High-frequency indicators present a mixed picture of the economy, with several indicators showing a robust growth while some showing a tepid growth. Survey based indicators on manufacturing and services present an encouraging picture of the economy.

The goods and services tax (GST) collections (GST) hit an all-time high of 1.87 lakh crore in April, surpassing the previous record of Rs 1.67 lakh crore in April last year. While the surge was driven by year-end sales, the numbers also reflect better compliance and revival in economic activity. Rural economy is showing early signs of revival that could be marred by unseasonal rains and hailstorms.

Bank credit, while still robust, is being driven by personal loans and services. Credit to industry, particularly to large industries, has declined in recent months. Equity markets have picked up. Services exports continue to do well and will likely help in shielding the economy from global recession.

Activity-based indicators

India’s services activity measured by the S&P Global India services Purchasing Managers Index soared to a 13-year high of 62 in April from 57.8 in March. The manufacturing activity also increased to a four-month high in April.

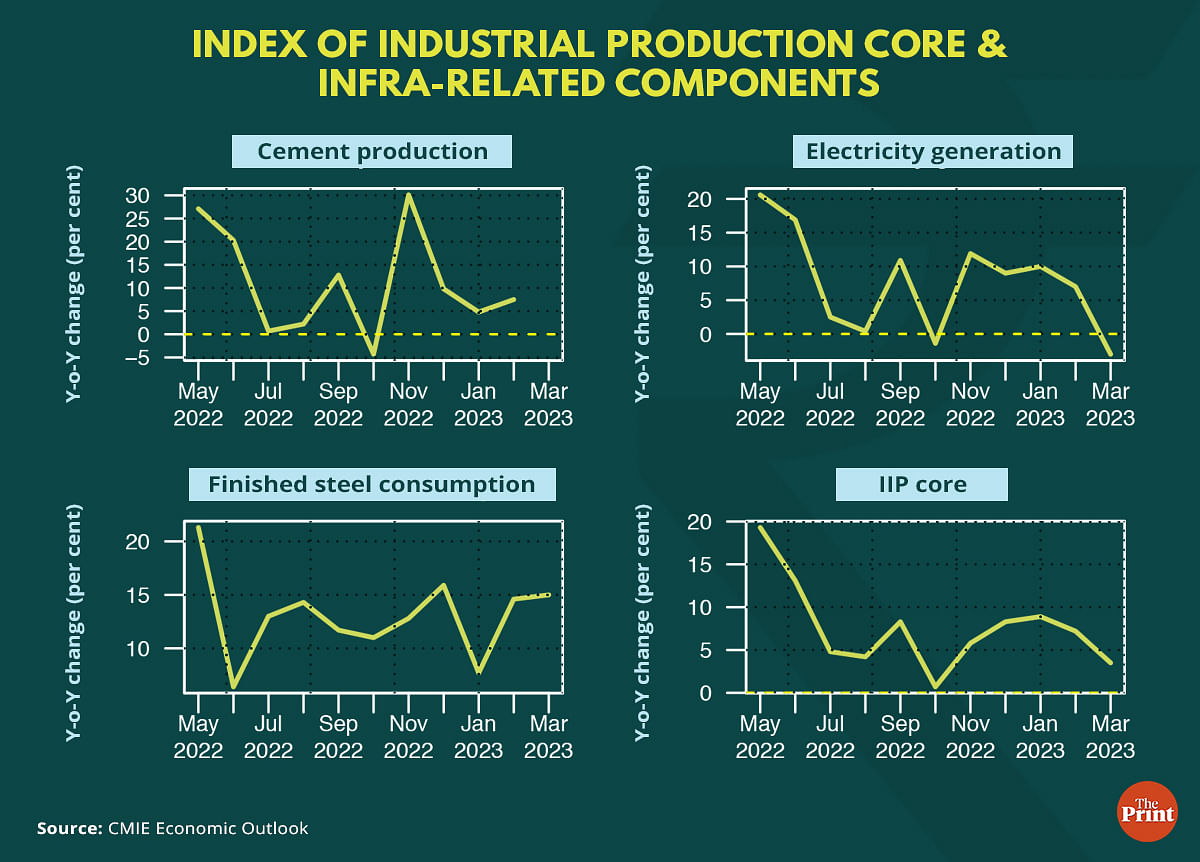

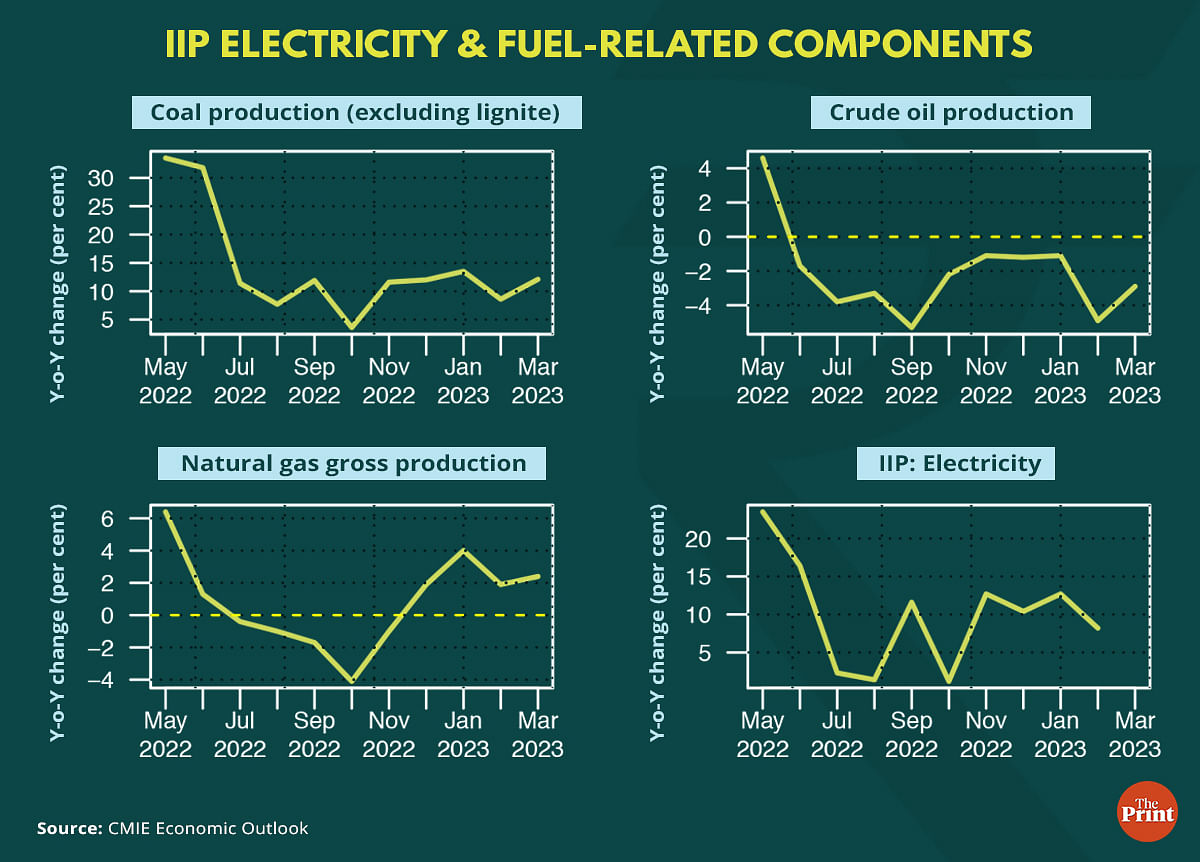

Production of eight core infrastructure sectors slowed to a five-month low of 3.6 per cent in March. Only three sub-components, coal, steel and fertiliser registered a strong growth while electricity, cement, natural gas, crude oil and refinery products registered weak growth.

Unseasonal rainfall in March is likely to have impacted the output in some sectors. The slower growth in the core industries is likely to reflect in the Index of Industrial Production (IIP) for March. Lower than expected temperature in April is likely to result in lower generation of electricity.

Demand side indicators

Passenger vehicle sales registered a decent growth in March despite a high base. The last fiscal year as a whole saw India’s passenger vehicle sales rising by 27 per cent. Easing of chip shortage, rising income, pent-up demand, especially for sport utility vehicles (SUVs) supported the demand for passenger vehicles, despite higher inflation.

Small cars and sedans are losing ground to SUVs. Passenger vehicle sales have surpassed the levels seen in pre-Covid years. Growing preference among car buyers for high-end premium models is driving the demand in the auto sector.

Rural market is witnessing green shoots of recovery. A key indicator of rural demand, tractor sales clocked double-digit growth for the fourth consecutive month in March. The harvesting and procurement of crops are in full swing, leading to improved sentiments in rural markets. Wheat procurement has crossed last year’s level. Higher cash flow from Rabi crops will support revival of rural demand.

Higher minimum support prices for farm commodities and high reservoir level for Kharif sowing is likely to improve the disposable income and consumer sentiments in rural areas.

For the full financial year, tractor sales have exceeded the sales seen in the pre-Covid period. Another indicator of rural demand, two-wheeler sales has seen a rebound in recent months but sales have yet to reach pre-pandemic levels.

Going forward, unseasonal rains could cause crop damage and suppress rural sentiments.

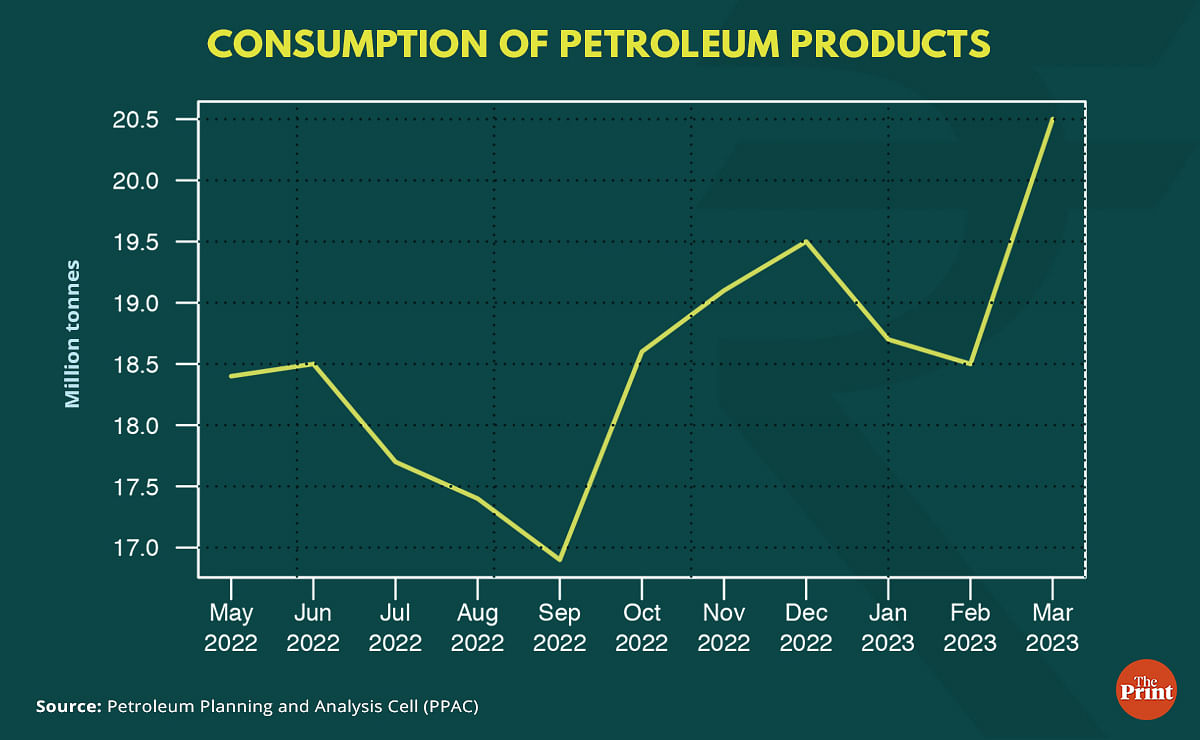

Consumption of petroleum is one of the key measures of tracking industrial activity and domestic consumption trends. At 20.5 million tonnes, consumption of petroleum products in March was the highest ever in a single month. India consumed a total of 222.30 million tonnes of petroleum products in 2022-23 — 10.2 per cent higher than last year.

The country’s petroleum product consumption is expected to touch a new high in 2023-24, indicating a pick-up in economic activity.

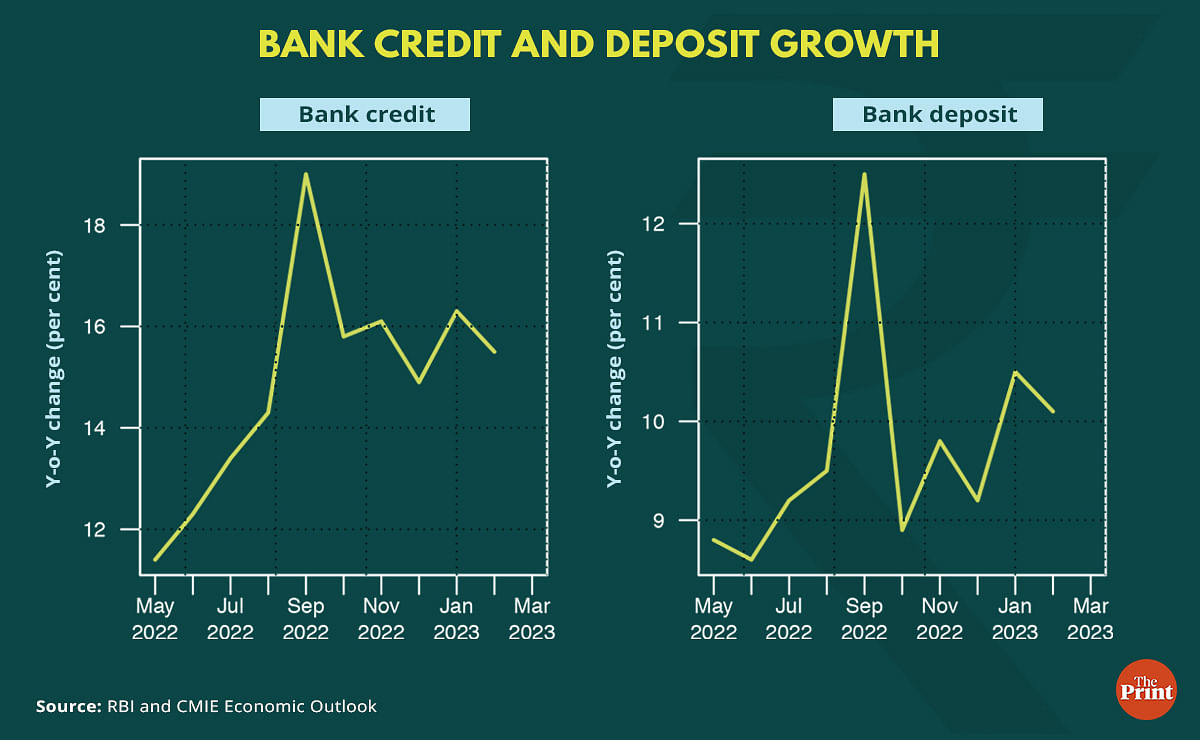

Bank credit growth off its peak but still strong, deposits showing signs of pick-up

Bank credit clocked a robust 15 per cent growth in FY 2023 due to low base of last year and a higher demand for funds as economic recovery gained momentum.

The key drivers of credit growth have been personal loans and services. Personal loans registered a growth of 20.6 per cent (y-o-y) in March 2023 as compared with 12.6 per cent a year ago, primarily driven by housing loans.

Credit to industry registered a growth of 5.7 per cent in March 2023 while credit to large industry rose by 3 per cent. Credit to services also registered a strong double-digit growth of 19.8 per cent in March. The surge is primarily driven by demand for bank credit by non-bank financial companies (NBFCs).

Credit to industry saw a sharp pick-up between April-October of the last financial year. From November to February, outstanding credit to industry fell sharply. Latest number for March shows an encouraging pick-up in credit to large industry. On the other hand, personal loans (a proxy for loans to households) have seen a sustained pick-up. The robust rise in personal loans is driven by housing loans and vehicle loans.

As an outcome of these trends, the composition of bank credit has seen a perceptible shift. The share of personal loans in the overall outstanding credit increased from 25.6 per cent in 2018-19 to touch almost 30 per cent by the end of 2022-23. During the same period, the share of industry in the outstanding bank credit has declined from 33 per cent to 24 per cent.

Bank deposit growth was 9.6 per cent as of end March 2023. As credit growth (15 per cent) outpaced deposit growth, the credit-deposit ratio rose to 75.8 per cent, as of end March. Since the beginning of April, however, the incremental addition to deposits has exceeded the addition to credit. This has resulted in the credit-deposit ratio falling to 75 per cent as of 7 April and further to 71.92 per cent as of 22 April.

Equity markets started the new financial year on an encouraging note

After four months of subdued growth, the equity markets posted their best monthly performance in April since November 2022. While BSE Sensex gained 3.6 per cent, Nifty gained 4.1 per cent in April over March. With most of the advanced economies’ central banks signalling an end to their rate hike cycle, equity markets may continue to show recovery in the coming months.

Improvement in risk sentiments and inflows from foreign portfolio investors supported the markets last month. The recovery in the equity market in April was broad-based, with most sectors registering a positive return. Particularly, the rate sensitive sectors such as metals, infrastructure performed well in April. The IT index was the only one with negative returns.

Foreign Portfolio Investors were net buyers with net investment of USD 1,655 million in April.

Resurgence in services exports will aid in controlling the current account deficit

India’s services exports stood at USD 30.48 billion, a growth of 13 per cent year-on-year. March services imports recorded a growth of 6 per cent to USD 16.27 billion. Goods exports fell 13.9 per cent in March. Despite global challenges, India’s overall exports (merchandise and services combined) in FY 2022-23 (April-March) is estimated to exhibit a positive growth of 13.84 per cent over FY 2021-22 (April-March).

The rise in services exports will likely help to rein in current account deficit and shield the economy from external sector vulnerabilities. India’s current account deficit narrowed sharply to USD 18.2 billion (2.2 per cent of GDP) in October-December 2022 from USD 30.9 billion (3.7 per cent of GDP) in the previous quarter.

With a sustained rise in services exports, India’s current account deficit estimates for 2022-23 and 2023-24 are likely to be revised downwards.

Radhika Pandey is a Senior Fellow and Pramod Sinha is a Fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.