Rescuing IL&FS, which has a total debt of $12.6 billion, is vital to stem the risk of default spreading to other lenders.

Mumbai: An Indian financier that roiled markets by defaulting on debt unveiled details of its restructuring proposal over the weekend, including hiring a firm to turn around the distressed company.

Stockholders endorsed Infrastructure Leasing & Financial Services Ltd.’s plan to raise as much as 150 billion rupees ($2.1 billion) through a non-convertible debt sale, and increase the firm’s borrowing limit by 100 billion rupees to 350 billion rupees, IL&FS said in a filing. The lender also got permission to boost its share capital to enable a rights offering.

Rescuing the firm, which has total debt of $12.6 billion 61 percent in the form of loans from financial institutions — is vital for authorities to stem the risk of default spreading to other lenders in the world’s fastest-growing major economy. The latest move will ease investor concerns but doesn’t resolve the matter, according to Jagannadham Thunuguntla, senior vice president at Mumbai-based Centrum Broking Pvt.

“Time bound execution of the plans outlined to shareholders is the key to salvaging the situation,” said Kranthi Bathini, a Mumbai-based director at WealthMills Securities Ltd. ”Market still expects that government will step in and act decisively to save the group rather than pushing them to do a fire sale of assets.”

IL&FS hired Alvarez & Marsal, which helped revamp Jet Airways India Ltd. in 2015 and is currently working on restructuring Essar Steel Ltd., to come up with a plan to rescue the company. IL&FS has already sought to buy itself time for the restructuring by filing an application to avoid being dragged to bankruptcy court.

The beleaguered group can raise 600 billion rupees by selling assets, according to the chairman of its biggest shareholder and the nation’s largest life insurer, Life Insurance Corp. of India. LIC Chairman V.K. Sharma on Friday said that the insurer is open to subscribing to the lender’s rights offer.

“Backing by top shareholder of IL&FS is a comforting factor for the markets,” said Kunal Shah, senior vice president at Mumbai-based Kotak Mahindra Life Insurance Co. “The overhang and concerns will soothe further when there are definitive signs of an actual transaction happening — be it an asset sale or fundraising through a rights offering.”

Other investors in IL&FS also include Japan’s Orix Corp., the second-largest shareholder in the company, Abu Dhabi Investment Authority and Housing Development Finance Corp., India’s biggest mortgage lender.

IL&FS funds infrastructure projects across Asia’s third-largest economy and is considered to be systemically important by the central bank. Its defaults on commercial paper, once considered rock-solid, from August sparked concern among households holding mutual funds invested in such debt, and forced banks, mutual and pension fund managers to brace for further losses.

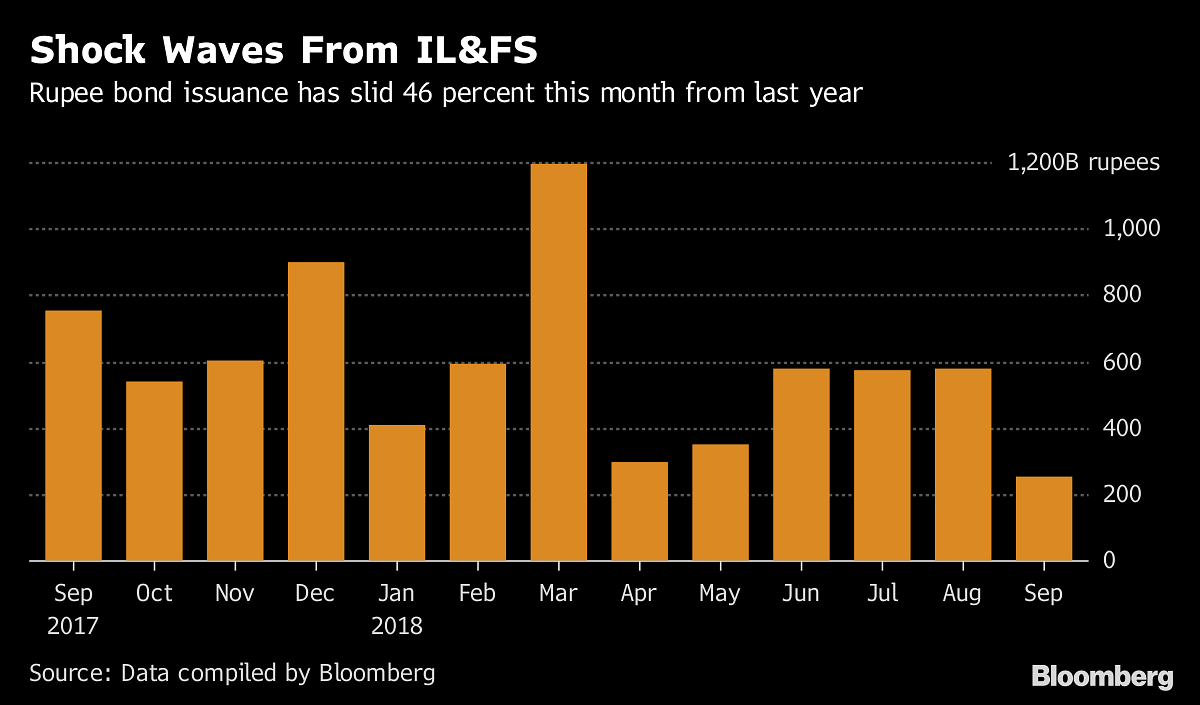

The fear added to pressure on borrowing costs for all companies in India’s credit market, led to a slump in corporate bond issuance and sparked a brief but sharp sell-off in equities. There was also concern that the group’s troubles could spread to other shadow banks and crimp Prime Minister Narendra Modi’s infrastructure plans before elections next year.

“Any economy, especially emerging economies, should try to prevent a liquidity crisis at any cost, as that can lead to solvency risk across the system,” Centrum’s Thunuguntla said. “The government has to step in soon as a coordination point between RBI, LIC and Sebi just the way U.S. government did in 2008” during the Lehman crisis, he said referring to the Indian central bank and the market regulator.

Reserve Bank of India officials on Friday met the top shareholders of IL&FS in Mumbai to assess a debt resolution plan.

The company has already received satisfactory offers for 14 out of the 25 assets put on the block, according to an internal memo seen by Bloomberg.

IL&FS has felt the pain from interest rates that have soared to multi-year highs for short-term borrowings. On top of that, some of IL&FS’s own construction projects including roads and ports have faced cost overruns amid delays in land acquisition and approvals. Disputes over contracts have locked about 90 billion rupees of payments due from the government.

IL&FS’s outstanding debentures and commercial paper accounted for 1 percent and 2 percent, respectively, of those markets as of March 31, according to Moody’s Investor Services. Its bank loans made up about 0.5 percent to 0.7 percent of banking system loans, Moody’s said — Bloomberg.