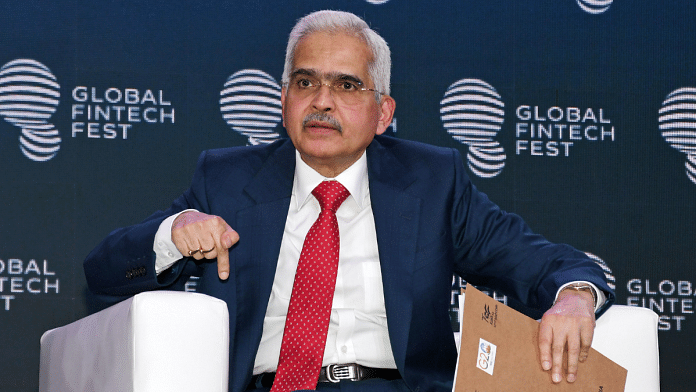

New Delhi: The Reserve Bank of India’s (RBI) Monetary Policy Committee has decided to keep the benchmark interest rate or repo rate unchanged at 6.5 percent for the fourth consecutive time, RBI governor Shaktikanta Das announced Friday.

The repo rate is the rate at which the RBI lends to banks, and which influences the interest rate banks charge their borrowers.

The Monetary Policy Committee (MPC) met between 4 and 6 October and unanimously decided to leave the repo rate unchanged. The Repo rate was last changed on 8 February, when it was hiked to 6.5 percent from the earlier 6.25.

Das in his statement said that the central bank was watchful about the inflation scenario in the country and has identified high inflation as a major threat to macro-economic stability.

According to financial experts, the decision to not raise interest rates was expected, and was a “positive one”. However, the decision to not cut rates would also mean that they would remain high, which would impact several sectors of the economy, they added.

“On a positive note, interest rates haven’t increased as anticipated, however, they are expected to remain elevated for an extended period,” said Vinod Nair, head of research, Geojit Financial Services.

He added: “This will have an implication on rate-sensitive sectors, like banking, auto, core industries, and heavy-weighted balance sheet companies.”

Also Read: How inclusion of Indian bonds in global indices could unleash potential of India’s financial market

The GDP growth

Giving a growth outlook for the year, the RBI governor projected the real gross domestic product (GDP) growth at 6.5 percent for the current 2023-24 fiscal — with 6.5 percent growth in the second quarter (Q2), 6 percent in quarter three (Q3) and 5.7 percent in quarter four (Q4). GDP growth in the first quarter (Q1) of this financial year stood at 7.8 percent.

The GDP growth estimate for the first quarter of the 2024-25 financial year (FY) also remains unchanged at 6.6 percent.

“Looking ahead, domestic demand conditions are likely to benefit from sustained buoyancy in services, consumer and business optimism, government’s continued thrust on capex (capital expenditure), healthy balance sheets of banks and corporates, and supply chain normalisation,” Das said in his statement.

He added: “Headwinds from geopolitical tensions and geoeconomic fragmentation, volatility in global financial markets, global economic slowdown, and uneven monsoon, however, pose risks to the outlook.”

The RBI policy statement also highlighted the inflationary pressures in the country, and said that the outlook “is uncertain due to factors such as low kharif sowing for important crops like pulses and oilseeds, low reservoir levels, and fluctuating global food and energy prices”.

Given the uncertainties, the consumer price index (CPI) inflation is projected at 5.4 percent for FY 2023-24 with Q2 at 6.4 percent, Q3 at 5.6 percent and Q4 at 5.2 percent. The CPI inflation estimate for the Q1 of FY 2024-25 is projected at 5.2 percent, the statement said.

Das said that core inflation during July-August 2023 had reduced by 140 basis points to touch 4.9 percent compared to its peak in January 2023.

He also said that headline inflation (or the total inflation) had come down to 4.6 percent in Q1 of 2023-24 compared to 7.3 percent in Q1 of 2022-23.

“According to the RBI’s inflation prediction for Q3 and this FY, today’s policy outcome is not surprising,” said Shantanu Bhargava, managing director, head of discretionary investment services, Waterfield Advisors.

“We expect the RBI to retain the status quo unless we see a durable drop in inflation, and if steady economic activity continues,” he added.

Meanwhile, Das has called for a close monitoring of incoming data on external factors, such as financial market conditions and energy prices, to prevent sudden food price shocks that affect inflation in the country.

“The Indian banking system continues to be resilient, backed by improved asset quality, stable credit growth and robust earnings growth,” Das said.

“The credit growth is broad-based and backed by the strong fundamentals of financial institutions,” he added.

The RBI statement also gave a summary of India’s external sector this year, showing a decline in both exports and imports of goods. However, the services sector was on a positive path with robust growth in software and business services during July-August 2023, it added.

(Edited by Richa Mishra)

Also Read: Why homeowners are celebrating RBI’s latest order to banks on asset-related papers