Data released earlier this week shows a contraction in Goods and Services Tax collections in August. The decline in tax revenue was to be expected. Since Covid-19 hit India, economic activity has been lower due to the lockdown. Lower economic activity means lower production, and thus, lower taxes. Based on expectations of lower activity, we expect tax revenues to decline by about 12.5 per cent for the year as a whole.

The data showed that the gross GST revenue collected in the month of August was Rs 86,449 crore, 12 per cent lower than the collection for August 2019.

Budget estimates of tax revenue for 2020-21 — Rs 16.3 lakh crore — were already an ambitious target over the previous year’s revised estimates of Rs 15 lakh crore. The estimates were based on a nominal GDP growth projection of 10 per cent made before Covid-19 hit India.

With the outbreak of the pandemic and the subsequent nationwide lockdown, nominal GDP growth and tax collections are expected to be lower. In a recent paper, we estimate the tax revenue for 2020-21 based on the lower expected growth.

Due to the pandemic, the economy is facing the twin shocks of widespread supply-side disruptions and large-scale reductions in aggregate demand. Although there has been a gradual relaxation in the lockdown from June 2020 onwards, the economy has been coming back to life only slowly. While rural areas opened up relatively quickly, urban India continues to see lower economic activity. Consequently, in the April-June quarter of 2020, India’s GDP contracted by 23.9 per cent.

Also read: Govt finances deteriorating. Postpone fiscal deficit goals, make economics more transparent

Nominal GDP growth will be zero

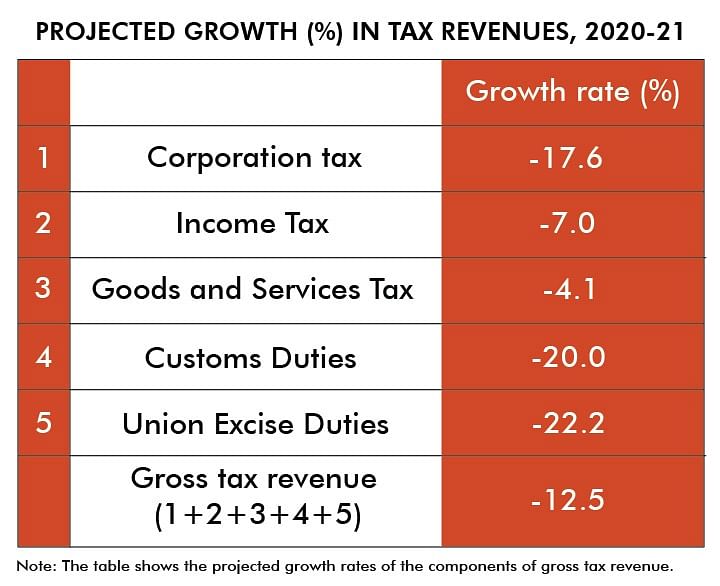

The central government earns revenues from five main types of taxes. The sum total of revenues obtained from these taxes is referred to as the Gross Tax Revenue (GTR). These include direct taxes such as tax from corporate profit and income tax (accounting for roughly 28 per cent and 26 per cent of GTR, respectively), indirect taxes such as GST, customs duties from non-oil imports and Union excise duties from oil imports (accounting for roughly 28 per cent, 6 per cent and 12 per cent of GTR, respectively).

We project the GTR for 2020-21 using a bottom-up approach. We start with the individual components of GTR (i.e. corporate tax, income tax, GST, customs duties, and excise duties) and calculate the long-term averages of the ratios of these components to the relevant aggregates such as nominal GDP, corporate profit, imports etc. Then, we multiply these long-term average ratios, with the projected values of the relevant aggregates for 2020-21.

Although it is difficult to come to a precise forecast of GDP due to the continuing uncertainty about the pandemic, a real GDP growth rate of -5 per cent for 2020-21 is what a number of economists and analysts expect. Consumer price index (CPI) inflation can be expected to be 5 per cent, given the recent surge in inflation. This gives us an expected nominal GDP growth rate of zero.

Also read: Why loan restructuring is a welcome move from RBI, and what govt now needs to do for borrowers

Tax collections won’t be same as last year

In other words, we anticipate that nominal GDP in 2020-21 will remain the same as in 2019-20. We expect that tax collections this year will be lower than last year because of the pandemic. Thus, instead of assuming that at the same nominal GDP levels, we get the same income tax and GST revenue as last year, we expect that these tax collections will be in line with the long-term average ratio.

Applying the average income tax-to-GDP ratio of the last nine years (since 2011-12 when the new GDP data became available) to the projected nominal GDP, we get a 7 per cent decline in income tax revenue for 2020-21. Similarly we get a decline in GST of 4.1 per cent.

We expect that corporate profit will fall by 20 per cent in 2020-21 compared to last year. Profits of the NIFTY50 companies listed on the National Stock Exchange fell by 15 per cent in the January-March quarter. The situation is likely to worsen significantly in the April-June quarter owing to the lockdown. Even if sales and profits improve later in the year, overall, we expect a 15 per cent decline in corporate profits for this year. This gives us a projected decline in corporate tax by 17.6 per cent.

In March, non-oil imports fell 21 per cent and in April, by 41 per cent. Accordingly, in our baseline scenario, we expect non-oil imports, and hence Custom duties, to fall by 20 per cent for the year as a whole. Finally, the value of oil imports may be expected to fall by 30 per cent owing to the reduction in oil prices. This gives us a decline in excise tax revenue by 22.2 per cent.

Our projections for the growth rates of the various components of GTR for 2020-21 are summarised in the table below. We predict that GTR will contract by around 12.5 per cent.

Financing the budgeted expenditure of Rs 30 lakh crore estimated in the Union Budget 2020-21, as well as the Covid-19 fiscal package, was already a challenge. With the additional challenges that lower tax collections pose, this is going to be an even bigger challenge.

Ila Patnaik is an economist and a professor at National Institute of Public Finance and Policy.

Rajeswari Sengupta is an Assistant Professor of Economics at the Indira Gandhi Institute of Development Research (IGIDR) in Mumbai, India.

Views are personal.

Also read: Why India has increased economic freedoms in response to Covid, unlike Europe & US

It is obvious India’s fiscal crisis can only get worse. The following are indicators.

The Economy shrunk after demonetisation. The BJP Hindus said people will shift to cashless card transactions and so sales will be taxed at the point of sale. It did not happen, Indians are back to cash and black economy works with Rs 2000 notes doubly well.

GST led to reduction in tax collection.

Covid mishandling and unplanned lockdown led to crippling of the economy.

Defence expenditure has rocketed due to Chinese pressure.

Modi has wasted taxpayer’s money on Patel statue, buying a plane for himself, central vista project, beating up student, CAA-NRC….

Due to loss of jobs, there is no purchasing power, so consumer demand is down.

Banks are in trouble.

Gov.t. assets are being sold at low prices. All deals favour Ambani and Adani, so the rich get richer, but not the majority.

RBI is raided to finance govt..

Still, it is fine according to Hindus. Because India works on dharma, not on economy and jobs like other countries.

Stop disobeying govt or else get beaten like caa protesters

The BJP has given the Hindus its main promise : Hindutva.

The economy was secondary .

Hindus should be satisfied. They knew what they voted for, they got what they desired. They were convinced a chai wallah doubling as a chowkidar was in the best interests of Hindus.

The BJP govt. is acting like a monkey that has its fist stuck in a tender coconut with a small opening. It does not want to let go off the contents by opening its fist and it cannot get rid of the coconut if it does not open its fist. The economy was doing well in 2016. They brought in the GST with back breaking tax rates. They were under the impression that when the economic activity is fine they can tax away to glory. Jaitley, no finance man in the first place, did away with most tax concessions to ensure that all the money was cornered in govt. hands. Retrospective tax stayed. LTGC in equities was cancelled. All capital gains bonds had to be locked in for 5 instead of 3 years. Almost everything came under the tax net. Can you imagine cement attracting sin tax? Old cardboard, waste paper and plastic and even second hand furniture attracted 18 percent GST. On every transaction the small business man found that the govt. was cornering more by way of tax than the business man was getting by way of profit. With high prices because of high taxation, peoples appetite to spend came down steadily. The MV act made regulations stringent mindlessly. BS IV to BS VI in double time was a cruel joke. The draconian lock down with zero flexibility was a morale breaker. People were locked down wherever they were with no scope to even get back home for 2 months. Industry captains appealed for more time in case of the MV act and migrants in case of the lockdown. People became infected wherever they were confined which became hot spots. They were then allowed to get back after 2 months of torture and then Covid 19 spread like wild fire bringing India to second spot in the world in infections. Mindlessly harsh MV regulation killed auto sales. Why would people want to buy cars it they are penalised for petty things. Imagine Gadkari in charge the road transport ministry of all the people. He can make roads but understanding the technicalities in emission is like trying to teach a lay man automobile engineering. Obstinacy in enforcing unreasonably harsh laws and trying to tax a nation into prosperity are the two cardinal faults of this govt. Modi needs to listen. Bashing on regardless with Man Ki Baath and sermons will lead to further pain. They need professionals in charge of ministries. At the local level funds are being squandered on useless projects. If you wangle money as tax and squander it, remember, I as a tax payer will penalise you for it. The BJP must remember that trampling on its vote bank is going to prove costly. You promised Hindutva and I got tax terrorism and harsh regulation. Not a good return at all.

‘You promised Hindutva and I got tax terrorism and harsh regulation. Not a good return at all.’

The BJP will say that they promised Hindutva and they gave Hindutva. There is a speech of Modi to elite suited and booted people gathered round dinner tables in a 5 star hotel, listing the status of his promises : Article 370, Done; Ram temple, Done, CAA, Done…..The audience roars and claps.

For the bulk of Hindus, Hindutva is the most important. They have no issues with the economy, they think it is the world situation.

‘Mindlessly harsh MV regulation killed auto sales. Why would people want to buy cars it they are penalised for petty things. ‘

According to Sitaraman, auto sales decreased because the young generation prefers Uber.

This is the result of Modi’s excessive greed and harassment of the productive to benefit the non productive since 2014 capped by his counter productive handing of China’s bio war has recoiled in a growing fiscal crisis.

A economic contraction of 24 basis points (24 %, or nearly a quarter of the economic productivity ceasing to exist). Only Peru and Macau have shown greater economic contractions.

This is inevitable as Modi Sarkar has eradicated the small and medium businesses since 2014 with his policies and the daily wage workers by “Lock Down”. These comprise a very large percentage of Indian productivity in a country dominated by unproductive capital and human resources in Government hands.

It is unlikely that Modi Sarkar can bring India out of this deep contraction.

Modi Government is antithetical to Indian economic growth.

Since 2014, they have reinforced the economic policies of previous government and added profligacy and recklessness of their own, all of which have stifled the productive to the benefit of the unproductive and crony businessmen.

India has been in a depression right since 2016, or thereabouts, Two Government Statisticians even quit service when asked to concoct the figures that Modi Sarkar presented to the public. The depression has been growing since then and has merely been exacerbated by COVID 19. Next to Peru and Macau, India has had the most severe contraction of any country in the World.

I very much doubt that the BJP which has not a clue about economics beyond continuing to indulge in atrocious “For Government, By Government, To Government” profligacy which has been pampering the unproductive while crushing the productive with greater gusto than any previous Government, will do anything about it other than using the opportunity to find more ways to prosper the Judges, Bureaucrats, Police, Politicians, Crony Businessmen and the Constitutionally preferred sections of society and foreign Governments at the cost of the rest of India even more than it has since 2014.

The recession is the result of Modi’s enormous greed and fascist “Tax and Waste” methods reflected in GST, demonetization, Lock Down, and taxing oil to maintain prices against a global fall and so on, to fund his multi appeasement policy:

(1) Appeasing with doles, increments and pampering of Moslems, Christians, SC, ST, BC, OBC, Judges, Bureaucrats, Police, Politicians, Public Sector and Crony (election bond) Capitalists at the cost of the rest of the Nation

(2) Bribe diplomacy of giving doles and aid to countries in competition with a far wealthier and more powerful China at the cost of Non VIP Indian citizens and India

(3) Appeasing China by running up a trade deficit with China larger than India’s defense budget and taking advantage of India’s woeful lack of indigenous ability and capacities in governance, science, technology, integrity, quality and engineering to purchase arms from the remaining four Permanent Members of the UN Security Council with scant regard for India’s best interests in terms of economy, value for money, military strategy, tactics and readiness, and,

(4) Most importantly bolstering and formalizing the Corruption established by the very first Prime Minister with the following measures:

(a) His Government has created “Election Bonds” to foment political corruption without any accountability and with invisibility.

(b) His Government has made an “anti corruption law” that criminalizes the victim of extortion, the so call “bribe giver” which will ensure that those who are forced to pay sums of hard earned money to Government employees to receive timely services and entitlements from Government Departments and PSUs dare not even complain about it lest they be sent to jail for seven years on “own confession”

(c) His Government retrospectively amended the Foreign Currency Regulation Act to legitimize money laundering by Political Parties.

(d) His Government exempted lawyers from GST so that there may be no obstruction to Judicial corruption”

(e) Exempting Agricultural income from Income Tax to facilitate money laundering by Judges, Bureaucrats, Police and Politicians who, ostensibly and for the record own unbelievably productive farm land through the simple expedient of purchasing crops from genuine farmers with extorted cash and selling it to marketing organizations as the produce of their own fallow land!

I have been saying all this right since 2014, when, after campaigning for the BJP, I became NOTA immediately after Modi’s first Act and thereafter have remained NOTA ever since but now veering around to support the opposition, any opposition, as the “lesser evil”. Manyawar Yashwant Sinha’s book on the subject covers a part of Modi’s consistently anti National and anti People economic policy.

‘This is inevitable as Modi Sarkar has eradicated the small and medium businesses since 2014 with his policies..’

There is a video of Modi proudly boasting that after demonetisation, 3 lakh businesses were shut down. The point he makes is that all these were running on black money. At that time, BJP Hindus applauded him for tackling corruption.

And amongst all his tax and waste schemes, you did not mention :

Buying a Boeing so he can travel like the US President.

Vanity project to reshape buildings around Parliament house

Tallest statue for Patel, built in China

Go shalas

Brand suit everyday

Foreign trips to bask in front of NRIs

Bullet train

PM Cares fund

But despite all these, Hindus adore him – because he beats up Muslims.

Dr Pronab Sen estimates 32% contraction for the first quarter, 14% for the year as a whole. That will impact tax collections quite savagely. Some feel the government should spend more, to support the economy. I believe it should practice austerity. Scrapping the Central Vista redevelopment project would send out a message of solidarity : We feel your pain.

Till economy picks up n lockdown is lifted, thou it will be painful to the consumers,

Why not double up the current tax surcharge on diesel, patrol , alcohol etc to run the centre n State govts. Consumers will understand the reasons of this unavoidable step. Congress n opposition parties shud refrain from fishing in the troubled waters.

Breed desi dogs and play desi toys,.