Mumbai: India’s central bank said it’s prepared to come to the help of the troubled shadow banking sector if needed, but stopped short of announcing specific action to help the country’s non-bank financial companies.

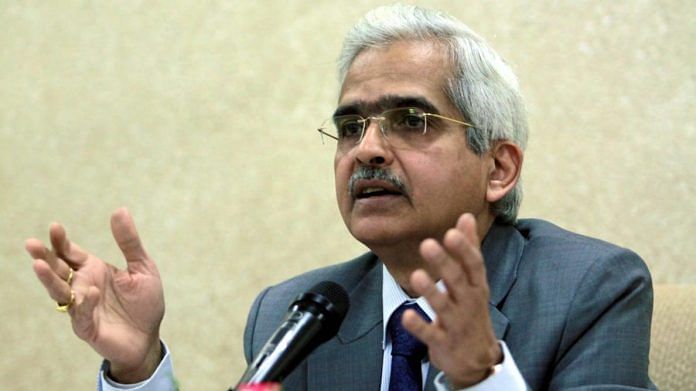

Speaking soon after announcing a cut in interest rates to the lowest in nine years, Reserve Bank of India Governor Shaktikanta Das told a press conference that the central bank is closely monitoring the NBFC sector and is ready to take “whatever steps are required” to ensure financial stability.

Some analysts had expected more decisive action to be announced together with the RBI’s statement. “The market was expecting some steps to ease the liquidity crunch in NBFCs, and to that extent the policy was bit negative,” said Siddharth Purohit, a banking analyst at SMC Global Securities. Further NBFC defaults will force Indian banks to increase their bad loan provisions, he added.

India’s shadow lenders have been under pressure since last year, when a series of defaults by Infrastructure Leasing & Financial Services forced the government to intervene and exposed weaknesses in the sector. The situation has worsened this week after Dewan Housing Finance Corp.’s rating was cut to default by Standard & Poor’s local arm after it delayed payments on bonds due on June 4.

The RBI said on Thursday it will form a committee to review its liquidity management framework, to simplify the current guidelines and communicate its objectives more clearly. It reiterated its view that there is adequate liquidity in the system.

“We are monitoring major entities in this universe of NBFCs and housing finance companies,” Das said. “The RBI remains committed to ensure we have a robust well-functioning NBFC sector.”

Jaikishan Parmar, research analyst at Angel Broking Ltd., said the RBI is right to be cautious to avoid creating moral hazard. The “RBI should not be the call option for NBFCs,” he said.

Indian equities extended their declines on Thursday after the RBI announcement, with the S&P BSE Bankex Index closing down 2.3%.

The central bank may want to wait for greater clarity on the new Indian government’s fiscal plans before committing to any large infusions of liquidity, according to Purohit. “I don’t expect the RBI will take a call on liquidity before the budget as it might want to look at the borrowing program and the fiscal deficit roadmap,” he said. – Bloomberg.

Also read: RBI cuts policy rates again, gives Modi govt a helping hand in battling falling growth