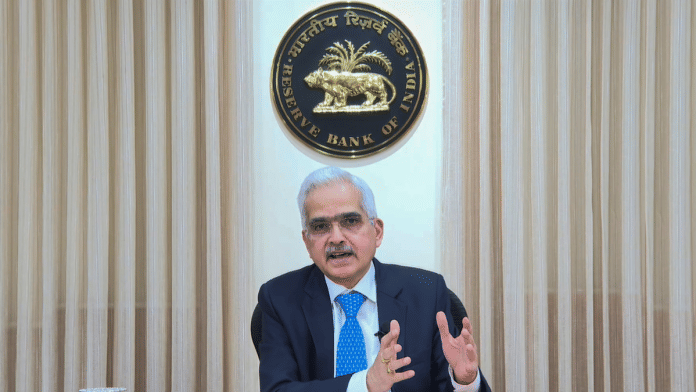

New Delhi: The Reserve Bank of India’s (RBI) monetary policy committee (MPC) has decided keep the key interest rate unchanged at 6.5 percent for the ninth consecutive time, Governor Shaktikanta Das announced on Thursday.

The MPC meeting, which began on 6 August, saw four out of six members vote to maintain the repo rate. Just as in the last meeting, the two remaining members, Ashima Goyal and Jayanth R. Varma, voted for a 25 basis point reduction. This was the first MPC meeting following the 2024-25 Union Budget on 23 July.

The last change to the repo rate was on 8 February, when it was increased to 6.5 percent from 6.25 percent.

Das said the committee, with a 4-2 majority, was focused on the “withdrawal of accommodation” to ensure inflation aligns with the target while supporting growth.

“Headline inflation, after remaining steady at 4.8 percent during April and May 2024, increased to 5.1 percent in June 2024, primarily driven by the food component, which remains stubborn,” Das said, explaining the rationale for keeping rates unchanged.

While core inflation (CPI excluding food and fuel) moderated, he said the fuel group remained in deflation, indicating falling prices. In addition, domestic growth is “holding up well”, he said, driven by steady urban consumption and improving rural consumption, coupled with strong investment demand.

Also read: Loan write-offs fall 27% in 5 years, public sector banks outperform private peers in recoveries

“Amidst this confluence of factors, the MPC judged that it is important for monetary policy to stay the course while maintaining a close vigil on the inflation trajectory and the risks thereof,” he further explained. “Resilient and steady growth in GDP enables monetary policy to focus unambiguously on inflation. It must continue to be disinflationary and resolute in its commitment to aligning inflation to the target of 4 percent on a durable basis.”

Commenting on the MPC’s decision, Dharmakirti Joshi, chief economist at CRISIL, said he expects the central bank to start cutting rates in October at the earliest, and has pencilled in two rate cuts this fiscal.

“On the domestic front, with a lower fiscal impulse and investment-focused spending, the budget was clearly non-inflationary,” Joshi said. “But that is not enough for the RBI to initiate rate cuts yet. Other domestic factors, particularly inflation, still dictate a cautious wait-and-watch approach.”

The next RBI MPC meeting is scheduled for 7-9 October.

Growth and inflation outlook

Das noted that global growth remained steady but uneven. While the manufacturing sector was slowing, the services sector was expected to sustain growth. He highlighted the volatile global financial markets and the challenges posed by demographic shifts, climate change, geopolitical tensions, rising public debt, and new technologies such as artificial intelligence.

The MPC projected real GDP growth for 2024-2025 at 7.2 percent, with quarterly estimates of 7.1 percent (Q1), 7.2 percent (Q2), 7.3 percent (Q3), and 7.2 percent (Q4).

Assuming a normal monsoon, CPI inflation for 2024-25 was projected at 4.5 percent, with quarterly estimates of 4.4 percent (Q2), 4.7 percent (Q3), and 4.3 percent (Q4).

Sunil Damnia, chief investment officer at market research firm MojoPMS, said statements from central banks have gained heightened importance following Japan’s interest rate hike, with significant attention on the Federal Reserve’s potential acceleration of rate cuts in the United States.

“Considering the global context, along with the higher base effect and favourable monsoon conditions, it would have been prudent for the RBI to cut interest rates in the latest monetary policy,” he said.

(Edited by Tikli Basu)

Also read: Sensex plunges 2300 points. Why a US jobs report caused Indian stock markets to crash

Neither interest rates nor inflation will come down in socialist India.