New Delhi: In a surprise move Thursday, the Reserve Bank of India (RBI) announced a status quo in key policy rates while lowering full-year growth projections to 5 per cent.

The repo rate has been retained at 5.15 per cent while the reverse repo rate stands at 4.9 per cent.

The decision of the six-member monetary policy committee (MPC) was unanimous.

“The MPC recognises that there is monetary policy space for future action. However, given the evolving growth-inflation dynamics, the MPC felt it appropriate to take a pause at this juncture,” the statement issued by RBI said, adding the accommodative stance will continue as long as it is necessary to revive growth, while ensuring that inflation remains within the target.

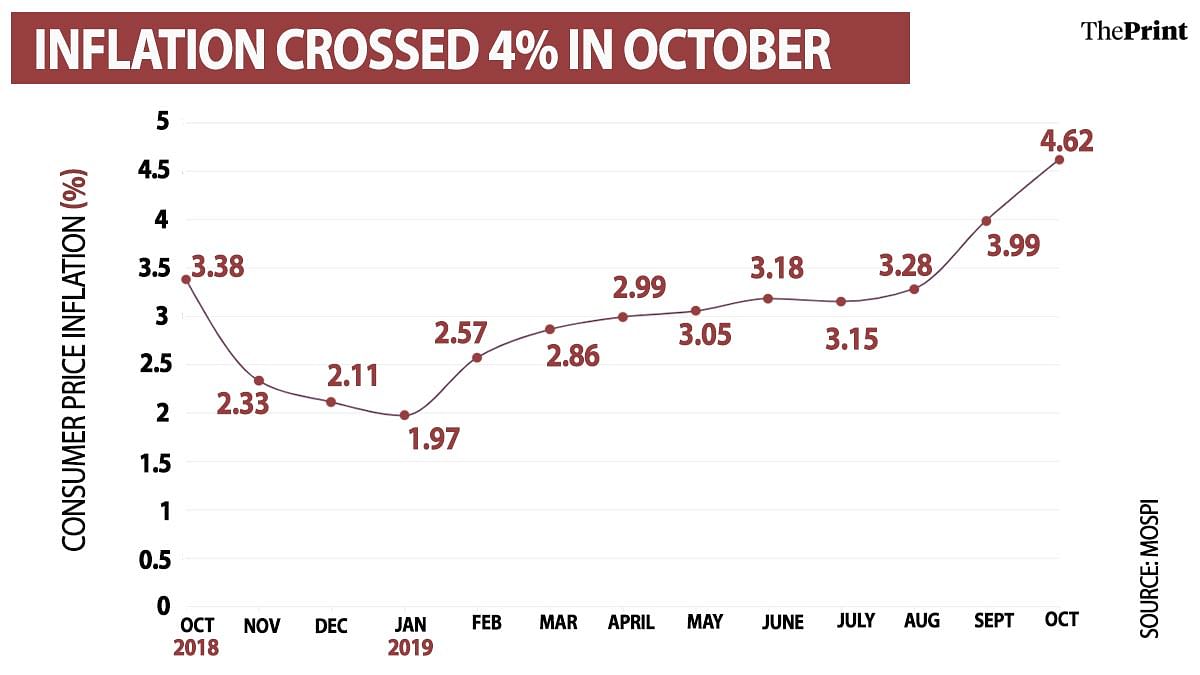

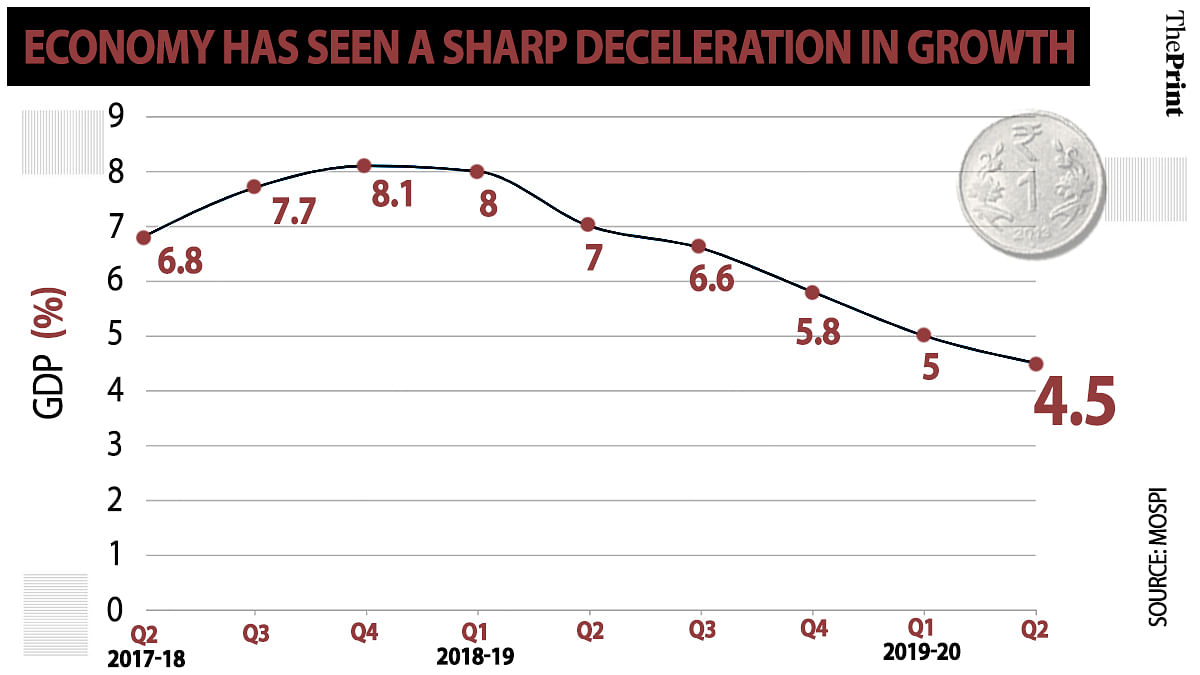

The central bank’s move comes at a time economic growth has slowed to a 26-quarter low of 4.5 per cent but inflation has risen above the 4 per cent target. In October, retail inflation came in at 4.62 per cent mainly driven by food inflation and is expected to inch up to 5 per cent in November.

“The MPC notes that economic activity has weakened further and the output gap remains negative. However, several measures already initiated by the Government and the monetary easing undertaken by the Reserve Bank since February 2019 are gradually expected to further feed into the real economy,” the statement added, stating there are signs of recovery in investment activity.

“The need at this juncture is to address impediments, which are holding back investments. The introduction of external benchmarks is expected to strengthen monetary transmission. In this context, there is also a need for greater flexibility in the adjustment in interest rates on small saving schemes,” it said.

The MPC was also cautious on the inflation trajectory, expecting it to rise over the next few months on account of higher food inflation. Consequently, it revised the inflation numbers upwards to 5.1-4.7 per cent for the second half of 2019-20.

Also read: Rate cuts won’t help India. RBI needs to increase money supply through quantitative easing

Growth projections

The MPC, which includes the RBI governor, revised the full year growth projections downwards to 5 per cent from 6.1 per cent forecast earlier.

Since February, RBI has cut rates by a total of 1.6 percentage points. At the same time, it has revised the growth projections for 2019-20 downwards by 2.4 percentage points from 7.4 per cent it forecast in the monetary policy announcement in February.

A slowdown in consumption and investment has led to a deceleration of growth in the economy with growth slowing for the sixth consecutive quarter in the July-September period. Data released by the Central Statistics Office showed that manufacturing sector growth had contracted 1 per cent in the quarter compared to the corresponding year-ago period.

Gross fixed capital formation, an indicator of investment demand in the economy, also grew by only 1 per cent in the quarter.

‘Need to see government measures’

In a post policy press conference Thursday, RBI governor Shaktikanta Das defended the pause in rate cuts stating that there is a need to optimise the impact of reductions announced so far. He added that the monetary and fiscal policies are working together to counter the economic slowdown.

“We need to see what will be the counter cyclical fiscal measures that the government will announce in the Budget,” he said.

Economists, however, were caught by surprise at the pause.

“Above-target inflation and incomplete transmission outweighed the sharp cut in the GDP growth forecast, prompting the pause from the MPC,” said Aditi Nayar, principal economist at ICRA.

Nayar added that though the MPC has indicated that the stance will remain accommodative for as long as necessary to revive growth, the next rate cut will only be forthcoming when there is clear visibility that the headline CPI inflation will go below 4 per cent.

(Edited by Amit Upadhyaya)

Also read: After slew of rate cuts, Modi govt could now increase GST rates to boost revenues

“The need at this juncture is to address impediments, which are holding back investments.” It would be good to know what these are. In the trade-off between growth and inflation, one wonders what effect exposing Indian agriculture to more market forces will have?

Linking to the original statement would have been useful too (:

Gunjayesh hi nahin hai aur rate cuts ki, assuming costly money was depressing economic growth. Saving households should get a fair return on their bank FDs, that too supports consumption and economic activity. 2. Too much sand has been dumped onto the gearbox. Take a cloth and some oil, start cleaning it. Slow, patient, unglamorous work.

Everytime the RBI governor takes the mic, I become nervous, lest he announce another interest rate cut. My returns from FDs diminish.

😩