The GST Council cut taxes on 50 goods which will cut revenue by $2.2 billion every year.

The GST Council move to slash levies on more than 50 goods will lower revenue by as much as Rs 15,000 crore ($2.2 billion) each year and is raising the prospect of the country missing budget goals again this year.

The council — a panel of federal and state finance ministers — cut the tax on items from washing machines and lithium iron batteries to stone-carved deities and sanitary napkins, as Prime Minister Narendra Modi looks to boost sentiment and growth before he faces re-election next year. The revenue loss will be minimal, India’s interim Finance Minister Piyush Goyal told reporters in New Delhi, without elaborating.

The decision could result in a revenue loss that’s as high as one per cent of tax budgeted to accrue to the federal government, according to officials who didn’t wish to be identified as they aren’t authorised to speak to the media.

The estimated loss in revenues comes at a time when India needs to keep its budget deficit in check as Modi prepares to ramp up spending on welfare programs from health to farming before general elections next year. The government has already widened its deficit goal for the current fiscal year to 3.3 per cent of gross domestic product from 3 per cent, putting pressure on bond yields.

The benchmark 10-year yield is up nearly 50 basis points this year, after climbing 81 basis points last year.

“It may not be the most marvelous move for the overall budget, but it is not a bad deal either if overall collections pick up for the government,” said Indranil Pan, chief economist at IDFC Bank Ltd. in Mumbai. “These rates were expected to come down and have been advanced because of the election cycle.”

The new GST rates are effective 27 July and the panel will meet again 4 August to discuss issues faced by small businesses.

Revenue concerns

India’s GST is just over one-year-old and the panel has already revised rates several times. The latest reduction comes before polls later this year in the states of Madhya Pradesh and Rajasthan, both governed by Modi’s Bharatiya Janata Party. Tax cuts on the last few occasions came closer to the date of some state polls, lending strength to arguments it was done for electoral gains.

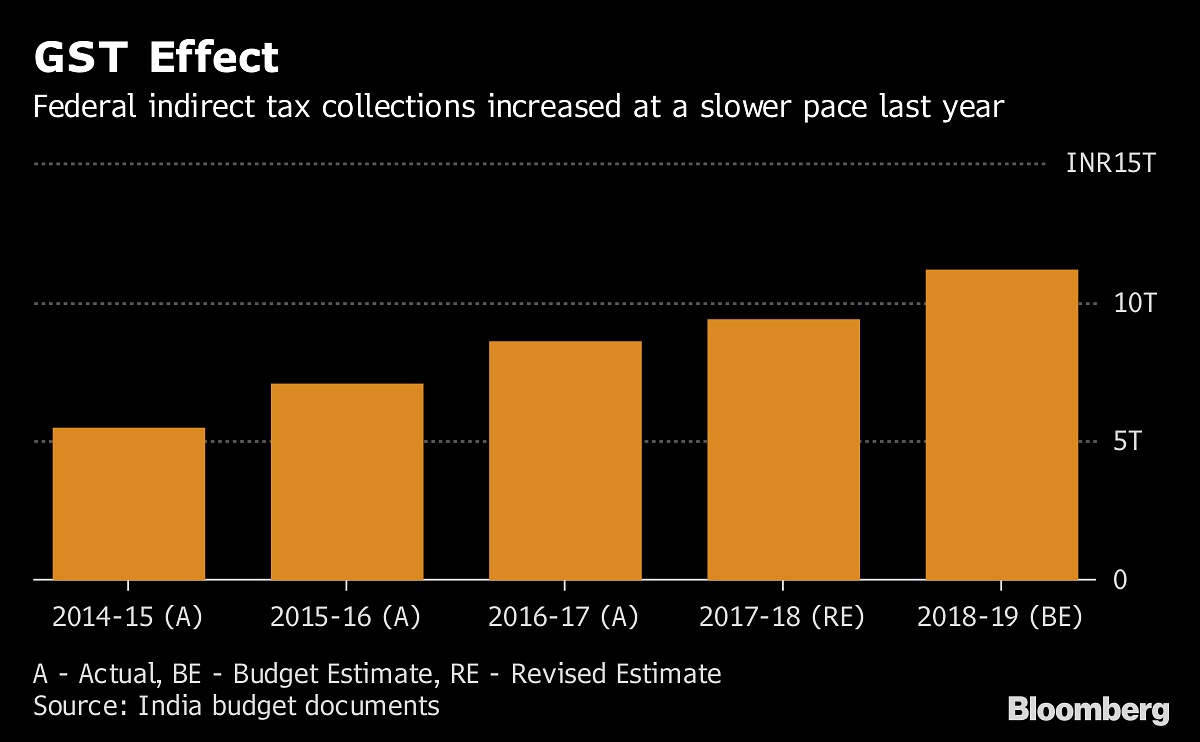

Modi needs resources to boost welfare spending before the federal election in 2019. Monthly GST receipts have picked up after teething troubles, but are still not strong enough to meet the government’s annual tax target of about Rs. 15 trillion.

GST, touted as one of the biggest reforms of the Modi government, replaced a myriad of levies with a nationwide sales tax. Its introduction was marred by glitches and business disruptions.- Bloomberg.