Chennai: When Tamil Nadu chief minister MK Stalin was handed the black pair of Crocs on 29 November, the first thing he did was to turn them over to look at the words embossed on the soles: Made in India.

“Now we can do this right here in Tamil Nadu!” he exclaimed, according to a businessman present at the meeting.

The simple pair of black Crocs with a red strap — the questionably stylish brand that has fought a hard battle to find its way to fashion fame — is holding out a global promise for Indian industry in the state of Tamil Nadu. With Crocs now being manufactured at a new footwear park in central Tamil Nadu’s Perambalur, India has entered a new market: that of non-leather footwear.

And it’s not just Crocs. Shoes for brands like Nike, Adidas, and Puma will also be manufactured in Tamil Nadu by Taiwanese giants, as the world pivots towards a new China+1 strategy to diversify production and supply chains. Combined with the sustainable potential of non-leather footwear, and Tamil Nadu’s manufacturing bullishness and robust female workforce, the move is a trifecta of sustainability, diversity, and foreign investment.

And these shoe factories can now foot India’s manufacturing dreams.

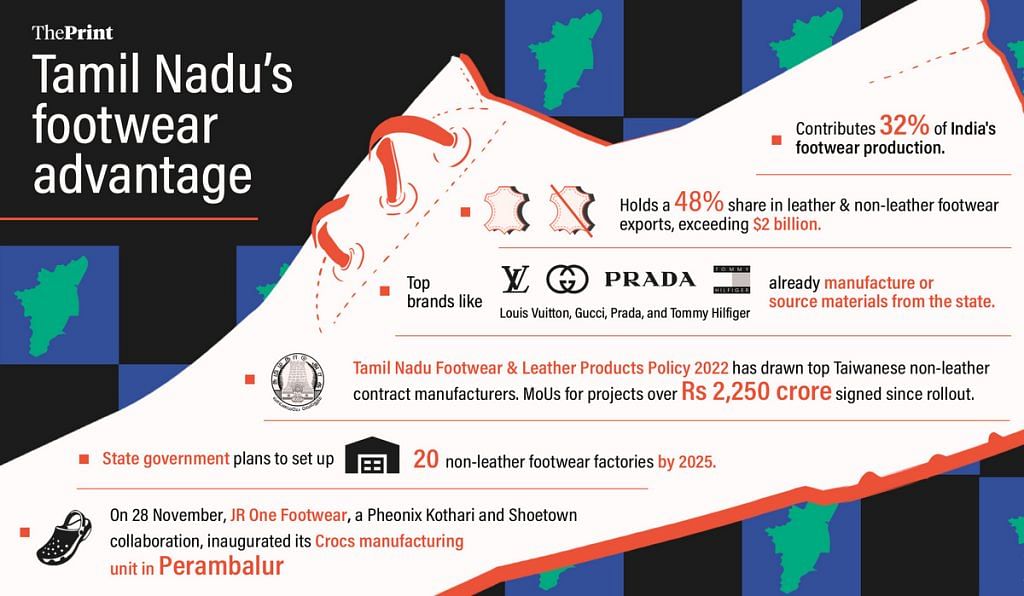

India, long dismissed as lagging behind Vietnam and Indonesia in manufacturing and exports, now has its first component manufacturing cluster in the Perambalur park, which was built and operational in exactly one year. The Crocs factory, a joint venture between Taiwan’s Shoetown — Nike’s biggest contract manufacturer — and India’s Phoenix-Kothari Group, has already made prototypes and will soon be producing for consumption, just ahead of the state’s global investors’ summit in January 2024. Other Taiwanese companies are following suit, with plans to set up plants across Tamil Nadu.

With this first-mover advantage, Tamil Nadu has sketched an impressive arc of investment for itself — from automobiles to electronics and now non-leather footwear.

For context, India accounts for 13 per cent of the world’s total leather goods, exporting $4.25 billion worth of leather in 2022, of which Tamil Nadi holds a 48 per cent share. Leather from the state is being used by global luxury brands like Ferragamo, Prada, and Louis Vuitton. By comparison, India’s non-leather footwear exports were only $214 million in 2021-2022, but Tamil Nadu is poised to change that.

The fact that Taiwanese companies are choosing the state to set up non-leather shoe factories over other potential contenders like Indonesia, Bangladesh, and Cambodia signals an edge for India, according to industry experts. What helped pave the way was Tamil Nadu’s 2022 footwear and leather products policy, which offers subsidies and support for foreign investment. The state has since signed MoUs for investment projects worth at least Rs 2,250 crore in this sector.

Then, the Indian government implemented quality control norms for the footwear industry in 2023, raising the standard of imported components and boosting domestic production— right on time for Tamil Nadu.

“The potential in this sector is vast,” said TRB Rajaa, Minister of Industries of Tamil Nadu, adding that the new footwear park in Perambalur and the DMK government’s sector-specific policy will capitalise on it. “Each large factory has the capacity to employ tens of thousands, and our ongoing negotiations with numerous international firms are promising. We are optimistic that Tamil Nadu will soon become a primary manufacturing location for all major global footwear brands.”

For many market watchers, Taiwan’s entry into Tamil Nadu is a gateway to realising India’s manufacturing dreams. But geopolitics is a major factor, and timing is of the essence.

Also Read: Morbi is India’s undisputed tile champion. Now this Gujarat town is eyeing China’s crown

China+1 strategy

The Big Four of the non-leather footwear industry — which includes everything from bathroom slippers to sandals to heels to sports shoes — are Shoetown, Feng Tay, Pou Chen, and Hong Fu.

Between them, these players churn out all the footwear of brands like Nike, Adidas, Reebok, Puma, Converse, and Crocs. Now, all four are setting up shop in Tamil Nadu, with a fifth big contract manufacturer potentially joining the mix.

For many market watchers, Taiwan’s entry into Tamil Nadu is a gateway to realising India’s manufacturing dreams. But geopolitics is a major factor, and timing is of the essence.

“The China+1 window has opened up, but it’s not open for long,” said Irshad Mecca, director of Farida Shoes, a leading manufacturer and leather exporter based in the leather hub Ambur. He estimates India has about three years to put its foot in the door and beat footwear competitors like Indonesia and Bangladesh.

We have to shed our ‘skill’ mindset and shift to a ‘scale’ mindset to compete… This transition will determine how domestic players fare when compared to foreign players.

-Irshad Mecca, director of Farida shoes

A good business relationship between India and Taiwan has sweetened the deal. And it helps that there are now direct flights from Tiruchirapalli airport to Southeast Asian countries, along with the proximity of industrial parks like Perambalur to Chennai and all of Tamil Nadu’s ports.

“We’re late on footwear — Japan and Korea dominate automobiles and electronics already. Every other country is saturated. India offers promise, but now the industry could add local value instead of simply being an export offering,” said Aqeel Panaruna, who runs Florence Shoe company and is the former chairperson of the Council of Leather Exports. “For the next two decades, we’ll have a boom of non-leather manufacturing exports, so it’s good that India is riding this growth wave.”

Panaruna has been tracking the shift from leather to non-leather keenly. Tamil Nadu currently accounts for about 48 per cent of all leather shoe exports from India. And now, he expects the state to be responsible for two-thirds of all exports in the footwear sector with the latest Taiwanese entrants. The other close Indian competitor is Haryana, which leads in the domestic market.

Three key factors make Tamil Nadu especially alluring for global non-leather footwear companies, other than its general standing as a global manufacturing hub, according to Industries Minister Rajaa.

The first is that the state boasts one of the oldest leather clusters in India, with a history spanning over a century. “This rich heritage has fostered a dynamic footwear ecosystem and established international business connections, enabling a seamless transition to meet the non-leather sector’s demands,” Rajaa said. The second factor is the participation of women in Tamil Nadu’s workforce, giving it another competitive advantage. And the third is the state’s commitment to addressing environmental concerns by promoting renewable energy. According to reports, the state is aiming for 50 per cent green energy in its grid by 2030.

Tamil Nadu’s rich heritage (in leather) has fostered a dynamic footwear ecosystem… enabling a seamless transition to meet the non-leather sector’s demands

–TRB Rajaa, Tamil Nadu industries minister

Manufacturers are optimistic that Tamil Nadu is just the starting point. “Aatmanirbhar Bharat is an important programme,” said Dr. Rafiq Ahmed, chairperson of the Phoenix Kothari Group that set up the Crocs factory in Perambalur. “This kind of industry should be built up in states where employment is required.”

The success of Phoenix Kothari’s partnership with Shoetown has set a positive precedent for other domestic players. Other states like Odisha have invited Ahmed to set up factories there too, offering huge subsidies for Taiwanese partnerships. Madhya Pradesh and Maharashtra want some of the action too, he said.

Non-leather footwear is a cheaper, faster alternative— twice as many shoes can be produced in an hour compared to leather.

Advent of athleisure

The rise of athleisure clothes and shoes during the pandemic changed the game.

Sports shoes replaced leather loafers, leggings took over from jeans, and a hoodie is now as acceptable as a blazer in the workplace. Women workers have traded sandals and slippers for sneakers, even pairing them with traditional Indian clothes as they prioritise comfort over convention.

This shift presents a golden opportunity for the non-leather footwear industry. Sultana Parveen, 28, a nine-year veteran at a northern Tamil Nadu shoe factory, embodies this new era.

She assembles sneakers on the factory floor, with her own pair of comfy shoes snug on her feet—she bought them at a good price during a Flipkart sale, she said a little sheepishly, and not from the factory. Like most global consumers today, she puts a premium on comfort and cost over big names and brand loyalty.

Parveen’s factory is keeping up with new trends too and is pivoting from leather to non-leather footwear. She says she has only started assembling non-leather shoes in the last few months.

Behind her, around 20 deft pairs of hands transform a piece of rubber at one end of a conveyor belt into a fully formed running shoe by the other end.

Non-leather footwear is a cheaper, faster alternative— twice as many shoes can be produced in an hour compared to leather. It’s also safer for the worker with fewer rejections due to quality. And it’s work that doesn’t require a higher degree or specialised skills, making it a good option for workers like Parveen, a 10th-class graduate. As a recent divorcee with no children who lives with her family, her salary goes straight into her savings for gold jewellery. Perhaps even a house one day.

With Tamil Nadu investing heavily in non-leather footwear, it’s women like Parveen who will carry the industry. Of the 1.6 million women factory workers in India, 43 per cent work in Tamil Nadu alone. Many workers are also expected to be transplanted from the state’s already thriving garment industry, as the materials they work with will be similar. And going by the enthusiasm of all involved — from the government to corporations to workers — this nascent industry could be the start of a manufacturing revolution in Tamil Nadu.

As the investments pour in and factories rise up, anxieties are also swirling that existing domestic players — especially those that work in leather footwear — might get eaten up by Taiwanese giants.

The road to investment

Perambalur, carved out of the larger, more bountiful Tiruchirapalli, is undergoing a remarkable makeover. Once written off as a poor district in the hinterlands, it has, in just one year, become the sole cluster for component manufacturing across the entire country.

The State Industries Promotion Corporation of Tamilnadu Ltd (SIPCOT) industrial park and the shoe factory were inaugurated in November 2022, attracting international attention. Delegations from countries like Taiwan, China, Korea and Vietnam have been dropping by to see what the fuss is about.

“Perambalur is accessible by road and has good quality power,” said M Vijayabaskar, professor at the Madras Institute of Development Studies and member of the State Planning Commission, on why the site is a good idea. “The big challenge for manufacturing to move to backward areas is the absence of infrastructure. Here, Tamil Nadu has an edge in terms of relatively well-distributed infrastructure.”

Perambalur’s hopes are now pinned on the footwear industry. The centrally located district was only earmarked for the project when Phoenix Kothari’s Ahmed bit the bullet and bought the land in mid-2022. The Tamil Nadu government, he says, readily backed the move.

“Everyone thought I’d gotten stuck with an impossible plan,” said Ahmed. “But we succeeded — because Shoetown wanted to set up in India. When we, as the local partner supported them, it sealed the deal,” he added. The global giant teaming up with an Indian firm for both domestic and export markets was the first collaboration of its kind in the footwear industry.

The Make in India dream is happening. It’s not us, it’s the world that will go crazy over Made in India

-Rafiq Ahmed, chairman of the Phoenix Kothari Group

But Taiwanese companies have had India in their sights for years. So far, around 250 Taiwanese firms have invested $4 billion in India. They see India as the “next big destination”, say industry experts. Recent successes, like Foxconn’s iPhone 15 assembly in Sriperumbudur, Tamil Nadu, reinforce this confidence. Other cross-industry collaborations are in flow too. A 15-member garment delegation from Tamil Nadu visited Taiwan in October 2023, and future exchanges are planned. Tamil Nadu is also holding a huge global investors summit in January 2024, in the hope of wooing further investment.

Even in the non-leather footwear sector, Taiwanese tie-ups aren’t new. Feng Tay started to invest in Tamil Nadu as early as 2006, and now has factories in Cheyyar and Bargur. Apache also has a factory in Andhra Pradesh. However, these are simply contract manufacturing plants utilising Indian land and labour.

“Feng Tay was the pioneer, and now there’s a flood of interest,” said industries secretary Arun Roy. “The renewed interest is partly because of two things: the China + 1 strategy, the way that Feng Tay has thrived. And that’s given a lot of confidence to investors.”

Now, with the four huge upcoming Taiwan-India factories in Tamil Nadu set to exclusively use locally made components, the state could wrest the manufacturing mantle out of competitors’ hands. And put India firmly on the manufacturing map.

Skill vs scale, leather vs non-leather

As the investments pour in and factories rise up, anxieties are also swirling that existing domestic players — especially those that work in leather footwear — might get eaten up by Taiwanese giants.

Ambur, near Vellore in northern Tamil Nadu, is a hub for leather tanneries and factories. Most of them are officially classified as medium and small enterprises and rely on a skilled labour force. The closest competition to Ambur so far is Uttar Pradesh, with Agra and Kanpur being major leather hubs, but the industry is more unorganised there when compared to Tamil Nadu. Now Ambur’s leather factories are grappling with the looming threat of Taiwan’s mechanised might in the large-scale manufacturing of non-leather footwear.

Those who can have quickly begun to pivot.

“We have to shed our ‘skill’ mindset and shift to a ‘scale’ mindset to compete in this industry,” said Mecca of Farida Shoes. “This transition will determine how domestic players fare when compared to foreign players.”

While Tamil Nadu’s new footwear policy offers incentives for foreign players looking to diversify their production from China, it also provides opportunities for the domestic industry to adapt and become more competitive, according to industries secretary Roy. “This is something that’s aligned with our own industrial policy because it goes to rural areas,” he said.

Both Mecca and Panaruna, experts in leather goods, emphasised that working with the material is an extremely niche skill. “Leather is an art, it’s a handicraft that requires skill,” said Panaruna. “Non-leather is mechanised, which means it can generate more employment for a larger segment of people.”

Leather footwear factories, already the first choice for non-leather products by brands like Decathlon, Bata, and Skechers, present opportunities for both smaller players in the domestic market and larger players in exports.

Mecca advised strategic decision-making. “We need to choose our game wisely— to play in the niche segment, like the Europeans, or in the scale segment, like the Chinese and Taiwanese. If it’s niche, then we need to start investing on innovation and design,” he said.

Some industry leaders are hoping that the Taiwanese wave could improve standards in India. Ahmed, for instance, has sent several employees for training in his partner’s existing facilities in Vietnam and Indonesia to implement best practices.

“The Make in India dream is happening,” said Ahmed. “It’s not us, it’s the world that will go crazy over Made in India.”

Also Read: Hyderabad wants to be smart, efficient. But face recognition tech, CCTVs making it paranoid

Potential problems

Tamil Nadu, India’s most industrialised state, is aggressively positioning itself as a destination for foreign investment and new industries, exemplified by the rapid establishment of the Permbulur footwear park.

However, while the non-leather footwear industry offers promise, it’s still nascent. Labour lawyers and grassroots organisations are keeping an eye on the developments. Situated at the intersection of leather and garments, whose challenges are known, the non-leather footwear industry remains uncharted territory.

Perambalur will be a huge source of cheap labour, as there aren’t too many industries around, according to a local worker at an NGO. While the Taiwanese firms are expected to pay Rs 13,000-15,000 a month, local workers say that the average salary is only around Rs 8,000.

While the local leather industry could take a hit, producing non-leather footwear could be an overall improvement for workers — though it is too soon to tell. Leather work in India carries a complex sociopolitical baggage, largely employing Dalit and Muslim labour. Numerous health and safety concerns, particularly around tanneries, further plague the leather industry.

Industries minister Rajaa says Tamil Nadu stands out for its diverse workforce, pointing to practices that support the participation of women, such as the provision of childcare facilities in factories.

“We are sure that as new sectors emerge and grow, they will also adopt these successful practices,” he said. “We continuously strive to enhance the experience of women in our workplaces.” He added that the government trusted that the companies — with their global clientele and customer base — would adhere to the highest standards and reinforce the state administration’s commitment to a secure and inclusive workforce.

The aspiration is that the success of the footwear park will influence the broader Indian manufacturing ecosystem, akin to how Foxconn set the trend with the iPhone — now the Tata Group has followed up and will produce India’s first homegrown iPhone.

“We need Chinese technology when it comes to manufacturing,” said Ahmed. “And Taiwan is the gateway to this tech.”

(Edited by Asavari Singh)