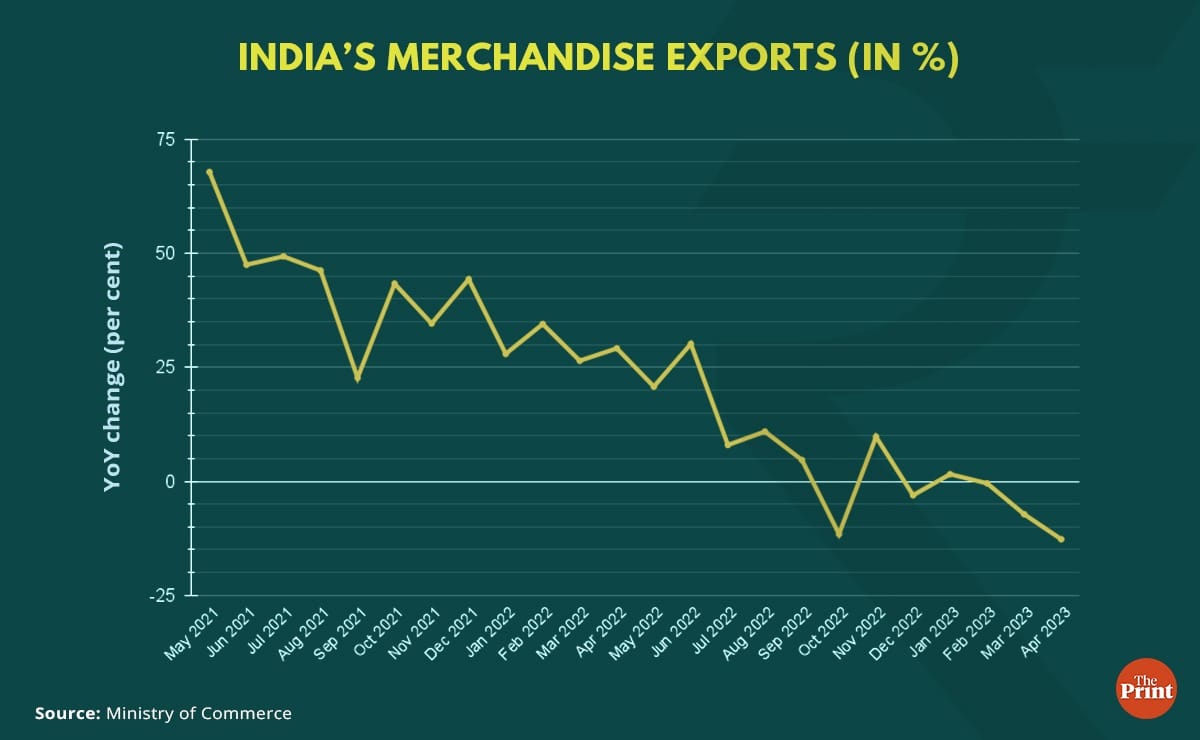

Sluggish demand and recession in major trading partners led to a 12.7 per cent contraction in India’s merchandise exports. According to the Directorate General of Foreign Trade, demand scenario does not look optimistic as far as US and Europe markets are concerned.

Many Indian companies, particularly in the Information Technology (IT) sector with exposure to the US could face troubles due to scaling back of work orders and hit to investor sentiment.

Loss of confidence in the dollar, flight towards golds, supply chain disintegration

US Treasury securities are widely held by investors around the world. Their yields serve as a benchmark for other financial instruments. The creditworthiness of US treasury securities has long bolstered demand for US dollars, as the world’s reserve currency.

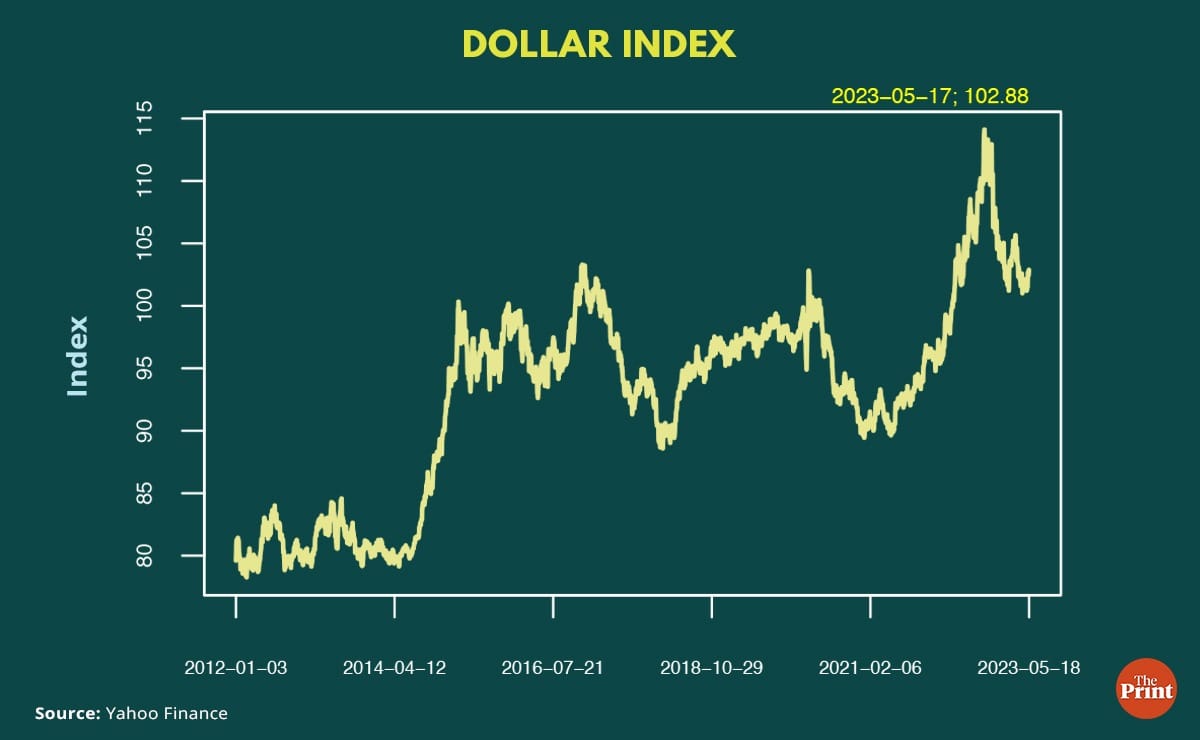

A hit to confidence in the US due to the default or the uncertainty surrounding it could cause investors to sell US treasury bonds and thus weaken the dollar.

China remains the largest foreign holder of US treasury securities after Japan. China has been cutting its holding of US treasury securities in the past few months.

The stalemate on debt ceiling in the US would push China to further reduce its exposure to US treasury securities. This would give impetus to China’s efforts to use the yuan to settle foreign trade transactions.

Ongoing efforts by countries to bypass the dollar could further gain momentum. Countries will try to reduce their reliance on the dollar by creating multiple new trading blocs which could lead to barriers to trade and undermining of supply chain integration.

Even while the share of US dollar in the world’s foreign exchange reserves has seen a decline, still over half of the world’s foreign currency reserves are held in US dollars. In recent times, central banks have been turning away from dollars and shifting to gold. The uncertainty triggered by the impasse on the debt ceiling could bolster the attractiveness of gold even further.

Radhika Pandey is Senior Fellow at National Institute of Public Finance and Policy.

Views are personal.

Also read: How hyperinflation, economic turmoil is pushing people to adopt crypto in several emerging economies