The action of regulators against older generation leaders of 3 private banks is seen to benefit share holders in the long term.

New Delhi: Change is coming to some of India’s top private banks as regulators shunt aside a previous generation of leaders in a bid to improve corporate governance and get to grips with a mountain of bad loans.

By cutting short the terms of the chief executives of Axis Bank Ltd. and Yes Bank Ltd., both of which were found to have a higher ratio of bad assets than initially reported, the Reserve Bank of India has signaled that management will be held accountable. That’s a positive development for bank shareholders.

“The RBI action sends a strong signal to boards to take their jobs a lot more seriously when it comes to evaluating CEO performance and the question of succession planning,” said T.T. Ram Mohan, a professor of Finance and Economics at the Indian Institute of Management in Ahmedabad. “That can only be good for shareholders from the long-term point of view.”

Here’s a summary of the main changes:

Yes Bank

The central bank last month refused to approve a renewed term for Yes Bank’s Chief Executive Officer, Rana Kapoor, asking him to step down by January. Yes Bank shares have tumbled 27 percent since news last month that Kapoor will depart from a bank he has headed since it was founded 14 years ago.

While the central bank didn’t give a reason for its decision, it had tussled with Yes Bank about how how much of its loans should be recognized as nonperforming.

An internal candidate would be less likely to tamper with “Kapoor’s focus on growth,” according to Payal Pandya, an analyst at Centrum Wealth Management. On the other hand, if there was a problem with internal controls, then an external candidate may provide greater accountability on the bad loan issues, according to Suyash Rai, senior consultant at National Institute of Public Finance and Policy.

Axis Bank

Axis Bank too saw CEO Shikha Sharma’s term curtailed by the RBI, after a nine year tenure. She will step down by the end of this year, to be succeeded by Amitabh Chaudhry, former head of HDFC Standard Life Insurance Co.

Punit Srivastava, head of research at Daiwa Capital Markets, said the transition should be positive for the bank, whose shares have risen 13.5 percent since news of Sharma’s departure in April.

“They are on a stronger wicket in terms of their balance sheet, with sufficient capital” said Srivastava. “The top leadership issue has been cleared.”

ICICI Bank

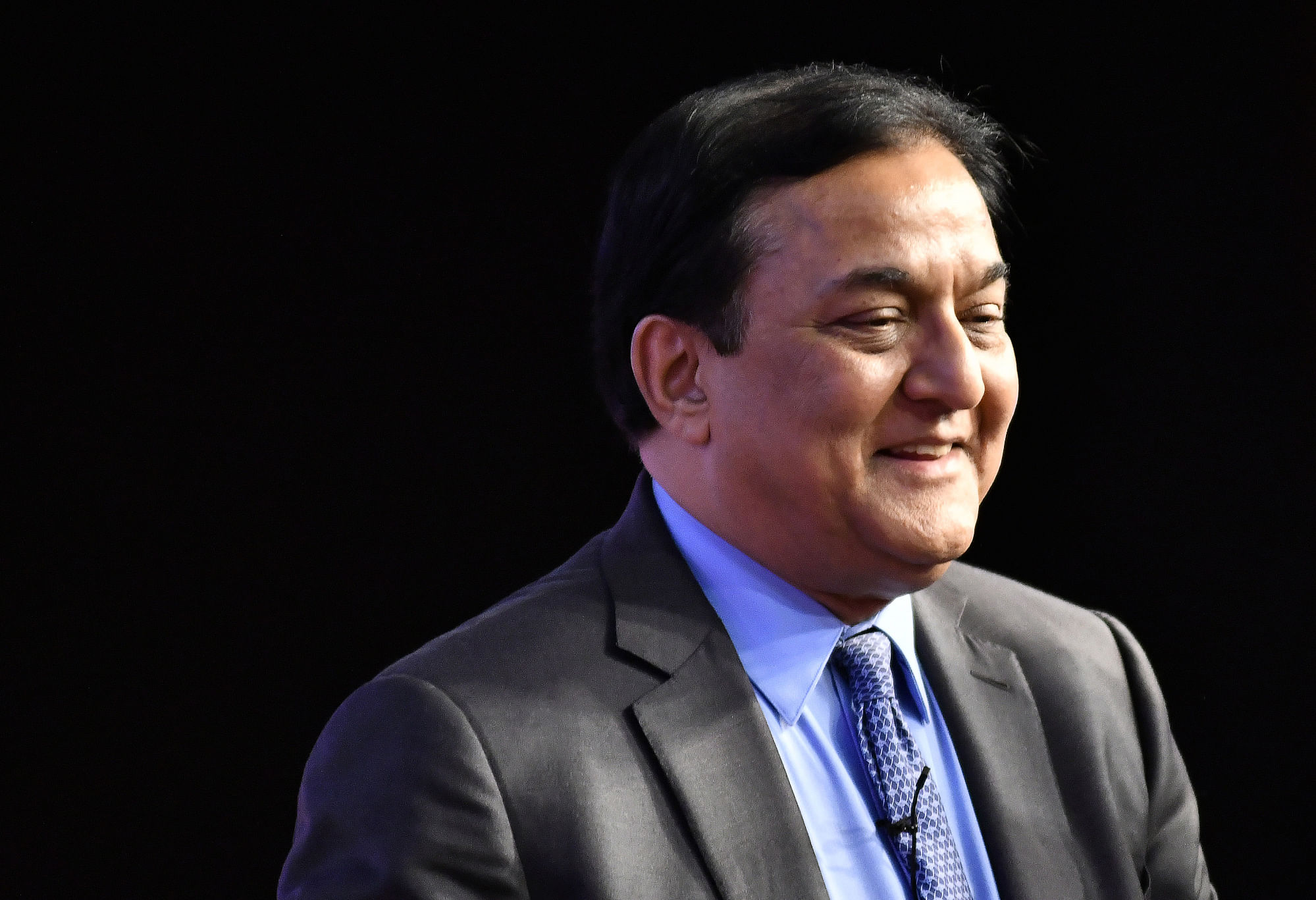

ICICI Bank ltd. announced last week that its longstanding CEO Chanda Kochhar had stepped down. The reasons weren’t disclosed but her resignation follows a period of three months during which she has been on leave, pending the results of an inquiry into allegations against her, including claims of a “quid pro quo” in dealings with certain of the bank’s borrowers.

She has been replaced by the bank’s Chief Operating Officer Sandeep Bakhshi, who was appointed for a 5-year term, subject to approval by the RBI. Kochhar had headed the bank since 2009.

“Sandeep Bakhshi enjoys a good reputation in the industry. I don’t see any red flag there,” said Rai.-Bloomberg