There are dangers in using the overvaluation argument to not support the rupee when it is hitting multiple lows, experts say.

Mumbai: As the Indian rupee plumbs new depths, the currency’s overvaluation relative to the nation’s trading partners has been used as a justification for the relative inaction from policymakers.

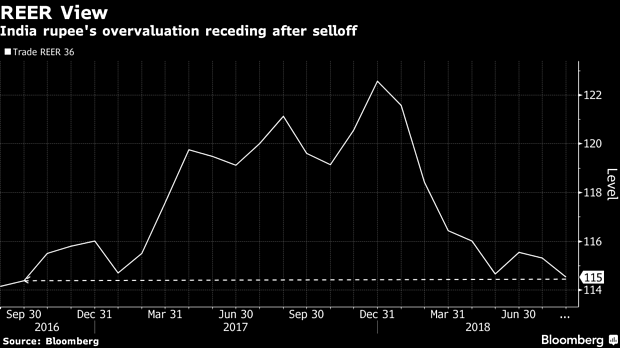

There’s evidence now to show this argument is weakening. The nation’s 36-currency real effective exchange rate, or REER, was 114.54 in August, a two-year low, and down from 115.32 in July, according to data released Tuesday.

There are dangers in using the overvaluation argument to not support the rupee when it is hitting multiple lows, said Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. in Singapore.

“Observable rupee shifts have far more impact on the psyche – including market psyche,” he said. “And it is hard — and very expensive — to catch falling knives once reflexivity sets in.”

The response of policy makers to the currency’s stumble has been rather muted compared with the big interest-rate defense seen in other countries with wide current-account deficits like Indonesia. “While the Reserve Bank of India has been intervening in the FX market, the size of recent intervention looks to be less compared to before,” Khoon Goh, head of research at Australia and New Zealand Banking Group Ltd. in Singapore, said Monday.

The RBI net sold $1.9 billion of foreign currency in July to support the rupee, data Tuesday showed. This week’s currency selloff, which has nudged the rupee toward 73 per dollar, has led to an increase in chatter on the possible steps likely from the central bank, including raising money from overseas Indians.

The depreciation has more or less accounted for the overvaluation seen in the past two-to-three years, according to Kotak Mahindra Bank. The rupee has slid about 15 percent against the dollar from the taper-tantrum period in 2013, significantly less than other big emerging markets, the lender said in a note.

“On REER basis, the INR remains overvalued against long-term average though it has come down from its highs,” economists Suvodeep Rakshit and Upasna Bhardwaj wrote.

The rupee is Asia’s worst-performing currency this year, and its one-month volatility is at levels last seen in 2015, data compiled by Bloomberg show.-Bloomberg