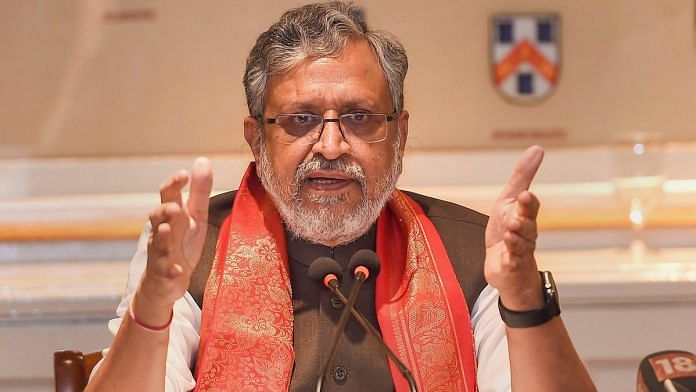

New Delhi: The central government has given the best possible package to states for meeting the revenue shortfall in goods and services tax (GST) and some states are politicising the issue, Bihar Deputy Chief Minister Sushil Kumar Modi has said.

Speaking to ThePrint over the phone Wednesday evening, Modi, who holds the finance portfolio in the Bihar government, said cooperative federalism demands that states and the central government both appreciate the revenue constraints the other is facing.

“Cooperative federalism means that both should care for each other. The central government is also facing revenue constraints. Its customs and corporate tax collections have been impacted,” said Modi, a member of the BJP, which is an alliance partner in the Janata Dal (United)-led Bihar government.

“It has already committed to borrow Rs 12 lakh crore from the markets in the fiscal,” Modi added. “Some states are politicising the issue. It is not as if the central government has plenty of money and it is not giving money to the states.”

Modi is a veteran of the GST, who has been involved in its planning and implementation since much before it went live in 2017. Between 2011 and 2013 (when he resigned as Bihar finance minister in light of a brief split between the BJP and the JD-U), he headed the empowered committee of state finance ministers looking into its launch.

His comments come at a time when many opposition-led states have decided to reject the two options put forward by the central government last week to make up for its inability to pay the GST compensation it owes states. Covid-19 and the preceding lockdown have taken a heavy hit on the compensation fund that the central government formed to make up for the revenue losses suffered by states on account of the shift to the GST regime in 2017.

The central government’s two alternatives require the states to borrow: The central government has said states can either borrow Rs 97,000 crore (revenue shortfall arising on account of GST implementation and not taking into account the Covid-19 impact) or borrow the entire Rs 2.35 lakh crore, which is the estimated shortfall in the compensation fund.

Opposition-ruled states have dismissed the first option on the grounds that the amount is low and insufficient to meet their requirements. The second option has been rejected because the burden of repaying the interest on the debt would fall on the states.

These states are adamant that the borrowing should be done by the central government, saying it can access funds at a lower cost and also has the option to monetise its deficit. The central government has rejected the demand.

At least four chief ministers have written to the Prime Minister, urging him to intervene and resolve this issue, which they say threatens cooperative federalism.

However, BJP-ruled Karnataka has announced that it favours states borrowing Rs 97,000 crore.

Modi said even Bihar was initially in favour of the central government borrowing. “However, when the central government explained the constraints faced by it as well as the details of the two options, we decided that option 1 is the ideal option and will place no financial burden on the states,” he added.

Also Read: Rs 3 lakh cr GST shortfall to states, Sitharaman says act of God may see economy contracting

‘Confident of consensus in GST council’

Modi expressed confidence that the central government and states will reach a consensus in the next GST council meeting. He said states will opt for option 1 as it places no financial burden on them.

“I am hopeful that the GST council will agree for option 1. If states do not agree, then they will not get any funds,” he said.

Modi pointed out that there were differences of opinion in the past also, but “eventually there was convergence”.

According to him, taking the first option means states will be compensated to the extent of Rs 97,000 crore in the current fiscal. The remaining losses of states — Rs 1.38 lakh crore (Rs 2.35 lakh crore minus Rs 97,000 crore) — will be deferred and paid to the states in the later years.

He also referred to the central government’s plans to extend the July 2022 deadline for the collection of cess that drives the compensation fund. The cess deadline, he said, will be “extended by 3-5 years”, and first be used to pay interest, and then the principal amount, and then to compensate states.

Specific to Bihar, Modi said the state will incur a loss of around Rs 10,000 crore in the current fiscal but will get Rs 3,512 crore as funds if it opts for the first option.

The remaining amount of Rs 6,539 crore, he added, will be made good in the years following 2021-22.

The option to borrow Rs 97,000 crore, he said, allows states to borrow an additional 0.5 per cent of their gross state domestic product unconditionally.

He added that states would have incurred losses even if value added tax (VAT) — the indirect tax regime that was subsumed by the GST — was in force.

Modi dismissed talk of invoking the resolution mechanism for disputes between states and the central government, for which a broad provision has been laid out in the Constitution.

“There is no mechanism at present. It will take at least a year to evolve the mechanism. But money is needed now,” he said.

Also Read: At least 10 states to reject Modi govt’s borrowing options, say GST compensation their right

India is a Union of States. Even if one State is weak, the Union cannot be strong. For Union of strong self-reliant States to emerge, every State would have to rely on the taxes levied by it and on the central tax revenues assigned to it by the Constitution. The lawmakers serving the Union and every small and big States would have to seriously consider whether the July 2017 Reform has secured the interests of the States as secured in Article 274. That the buoyancy of states’ own tax revenues improved significantly after they began collecting state sales taxes on value-added basis from 2005 when the buoyancy of CENVAT continued to be weak cannot be forgotten. In the devolution of moneys from the Union to States , neither the Union ought to be paternalistic nor the States ought to be parasitic.

the modi government was eager to prove it was a mover and shaker. it took credit for a poorly thought out and implemented GST program which set the economy back – by how much the numbers may be disputed . further the Government of India is responsible for how well it runs the economy of India. Clearly if its major pre-occupation is to play politics between BJP and non BJP states the economy will suffer and so will GST collections. the Government of India is also directly responsible for the mismanagement of the Corona lock down and subsequent mishandling including leaving the handling of the Corona virus to the states – when the Centre should have been responsible for a planned shut down and reemergence form the shut down. so what is the center now trying to do.

State Governments are demanding shortfall compensation of GST from Central Government which is provided in GST rules and this amount is not repayable by State Governments but if the State Governments borrow from RBI as mentioned in the package the responsibility of repayment will be of State Governments.

When the state fight for the tax losses have they supported any of the dealers in the pandemic I have been behind the sits they adv for the support and land up in fake promises.

Registered dealer since 2004 and not seeked support. First time beaning trying since May 2020.

In bringing about the GST, the center and states gave up their rights in taxation matters for the common good accepting the methodology which was well debated and agreed to in the parliament.

The intention was to have a conscientious on all decisions as for as possible, failing which a reasonably weighted voting system was agreed to which could not give a free hand to any side.

Under the prevailing circumstances in stead of pitching in with the state resources, making an issue of short fall,knowing fully well the demands that could with the unpredictability on the border with china.

Surely the Government will deal with it but it cuts a sorry figure when the politics is resorted to at such levels, by otherwise highly educated people.

Issue can be resolved to some extent by the individual states by further increasing surcharge on patrol, diesel n alcohol. Was saddened to learn the even Amrinder Ji is starting to raise his objections. Manmohan Singh himself famously said tt “money does not grow on trees” Why don’t you relax the lockdown n open up the economic activity whilst using face masks n observing safe distance. This pandemic is going to be here for some time hence we have to get on with our daly chores.

Free bees can not go on and on, this makes public lethargic. Passing the buck n repeating statements – I Said So – is not a good politics. I know Manpreet Ji is a reasonable politician hr can assist. Other states can take the cue…

Some Mamata like politicos are making too much hue and cry over shortfall in GST collections and subsequently inability of the central government to pay promised compensation as promised at the time of initiating new indirect tax regime. They should accept the suggestion of the central government to get short/medium term loan from RBI . They should be thankful that these loan will be self-liquidating under GST regime. Had the states been following old Sales tax regime , that , too , would have made a major dent in their earnings and most of the state Government would have been requesting for bail-out package from the Central government or would have been asking RBI to give them short to medium term loans . So stop politicking . You can not blame Modi for every thing under sun . He is doing his duty as per requirement of the post he is holding. Politicos working as CM s in different states should also follow his example.