Singapore: Equities retreated from Thursday’s record high in a volatile session after Prime Minister Narendra Modi named Nirmala Sitharaman as the new finance minister in a surprise move and as trade-war rhetoric heated up.

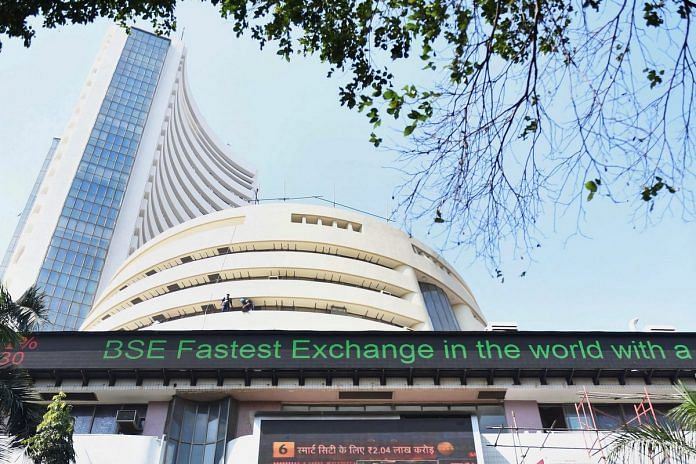

The benchmark S&P BSE Sensex ended 0.3% lower at 39,714.20 in Mumbai, after a volatile session during which it gained as much as 0.7% and surpassed its record close hit on Thursday, and fell as much as 1.2%. The NSE Nifty 50 Index retreated 0.2%.

Modi on Thursday picked leaders with experience for key portfolios as he began a second five-year term facing an economic slowdown and global headwinds. Finance minster’s berth was a key focus for market participants.

Economists estimate that a report later Friday will show the pace of gross domestic product growth in the three months through March was the slowest in almost two years, while the central bank meets June 6 to decide on monetary policy.

Both gauges clicked a third straight month and week of gains amid continued optimism that Modi will adopt policies to spur growth after his landslide victory in elections.

Strategist View

It would have been better if someone with more experience in handling the economy or a monetary institution could have come as finance minster considering the global trade war and slowing growth at home, said Chokkalingam G, managing director of Equinomics Research & Advisory Pvt. in Mumbai. The surprise nomination of Nirmala Sitharaman as finance minister disappointed some investors, alongside some trade war-led volatility in global markets, said Sameer Kalra, president of Mumbai-based advisory Target Investing.

“We may see this negative impact driven by domestic investors to continue for next couple of days.” “It looks like a case of basket selling, some investors taking profit from the rally before and after the political event of a stable federal government played out last week,” said Purvesh Shelatkar, head of institutional brokering at Monarch Networth Capital Ltd. in Mumbai. “It’s sheer volatility as the global headwinds are getting worse every passing day,” Avinash Gorakshakar, head of research at Joindre Capital Services Ltd., said.

The Numbers

Thirteen of the 19 sector indexes compiled by BSE Ltd. slipped, led by a gauge of power-generation and transmission stocks. Twenty of the 31 Sensex members and 27 of the 50 Nifty companies fell. Yes bank Ltd. dropped the most on the benchmark while Asia Paints ltd. was the top gainer. Of the 50 Nifty companies that have announced their results so far, 30 have either met or exceeded analyst estimates. – Bloomberg.

Also read: Nirmala Sitharaman is India’s first woman FinMin but has little time to rest on that laurel

All nationalised banks and public sector units must become profit making entity otherwise keeping continue them through providing fund for decades is unwise as tax collected money is not belongs to government. So government should not allow for wasteing of tax collected money.

President Trump is threatening tariffs for Mexico, trade relations with the EU are strained, PM Abe is using all his goodwill to keep the keel even. This is a difficult environment for India’s foreign trade. Restoring global competitiveness is something the new FM should focus on, with help from Commerce Minister Piyush Goel.