Morbi: The air in Gujarat’s Morbi is thick with grit as workers pour out of towering factories, loading freshly baked, furnace-warm tiles onto waiting trucks. These slabs — 4 million square feet of them churned out daily— will soon be the base for toddlers’ first steps, the click-clack of heels, and even the walls of dream bathrooms worldwide. Yet, Morbi, India’s undisputed ceramic king, craves more. China’s shadow looms and there’s buzz about a masterplan to topple the tile titan.

Morbi is revving up for a power boost, with a 425-hectare ceramics park expected to come up in the next six months. About 100 kilometres away in Rajkot, engineers are getting ready to build Made in India machines for these factories, ditching the old reliance on imports from the European Union.

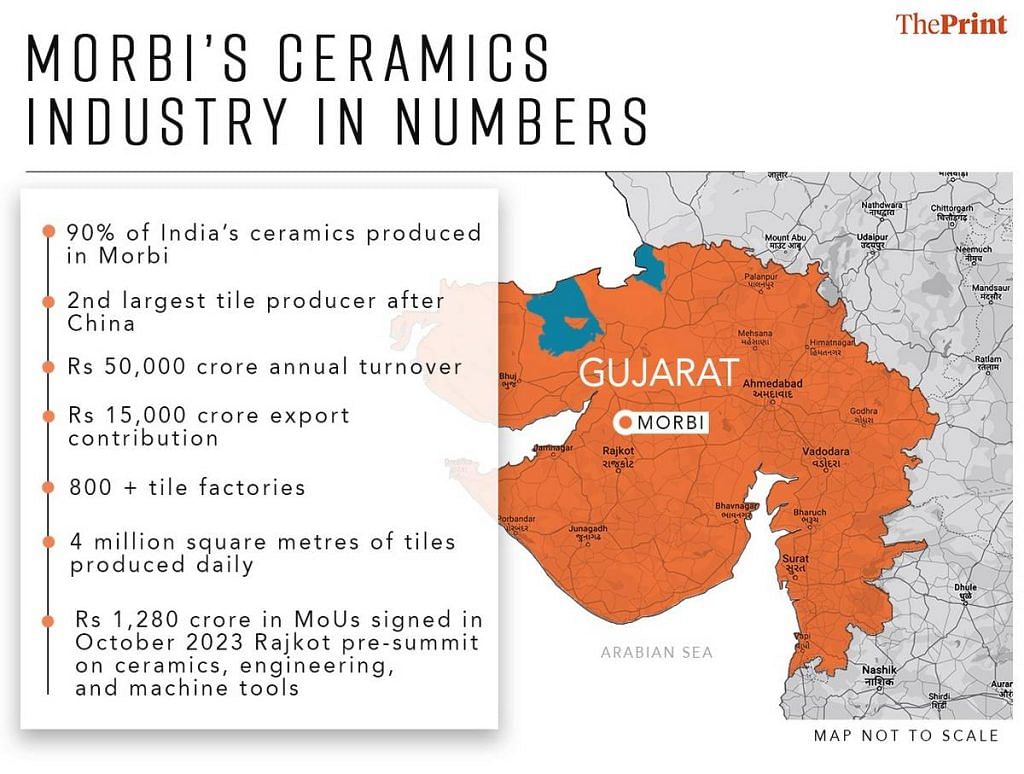

Right now, the dusty district is home to over 800 tile factories crammed into a 60-kilometre radius, accounting for 90 percent of India’s tile production—second only to China. The annual turnover is about Rs 50,000 crore, with exports constituting Rs 15,000 crore, according to government data.

Although the market size is one-fourth that of China’s, the dreams here are larger than life. Demand is only growing worldwide and in a post-Covid world, industry leaders are optimistic about flipping the game as early as within the next half decade.

“After Covid, a lot of European companies have become allergic to China,” said Mukesh Bhai Kangariya, president of the Morbi Ceramic Tiles Manufacturers Association. “That business is shifting to us, we’re thriving and growing at a faster rate. We’ll soon leave China behind.”

In Gujarat’s development story, the ceramics industry has been a major growth engine. But so far, Morbi’s tile industry has been cruising on self-drive mode and lacks the organisation and infrastructure to climb to the next level, claim industry leaders.

However, change seems to be in the air. The state government is spotlighting the sector as it gears up for the 10th edition of the Vibrant Gujarat Global Summit, scheduled for 10-12 January 2024. In October this year, seven agreements for investments exceeding Rs 1,280 crore were inked in the Rajkot pre-summit focusing on ceramics, engineering, and machine tools.

Now, the call is for the government to push the pedal on more subsidies and investments to propel the industry to the next level.

The Chinese industry’s compound annual growth rate (CAGR) is less than 5 per cent, while India’s is at 8.94 per cent, according to projections for 2023- 2028.

Also Read: Politics, influence, caste — the murky loan dealings of Gujarat’s cooperative banks

All fired up

Sprawled across an acre of land, Segam tiles factory is one of Morbi’s many tile powerhouses, employing hundreds and pumping out 11,000 boxes of the product, in all shapes and sizes, every single day.

The volumes make it look quicker and easier than it is—tile-making is a complex, multi-step process. First, in-house research teams scrutinise the raw material— sand— and then fortify it with special machines. After that, the material takes a fiery journey through electric brick kilns. After undergoing kiln treatments twice, taking over an hour to solidify, the tiles are digitally glazed, printed, and carefully packed into cardboard boxes before being dispatched to various destinations in huge trucks.

It’s a complicated, risky, and expensive business, but Morbi’s industry insiders say it will all soon be even more worth the trouble. According to them, tiles will be the next big thing in home and office interiors within the next two years.

Domestically, they’re eyeing the markets in Northeast India, where tiles are only now coming into vogue. Meanwhile, in cold European countries, the trend is shifting from carpet-laid floors to central heating under tiles. And more corporate offices are opting for the sleek aesthetics of tiled walls.

China signs long-term agreements with companies for fuel prices. That’s the kind of formula Morbi needs

-Nilesh Chetparia, former president of the Morbi Ceramics Association

Even though China’s market at over two lakh crore is about four times bigger than Morbi’s, industry leaders are hopeful that they will be able to leverage waning faith in doing business with the East Asian country, particularly after the pandemic. They are betting that European countries, disillusioned with China, will soon open their arms more widely to Gujarat for their tiling needs.

But to reach the top position on the global stage, the MoUs worth Rs 1,280 signed in Rajkot aren’t going to cut it, according to Kangariya.

“These MoUs signed in every district aren’t very beneficial to the industry as such. Perhaps the companies who sign MoUs will get priority for business, that’s it,” he said.

To outshine China, industry leaders are looking at more affordable rates of gas and other tax subsidies so they can offer more competitive rates.

“We’ll definitely beat China in the next 5-7 years,” said Nilesh Chetparia, former president of the Morbi Ceramics Association. “This is as long as fuel cost is controlled. If Morbi can become such a big industrial hub without any help, developing clusters for manufacturing and ensuring ease in business will bolster the business.”

The industry might just be onto something. The Chinese industry’s compound annual growth rate (CAGR) is less than 5 per cent, while India’s is at 8.94 per cent, according to projections for 2023-2028.

However, in 2022, China pushed out 9,000 million square metres of tiles, but Morbi, per government estimates, was at a comparatively modest 1,200 square metres.

Now, all eyes are on that promised ceramics park— the game-changer that might just help Morbi leave China in the tile dust.

Morbi’s recipe for tile supremacy has a few essential ingredients—proximity to Mundra port, access to raw materials from Rajasthan, and the entrepreneurial spirit of the Patel community.

‘City hasn’t grown with business’

Morbi’s development hasn’t kept pace with its Rs 50,000 crore industry. The roads are in disrepair, frequent truck movements lead to jams, and the absence of a centralised industry hub leaves key players—manufacturers, suppliers, retailers, and customers—scattered unevenly across the city.

“The city has not grown the way the business has,” said Jeetendra Singhania, one of the owners of Nice Tiles, a manufacturer, adding that basic facilities like adequate drinking water facilities and public transport are crucial for creating a thriving business environment.

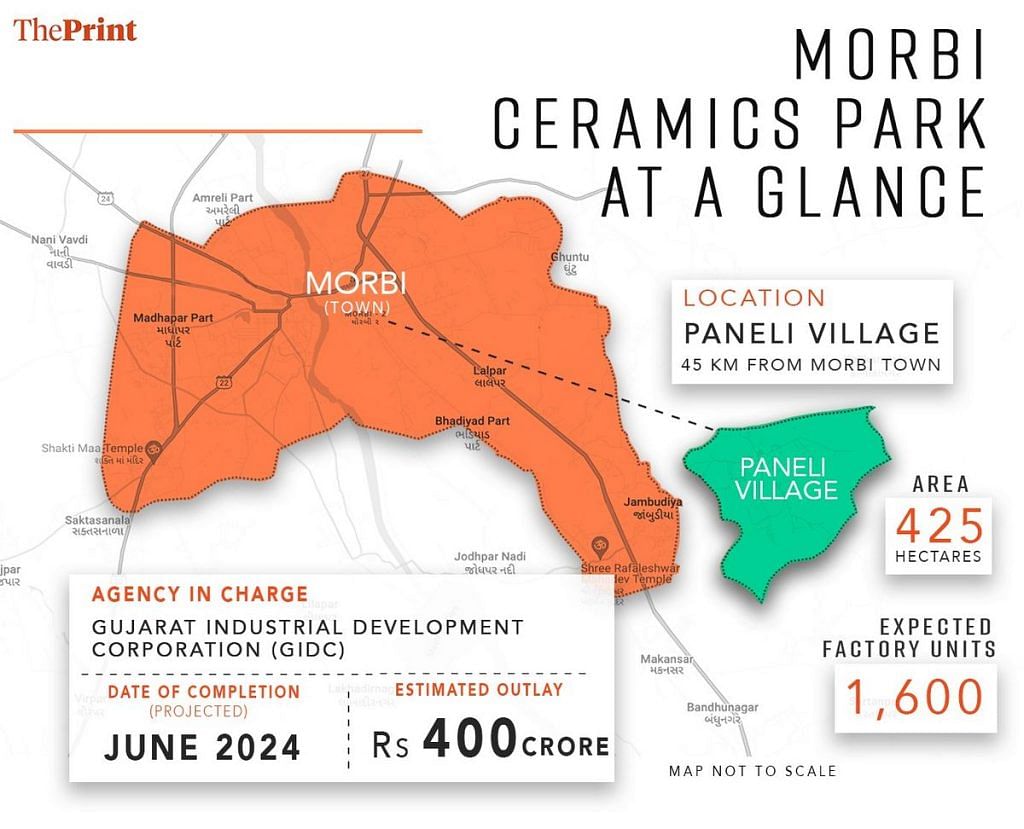

The much-touted solution to these challenges is the promised ceramics park, envisioned as an industrial cluster flush with facilities in Paneli village, 45 kilometres from Morbi city.

The government has acquired 425 hectares of land, on which 1,600 factory units are expected to be built, or shifted, officials in the Gujarat Industrial Development Corporation (GIDC) said on condition of anonymity. The work is expected to be completed in June next year.

However, some industry leaders question the practicality of the cluster concept. One manufacturer, on the condition of anonymity, asked how it would be practical to shift his entire business, including heavy machinery, to a park that is nearly 50 kilometres away.

Everyone wants more clarity. “The policy of the ceramics park should be made very clear. How much area will we get? Will the land be cheaper than what we can buy outside? How much will a person get if they want to sell the land— because they wouldn’t be able to do it without government intervention or permission? So what benefits are we getting?” asked Chetparia.

If manufacturing is done in Rajkot, then it will lead to 25 per cent savings in costs for businesses

– Narendra Pancholi, president of the Rajkot Engineering Association

On concerns such as these, a GIDC official suggested that clusters are the perfect habitat for industries to thrive, facilitating ease of business, transparency, and cost reduction.

“Where does a lion stay? In a jungle. He thrives in a jungle. In the same way, businesses thrive in clusters. It will bring together manufacturers, retailers, suppliers, and workers in one place,” he said

Made-in-India machinery, China formula

To slash the manufacturing costs of tiles, the government has facilitated the signing of an MoU between the Rajkot Engineering Association and select tile manufacturers in Morbi.

This MOU, part of a pre-summit of the Vibrant Gujarat Global Summit, is a step toward ensuring that machinery for making tiles is built within India instead of being imported.

Narendra Pancholi, president of the Rajkot Engineering Association, said that machinery for ceramics is currently imported from European countries like Switzerland, Germany, as well China.

He also pointed out an existing practice that “makes no sense”—machine parts manufactured in Rajkot are exported to Europe for assembly, after which the finished product is imported by Morbi tile-makers. “If manufacturing is done in Rajkot, then it will lead to 25 per cent savings in costs for businesses,” Pancholi added.

For tile manufacturers, the swift acquisition of machinery is crucial due to rapid wear and tear—some estimates suggest replacements are needed every six months. This aspect makes the business particularly risky and costly, industry experts said.

Technological advances in the ceramics industry are fast-paced, said Dharnendra Bhai Singhania, co-owner of Nice Tiles and a 25-year veteran in ceramics. “Every six months there’s a technological shift, and to stay ahead of the curve one has to invest in the machinery. This makes tile-making one of the toughest businesses to survive in,” he said. If machines are built in Rajkot, it will be good for the industry, he added.

Chetparia, however, argued that what’s even more necessary is for the government to take a cue from the China ‘formula’— specifically subsidising fuel costs and steering the industry toward greater organisation.

“China signs long-term agreements with companies for fuel prices. That’s the kind of formula Morbi needs,” he said.

Patels, port, and pipeline

Morbi’s recipe for tile supremacy has a few essential ingredients—proximity to Mundra port, access to raw materials from Rajasthan, and the entrepreneurial spirit of the Patel community.

Several decades ago, it all began as a way for Patel farmers to make some extra side income, said Mukesh Bhai Kangariya at his factory-cum-office in the city.

“The Patels started erecting kilns on their farms and that’s how the business of making tiles started in Morbi,” said Kangariya, who also belongs to the community. “Since the very beginning, community members have been helpful to each other. We’re transparent and supportive and help families raise funds to start their business.”

In the beginning other communities (other than Patels) were also involved in the business. But they didn’t survive for long because they didn’t enjoy this kind of community support

-Dharnendra Bhai Singhania, owner of Nice Tiles

The first ceramic tile plant in 1985 marked the beginning of Morbi’s journey to becoming India’s tile champion. And from the outset, business owners were committed to keeping pace with global trends.

“When some traders and businessmen went to China in the 80s, they saw that the world was moving from mosaics to vitrified and ceramic tiles. They acquired the know-how to make the new generation of tiles and passed on the knowledge to other traders back in India. To keep up with a changing world, Morbi quickly transformed to making ceramics,” Kangariya added.

Even today, 99 per cent of manufacturers in Morbi belong to the Patel community, providing direct and indirect employment for 4-5 lakh people, according to him.

“In the beginning other communities were also involved in the business, working from Rajkot. But they didn’t survive for long because they didn’t enjoy this kind of community support,” said Dharnendra Bhai Singhania of Nice Tiles.

Setting up a factory for ceramic tiles requires an investment of at least Rs 50-100 crore, and one can start making losses very quickly because the set-up is expensive and vast, he explained. “Within families here, responsibilities are split between various members and so are investments. Therefore, it was easier for the Patels to thrive in the business.” Kangariya added that on average every company has 20-25 partners to share the risk and profit.

While business practices may verge on parochial, global connections and tech advances have been game-changers.

Morbi’s proximity to Mundra port facilitates tile exports to over 180 countries, while in 2001, during Narendra Modi’s tenure as Gujarat Chief Minister, a gas pipeline from Qatar streamlined the industry and cut production time.

“We used to have tunnel kilns in which tiles were made from crude oil. Production time was 24 hours. So, for a day we were blind as to what the outcome would be. After the availability of gas, coupled with the influx of roller kilns, our fortunes changed. And the production time came down drastically, leading to more production volumes,” Kangariya said.

Tech advances in the early 2000s catapulted Morbi to a global player, say industry experts. Now, they’re looking to government policies to organise the industry and make it the world’s number one.

(Edited by Asavari Singh)